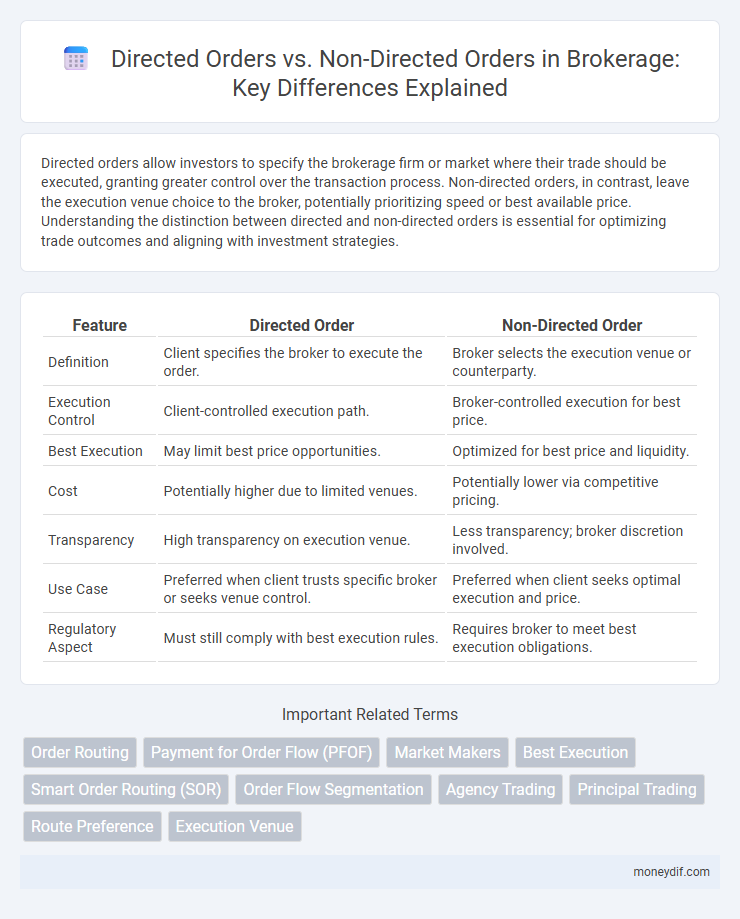

Directed orders allow investors to specify the brokerage firm or market where their trade should be executed, granting greater control over the transaction process. Non-directed orders, in contrast, leave the execution venue choice to the broker, potentially prioritizing speed or best available price. Understanding the distinction between directed and non-directed orders is essential for optimizing trade outcomes and aligning with investment strategies.

Table of Comparison

| Feature | Directed Order | Non-Directed Order |

|---|---|---|

| Definition | Client specifies the broker to execute the order. | Broker selects the execution venue or counterparty. |

| Execution Control | Client-controlled execution path. | Broker-controlled execution for best price. |

| Best Execution | May limit best price opportunities. | Optimized for best price and liquidity. |

| Cost | Potentially higher due to limited venues. | Potentially lower via competitive pricing. |

| Transparency | High transparency on execution venue. | Less transparency; broker discretion involved. |

| Use Case | Preferred when client trusts specific broker or seeks venue control. | Preferred when client seeks optimal execution and price. |

| Regulatory Aspect | Must still comply with best execution rules. | Requires broker to meet best execution obligations. |

Understanding Directed Orders in Brokerage

Directed orders in brokerage specify that a trade must be executed through a particular broker or dealer, allowing investors to maintain control over transaction routing. These orders can influence execution quality, as the designated broker may have better access to specific markets or liquidity pools. Understanding the impact of directed orders helps investors balance personalized service with potential limitations on price improvement and execution speed.

What Are Non-Directed Orders?

Non-directed orders in brokerage refer to instructions given by investors allowing brokers to execute trades without specifying the venue or counterparty, granting brokers discretion in order routing. This flexibility enables brokers to seek the best available price across multiple trading platforms or liquidity pools, often enhancing execution efficiency and potentially reducing transaction costs. Non-directed orders contrast with directed orders, where investors explicitly choose the execution venue, possibly limiting trade optimization.

Key Differences: Directed vs Non-Directed Orders

Directed orders specify a particular broker or dealer to execute a trade, giving investors control over the transaction's routing, while non-directed orders allow the brokerage firm to select the executing party based on best execution policies. Directed orders may limit access to better pricing or liquidity available through alternative brokers, potentially affecting trade execution quality. Non-directed orders leverage the broker-dealer network to optimize trade execution, often resulting in improved pricing and reduced market impact.

How Brokers Handle Directed Orders

Brokers handling directed orders execute trades exclusively through a specified market center or venue as instructed by the client, ensuring compliance with the order's routing preferences and maintaining transparency in transaction processing. This method allows brokers to prioritize client control over execution venue selection while potentially impacting the order's price improvement opportunities or execution speed. Directed orders require brokers to carefully manage routing instructions, balancing client directives with best execution obligations under regulatory frameworks like Reg NMS.

