Margin brokerage allows investors to borrow funds from brokers to purchase securities, amplifying potential returns but also increasing risk due to leverage. Cash brokerage requires investors to use only their available funds to buy securities, minimizing risk but limiting purchasing power. Understanding the differences in risk exposure, capital requirements, and potential returns is crucial when choosing between margin and cash brokerage accounts.

Table of Comparison

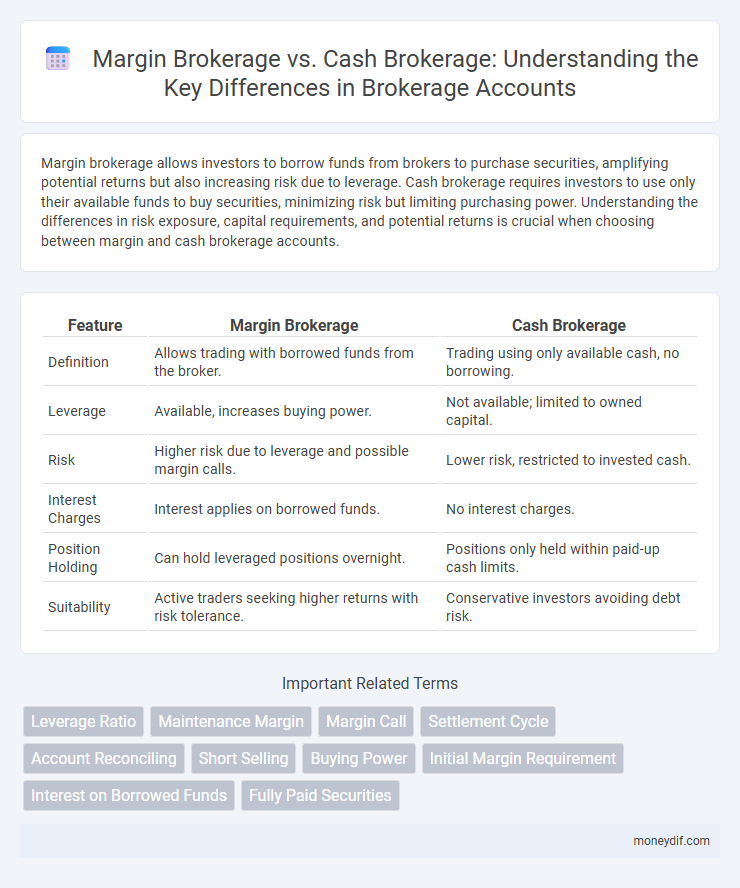

| Feature | Margin Brokerage | Cash Brokerage |

|---|---|---|

| Definition | Allows trading with borrowed funds from the broker. | Trading using only available cash, no borrowing. |

| Leverage | Available, increases buying power. | Not available; limited to owned capital. |

| Risk | Higher risk due to leverage and possible margin calls. | Lower risk, restricted to invested cash. |

| Interest Charges | Interest applies on borrowed funds. | No interest charges. |

| Position Holding | Can hold leveraged positions overnight. | Positions only held within paid-up cash limits. |

| Suitability | Active traders seeking higher returns with risk tolerance. | Conservative investors avoiding debt risk. |

Introduction to Margin Brokerage vs Cash Brokerage

Margin brokerage allows investors to borrow funds from brokers to purchase securities, leveraging their investment potential while incurring interest charges on the borrowed amount. In contrast, cash brokerage requires investors to use only their available capital for transactions, eliminating the risk of debt but limiting buying power. Understanding the differences between margin and cash brokerage is crucial for managing risk tolerance and investment strategies effectively.

Key Differences Between Margin and Cash Brokerage

Margin brokerage allows investors to borrow funds from brokers to purchase securities, amplifying both potential gains and losses, whereas cash brokerage requires full payment for securities at the time of purchase, eliminating debt risk. Margin accounts involve interest charges on borrowed funds and higher risk exposure, while cash accounts offer straightforward transactions with no leverage and lower risk. Regulatory requirements and risk management differ significantly; margin brokerage often mandates maintenance margins and has stricter compliance rules compared to cash brokerage.

How Margin Brokerage Works

Margin brokerage allows investors to borrow funds from the broker to buy securities, amplifying purchasing power beyond available cash. The investor's account acts as collateral, with maintenance margin requirements ensuring sufficient equity is maintained to cover potential losses. Interest charges apply on borrowed amounts, and margin calls may occur if the account equity falls below the broker's threshold, necessitating additional funds or asset liquidation.

How Cash Brokerage Works

Cash brokerage requires investors to pay the full amount for securities upfront, ensuring transactions are settled immediately without borrowing funds. This method minimizes risk since there is no leverage involved, and investors can only buy stocks with available capital in their accounts. Cash brokerage accounts are ideal for conservative traders seeking straightforward ownership and avoiding margin calls or interest charges.

