Block trades involve the private sale of a large number of securities directly between parties, often executed off-exchange to minimize market impact and price fluctuations. Agency trades are transactions where brokers act on behalf of clients, executing orders on public exchanges to obtain the best possible price. Understanding the distinction between block and agency trades is critical for optimizing trade execution strategies and managing market liquidity efficiently.

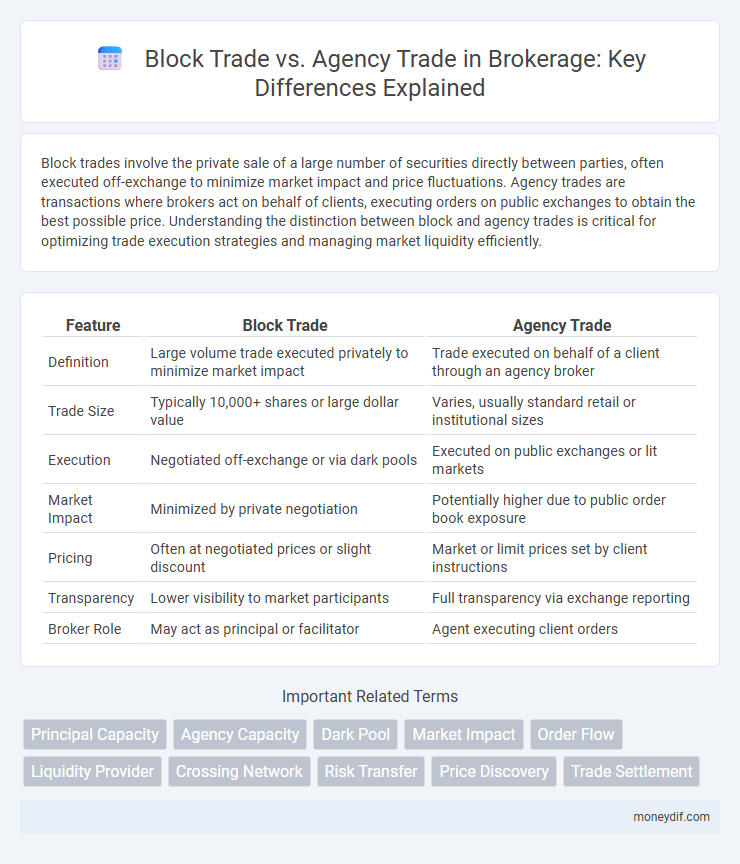

Table of Comparison

| Feature | Block Trade | Agency Trade |

|---|---|---|

| Definition | Large volume trade executed privately to minimize market impact | Trade executed on behalf of a client through an agency broker |

| Trade Size | Typically 10,000+ shares or large dollar value | Varies, usually standard retail or institutional sizes |

| Execution | Negotiated off-exchange or via dark pools | Executed on public exchanges or lit markets |

| Market Impact | Minimized by private negotiation | Potentially higher due to public order book exposure |

| Pricing | Often at negotiated prices or slight discount | Market or limit prices set by client instructions |

| Transparency | Lower visibility to market participants | Full transparency via exchange reporting |

| Broker Role | May act as principal or facilitator | Agent executing client orders |

Introduction to Block Trade and Agency Trade

Block trade involves the private negotiation and execution of large securities transactions, typically exceeding 10,000 shares or $200,000 in value, allowing institutions to avoid market impact and price fluctuations. Agency trade occurs when brokers act solely on behalf of clients, executing buy or sell orders without taking ownership of the securities, prioritizing best execution and transparency. Understanding these distinctions is crucial for optimizing trade strategies in institutional and retail brokerage environments.

Key Definitions: Block Trade vs Agency Trade

Block trades involve the buying or selling of a large number of securities, typically negotiated privately between parties to minimize market impact and ensure price stability. Agency trades occur when a broker acts on behalf of a client, executing orders in the open market without taking ownership of the securities, prioritizing best execution and transparency. Understanding the distinction between block trade and agency trade is essential for effective trading strategies and risk management in brokerage operations.

How Block Trades Work in Brokerage

Block trades in brokerage involve the private negotiation of large-volume securities transactions between institutional investors, minimizing market impact and price fluctuations. These trades are executed off the public exchange through a broker-dealer who matches buyers and sellers discreetly, ensuring confidentiality and efficient trade execution. By facilitating large orders without causing significant price movement, block trades provide liquidity and enable institutions to manage portfolio risks effectively.

