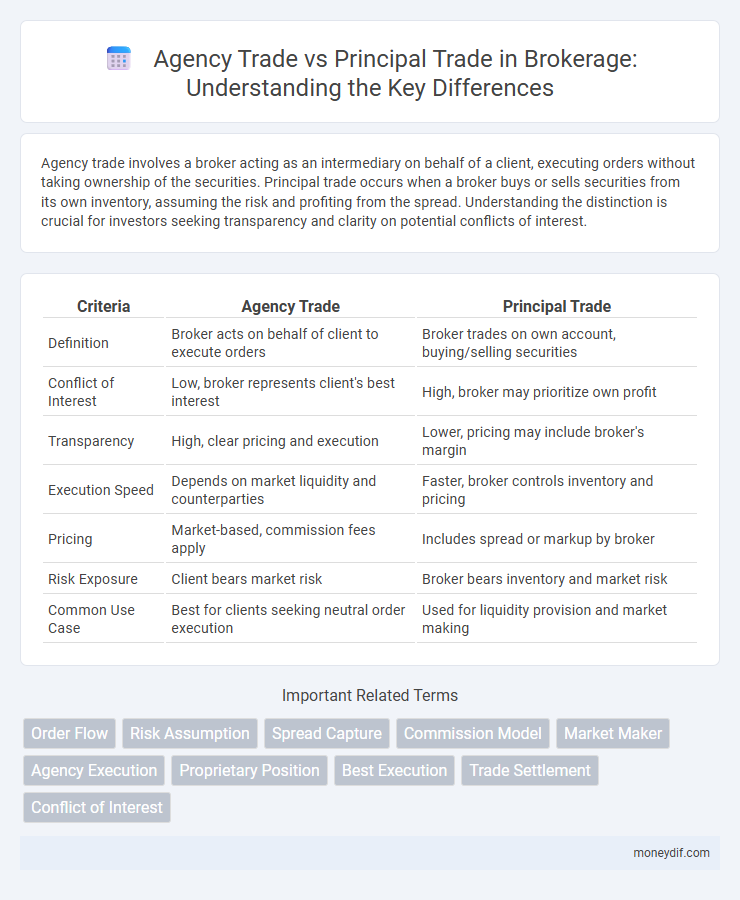

Agency trade involves a broker acting as an intermediary on behalf of a client, executing orders without taking ownership of the securities. Principal trade occurs when a broker buys or sells securities from its own inventory, assuming the risk and profiting from the spread. Understanding the distinction is crucial for investors seeking transparency and clarity on potential conflicts of interest.

Table of Comparison

| Criteria | Agency Trade | Principal Trade |

|---|---|---|

| Definition | Broker acts on behalf of client to execute orders | Broker trades on own account, buying/selling securities |

| Conflict of Interest | Low, broker represents client's best interest | High, broker may prioritize own profit |

| Transparency | High, clear pricing and execution | Lower, pricing may include broker's margin |

| Execution Speed | Depends on market liquidity and counterparties | Faster, broker controls inventory and pricing |

| Pricing | Market-based, commission fees apply | Includes spread or markup by broker |

| Risk Exposure | Client bears market risk | Broker bears inventory and market risk |

| Common Use Case | Best for clients seeking neutral order execution | Used for liquidity provision and market making |

Understanding Agency Trade in Brokerage

Agency trade in brokerage involves a broker acting on behalf of a client to buy or sell securities, prioritizing the client's best interests and transparency in execution. This contrasts with principal trade, where the broker acts as the counterparty, potentially creating conflicts of interest due to holding the securities. Understanding agency trade is essential for investors seeking clear fiduciary responsibility and reduced risk of price manipulation in their transactions.

What Is a Principal Trade?

A principal trade occurs when a brokerage firm buys or sells securities for its own account, rather than on behalf of a client. In this type of trade, the broker acts as the principal, assuming risk by holding the security before selling it to or buying it from the client. This contrasts with agency trades, where the broker acts solely as an intermediary, executing orders on behalf of clients without taking ownership of the securities.

Key Differences Between Agency and Principal Trades

Agency trades involve brokers acting on behalf of clients to execute buy or sell orders without taking ownership of the securities, ensuring impartiality and transparency. Principal trades occur when brokers trade securities for their own accounts, potentially creating conflicts of interest due to the broker acting as both buyer and seller. Key differences include risk exposure, with agency trades limiting broker risk while principal trades involve inventory management and profit from price spreads.

How Brokers Execute Agency Trades

Brokers execute agency trades by acting solely on behalf of their clients, seeking the best available market prices without taking ownership of the securities. They prioritize transparency and fiduciary duty, ensuring clients' interests are protected during the transaction process. Execution methods often involve using electronic trading platforms and routing orders to various exchanges to achieve optimal price and liquidity.

The Role of Conflict of Interest in Principal Trading

Conflict of interest in principal trading arises when a broker-dealer acts as both agent and principal, potentially prioritizing their own profit over the client's best interest. This dual role can lead to biased trade executions since the broker benefits directly from principal trades, unlike agency trades where the broker earns commissions without taking ownership. Regulatory frameworks require transparent disclosures to mitigate risks and ensure clients understand the inherent conflicts in principal trading scenarios.