Pros and Cons of Margin Brokerage

Margin brokerage allows investors to borrow funds to purchase securities, amplifying potential returns by leveraging capital; however, it also increases risk exposure due to interest costs and the possibility of margin calls during market downturns. This method offers greater buying power and flexibility compared to cash brokerage, where transactions are limited to available cash, reducing risk but also capping profit potential. Margin accounts require careful risk management strategies and understanding of margin requirements set by regulatory bodies to avoid forced liquidation and significant financial losses.

Pros and Cons of Cash Brokerage

Cash brokerage requires full payment for securities, eliminating the risk of margin calls and debt, thus providing a safer investment approach for risk-averse traders. It restricts purchasing power to available funds, limiting potential gains compared to margin brokerage where leverage amplifies returns. Cash brokerage avoids interest charges and the complexities of margin maintenance, making it simpler but less flexible for active or high-volume investors.

Risk Management in Margin vs Cash Brokerage

Margin brokerage involves borrowing funds from the broker to purchase securities, increasing both potential returns and exposure to market volatility, which requires robust risk management strategies such as margin calls and stop-loss orders to mitigate leveraged losses. Cash brokerage restricts trading to available funds only, inherently limiting financial risk and eliminating margin call concerns, making it more suitable for conservative investors focused on capital preservation. Effective risk management in margin brokerage includes monitoring margin requirements and maintaining sufficient equity, whereas cash brokerage prioritizes portfolio diversification and liquidity to manage risks.

Costs and Fees Comparison

Margin brokerage incurs interest charges on borrowed funds, increasing overall trading costs compared to cash brokerage, which requires full payment of securities upfront, eliminating interest expenses. Cash brokerage typically involves lower fees since there is no margin interest, but margin accounts may have maintenance fees and higher minimum balance requirements. Investors must weigh the higher costs of margin interest and potential fees against the cash brokerage's straightforward fee structure when selecting service types.

Investor Suitability: Margin vs Cash Accounts

Margin brokerage accounts suit experienced investors who understand leverage risks and seek to amplify potential returns by borrowing funds, while cash brokerage accounts are ideal for conservative investors prioritizing full payment for securities to avoid debt exposure. Margin accounts require maintaining minimum equity levels and may trigger margin calls, posing higher risk compared to cash accounts that settle trades using available cash only. Investor suitability hinges on risk tolerance, trading goals, and familiarity with margin maintenance rules.

Choosing the Right Brokerage Account for Your Needs

Margin brokerage allows investors to borrow funds to leverage their trades, providing greater buying power but increasing exposure to risk and interest costs. Cash brokerage requires full payment for securities upfront, offering a lower-risk approach suitable for conservative investors prioritizing straightforward transactions. Selecting the right brokerage account depends on your risk tolerance, investment strategy, and financial goals, balancing leverage benefits against potential liabilities.

Important Terms

Leverage Ratio

Margin brokerage typically requires a lower leverage ratio compared to cash brokerage, enabling investors to amplify buying power while increasing risk exposure.

Maintenance Margin

Maintenance margin in margin brokerage requires investors to maintain a minimum equity level in their accounts to avoid margin calls, unlike cash brokerage where transactions settle only with available funds.

Margin Call

Margin call occurs when the equity in a margin brokerage account falls below the broker's required maintenance margin, necessitating the investor to deposit additional funds or securities to cover the shortfall. Unlike cash brokerage accounts where transactions are fully paid with available cash, margin brokerage allows leveraging by borrowing funds from the broker, thereby increasing both potential gains and the risk of margin calls.

Settlement Cycle

Settlement cycle for margin brokerage is typically shorter due to intraday trading and collateral management, whereas cash brokerage follows a standard T+2 cycle for stock ownership transfer.

Account Reconciling

Margin brokerage accounts require meticulous account reconciling to accurately track borrowed funds and interest, whereas cash brokerage accounts focus on straightforward balance verification without leverage considerations.

Short Selling

Short selling requires margin brokerage accounts due to the need for borrowing shares, whereas cash brokerage accounts do not support short selling as they only allow trading with owned funds.

Buying Power

Buying power in margin brokerage significantly exceeds that in cash brokerage by allowing investors to leverage borrowed funds for larger trades while cash brokerage limits purchases to available account cash.

Initial Margin Requirement

Initial Margin Requirement typically applies to Margin Brokerage accounts where investors borrow funds to trade securities, whereas Cash Brokerage requires full payment for securities without leveraging.

Interest on Borrowed Funds

Interest on borrowed funds in margin brokerage is charged on the loan amount used to buy securities, whereas cash brokerage involves no interest since purchases are made with available funds.

Fully Paid Securities

Fully paid securities in cash brokerage are purchased entirely with available funds, eliminating margin risk, whereas margin brokerage allows buying securities using borrowed funds, increasing leverage and potential returns but also risk.

Margin Brokerage vs Cash Brokerage Infographic

moneydif.com

moneydif.com