The Mechanics of Agency Trades

Agency trades involve brokers acting on behalf of clients, executing buy or sell orders by seeking the best available market price without taking ownership of the securities. The broker matches the client's order with market liquidity, ensuring transparency and minimizing market impact while charging commissions for execution services. This mechanism contrasts with block trades where firms trade large volumes directly, often negotiated privately to avoid price fluctuations.

Major Differences Between Block and Agency Trades

Block trades involve large-volume securities transactions executed privately between institutional investors, often negotiated off-exchange to minimize market impact. Agency trades are executed on behalf of clients by brokers who act as intermediaries, selling or buying securities at prevailing market prices, prioritizing best execution and transparency. The major differences lie in trade size, execution method, and the level of market impact and price negotiation involved.

Advantages of Block Trading for Investors

Block trading offers investors the advantage of executing large orders with minimal market impact, preserving price stability and avoiding significant fluctuations. This method ensures increased liquidity and faster transaction times by allowing institutions to buy or sell substantial volumes off the open market. Investors benefit from reduced transaction costs and enhanced confidentiality compared to traditional agency trades executed on public exchanges.

Benefits and Limitations of Agency Trades

Agency trades offer clients direct market access and enhanced transparency, allowing brokers to execute orders on behalf of clients without taking proprietary positions. Benefits include reduced conflict of interest, as brokers act as fiduciaries, and potential for better price discovery in public markets. Limitations involve slower execution speed compared to block trades, possible market impact from larger orders, and higher exposure to market volatility during order fulfillment.

Impact on Market Liquidity and Transparency

Block trades typically involve large volumes of securities executed privately between parties, minimizing immediate market impact but potentially reducing transparency and short-term liquidity. Agency trades, conducted by brokers on behalf of clients in public markets, enhance transparency and contribute to continuous price discovery, thereby supporting overall market liquidity. The choice between block and agency trades affects market dynamics, with block trades offering discretion at the expense of immediate transparency, while agency trades promote openness and fluidity in trading activity.

Regulatory Considerations in Block and Agency Trading

Block trades typically involve large volume transactions executed off-exchange, requiring strict compliance with regulatory frameworks such as FINRA Rule 5170 and SEC Regulation SHO to prevent market manipulation and ensure transparent reporting. Agency trades, executed on behalf of clients through brokers acting as intermediaries, must adhere to fiduciary duties and best execution standards mandated by the SEC and FINRA to protect client interests. Both trade types necessitate robust recordkeeping and reporting to regulators, with agency trades often subject to additional scrutiny regarding trade allocation and conflict-of-interest policies.

Choosing the Right Trade Type for Your Brokerage Needs

Block trades offer large volume transactions executed privately between parties, minimizing market impact and enhancing price stability. Agency trades involve brokers acting on behalf of clients to execute orders in the open market, providing transparency and price discovery. Selecting the right trade type depends on factors such as trade size, market conditions, and the need for discretion versus execution speed in brokerage strategies.

Important Terms

Principal Capacity

Principal capacity involves trading securities from the firm's own inventory for block trades, whereas agency capacity executes block trades by matching buyers and sellers without holding the securities.

Agency Capacity

Agency capacity involves executing block trades on behalf of clients without taking market risk, contrasting with agency trades that typically handle smaller order sizes with less impact on market liquidity.

Dark Pool

Dark pool trades typically involve large block trades executed privately to minimize market impact, whereas agency trades are conducted on behalf of clients through public exchanges with transparent pricing.

Market Impact

Block trades significantly impact market prices due to large order sizes executed privately, whereas agency trades, executed on behalf of clients on the open market, typically have less immediate market impact.

Order Flow

Order flow analysis reveals that block trades, involving large, privately negotiated transactions, typically impact market liquidity and price discovery differently than agency trades, which execute client orders through public markets.

Liquidity Provider

Liquidity providers enhance block trade execution by offering deep market access and minimizing price impact compared to agency trades, which rely on brokers to execute orders at prevailing market prices.

Crossing Network

Crossing networks facilitate block trades by matching large buy and sell orders internally, reducing market impact compared to agency trades executed on public exchanges.

Risk Transfer

Risk transfer in block trades is higher for dealers absorbing large positions, whereas agency trades transfer risk directly to clients without dealer inventory exposure.

Price Discovery

Price discovery in block trades often reflects negotiated prices between parties, while agency trades rely on market-driven prices established through public order books.

Trade Settlement

Block trades involve large-volume securities transactions executed outside the open market to minimize price impact, while agency trades are executed on behalf of clients in public markets, affecting trade settlement timelines and risk management differently.

Block Trade vs Agency Trade Infographic

moneydif.com

moneydif.com