Principal trading involves a brokerage firm buying and selling securities for its own account, profiting from the spread between purchase and sale prices. Agency trading occurs when the broker acts on behalf of a client, executing orders without taking ownership of the securities, earning commissions or fees for the service. Understanding the distinctions between principal and agency trading is crucial for investors to assess potential conflicts of interest and trading costs.

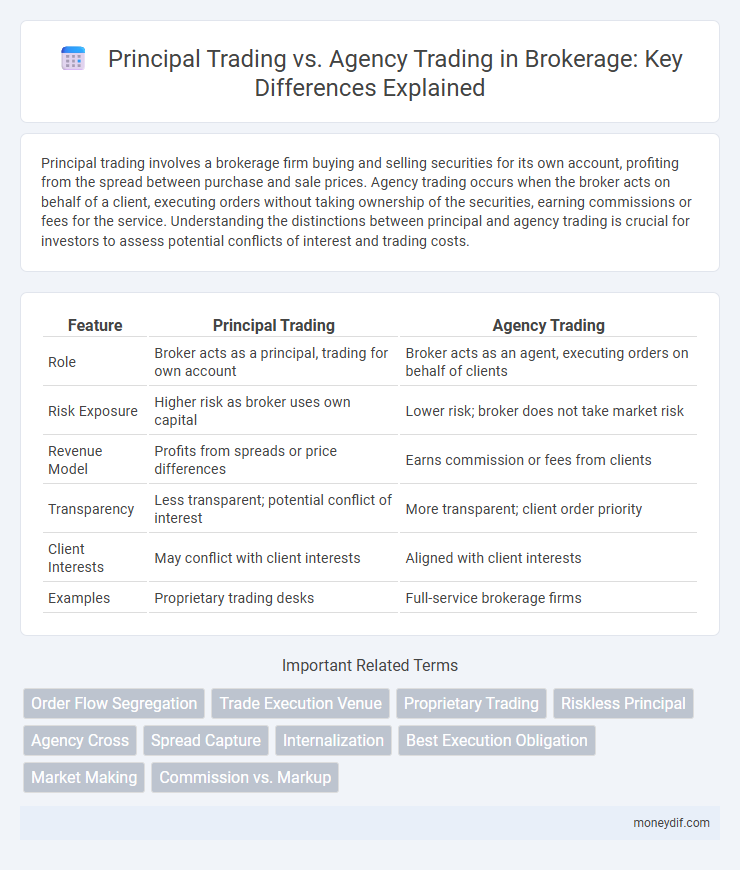

Table of Comparison

| Feature | Principal Trading | Agency Trading |

|---|---|---|

| Role | Broker acts as a principal, trading for own account | Broker acts as an agent, executing orders on behalf of clients |

| Risk Exposure | Higher risk as broker uses own capital | Lower risk; broker does not take market risk |

| Revenue Model | Profits from spreads or price differences | Earns commission or fees from clients |

| Transparency | Less transparent; potential conflict of interest | More transparent; client order priority |

| Client Interests | May conflict with client interests | Aligned with client interests |

| Examples | Proprietary trading desks | Full-service brokerage firms |

Understanding Principal Trading in Brokerage

Principal trading in brokerage involves firms buying and selling securities from their own inventory, enabling them to profit from price fluctuations. This contrasts with agency trading, where brokers act solely as intermediaries executing client orders without taking market risk. Understanding principal trading helps investors recognize potential conflicts of interest and pricing differences when brokers trade on their behalf.

What is Agency Trading?

Agency trading involves a broker acting as an intermediary between buyers and sellers, executing orders on behalf of clients rather than trading for their own account. Brokers in agency trading earn commissions or fees without taking on market risk, ensuring transparency and alignment with clients' interests. This model contrasts with principal trading, where brokers trade from their own inventory, potentially creating conflicts of interest.

Key Differences Between Principal and Agency Trading

Principal trading involves a broker buying or selling securities for their own account, creating a conflict of interest as they profit from the spread. Agency trading occurs when brokers execute trades on behalf of clients, earning commissions without taking ownership of the securities. The key differences lie in risk exposure, profit sources, and fiduciary responsibilities, with principal trading bearing direct market risk and agency trading prioritizing client interests.

Roles of Brokers in Principal vs Agency Trading

Brokers acting in principal trading roles buy and sell securities for their own accounts, assuming risk and profiting from price spreads. In agency trading, brokers execute orders on behalf of clients, prioritizing best execution without holding inventory or exposing themselves to market risk. The distinction lies in whether the broker acts as a counterparty (principal) or an intermediary (agent), influencing transparency, conflict of interest, and regulatory obligations.

