Straight-Through Processing (STP) in brokerage enables automated trade execution, reducing errors and accelerating transaction times compared to manual processing, which relies on human intervention and is prone to delays. STP enhances efficiency by integrating multiple systems seamlessly, ensuring orders are processed swiftly without manual input. Manual processing, while offering control and oversight, increases operational risks and costs due to its slower pace and potential for human error.

Table of Comparison

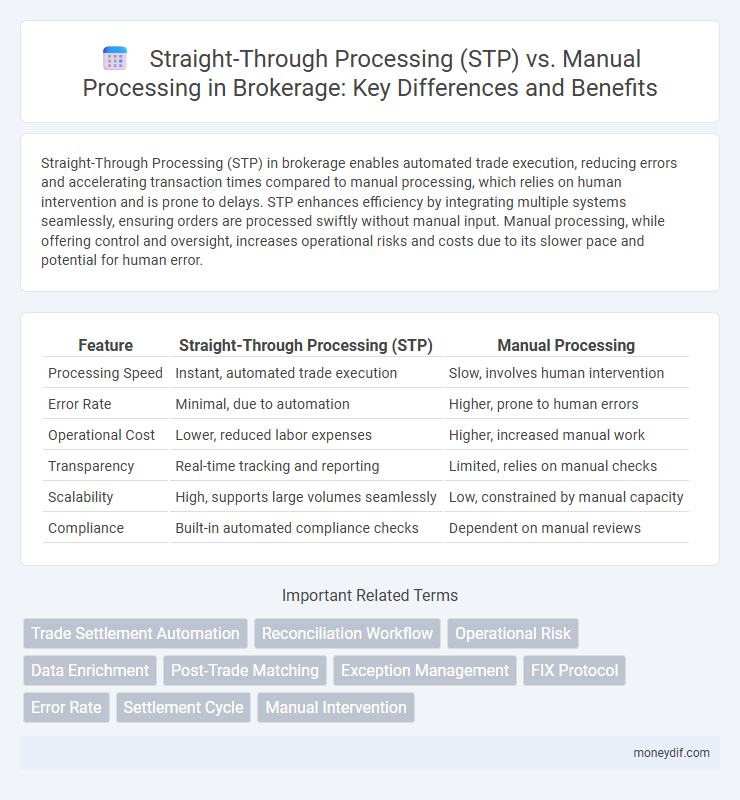

| Feature | Straight-Through Processing (STP) | Manual Processing |

|---|---|---|

| Processing Speed | Instant, automated trade execution | Slow, involves human intervention |

| Error Rate | Minimal, due to automation | Higher, prone to human errors |

| Operational Cost | Lower, reduced labor expenses | Higher, increased manual work |

| Transparency | Real-time tracking and reporting | Limited, relies on manual checks |

| Scalability | High, supports large volumes seamlessly | Low, constrained by manual capacity |

| Compliance | Built-in automated compliance checks | Dependent on manual reviews |

Introduction to STP and Manual Processing in Brokerage

Straight-Through Processing (STP) in brokerage enables seamless automated trade execution by directly routing orders from clients to the market without manual intervention, reducing processing time and minimizing errors. Manual processing involves human intervention at various stages of order execution, often leading to longer settlement times and a higher risk of operational mistakes. Brokers leverage STP to enhance transaction efficiency and accuracy, while manual processing remains in use for complex or non-standard trades requiring personalized oversight.

Key Differences Between STP and Manual Processing

Straight-Through Processing (STP) automates trade execution, reducing human errors and accelerating transaction speed, while manual processing relies on broker intervention and manual input which increases the risk of delays and mistakes. STP enhances operational efficiency by integrating automated workflows across systems, unlike manual processing which requires repetitive tasks and increases operational costs. The scalability and accuracy of STP significantly improve trade lifecycle management compared to the slower, error-prone nature of manual processing in brokerage operations.

Efficiency and Speed: STP vs Manual Processing

Straight-Through Processing (STP) excels in efficiency and speed by automating trade execution, reducing manual intervention, and minimizing errors that commonly occur in manual processing. Manual processing often leads to delays and increased operational risks due to human input, slowing down transaction times and affecting overall brokerage performance. Implementing STP systems enhances real-time transaction handling and accelerates settlement cycles, significantly improving brokerage firms' ability to manage high volumes of trades quickly and accurately.

Impact on Trade Accuracy and Error Reduction

Straight-Through Processing (STP) significantly enhances trade accuracy by automating data flow between trade order initiation and settlement, reducing human error associated with manual input. Manual processing increases the risk of discrepancies due to reliance on manual entry and verification, which can lead to trade mismatches and settlement delays. Implementing STP in brokerage operations decreases error rates, accelerates transaction times, and improves overall operational efficiency.

