Tape-A and Tape-B refer to different market data feeds that provide real-time trade information from various stock exchanges. Tape-A primarily covers securities listed on the New York Stock Exchange (NYSE), offering valuable insights into large-cap stock movements, while Tape-B includes data from regional exchanges and other markets, capturing a broader range of trading activity. Comparing Tape-A and Tape-B enables brokers to analyze market depth and liquidity more effectively, optimizing trade execution strategies.

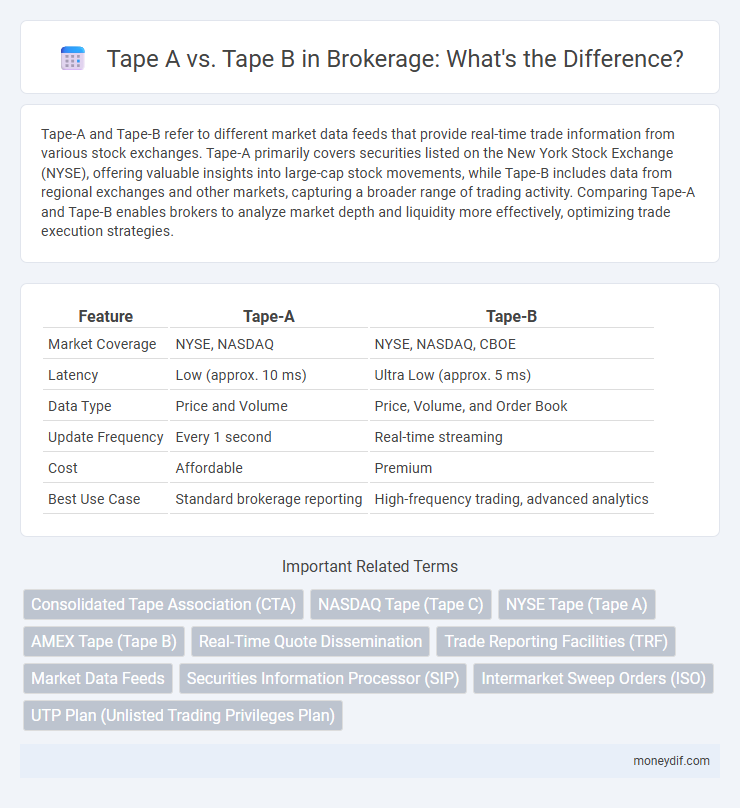

Table of Comparison

| Feature | Tape-A | Tape-B |

|---|---|---|

| Market Coverage | NYSE, NASDAQ | NYSE, NASDAQ, CBOE |

| Latency | Low (approx. 10 ms) | Ultra Low (approx. 5 ms) |

| Data Type | Price and Volume | Price, Volume, and Order Book |

| Update Frequency | Every 1 second | Real-time streaming |

| Cost | Affordable | Premium |

| Best Use Case | Standard brokerage reporting | High-frequency trading, advanced analytics |

Introduction to Tape-A and Tape-B in Brokerage

Tape-A and Tape-B are components of the consolidated tape system that records real-time trade data from different stock exchanges. Tape-A primarily covers securities listed on the New York Stock Exchange (NYSE) and includes large-cap stocks, while Tape-B focuses on securities traded on regional exchanges such as the Chicago Stock Exchange, highlighting mid-cap and small-cap listings. Understanding the differences between Tape-A and Tape-B is essential for brokers to accurately process trade information and execute orders across various market venues.

Key Differences Between Tape-A and Tape-B

Tape-A represents securities transactions on primary exchanges like NYSE, reflecting high liquidity and broad market participation, while Tape-B covers transactions on regional exchanges such as NYSE American and NYSE Arca, often showing less volume and lower spreads. Price reporting and regulatory requirements differ, with Tape-A providing more immediate and comprehensive trade data compared to the more delayed and fragmented data from Tape-B. Understanding these distinctions is crucial for brokers analyzing market depth, execution quality, and real-time pricing accuracy.

Historical Evolution of Tape-A and Tape-B

Tape-A and Tape-B represent distinct categories of securities trade data, with Tape-A historically covering stocks listed on the New York Stock Exchange (NYSE) and Tape-B tracking trades of securities on the American Stock Exchange (AMEX) and regional exchanges. The development of Tape-A began in the 19th century alongside the establishment of the NYSE, evolving through technological advancements to provide real-time trade reporting. Tape-B emerged later to accommodate growth in regional and secondary markets, reflecting a broader diversification in trading venues and regulatory frameworks.

Market Coverage: NYSE vs. Regional Exchanges

Tape A represents securities listed on the New York Stock Exchange (NYSE), offering broader market coverage with high trading volumes and liquidity. Tape B encompasses stocks from regional exchanges like the Chicago Stock Exchange and NYSE American, featuring more specialized listings with narrower market exposure. Traders often monitor Tape A for large-cap, widely followed securities, while Tape B provides insights into mid-cap and small-cap equities on regional platforms.

