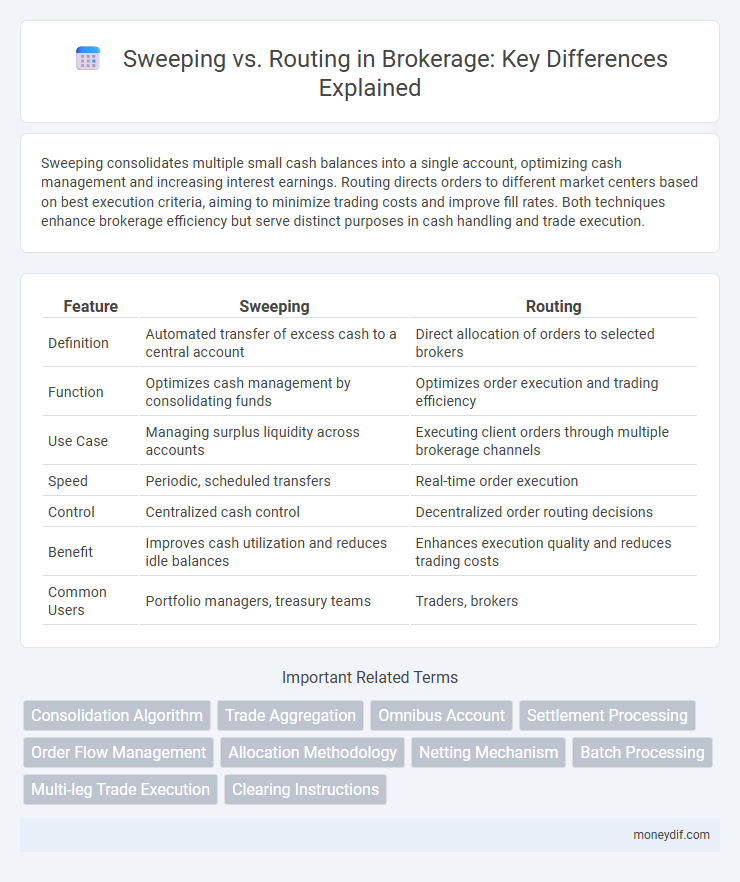

Sweeping consolidates multiple small cash balances into a single account, optimizing cash management and increasing interest earnings. Routing directs orders to different market centers based on best execution criteria, aiming to minimize trading costs and improve fill rates. Both techniques enhance brokerage efficiency but serve distinct purposes in cash handling and trade execution.

Table of Comparison

| Feature | Sweeping | Routing |

|---|---|---|

| Definition | Automated transfer of excess cash to a central account | Direct allocation of orders to selected brokers |

| Function | Optimizes cash management by consolidating funds | Optimizes order execution and trading efficiency |

| Use Case | Managing surplus liquidity across accounts | Executing client orders through multiple brokerage channels |

| Speed | Periodic, scheduled transfers | Real-time order execution |

| Control | Centralized cash control | Decentralized order routing decisions |

| Benefit | Improves cash utilization and reduces idle balances | Enhances execution quality and reduces trading costs |

| Common Users | Portfolio managers, treasury teams | Traders, brokers |

Understanding Sweeping and Routing in Brokerage

Sweeping in brokerage refers to the automatic transfer of uninvested cash into interest-bearing accounts or money market funds to maximize returns, reducing idle funds in customer accounts. Routing involves directing client orders to various trading venues or market makers to achieve the best execution price, considering factors like speed, price, and liquidity. Understanding the distinction between sweeping and routing enables brokers to optimize client asset utilization and trade execution quality effectively.

Key Differences Between Sweeping and Routing

Sweeping in brokerage involves automatically transferring idle cash balances into interest-bearing accounts or money market funds to maximize returns, while routing directs buy and sell orders to various market venues to achieve the best execution. Key differences include sweeping's focus on cash management and yield optimization compared to routing's emphasis on order execution efficiency and price improvement. Sweeping typically deals with fund allocation post-trade, whereas routing concerns pre-trade order handling and venue selection.

How Sweeping Works in Brokerage Accounts

Sweeping in brokerage accounts involves automatically transferring uninvested cash into interest-bearing accounts or money market funds to maximize returns on idle funds. This process ensures that excess cash is efficiently managed by reducing the opportunity cost of holding non-productive cash. Sweeping mechanisms enhance liquidity management by seamlessly reallocating funds without manual intervention, optimizing overall portfolio performance.

The Mechanics of Order Routing

Order routing involves directing client orders to various venues such as exchanges or market makers to achieve the best execution based on price, speed, and liquidity. Brokerage firms use advanced algorithms to analyze multiple factors including order size, market conditions, and transaction costs to optimize routing decisions. Sweeping differs by breaking large orders into smaller segments and sending them sequentially across multiple venues to capture liquidity without significant market impact.