Cost Implications: Automation vs Manual Labor

Straight-Through Processing (STP) significantly reduces operational costs by automating trade execution, minimizing human intervention, and decreasing error rates, which lowers compliance and correction expenses. In contrast, manual processing demands higher labor costs due to increased staffing requirements, longer transaction times, and greater risk of costly errors or regulatory penalties. Brokers adopting STP benefit from streamlined workflows and improved scalability, ultimately enhancing profit margins by cutting overhead and improving transaction efficiency.

Risk Management in STP and Manual Environments

Straight-Through Processing (STP) enhances risk management in brokerage by automating trade execution and reducing human error, which minimizes operational risks and expedites transaction times. Manual processing, while allowing for human judgment in complex scenarios, increases exposure to errors, delays, and compliance risks due to manual data entry and verification. Integrating STP systems with real-time risk analytics optimizes monitoring and mitigation, whereas manual environments rely heavily on post-trade reconciliation and manual oversight to manage risk effectively.

Regulatory Compliance: Automated vs Manual Approaches

Straight-Through Processing (STP) enhances regulatory compliance by automating trade execution, reducing human errors and ensuring real-time reporting that meets strict financial regulations. Manual processing increases the risk of non-compliance due to delayed data entry, inconsistent records, and potential oversight of mandatory regulatory updates. Automated systems provide audit trails and transparency critical for regulatory bodies, streamlining compliance verification compared to manual workflows.

Client Experience and Transparency Comparison

Straight-Through Processing (STP) significantly enhances client experience by automating trade executions, reducing processing time from minutes to seconds, and minimizing errors commonly found in manual processing. Clients benefit from increased transparency through real-time status updates and instant confirmations, whereas manual processing often suffers from delays and limited visibility into order progress. Improved operational efficiency and transparent communication in STP systems foster greater trust and satisfaction among brokerage clients compared to manual methods.

Scalability and Growth Potential

Straight-Through Processing (STP) enhances scalability by automating trade execution, reducing errors and processing time compared to manual processing. Brokerages leveraging STP can handle higher transaction volumes efficiently, supporting rapid business growth without proportional increases in operational costs. Manual processing limits growth potential due to its reliance on human intervention, increasing the risk of delays and errors as transaction volumes rise.

Choosing Between STP and Manual Processing for Your Brokerage

Choosing between Straight-Through Processing (STP) and manual processing for your brokerage depends on trade volume, accuracy needs, and operational efficiency. STP offers automated, high-speed order execution with reduced errors and lower costs, ideal for high-frequency trading environments. Manual processing, while slower and prone to human error, allows for personalized trade handling and is better suited for complex or low-volume trades requiring human judgment.

Important Terms

Trade Settlement Automation

Trade settlement automation enhances efficiency by enabling straight-through processing (STP) to eliminate errors and delays compared to costly, error-prone manual processing in financial transactions.

Reconciliation Workflow

Reconciliation workflow in financial services streamlines the verification and matching of transactions to ensure accuracy, complementing Straight-Through Processing (STP) by automating end-to-end data flow without manual intervention. Manual processing, in contrast, relies on human oversight for exception handling and error resolution, which can slow down transaction cycles and increase operational risks compared to the efficiency gains achieved through STP integration.

Operational Risk

Operational risk increases significantly with manual processing due to higher error rates and delays compared to the efficiency and accuracy enabled by Straight-Through Processing (STP) in financial transactions.

Data Enrichment

Data enrichment enhances Straight-Through Processing (STP) by automating data validation and integration, significantly reducing errors and processing time compared to Manual Processing.

Post-Trade Matching

Post-trade matching automates trade reconciliation within Straight-Through Processing (STP) to enhance accuracy and speed, reducing errors and operational costs compared to manual processing.

Exception Management

Exception management in Straight-Through Processing (STP) minimizes manual intervention by automatically identifying and resolving transaction errors, enhancing efficiency compared to traditional manual processing.

FIX Protocol

The FIX Protocol enhances Straight-Through Processing (STP) by enabling seamless electronic communication between financial institutions, reducing errors and delays inherent in manual processing workflows.

Error Rate

Error rate in Straight-Through Processing (STP) typically remains below 1%, significantly reducing operational risks compared to manual processing, which can exhibit error rates up to 5-10% due to human intervention. Enhanced STP systems leverage automation, data validation, and AI-driven anomaly detection to minimize processing errors and improve transaction accuracy.

Settlement Cycle

Settlement Cycle efficiency improves significantly with Straight-Through Processing (STP), reducing errors and processing time compared to manual processing.

Manual Intervention

Manual intervention disrupts Straight-Through Processing (STP) workflows by introducing human review and input, increasing processing time and potential errors compared to fully automated manual processing.

Straight-Through Processing (STP) vs Manual Processing Infographic

moneydif.com

moneydif.com