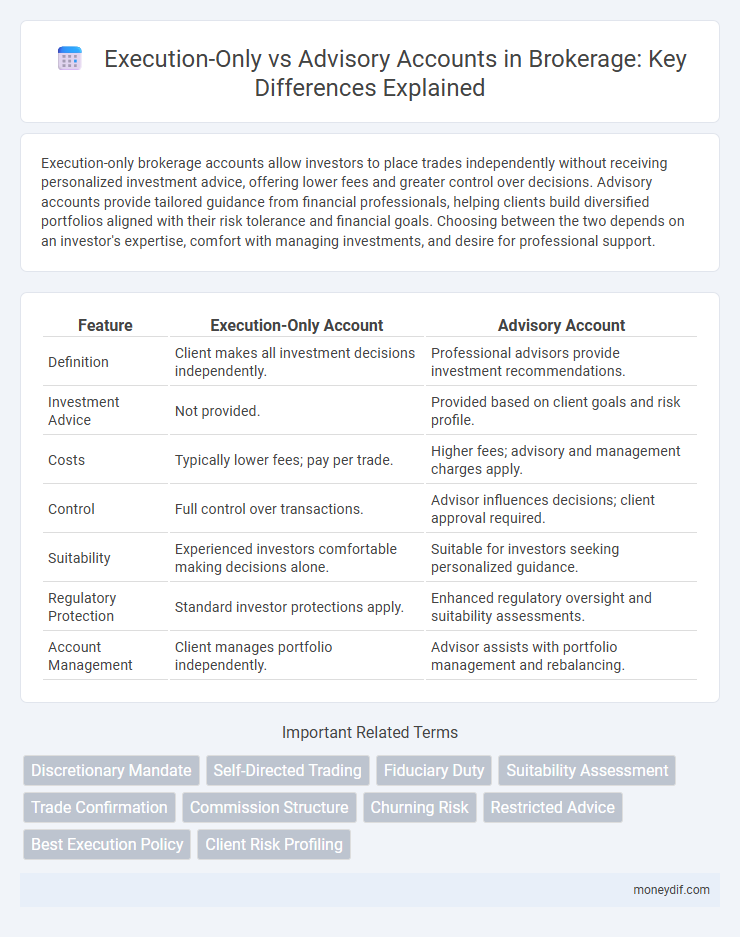

Execution-only brokerage accounts allow investors to place trades independently without receiving personalized investment advice, offering lower fees and greater control over decisions. Advisory accounts provide tailored guidance from financial professionals, helping clients build diversified portfolios aligned with their risk tolerance and financial goals. Choosing between the two depends on an investor's expertise, comfort with managing investments, and desire for professional support.

Table of Comparison

| Feature | Execution-Only Account | Advisory Account |

|---|---|---|

| Definition | Client makes all investment decisions independently. | Professional advisors provide investment recommendations. |

| Investment Advice | Not provided. | Provided based on client goals and risk profile. |

| Costs | Typically lower fees; pay per trade. | Higher fees; advisory and management charges apply. |

| Control | Full control over transactions. | Advisor influences decisions; client approval required. |

| Suitability | Experienced investors comfortable making decisions alone. | Suitable for investors seeking personalized guidance. |

| Regulatory Protection | Standard investor protections apply. | Enhanced regulatory oversight and suitability assessments. |

| Account Management | Client manages portfolio independently. | Advisor assists with portfolio management and rebalancing. |

Understanding Execution-Only Accounts

Execution-only accounts allow investors to independently place trades without receiving personalized investment advice or recommendations from the brokerage. These accounts typically feature lower fees compared to advisory accounts since the broker's role is limited to processing orders rather than offering portfolio guidance. Understanding the reduced level of support and increased responsibility for investment decisions is crucial for investors considering execution-only services.

What Is an Advisory Account?

An advisory account provides personalized investment recommendations tailored to an individual's financial goals, risk tolerance, and investment horizon, typically managed by a licensed financial advisor. Unlike execution-only accounts, where clients make all trading decisions independently, advisory accounts involve professional guidance that includes ongoing portfolio monitoring and adjustments. This service often includes comprehensive financial planning, tax considerations, and retirement strategies, enhancing the potential for optimized investment outcomes.

Key Differences Between Execution-Only and Advisory Accounts

Execution-only accounts allow investors to make trading decisions and execute orders independently without receiving personalized investment advice from brokers. Advisory accounts involve brokers providing tailored recommendations based on the client's financial goals, risk tolerance, and market analysis. The main differences lie in the level of guidance, responsibility for investment decisions, and associated fees, with advisory accounts typically charging higher fees for professional consultation services.

Pros and Cons of Execution-Only Accounts

Execution-only accounts offer full control and lower fees since investors make all decisions without advisory input, ideal for experienced traders seeking cost efficiency. However, the absence of professional guidance increases risks, particularly for novices who may lack market insight and strategic planning support. This model demands strong self-discipline and knowledge to avoid costly errors and optimize portfolio performance.

