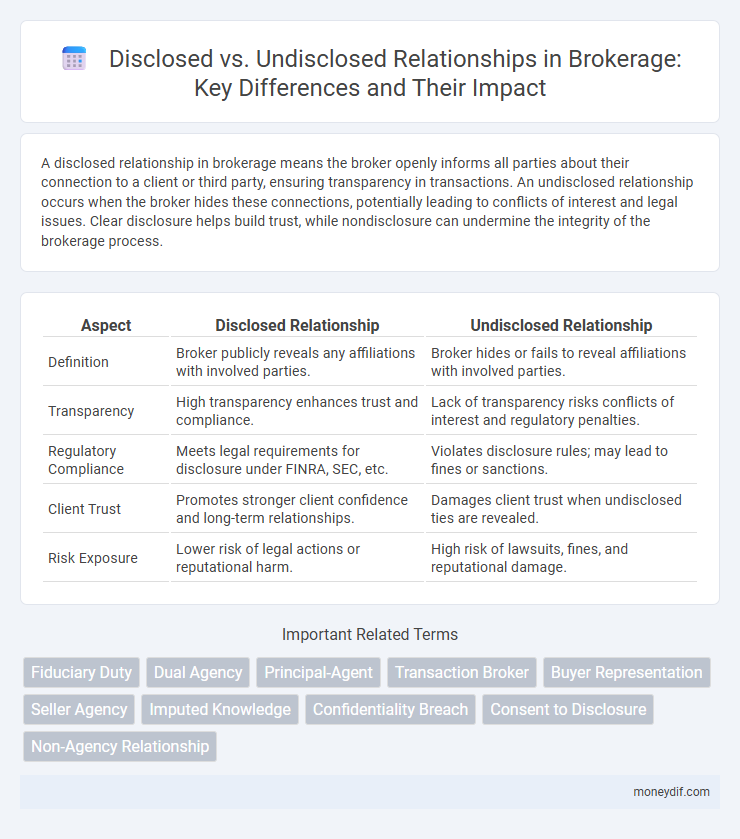

A disclosed relationship in brokerage means the broker openly informs all parties about their connection to a client or third party, ensuring transparency in transactions. An undisclosed relationship occurs when the broker hides these connections, potentially leading to conflicts of interest and legal issues. Clear disclosure helps build trust, while nondisclosure can undermine the integrity of the brokerage process.

Table of Comparison

| Aspect | Disclosed Relationship | Undisclosed Relationship |

|---|---|---|

| Definition | Broker publicly reveals any affiliations with involved parties. | Broker hides or fails to reveal affiliations with involved parties. |

| Transparency | High transparency enhances trust and compliance. | Lack of transparency risks conflicts of interest and regulatory penalties. |

| Regulatory Compliance | Meets legal requirements for disclosure under FINRA, SEC, etc. | Violates disclosure rules; may lead to fines or sanctions. |

| Client Trust | Promotes stronger client confidence and long-term relationships. | Damages client trust when undisclosed ties are revealed. |

| Risk Exposure | Lower risk of legal actions or reputational harm. | High risk of lawsuits, fines, and reputational damage. |

Understanding Brokerage Relationships

Disclosed relationships in brokerage require the agent to inform all parties about their role and any conflicts of interest, ensuring transparency and trust during transactions. Undisclosed relationships occur when the broker represents one party without explicitly revealing this to others, potentially leading to conflicts and ethical concerns. Understanding these distinctions is crucial for legally compliant brokerage practices and protecting the interests of clients.

What is a Disclosed Relationship in Brokerage?

A disclosed relationship in brokerage occurs when the broker openly informs all parties involved about any existing connections or affiliations that could influence the transaction. This transparency helps maintain trust and ensures compliance with legal and ethical standards while preventing conflicts of interest. Brokers must clearly communicate these relationships to clients before proceeding with any deals or negotiations.

Key Features of Undisclosed Relationships

Undisclosed relationships in brokerage occur when an agent represents both the buyer and the seller without informing either party, creating potential conflicts of interest and reduced transparency. Key features include the absence of explicit consent from clients, increased risk of biased advice, and limited disclosure of material information that could affect negotiation outcomes. Agents must navigate strict legal and ethical guidelines to maintain trust while balancing fiduciary duties in these arrangements.

Legal Implications of Disclosed vs. Undisclosed Relationships

Disclosed relationships in brokerage involve openly informing all parties about any existing affiliations, ensuring transparency and compliance with legal regulations such as fiduciary duties and anti-fraud laws. Undisclosed relationships may lead to conflicts of interest, breaches of contract, and potential legal actions including sanctions or license revocations under securities and real estate laws. Regulatory bodies like the SEC and FINRA emphasize disclosure to protect investor interests and maintain market integrity.

