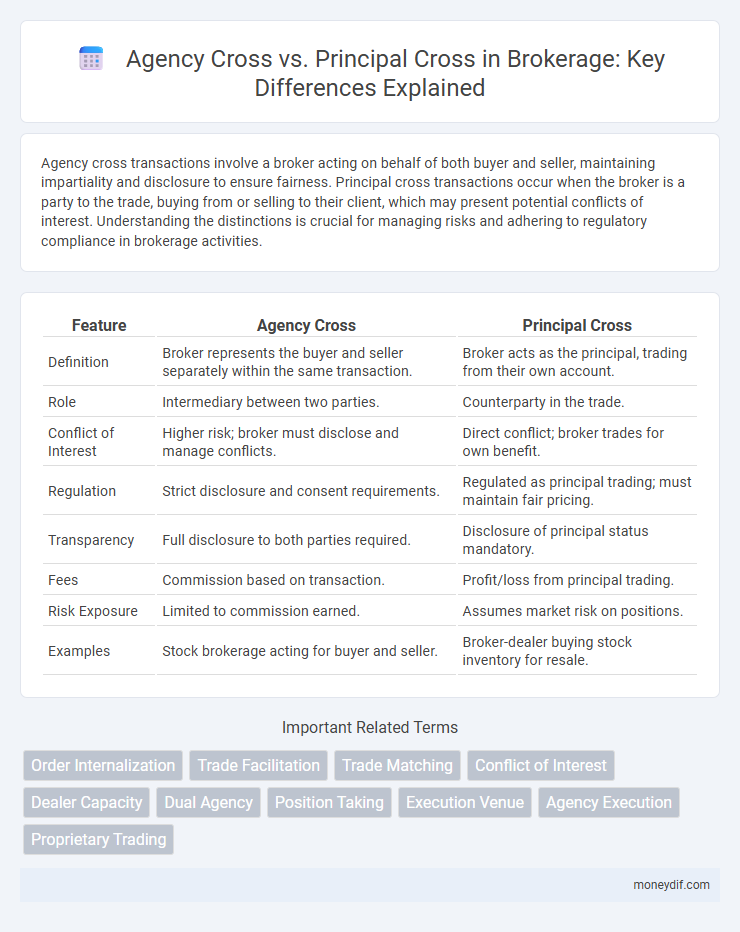

Agency cross transactions involve a broker acting on behalf of both buyer and seller, maintaining impartiality and disclosure to ensure fairness. Principal cross transactions occur when the broker is a party to the trade, buying from or selling to their client, which may present potential conflicts of interest. Understanding the distinctions is crucial for managing risks and adhering to regulatory compliance in brokerage activities.

Table of Comparison

| Feature | Agency Cross | Principal Cross |

|---|---|---|

| Definition | Broker represents the buyer and seller separately within the same transaction. | Broker acts as the principal, trading from their own account. |

| Role | Intermediary between two parties. | Counterparty in the trade. |

| Conflict of Interest | Higher risk; broker must disclose and manage conflicts. | Direct conflict; broker trades for own benefit. |

| Regulation | Strict disclosure and consent requirements. | Regulated as principal trading; must maintain fair pricing. |

| Transparency | Full disclosure to both parties required. | Disclosure of principal status mandatory. |

| Fees | Commission based on transaction. | Profit/loss from principal trading. |

| Risk Exposure | Limited to commission earned. | Assumes market risk on positions. |

| Examples | Stock brokerage acting for buyer and seller. | Broker-dealer buying stock inventory for resale. |

Understanding Agency Cross Transactions

Agency cross transactions occur when a broker represents both the buyer and the seller in the same deal, maintaining fiduciary duties to both parties while facilitating negotiation and execution. Principal cross transactions involve the broker acting as a principal in the trade, buying or selling securities for their own account which can lead to conflicts of interest without proper disclosure. Understanding the distinctions and regulatory requirements for agency cross and principal cross transactions is critical to ensuring transparency, compliance, and ethical brokerage practices.

Defining Principal Cross Transactions

Principal cross transactions occur when a brokerage firm acts as both the agent and the principal in the same trade, buying and selling securities from its own inventory to fulfill a client's order. This contrasts with agency cross transactions, where the broker matches two clients' buy and sell orders without using its own inventory. Principal crosses can create potential conflicts of interest, requiring brokers to disclose the transaction terms and ensure fair pricing to protect client interests.

Key Differences Between Agency Cross and Principal Cross

Agency Cross occurs when a brokerage represents two different clients in the same transaction, maintaining fiduciary duties for both parties independently, whereas Principal Cross involves the brokerage acting as a principal or direct party in the transaction, often selling its own property or interest. Agency Cross demands heightened disclosure and conflict of interest management to protect client interests, while Principal Cross requires transparency regarding the brokerage's financial stake to ensure ethical compliance. Key differences lie in representation roles, conflict management, and disclosure obligations, affecting regulatory adherence and client trust in brokerage services.

Regulatory Framework for Cross Trades

The regulatory framework for agency cross and principal cross trades mandates strict disclosure and best execution obligations to protect market integrity and investor interests. Agency cross trades require brokers to act in the best interest of both buyers and sellers without taking a proprietary position, ensuring transparency and avoiding conflicts of interest per SEC Rule 206(3)-2 and FINRA Rule 5240. Principal cross trades involve a broker-dealer executing trades against its own inventory, subject to additional requirements such as fair pricing and written client consent to comply with fiduciary duties and prevent market manipulation.