Impact on Trade Reporting and Transparency

Tape-A encompasses trades executed on NYSE-listed securities, providing high transparency and timely trade reporting due to its large volume and established infrastructure. Tape-B covers trades from regional exchanges and less liquid securities, which can result in delayed reporting and reduced market transparency compared to Tape-A. The disparity between Tape-A and Tape-B influences brokers' ability to access real-time data, affecting trade execution quality and regulatory compliance in trade reporting.

Pricing Models: Fees and Costs Comparison

Tape-A and Tape-B differ significantly in pricing models, impacting brokerages' fee structures and overall costs. Tape-A's pricing model often involves higher fees due to its broader data coverage of NYSE-listed securities, while Tape-B typically offers competitive rates with a focus on AMEX and regional exchange securities. Brokerages must evaluate these fee differences carefully to optimize cost-efficiency based on their trading volume and market focus.

Regulatory Framework for Tape-A and Tape-B

Tape-A and Tape-B securities are regulated under distinct frameworks that govern equity market data dissemination. Tape-A securities, which include stocks listed on the New York Stock Exchange (NYSE), are subject to the Consolidated Tape Association (CTA) Plan, ensuring real-time reporting and dissemination of trade and quote information. Tape-B securities, covering those listed on regional exchanges such as the Chicago Stock Exchange, fall under the CTA's separate B Plan, with specific rules tailored to regional market transparency and reporting standards.

Role in Consolidated Tape Systems

Tape-A and Tape-B play distinct roles in consolidated tape systems, with Tape-A aggregating transaction data from primary listing exchanges, offering comprehensive volume and price information. Tape-B covers transaction data from regional exchanges that list secondary securities, ensuring broader market coverage beyond Tape-A's scope. This division enhances transparency and efficiency by segmenting and consolidating trade data in real-time across all equity markets.

Broker Strategies for Utilizing Tape-A and Tape-B

Broker strategies frequently leverage Tape-A for accessing high liquidity securities predominantly from the New York Stock Exchange, optimizing trade execution speed and minimizing slippage. Tape-B provides critical data on securities listed on regional exchanges, enabling brokers to identify alternative liquidity sources and improve price discovery. By integrating Tape-A and Tape-B data feeds, brokers enhance market transparency and develop sophisticated algorithms that capitalize on cross-exchange arbitrage opportunities.

Future Trends and Developments in Market Tapes

Tape-A and Tape-B represent distinct segments of the consolidated market tape, with Tape-A covering securities listed on the New York Stock Exchange and Tape-B including those on regional exchanges. Future trends indicate increasing integration of real-time data analytics and AI-driven insights to enhance Tape-A and Tape-B's utility for brokers and traders. Advancements in blockchain technology and decentralized data sharing are anticipated to further improve transparency and reduce latency in market tape dissemination.

Important Terms

Consolidated Tape Association (CTA)

The Consolidated Tape Association (CTA) manages Tape-A, which reports trades from NYSE-listed securities, while Tape-B consolidates trades from regional exchanges for securities primarily listed on other venues.

NASDAQ Tape (Tape C)

NASDAQ Tape (Tape C) represents stocks listed on the NASDAQ exchange, differentiating from Tape A and Tape B which correspond to New York Stock Exchange (NYSE) and NYSE American listings respectively.

NYSE Tape (Tape A)

NYSE Tape (Tape A) exclusively reflects trading activity and price data for securities listed on the New York Stock Exchange, whereas Tape B reports trades from regional exchanges and includes a broader range of securities not listed on the NYSE.

AMEX Tape (Tape B)

AMEX Tape B contains real-time NYSE Arca order book data focusing on electronic securities trading, supplementing Tape A which covers NYSE-listed equities and Tape C that includes NASDAQ securities.

Real-Time Quote Dissemination

Real-Time Quote Dissemination ensures investors receive the latest price updates from Tape A, which covers NYSE-listed stocks, and Tape B, covering AMEX-listed securities, enabling accurate and timely market decisions. Market participants rely on this system to monitor liquidity and price movements across these tapes for efficient trading execution.

Trade Reporting Facilities (TRF)

Trade Reporting Facilities (TRF) on Tape A primarily capture securities listed on the New York Stock Exchange (NYSE), while Tape B covers securities listed on regional exchanges, facilitating accurate post-trade data dissemination across U.S. equities markets.

Market Data Feeds

Tape-A market data feeds capture trades and quotes from NYSE-listed securities, while Tape-B feeds provide real-time data for securities listed on regional exchanges, offering distinct coverage and latency profiles essential for traders.

Securities Information Processor (SIP)

Tape A and Tape B are two major market data feeds aggregated and distributed by Securities Information Processors (SIPs) to consolidate trade and quote information for NYSE-listed and other exchange-listed securities, ensuring transparent and efficient market access.

Intermarket Sweep Orders (ISO)

Intermarket Sweep Orders (ISO) enable traders to simultaneously execute large orders across multiple venues, with Tape A reflecting NYSE-listed securities and Tape B covering NYSE American and regional exchange stocks, optimizing price discovery and liquidity access.

UTP Plan (Unlisted Trading Privileges Plan)

The UTP Plan governs unlisted trading privileges primarily for Tape-A securities, while Tape-B securities are regulated under the OPRA Plan, affecting market data dissemination and access differences between the two.

Tape-A vs Tape-B Infographic

moneydif.com

moneydif.com