Broker Obligations in Different Relationship Types

Brokers in a disclosed relationship must explicitly inform clients about any affiliation with the other party, ensuring transparency and full disclosure of potential conflicts of interest. In contrast, undisclosed relationships require brokers to maintain confidentiality about their connection with other parties, but they are still obligated to act in the best interests of their clients. Regulatory frameworks mandate that brokers uphold fiduciary duties regardless of relationship type, emphasizing honesty, loyalty, and fair dealing to protect client interests.

Risks Associated with Undisclosed Relationships

Undisclosed relationships in brokerage create significant risks, including conflicts of interest that may compromise client trust and lead to legal liabilities. Brokers who fail to reveal these relationships expose themselves to regulatory penalties and potential loss of licensure. Transparency in disclosing relationships is crucial to maintaining ethical standards and protecting both clients and brokers from reputational damage and financial harm.

Benefits of Transparency in Brokerage

Transparency in brokerage through disclosed relationships enhances trust and minimizes conflicts of interest by clearly informing clients of any affiliations between brokers and counterparties. This openness allows clients to make well-informed decisions, improving satisfaction and regulatory compliance while fostering long-term loyalty. Maintaining disclosed relationships supports ethical standards and reduces potential legal risks associated with undisclosed connections.

Impact on Clients: Disclosed vs. Undisclosed Relationships

Disclosed relationships in brokerage foster transparency, enabling clients to make informed decisions and trust the advisor's recommendations, which can mitigate conflicts of interest. Undisclosed relationships, however, may compromise client interests by obscuring potential biases, leading to decisions that might not align with the client's best financial outcome. Regulatory bodies increasingly emphasize disclosure to protect investors and uphold market integrity.

Regulatory Requirements for Brokerage Disclosure

Brokerage firms must adhere to regulatory requirements by clearly disclosing any disclosed relationships to clients, including conflicts of interest and affiliations that may influence transactions. Undisclosed relationships violate fiduciary duties and regulatory standards set by entities such as the SEC and FINRA, potentially resulting in penalties and loss of license. Transparent disclosure ensures compliance with regulations like Regulation Best Interest, promoting investor protection and trust in brokerage services.

Best Practices for Establishing Brokerage Relationships

Establishing brokerage relationships requires clear communication of whether the brokerage relationship is disclosed or undisclosed to avoid conflicts of interest and ensure regulatory compliance. Best practices include providing clients with a written agreement outlining the scope of representation, duties owed, and disclosure of any existing relationships that could influence the transaction. Maintaining transparency and adhering to fiduciary duties helps build trust and protects all parties involved during real estate transactions.

Important Terms

Fiduciary Duty

Fiduciary duty requires full disclosure of relationships to maintain trust, as undisclosed relationships can lead to conflicts of interest and legal liability.

Dual Agency

Dual agency occurs when a real estate agent represents both the buyer and seller, requiring a disclosed relationship to ensure transparency and avoid conflicts of interest, whereas an undisclosed relationship may lead to legal issues and ethical violations.

Principal-Agent

In a Principal-Agent context, a disclosed relationship occurs when the third party is aware of the principal's identity, ensuring direct accountability and clear legal obligations between all parties. In contrast, an undisclosed relationship keeps the principal's identity hidden from the third party, which can complicate liability issues and affect trust and contract enforceability.

Transaction Broker

A Transaction Broker facilitates a real estate transaction by assisting both parties without representing either as an agent, differing from a Disclosed Relationship where the broker openly represents one party, and an Undisclosed Relationship where the broker secretly represents one party without informing the other.

Buyer Representation

Buyer representation involves a disclosed relationship where the agent openly represents the buyer's interests, whereas an undisclosed relationship conceals the agent's representation, potentially causing conflicts of interest.

Seller Agency

Seller agency requires full disclosure of relationships, ensuring transparency, whereas undisclosed relationships can lead to conflicts of interest and legal risks.

Imputed Knowledge

Imputed knowledge legally attributes awareness from disclosed relationships but challenges arise in proving awareness in undisclosed relationships due to lack of direct or constructive notice.

Confidentiality Breach

A confidentiality breach occurs when an undisclosed relationship leads to unauthorized disclosure of sensitive information, whereas disclosed relationships involve transparency that helps prevent such breaches.

Consent to Disclosure

Consent to disclosure ensures transparency by distinguishing between disclosed relationships, where parties acknowledge their connections, and undisclosed relationships, which remain confidential to protect privacy and avoid conflicts of interest.

Non-Agency Relationship

A non-agency relationship differs from disclosed and undisclosed agency relationships in that the principal does not authorize the agent to act on their behalf, resulting in the agent having no authority to bind the principal in contracts.

Disclosed Relationship vs Undisclosed Relationship Infographic

moneydif.com

moneydif.com