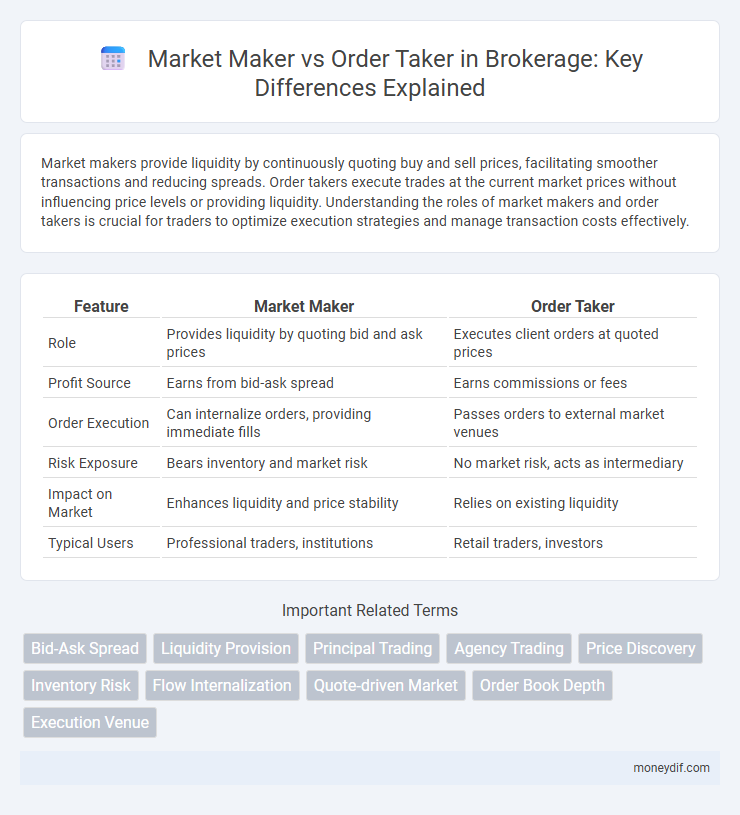

Market makers provide liquidity by continuously quoting buy and sell prices, facilitating smoother transactions and reducing spreads. Order takers execute trades at the current market prices without influencing price levels or providing liquidity. Understanding the roles of market makers and order takers is crucial for traders to optimize execution strategies and manage transaction costs effectively.

Table of Comparison

| Feature | Market Maker | Order Taker |

|---|---|---|

| Role | Provides liquidity by quoting bid and ask prices | Executes client orders at quoted prices |

| Profit Source | Earns from bid-ask spread | Earns commissions or fees |

| Order Execution | Can internalize orders, providing immediate fills | Passes orders to external market venues |

| Risk Exposure | Bears inventory and market risk | No market risk, acts as intermediary |

| Impact on Market | Enhances liquidity and price stability | Relies on existing liquidity |

| Typical Users | Professional traders, institutions | Retail traders, investors |

Understanding Market Makers and Order Takers

Market makers provide liquidity by continuously quoting buy and sell prices in financial markets, facilitating smoother and more efficient trading. Order takers, on the other hand, execute trades based on existing market prices without influencing the bid-ask spread. Understanding the roles of market makers and order takers is crucial for investors as it impacts trade execution, pricing dynamics, and overall market stability.

Core Functions: Market Makers vs Order Takers

Market makers provide liquidity by continuously quoting bid and ask prices, facilitating smoother trading and reducing price volatility. Order takers execute client orders without providing liquidity or altering market prices, focusing solely on matching buy and sell requests. The core function of market makers is to stabilize markets and ensure trade execution, whereas order takers primarily serve as intermediaries between clients and market venues.

How Market Makers Provide Liquidity

Market makers provide liquidity by continuously quoting both buy and sell prices for securities, ensuring there is always a counterparty for traders. This bid-ask spread facilitates smooth transactions and stabilizes market prices by absorbing supply and demand imbalances. Unlike order takers who execute trades based solely on client orders, market makers actively maintain market depth and reduce price volatility.

Order Takers: Role and Responsibilities

Order takers in brokerage facilitate client transactions by executing trade orders as received, ensuring prompt and accurate market access. Their responsibilities include processing buy and sell orders, maintaining compliance with regulatory requirements, and providing routine customer support. Effective order takers contribute to market liquidity by bridging client demands with market makers, enhancing overall trading efficiency.

Profit Models: Market Makers vs Order Takers

Market makers profit primarily from the bid-ask spread by providing liquidity and facilitating trades, capturing the difference between buying and selling prices. Order takers, however, earn through commissions or fees per transaction without direct exposure to price spreads or market risk. This contrast shapes their risk profiles and revenue stability in brokerage operations.