Fee Structures: Agency vs Principal Trading

Agency trading fees typically involve a commission charged as a percentage of the transaction value, reflecting the broker's role as an intermediary without assuming market risk. Principal trading fees often include a markup or markdown embedded in the bid-ask spread, compensating the broker for the risk taken when trading securities from their own inventory. Understanding these fee structures is essential for investors assessing cost transparency and potential conflicts of interest in brokerage services.

Regulatory Oversight of Agency and Principal Trades

Regulatory oversight of agency trades requires brokers to act in the best interests of their clients, ensuring transparent execution and fair pricing under frameworks like the SEC's Regulation Best Interest. Principal trades are subject to stricter scrutiny to prevent conflicts of interest, with regulators mandating full disclosure and fiduciary duties due to brokers acting on their own behalf. Compliance with MiFID II in Europe and FINRA rules in the U.S. governs both trade types, emphasizing transparency, fair dealing, and risk mitigation in brokerage activities.

Transparency and Disclosure Requirements

Agency trades require brokers to act on behalf of clients, ensuring full transparency and detailed disclosure of fees, commissions, and potential conflicts of interest. Principal trades involve brokers buying or selling securities from their own inventory, necessitating explicit disclosure of the broker's principal role to avoid conflicts and maintain client trust. Regulatory frameworks mandate rigorous transparency and disclosure standards to protect investors and uphold market integrity in both trade types.

Risks Associated with Agency and Principal Trades

Agency trades involve brokers acting on behalf of clients, exposing them primarily to risks related to fiduciary responsibility and potential conflicts of interest. Principal trades carry higher financial risks for brokers since they trade from their own inventory, facing market, inventory, and liquidity risks directly. Understanding these distinctions is crucial for risk management frameworks in brokerage operations.

Choosing the Right Trade Type: Investor Considerations

Investors must evaluate the trade type--agency or principal--based on transparency and potential conflicts of interest; agency trades offer direct client representation with commissions, while principal trades involve the broker acting as counterparty, potentially impacting price execution. Understanding the brokerage's role ensures alignment with investment goals and regulatory compliance, minimizing risks tied to trade execution. Carefully assessing trade type helps investors optimize transaction costs and market exposure tailored to their portfolio strategy.

Important Terms

Order Flow

Order flow represents the stream of buy and sell orders that brokerage agencies route to liquidity providers, distinguishing agency trades where brokers act on behalf of clients from principal trades where dealers trade against their own inventory. Understanding the nuances between agency and principal trades is crucial for analyzing market transparency, execution quality, and potential conflicts of interest in financial markets.

Risk Assumption

Risk assumption in agency trade involves the broker acting on behalf of the client without taking ownership of the securities, thereby transferring market risk to the principal. In principal trade, the dealer assumes the risk by buying or selling securities for their own account, exposing themselves to potential market fluctuations and profit or loss scenarios.

Spread Capture

Spread capture in agency trade involves earning the difference between bid and ask prices without taking market risk, whereas in principal trade, the firm profits by assuming inventory risk and directly benefiting from price changes.

Commission Model

The commission model distinguishes agency trade, where brokers earn fees acting on behalf of clients, from principal trade, where dealers buy and sell securities for their own accounts at risk.

Market Maker

Market makers facilitate liquidity by acting as principals, trading securities from their own inventory to provide continuous bid and ask quotes, while agency traders execute orders on behalf of clients without taking principal risk. The principal trade model involves the market maker bearing market risk, whereas agency trades focus on matching client orders, emphasizing transparency and fiduciary responsibility.

Agency Execution

Agency execution involves a broker acting on behalf of clients to execute trades without taking ownership, contrasting with principal trade where the broker trades from its own inventory, potentially creating conflicts of interest.

Proprietary Position

Proprietary position refers to a firm's own assets held for trading, distinguishing trades executed on its behalf as principal rather than acting as an agent for clients. In agency trades, the firm facilitates transactions solely by matching buyers and sellers without assuming ownership or market risk, whereas proprietary trading involves using the firm's capital to generate profits from market movements.

Best Execution

Best Execution requires brokers to prioritize client interests by ensuring the most favorable terms in agency trades rather than principal trades, where conflicts of interest may arise.

Trade Settlement

Trade settlement involves the final transfer of securities and payment between parties, with agency trades executed on behalf of clients without assuming ownership risk, while principal trades involve the dealer buying or selling securities from their own inventory, bearing the associated market risk.

Conflict of Interest

A conflict of interest arises when an agent's duty to act in the best interest of the principal conflicts with the agent's opportunity to engage in a trade for personal gain. This situation often leads to ethical dilemmas and regulatory scrutiny as the agent may prioritize self-interested trades over fiduciary responsibilities to the principal.

agency trade vs principal trade Infographic

moneydif.com

moneydif.com