Pros and Cons of Sweeping vs. Routing

Sweeping automatically transfers idle cash into interest-bearing accounts or investments, maximizing returns but potentially limiting immediate liquidity for trading. Routing directs orders to specific venues based on price and execution speed, enhancing trade execution quality but possibly incurring higher transaction costs due to complex routing algorithms. Choosing between sweeping and routing depends on whether the priority is optimizing cash yield or achieving the best trade execution price and speed.

Regulatory Considerations for Sweeping and Routing

Regulatory considerations for sweeping and routing in brokerage emphasize compliance with SEC Rule 606, requiring detailed disclosure of order routing practices to ensure transparency and best execution. Sweeping mandates strict adherence to Customer Protection Rule (SEC Rule 15c3-3), safeguarding client funds during transfers between accounts or platforms. Brokers must also navigate FINRA's requirements on order handling and periodic reporting to prevent conflicts of interest and maintain fair market practices.

Impact on Client Assets: Sweeping vs. Routing

Sweeping moves client assets into interest-bearing accounts or money market funds, maximizing liquidity and potential returns while maintaining easy access. Routing directs orders to specific market venues to secure the best execution price but does not affect how client assets are held or invested. The choice between sweeping and routing impacts asset growth and accessibility differently, with sweeping focusing on asset management and routing on order execution efficiency.

Technology’s Role in Sweeping and Routing

Technology streamlines sweeping and routing by automating fund transfers and order execution, enhancing efficiency and accuracy in brokerage operations. Advanced algorithms and APIs enable real-time decision-making to optimize cash management and trade routing based on market conditions and client preferences. Integration of AI and machine learning further refines the process by predicting trends and reducing operational risks.

Fees and Revenue Implications for Brokers

Sweeping directs client funds into interest-bearing accounts or money market funds, generating consistent revenue through fund management fees while potentially reducing commission income. Routing involves directing orders to specific market centers, where brokers may earn payment for order flow, impacting revenue based on volume and execution quality fees. Understanding the fee structures and revenue models of sweeping versus routing enables brokers to optimize profitability while balancing client service and regulatory compliance.

Best Practices for Selecting Sweeping or Routing

Selecting between sweeping and routing in brokerage requires careful analysis of transaction costs, order execution speed, and market liquidity to maximize trading efficiency. Sweeping is best for accessing fragmented liquidity pools quickly, while routing excels in directing orders to venues offering optimal price improvement and reduced fees. Employing real-time analytics and smart order routing algorithms enhances decision-making, ensuring compliance with regulatory obligations like SEC Rule 606.

Important Terms

Consolidation Algorithm

The Consolidation Algorithm enhances efficiency by optimizing Sweeping methods for centralized data aggregation while leveraging Routing techniques to minimize latency in distributed network environments.

Trade Aggregation

Trade aggregation optimizes execution by consolidating multiple orders into a single transaction, using sweeping to target multiple liquidity sources simultaneously and routing to direct orders through specific venues for best price discovery.

Omnibus Account

An Omnibus Account consolidates multiple client funds under one account, enabling efficient fund management through sweeping for automated aggregation or routing for directed transfers.

Settlement Processing

Settlement processing involves transferring funds between accounts, where sweeping automates consolidating balances into a master account daily, while routing directs individual transactions to specific accounts based on predefined criteria.

Order Flow Management

Order flow management enhances trade execution by using sweeping to break large orders into smaller parts across multiple venues, while routing directs orders to specific venues based on liquidity and speed.

Allocation Methodology

Allocation methodology in sweeping focuses on consolidating multiple accounts or transactions into a single pool to optimize liquidity management, whereas routing involves directing individual transactions through specific channels or pathways to maximize efficiency and cost-effectiveness. Sweeping minimizes idle balances by automatically transferring funds, while routing strategically selects payment routes based on criteria such as transaction fees, currency, and timing.

Netting Mechanism

The netting mechanism consolidates multiple transactions to minimize the number of payments, enhancing liquidity management by reducing settlement risks. Sweeping aggregates funds from various accounts into a single master account for centralized control, whereas routing directs funds to specific accounts based on predetermined rules, optimizing cash flow distribution within corporate treasury operations.

Batch Processing

Batch processing optimizes workflow by grouping similar tasks for efficient sweeping of large data sets, while routing directs individual tasks dynamically for real-time decision-making and resource allocation.

Multi-leg Trade Execution

Multi-leg trade execution optimizes order fulfillment by using sweeping to simultaneously access multiple liquidity pools, while routing directs orders sequentially to specific venues based on price and execution speed.

Clearing Instructions

Clearing instructions dictate whether funds are processed via sweeping, which consolidates multiple accounts into one, or routing, which directs transactions through specific payment paths for precise settlement.

Sweeping vs Routing Infographic

moneydif.com

moneydif.com