Advantages and Disadvantages of Agency Cross

Agency Cross transactions offer the advantage of transparency and adherence to fiduciary duties, as brokers represent both buyer and seller with full disclosure, enhancing trust and compliance. However, these transactions may face conflicts of interest, potentially complicating negotiations and raising ethical concerns if proper safeguards are not maintained. Despite these drawbacks, Agency Cross can streamline deals by consolidating communication and reducing transaction time.

Principal Cross: Risks and Benefits

Principal cross transactions involve a brokerage acting as the principal in both buying and selling securities within the same transaction, creating potential conflicts of interest due to the firm's dual role. The benefits include increased liquidity and potentially better pricing for clients, while risks encompass reduced transparency, possible price manipulation, and regulatory scrutiny. Effective disclosure and adherence to compliance standards are critical to managing these risks and protecting client interests in principal cross dealings.

Impact on Market Transparency

Agency crosses involve a broker matching buy and sell orders for different clients without taking a proprietary position, preserving market transparency by clearly delineating client interests. Principal crosses occur when a broker trades from its own inventory against a client, potentially reducing transparency due to conflicts of interest and less visible price discovery. The choice between agency and principal crosses significantly influences market transparency, affecting investor confidence and regulatory scrutiny.

Compliance Requirements for Cross Trades

Compliance requirements for agency cross trades mandate strict disclosure obligations and obtainment of client consent to prevent conflicts of interest and ensure transparency. Principal cross trades require rigorous compliance controls to address potential self-dealing risks, including fair pricing and regulatory reporting. Both transaction types are subject to SEC Rule 206(3)-2 under the Investment Advisers Act, emphasizing fiduciary duty and conflict mitigation.

Best Practices in Cross Trade Execution

In cross trade execution, best practices emphasize transparent disclosure and strict adherence to fiduciary duties to avoid conflicts of interest between agency and principal roles. Agency cross trades require clear client consent and fair price verification to ensure impartiality, whereas principal cross trades demand rigorous compliance with regulatory frameworks to prevent self-dealing risks. Utilizing third-party valuation tools and maintaining detailed trade records strengthen trust and regulatory compliance during cross trade activities.

Agency and Principal Cross: Real-World Examples

Agency Cross occurs when a brokerage represents both buyer and seller as agents, maintaining fiduciary duties to each party separately, while Principal Cross involves the brokerage acting as a principal on one side of the transaction, often selling its own inventory. A common Agency Cross example is a real estate firm facilitating a property sale between two clients, ensuring confidentiality and impartiality. In contrast, Principal Cross is frequent in securities trading where a brokerage sells shares from its own account to a client, potentially raising conflict-of-interest concerns.

Important Terms

Order Internalization

Order internalization occurs when brokers execute client orders within their own firm, often creating agency cross trades where client interests are matched internally rather than routing orders through principal cross arrangements involving external counterparties.

Trade Facilitation

Trade facilitation enhances efficiency by distinguishing between agency cross, where intermediaries act on behalf of principals, and principal cross, where parties directly engage in cross-border transactions.

Trade Matching

Trade matching in securities transactions ensures accurate pairing of buy and sell orders, with Agency Cross representing trades where a broker matches client orders without taking market risk, while Principal Cross involves the broker acting as a principal, trading from their own inventory and assuming risk. Effective trade matching reduces settlement errors and enhances market transparency by clearly distinguishing these differing broker roles.

Conflict of Interest

Conflict of interest arises when an agent's duty to multiple principals creates competing obligations between agency cross and principal cross relationships.

Dealer Capacity

Dealer capacity determines whether a transaction is classified as an agency cross, where the dealer acts as an agent facilitating trades between buyers and sellers, or a principal cross, where the dealer trades from its own inventory, impacting transparency and risk exposure.

Dual Agency

Dual agency occurs when a single real estate agent represents both the buyer and the seller in a transaction, creating potential conflicts of interest. Agency cross refers to the agent representing both parties under the same brokerage, while principal cross involves dual roles when the agent is also a principal in the transaction, requiring heightened disclosure and consent measures.

Position Taking

Position taking in agency cross vs principal cross scenarios involves agents acting on behalf of multiple principals, where conflicts of interest arise from balancing fiduciary duties to each principal while optimizing transaction outcomes.

Execution Venue

Execution venue selection significantly impacts Agency Cross and Principal Cross transactions by determining regulatory compliance, price transparency, and conflict-of-interest management in securities trading.

Agency Execution

Agency execution involves executing trades on behalf of clients without taking market risk, distinguishing it from principal cross where the dealer acts as a principal and matches internal buy and sell orders. In agency cross transactions, transparency and best execution obligations are critical, ensuring client interests are prioritized over firm inventory management.

Proprietary Trading

Proprietary trading involves firms using their own capital to trade, contrasting with agency cross and principal cross transactions where firms act as intermediaries or counterparties in executing client orders.

Agency Cross vs Principal Cross Infographic

moneydif.com

moneydif.com