Advantages and Drawbacks of Advisory Accounts

Advisory accounts offer personalized investment guidance, leveraging professional expertise to tailor portfolios according to individual risk tolerance and financial goals, which can enhance long-term returns and reduce emotional decision-making. However, these accounts typically involve higher fees compared to execution-only accounts, potentially impacting net performance, and may limit investor autonomy by relying heavily on the advisor's recommendations. Investors should weigh the benefit of expert advice against cost considerations and the desire for direct control over their investment choices.

Cost Comparison: Execution-Only vs Advisory

Execution-only brokerage accounts typically incur lower costs, as investors pay solely for transaction fees without advisory service charges. Advisory accounts include higher fees, often comprising a percentage of assets under management, reflecting personalized investment advice and portfolio management. Cost efficiency in execution-only accounts suits self-directed investors, while advisory accounts justify fees with tailored guidance and ongoing support.

Investor Suitability: Who Should Choose Which?

Execution-only accounts suit experienced investors who prefer full control and lower fees, making decisions without personalized advice. Advisory accounts are ideal for less experienced investors seeking tailored guidance and risk management from financial professionals. Choosing depends on individual knowledge, investment goals, and comfort with making independent decisions.

Role of Discretion in Account Types

Execution-only accounts grant investors full control over trade decisions with no broker intervention, eliminating discretionary management. Advisory accounts involve brokers providing tailored investment advice while the investor retains ultimate decision-making authority. Discretionary accounts empower brokers to make trade decisions on behalf of clients, leveraging professional discretion to manage portfolios actively.

Regulatory Considerations and Compliance

Execution-only accounts require strict adherence to suitability regulations, as brokers must ensure no unauthorized advice is provided, minimizing fiduciary duties and reducing liability risks. Advisory accounts involve comprehensive regulatory compliance, including Know Your Customer (KYC) protocols, continuous suitability assessments, and maintaining detailed documentation to demonstrate aligned investment recommendations. Regulatory bodies such as the SEC and FCA enforce stringent oversight on advisory services to protect investor interests, demanding enhanced transparency and accountability in client interactions.

Making the Right Choice: Factors to Consider

When choosing between execution-only and advisory brokerage accounts, investors should evaluate their investment knowledge, risk tolerance, and need for personalized guidance. Execution-only accounts offer lower costs and full control, suitable for experienced investors confident in making decisions independently. Advisory accounts provide professional advice and portfolio management but usually come with higher fees, ideal for those seeking tailored strategies and ongoing support.

Important Terms

Discretionary Mandate

A discretionary mandate empowers portfolio managers to make investment decisions on behalf of clients without needing pre-approval for each trade, contrasting with execution-only accounts where clients retain full control and advisors provide no investment recommendations. Advisory accounts involve personalized guidance and investment suggestions while requiring client consent before execution, blending elements absent in both discretionary and execution-only arrangements.

Self-Directed Trading

Self-directed trading allows investors to make independent decisions through execution-only accounts, where no financial advice is provided, enabling lower fees and greater control over trades. In contrast, advisory accounts offer personalized guidance and portfolio recommendations but typically involve higher costs due to ongoing advisory services.

Fiduciary Duty

Fiduciary duty mandates that financial advisors act in the best interests of their clients, providing tailored advice and personalized recommendations in advisory accounts. Execution-only accounts, by contrast, do not involve fiduciary responsibility, as clients make investment decisions independently without professional guidance or fiduciary oversight.

Suitability Assessment

Suitability assessment ensures clients' investment choices align with their financial goals and risk tolerance, distinguishing execution-only accounts, which lack personalized advice, from advisory accounts that provide tailored recommendations.

Trade Confirmation

Trade confirmation for execution-only accounts provides detailed transaction data without investment advice, unlike advisory accounts where confirmations include tailored recommendations and suitability information.

Commission Structure

Execution-only accounts feature a straightforward commission structure with fixed fees per transaction, reflecting minimal service involvement and lower costs. Advisory accounts typically incur percentage-based commissions or advisory fees tied to assets under management, compensating for personalized investment advice and portfolio management.

Churning Risk

Churning risk is significantly higher in advisory accounts due to frequent trading recommendations compared to the lower risk in execution-only accounts where clients independently manage transactions.

Restricted Advice

Restricted advice limits recommendations to a specific range of products or strategies, often aligned with the provider's offerings, contrasting with execution-only accounts where clients make investment decisions independently without any guidance. Advisory accounts provide tailored financial advice based on comprehensive client analysis, ensuring personalized investment strategies beyond the scope of restricted advice.

Best Execution Policy

Best Execution Policy ensures that brokers execute trades on execution-only accounts by prioritizing the most favorable terms available in the market without providing investment advice, while in advisory accounts, the policy integrates client-specific recommendations alongside optimal trade execution. Compliance with regulatory standards such as MiFID II mandates transparent processes for both execution-only and advisory services to achieve the best possible result for clients.

Client Risk Profiling

Client risk profiling determines an investor's risk tolerance and financial goals, essential for differentiating execution-only accounts, where clients make independent decisions without advice, from advisory accounts that provide tailored investment recommendations based on risk assessment. Effective risk profiling minimizes potential losses in advisory services by aligning investment options with the client's risk capacity, while execution-only accounts rely on the client's own risk judgment.

execution-only vs advisory account Infographic

moneydif.com

moneydif.com