Impact on Trade Execution and Pricing

Market makers provide liquidity by continuously quoting bid and ask prices, ensuring tighter spreads and faster trade execution, which benefits traders through reduced slippage and more stable pricing. Order takers, by filling existing orders, may experience slower executions and wider spreads during volatile market conditions, potentially increasing transaction costs. The presence of active market makers in a brokerage environment leads to improved price efficiency and enhanced market depth.

Risk Exposure: Market Makers Compared to Order Takers

Market makers assume higher risk exposure by continuously providing liquidity and maintaining bid-ask spreads in volatile markets, absorbing price fluctuations directly. Order takers, in contrast, face lower risk since they execute trades at prevailing market prices without holding inventory or quoting prices. This fundamental difference in risk profiles influences pricing efficiency and market stability within brokerage operations.

Regulatory Considerations for Brokers

Brokers acting as market makers must comply with stringent regulatory requirements, including transparency in quoting prices and maintaining fair market practices to prevent conflicts of interest. Order takers face oversight ensuring they execute client orders at the best available prices without exerting influence on market liquidity or pricing. Regulatory frameworks such as the SEC's Regulation NMS and FINRA rules emphasize fair execution, conflict mitigation, and detailed record-keeping to protect investors and maintain market integrity.

Technology Differences: Market Making vs Order Taking

Market makers utilize advanced algorithmic trading systems and real-time data analytics to continuously provide liquidity and manage bid-ask spreads, while order takers rely on simpler execution platforms to process client orders without influencing price levels. Market-making technology integrates complex risk management and pricing models to instantaneously adjust quotes, whereas order-taking platforms focus primarily on efficient order routing and trade confirmation. The technological divergence centers on market makers' need for high-frequency trading capabilities and deep market insights compared to the order takers' emphasis on execution speed and client interface.

Choosing Between Market Makers and Order Takers

Choosing between market makers and order takers depends on trading objectives and risk tolerance. Market makers provide liquidity by continuously quoting bid and ask prices, fostering smoother trade execution but potentially introducing wider spreads. Order takers execute trades at existing market prices, often resulting in faster transactions with reduced price manipulation risks but potentially less favorable pricing.

Important Terms

Bid-Ask Spread

Market makers maintain liquidity by quoting both bid and ask prices, profiting from the bid-ask spread, whereas order takers execute trades at these quoted prices without influencing the spread.

Liquidity Provision

Liquidity provision is primarily driven by market makers who supply buy and sell orders to ensure smooth trading and tighter bid-ask spreads, while order takers consume this liquidity by placing market orders that execute against these limit orders. Market makers enhance market efficiency by continuously quoting prices and absorbing inventory risk, whereas order takers focus on immediate trade execution without providing market depth.

Principal Trading

Principal trading involves market makers who trade securities for their own accounts, providing liquidity and setting bid-ask spreads, unlike order takers who execute client orders without assuming market risk.

Agency Trading

Agency trading involves intermediaries acting as order takers, executing client orders without assuming market risk, unlike market makers who provide liquidity by buying and selling securities from their own inventory.

Price Discovery

Price discovery hinges on the interplay between market makers, who provide liquidity by quoting bid and ask prices, and order takers, who execute trades based on existing quotes; this dynamic influences market efficiency and volatility. Market makers facilitate continuous price quotes, enabling smoother transactions, while order takers respond to these prices, driving demand and supply signals crucial for accurate asset valuation.

Inventory Risk

Inventory risk refers to the potential loss a market maker faces due to holding an asset whose price fluctuates before it can be sold, contrasting with order takers who execute trades without maintaining significant inventory. Market makers actively manage inventory risk by adjusting bid-ask spreads and trade sizes to balance supply and demand, while order takers primarily focus on executing client orders without exposure to price volatility.

Flow Internalization

Flow internalization occurs when market makers execute client orders within their own inventory instead of routing them to external exchanges, enhancing execution speed and reducing transaction costs compared to order takers who send orders to marketplaces. This practice allows market makers to capture bid-ask spreads and maintain liquidity, contrasting with order takers relying on market depth and external price discovery.

Quote-driven Market

Quote-driven markets rely on market makers who provide continuous bid and ask prices, contrasting with order takers who only execute trades without offering liquidity.

Order Book Depth

Order book depth reflects the liquidity provided by market makers through limit orders, enabling order takers to execute trades with minimal price impact.

Execution Venue

Execution venue selection directly impacts market makers and order takers by determining liquidity and trade efficiency; market makers benefit from venues with lower latency and deeper order books, while order takers prioritize venues offering best price execution and minimal slippage. Understanding venue characteristics such as dark pools, lit exchanges, and electronic communication networks (ECNs) helps in optimizing trade outcomes for both participant types.

market maker vs order taker Infographic

moneydif.com

moneydif.com