Benefits of Placing Directed Orders

Placing directed orders allows investors to choose specific market makers, potentially securing better pricing and faster execution compared to non-directed orders routed through broker's default channels. Directed orders provide greater control over trade execution, enhancing transparency and enabling investors to build relationships with preferred liquidity providers. This approach can reduce trading costs and improve overall order fulfillment efficiency, particularly in less liquid or volatile markets.

Risks Associated with Non-Directed Orders

Non-directed orders pose significant risks including potential conflicts of interest as brokers decide the execution venue, possibly leading to suboptimal trade prices or delayed executions. These orders may result in higher transaction costs due to less competitive routing compared to directed orders where clients specify the execution platform. Investors face increased market exposure and reduced control over trade outcomes, heightening the importance of understanding the broker's discretion in non-directed order handling.

Regulatory Considerations for Order Types

Regulatory considerations for Directed Orders require strict adherence to best execution obligations, ensuring brokers route orders to a client-specified venue without compromising price or execution quality. Non-Directed Orders grant brokers discretion to select execution venues, subject to regulatory mandates designed to optimize trade outcomes and prevent conflicts of interest. Compliance with SEC Regulation NMS and MiFID II guidelines mandates transparency and fairness in routing decisions, impacting the handling of both order types.

Impact on Trade Execution Quality

Directed orders instruct brokers to execute trades through specific venues or market makers, potentially limiting access to the best available prices and impacting execution quality. Non-directed orders allow brokers the flexibility to seek the most favorable market conditions, often resulting in better price improvements, reduced spreads, and faster execution times. Trade execution quality is typically higher with non-directed orders due to broader market access and competitive pricing opportunities.

Choosing the Right Order Type for Your Strategy

Directed orders allow investors to specify a particular broker or dealer to execute their trade, providing greater control over execution and potential cost savings. Non-directed orders are routed by the brokerage to the best available market or dealer automatically, optimizing for speed and price but sacrificing direct broker choice. Selecting the appropriate order type depends on your trading strategy's emphasis on control versus efficiency, with directed orders suited for targeted execution and non-directed orders favoring quick market access.

Best Practices for Investors Using Directed and Non-Directed Orders

Investors should carefully evaluate the trade-off between Directed Orders, which specify a particular broker, and Non-Directed Orders that allow the broker to route trades for optimal execution. Best practices recommend scrutinizing order execution quality, potential price improvement, and commission structures to maximize investment returns. Regularly reviewing trade confirmations and comparing execution reports ensures transparency and helps identify the most cost-effective order types for various market conditions.

Important Terms

Order Routing

Directed orders specify a broker for execution, ensuring targeted routing, while non-directed orders allow the trading venue to determine the best execution path based on market conditions.

Payment for Order Flow (PFOF)

Payment for Order Flow (PFOF) occurs when brokers route Directed Orders to specific market makers in exchange for compensation, while Non-Directed Orders are sent to the best available venue without predetermined routing, impacting execution quality and transparency.

Market Makers

Market makers adjust their bid-ask spreads and liquidity provision based on whether trades are directed orders, specifically routed to them, or non-directed orders that enter the market anonymously.

Best Execution

Best execution requires brokers to prioritize achieving the most favorable trade terms for clients, with directed orders limiting broker discretion by specifying execution venues, while non-directed orders grant brokers flexibility to select venues for optimal pricing and speed.

Smart Order Routing (SOR)

Smart Order Routing (SOR) optimizes trade execution by dynamically directing orders to the best available venues, distinguishing between directed orders that specify a target market and non-directed orders that allow the system to choose the optimal execution path.

Order Flow Segmentation

Order Flow Segmentation distinguishes Directed Orders, which are intentionally routed to specific market makers or venues, from Non-Directed Orders that are sent without predetermined targeting to optimize execution efficiency and market impact analysis.

Agency Trading

Agency trading involves executing Directed Orders, where brokers act on specific client instructions to trade designated securities, contrasting with Non-Directed Orders that allow brokers discretion to choose securities based on best execution principles.

Principal Trading

Principal trading involves a broker executing Directed Orders, where clients specify the trading venue, versus Non-Directed Orders, where brokers choose the venue to optimize execution.

Route Preference

Route preference in network routing prioritizes directed order paths to ensure predetermined, optimized data flow sequences, enhancing performance and reliability. Non-directed order routes offer flexibility by allowing data packets to traverse any available path, which can improve fault tolerance but may reduce predictability and optimality.

Execution Venue

Execution venues for directed orders are pre-specified by investors, while non-directed orders rely on brokers to select optimal venues based on best execution principles.

Directed Order vs Non-Directed Order Infographic

moneydif.com

moneydif.com