In brokerage, a principal acts on their own behalf, bearing full responsibility for transactions, while an agent represents the principal and acts on their behalf to facilitate deals. The distinction impacts liability, decision-making authority, and the legal obligations of each party in financial or real estate transactions. Understanding these roles ensures clarity in duties, confidentiality, and fiduciary responsibilities.

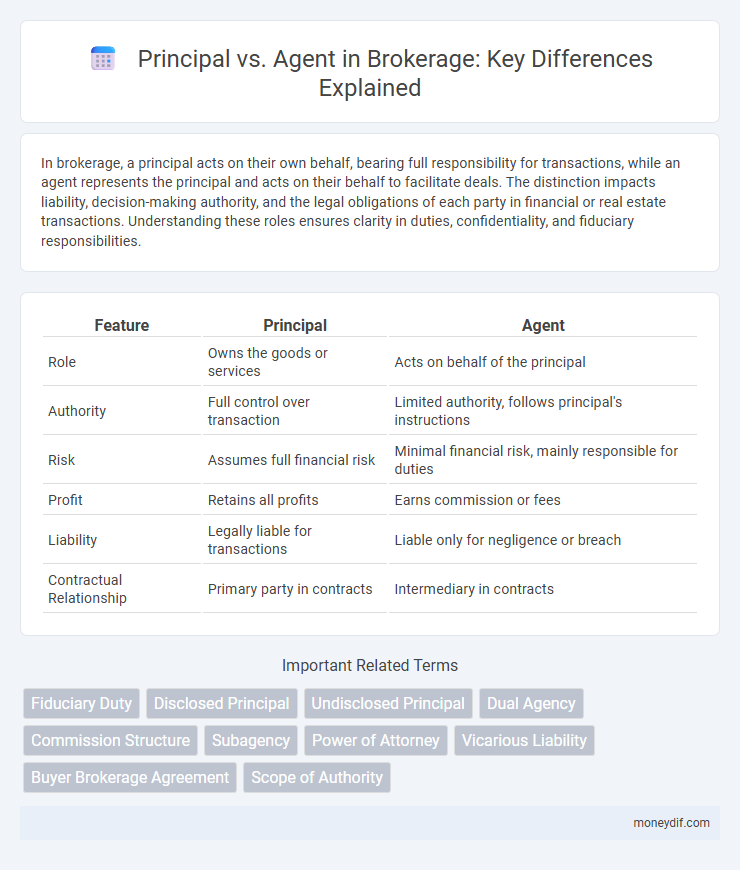

Table of Comparison

| Feature | Principal | Agent |

|---|---|---|

| Role | Owns the goods or services | Acts on behalf of the principal |

| Authority | Full control over transaction | Limited authority, follows principal's instructions |

| Risk | Assumes full financial risk | Minimal financial risk, mainly responsible for duties |

| Profit | Retains all profits | Earns commission or fees |

| Liability | Legally liable for transactions | Liable only for negligence or breach |

| Contractual Relationship | Primary party in contracts | Intermediary in contracts |

Understanding Principal and Agent Roles in Brokerage

In brokerage, the principal is the party who authorizes the agent to act on their behalf, retaining ownership of the assets or interests involved. The agent operates by executing transactions, providing advice, and negotiating terms within the scope of authority granted by the principal. Clear understanding of these roles ensures fiduciary responsibilities are met and legal obligations are upheld in brokerage agreements.

Key Differences Between Principal and Agent

The key differences between a principal and an agent in brokerage lie in their roles and responsibilities: the principal is the party who authorizes and benefits from the transaction, holding full ownership of rights, whereas the agent acts on behalf of the principal to facilitate deals and represent their interests. The principal bears the ultimate financial risk and liability, while the agent operates under a fiduciary duty, ensuring loyalty, care, and full disclosure to the principal. Contractually, the principal has the power to control the agent's actions within the scope of their agreement, but the agent does not have personal ownership stakes in the subject matter of the brokerage.

Legal Responsibilities of Principals and Agents

Principals hold the ultimate legal responsibility for actions taken by their agents within the scope of their authority, including contracts and transactions. Agents must perform duties with loyalty, care, and good faith to avoid breaches that can result in legal liability for both parties. Courts often scrutinize the extent of the agent's authority and adherence to fiduciary duties when determining legal accountability in brokerage disputes.