Cost Structures in Principal and Agency Trades

Principal trading involves brokers acting as the counterparty to client trades, generating profits through bid-ask spreads and inventory risk, often resulting in higher implicit costs embedded in pricing. Agency trading brokers execute orders on behalf of clients without taking ownership, charging explicit commissions or fees, leading to transparent and typically lower direct costs. Understanding the cost structures is crucial for investors to evaluate trade execution quality and overall transaction expenses in principal versus agency trading models.

Conflict of Interest: Principal Trading vs Agency Trading

Principal trading involves brokers buying and selling securities for their own accounts, creating a potential conflict of interest as they may prioritize their profits over clients' best interests. In contrast, agency trading requires brokers to act solely on behalf of clients, reducing conflicts by executing orders at the best available prices without proprietary gains. Regulatory frameworks emphasize transparency and fiduciary duty to mitigate conflicts inherent in principal trading practices.

Regulatory Oversight in Principal and Agency Transactions

Regulatory oversight in principal trading mandates brokers to disclose conflicts of interest and adhere to strict capital adequacy requirements, ensuring transparency and financial stability. In agency trading, regulators emphasize fiduciary duties, requiring brokers to act solely in the client's best interest while executing trades without assuming market risk. Both frameworks enforce compliance with SEC and FINRA rules, but principal trading faces more rigorous scrutiny due to the broker's direct market exposure.

Transparency and Disclosure in Brokerage Trades

Principal trading involves brokers buying or selling securities for their own accounts, which may create conflicts of interest due to less transparent pricing and disclosure. Agency trading requires brokers to act on behalf of clients, providing greater transparency through clear disclosure of commissions and execution details. Enhanced regulatory frameworks mandate brokers to disclose trade intentions, pricing sources, and any potential conflicts to ensure investor protection and trust in brokerage transactions.

Advantages and Disadvantages of Principal Trading

Principal trading allows brokers to profit directly from the spread by buying and selling securities from their own inventory, providing liquidity and potentially faster execution for clients. However, this model presents inherent conflicts of interest as brokers may prioritize their profit over best client prices, risking client trust and regulatory scrutiny. Despite these concerns, principal trading can offer tighter spreads and improved market efficiency, benefiting active traders who require immediate execution.

Choosing Between Principal and Agency Trading Strategies

Choosing between principal and agency trading strategies depends on the brokerage's risk tolerance and client focus. Principal trading involves the broker acting as the counterparty to transactions, potentially increasing profits but also exposing the firm to market risk. Agency trading prioritizes client interests by executing orders on behalf of clients, ensuring transparency and minimizing conflicts of interest.

Important Terms

Order Flow Segregation

Order Flow Segregation enhances market transparency by distinctly categorizing Principal Trading, where firms trade for their own accounts, from Agency Trading, where brokers execute orders on behalf of clients.

Trade Execution Venue

Trade execution venues differentiate between principal trading, where firms trade securities on their own account, and agency trading, where firms execute trades on behalf of clients without taking market risk.

Proprietary Trading

Proprietary trading involves a firm trading its own capital for profit, contrasting with agency trading where the firm executes trades on behalf of clients without risking its own funds.

Riskless Principal

Riskless principal transactions involve a broker simultaneously buying and selling securities for its own account to facilitate a client's order, distinguishing them from principal trading where the broker trades for its own benefit and agency trading where the broker acts solely on behalf of the client without taking ownership.

Agency Cross

Agency Cross trading occurs when an agency simultaneously executes buy and sell orders for the same security from different clients, contrasting with Principal Trading where the firm trades for its own account, potentially creating conflicts of interest.

Spread Capture

Spread Capture in Principal Trading involves profiting from the bid-ask spread as the trader acts as the counterparty, whereas Agency Trading earns commissions without assuming market risk by executing orders on behalf of clients.

Internalization

Internalization occurs when principal trading firms execute client orders from their own inventory, contrasting with agency trading where brokers act solely as intermediaries without assuming market risk.

Best Execution Obligation

Best Execution Obligation requires brokers to prioritize obtaining the most favorable terms for clients, especially differentiating between Principal Trading, where brokers trade on their own account, and Agency Trading, where brokers act solely on behalf of clients.

Market Making

Market making involves principal trading where firms trade assets from their own inventory to provide liquidity, contrasting with agency trading where brokers execute trades on behalf of clients without assuming market risk.

Commission vs. Markup

Commission represents a fixed fee charged by an agent for facilitating transactions in agency trading, while markup is the difference between the purchase and sale price reflecting profit in principal trading.

Principal Trading vs Agency Trading Infographic

moneydif.com

moneydif.com