Advantages of Acting as a Principal

Acting as a principal in brokerage provides direct control over transactions, allowing for faster decision-making and increased profit margins by eliminating intermediaries. Principals gain full ownership of assets, enabling them to leverage market opportunities without reliance on third-party agents. This role also offers greater confidentiality and reduced risk of information leakage compared to acting solely as an agent.

Benefits of Operating as an Agent

Operating as an agent in brokerage allows for reduced financial risk since agents do not hold inventory or purchase assets directly. Agents benefit from earning commissions on transactions without exposing their capital to market fluctuations or asset devaluation. This model enhances operational flexibility and scalability, enabling agents to represent multiple principals simultaneously and expand their client base efficiently.

Risk Factors for Principals vs Agents

Principals in brokerage face significant financial and legal risks as they assume responsibility for the transaction outcomes, including potential market losses and regulatory liabilities. Agents primarily encounter reputational and compliance risks, acting as intermediaries with limited exposure to direct financial losses but bearing accountability for accurate representation and due diligence. Effective risk management strategies differ, with principals requiring robust capital reserves and risk assessment frameworks, while agents focus on maintaining transparency and adherence to fiduciary duties.

Commission Structures: Principal vs Agent

Commission structures in brokerage differ significantly between principal and agent roles, impacting compensation models and potential conflicts of interest. Principals earn profits directly from trading securities they own, often through markups, markdowns, or spreads, aligning their incentives with market risks and inventory management. Agents receive commissions or fees for executing trades on behalf of clients, emphasizing transparent transaction charges without holding inventory, which fosters fiduciary responsibility and client trust.

Conflict of Interest Considerations

In brokerage, the distinction between principal and agent roles critically influences conflict of interest considerations, as principals act on their own behalf while agents represent clients' interests. Agents must prioritize fiduciary duties, ensuring transparency and avoiding situations where their interests diverge from those of the client, mitigating potential conflicts. Regulatory frameworks like FINRA and SEC impose stringent guidelines to manage and disclose conflicts, preserving market integrity and protecting investor trust.

Regulatory Compliance for Principals and Agents

Principals in brokerage hold primary responsibility for regulatory compliance, ensuring all transactions adhere to legal standards and financial regulations. Agents act on behalf of principals but must maintain strict adherence to compliance protocols, including accurate disclosures and ethical conduct. Both principals and agents are subject to oversight by regulatory bodies such as FINRA and the SEC to prevent fraud and protect investors.

Choosing the Right Role in Brokerage

Selecting the appropriate role in brokerage, whether as a principal or an agent, significantly influences transaction outcomes and liability exposure. Principals assume ownership of assets and bear full risk and reward, while agents act on behalf of clients, earning commissions without holding title. Understanding these distinctions enables brokers to strategically align their responsibilities with business goals and regulatory compliance.

Important Terms

Fiduciary Duty

Fiduciary duty in a principal-agent relationship requires the agent to act loyally and in the best interests of the principal, ensuring trust and transparency in all transactions.

Disclosed Principal

The disclosed principal is a party whose identity is known to the third party in a principal-agent relationship, distinguishing it from undisclosed or partially disclosed principals where the third party lacks full knowledge of the principal's identity.

Undisclosed Principal

An undisclosed principal is a party in a principal-agent relationship whose identity remains unknown to third parties while the agent acts on their behalf, potentially affecting liability and contractual obligations.

Dual Agency

Dual agency occurs when a real estate agent represents both the principal seller and the buyer, creating potential conflicts of interest under principal-agent law.

Commission Structure

Understanding the commission structure clarifies whether a party operates as a principal who earns revenue from sales or as an agent earning a commission fee on transactions.

Subagency

Subagency occurs when an agent appoints another agent to act on behalf of the principal, extending the principal-agent relationship and making the subagent legally accountable to both the original agent and the principal.

Power of Attorney

A Power of Attorney grants the Principal legal authority to appoint an Agent to act on their behalf in financial and legal matters.

Vicarious Liability

Vicarious liability holds a principal legally responsible for the wrongful acts committed by an agent within the scope of their authorized duties.

Buyer Brokerage Agreement

A Buyer Brokerage Agreement establishes a legal relationship where the agent represents the principal (buyer) exclusively in real estate transactions to protect the buyer's interests and negotiate terms.

Scope of Authority

The scope of authority defines the legal boundaries within which an agent can act on behalf of the principal to create binding obligations.

Principal vs Agent Infographic

moneydif.com

moneydif.com