Margin accounts allow investors to borrow funds from their broker to purchase securities, increasing their buying power but also amplifying risk due to potential interest charges and margin calls. Cash accounts require investors to pay for securities in full with available funds, limiting exposure to debt but restricting immediate purchasing capacity. Choosing between a margin and cash account depends on an investor's risk tolerance, investment strategy, and financial goals.

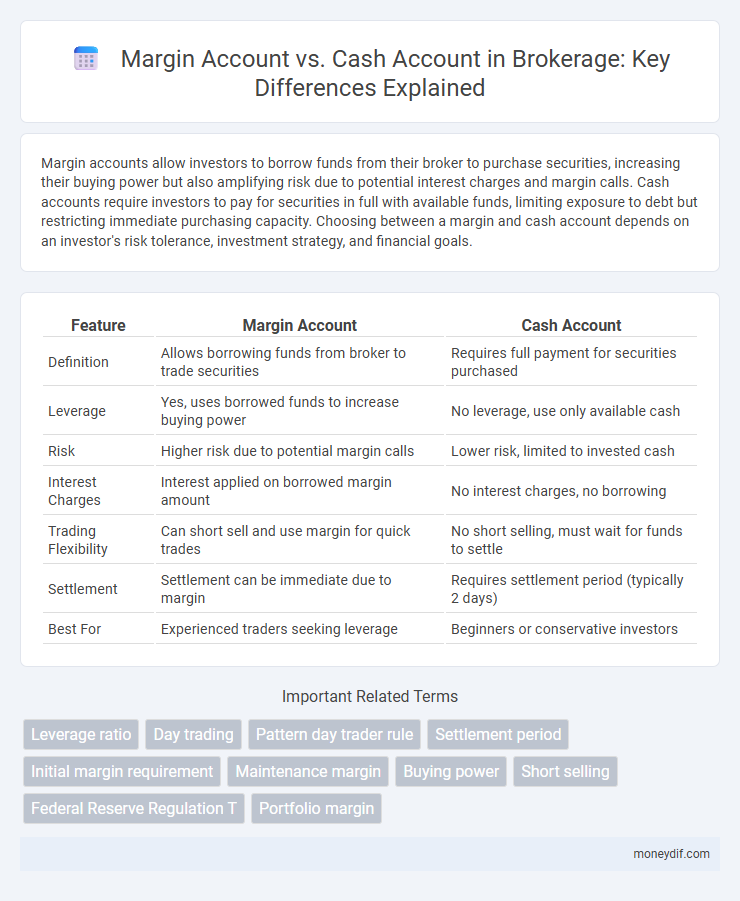

Table of Comparison

| Feature | Margin Account | Cash Account |

|---|---|---|

| Definition | Allows borrowing funds from broker to trade securities | Requires full payment for securities purchased |

| Leverage | Yes, uses borrowed funds to increase buying power | No leverage, use only available cash |

| Risk | Higher risk due to potential margin calls | Lower risk, limited to invested cash |

| Interest Charges | Interest applied on borrowed margin amount | No interest charges, no borrowing |

| Trading Flexibility | Can short sell and use margin for quick trades | No short selling, must wait for funds to settle |

| Settlement | Settlement can be immediate due to margin | Requires settlement period (typically 2 days) |

| Best For | Experienced traders seeking leverage | Beginners or conservative investors |

Understanding Margin Accounts and Cash Accounts

Margin accounts allow investors to borrow funds from brokers to purchase securities, leveraging their investment capital for potentially higher returns while incurring interest charges on borrowed amounts. Cash accounts require investors to pay the full purchase price of securities upfront, eliminating the risk of debt but limiting the ability to amplify gains through borrowing. Understanding the differences in risk exposure, margin requirements, and trading flexibility is essential when choosing between these account types.

Key Differences Between Margin and Cash Accounts

Margin accounts allow investors to borrow funds from the brokerage to purchase securities, increasing buying power but also introducing interest costs and the risk of a margin call. Cash accounts require investors to pay the full amount for securities, eliminating borrowing risks but restricting trading to available cash and settled funds only. Key differences include leverage availability, margin calls, interest charges, and settlement restrictions, which significantly impact trading strategies and risk management.

Pros and Cons of Using a Margin Account

Margin accounts offer investors the advantage of increased purchasing power by borrowing funds from the broker, enabling larger positions and potential higher returns. However, using a margin account involves the risk of margin calls, where investors must quickly deposit additional funds if the value of securities falls, which can lead to forced liquidation. Interest charges on borrowed amounts and the possibility of amplified losses make margin accounts more suitable for experienced traders with a higher risk tolerance compared to cash accounts.

Advantages and Limitations of Cash Accounts

Cash accounts offer the advantage of simplicity by requiring investors to pay the full purchase price of securities, reducing the risk of margin debt and interest charges. Limitations include restricted buying power since investors cannot leverage funds, potentially slowing portfolio growth compared to margin accounts. Additionally, cash accounts avoid the risk of margin calls but may delay the ability to reinvest proceeds due to settlement periods.

Risk Factors: Margin Account vs. Cash Account

Margin accounts carry higher risk than cash accounts due to the potential for amplified losses when borrowing funds to invest. In margin accounts, investors may face margin calls requiring immediate deposit of additional funds, increasing financial pressure during market downturns. Cash accounts restrict trades to available funds only, reducing debt exposure and minimizing the risk of forced liquidation.

Eligibility Requirements: Margin vs. Cash Accounts

Margin accounts require investors to meet specific eligibility criteria, including a minimum account balance typically set at $2,000 by FINRA regulations and approval based on creditworthiness and investment experience. Cash accounts have fewer restrictions, allowing most investors to open one without a minimum balance or credit check, as transactions must be fully funded by available cash. The distinction in eligibility impacts the ability to borrow funds for trading, with margin accounts enabling leverage while cash accounts limit trading to deposited funds.

Interest Rates and Fees Comparison

Margin accounts typically charge interest rates ranging from 7% to 10% on borrowed funds, significantly impacting overall trading costs, while cash accounts incur no interest since no borrowing is involved. Fees associated with margin accounts may include maintenance fees and margin call penalties, which are absent in cash accounts, making margin accounts generally more expensive. Understanding the interest rates and fee structures is crucial for investors to manage costs and risks effectively when choosing between margin and cash accounts.

Trading Flexibility and Buying Power

Margin accounts offer greater trading flexibility and increased buying power by allowing investors to borrow funds from their broker to purchase securities, enabling larger trades and potential for higher returns. Cash accounts require full payment for securities at purchase, limiting buying power to the actual cash available and restricting certain strategies such as short selling or purchasing on margin. Utilizing a margin account can enhance investment opportunities but carries higher risk due to leverage and potential margin calls.

Regulatory and Legal Considerations

Margin accounts and cash accounts are governed by distinct regulatory frameworks that affect investor rights and obligations. The Financial Industry Regulatory Authority (FINRA) and the Securities Exchange Commission (SEC) impose margin requirements to manage credit risk and protect market integrity, requiring brokers to collect a minimum initial margin and maintain maintenance margin levels. Cash accounts, regulated under SEC Rule 15c3-3, prohibit borrowing and require full payment for securities purchases, eliminating the risks associated with margin calls and leverage.

Choosing the Right Account for Your Investment Goals

Margin accounts offer investors the ability to borrow funds to amplify their buying power, which can enhance returns but also increases risk and potential losses. Cash accounts require full payment for securities, promoting disciplined investing and minimizing the risk of margin calls. Selecting the right account depends on your investment strategy, risk tolerance, and financial goals, with margin accounts suited for experienced investors seeking leverage, while cash accounts are ideal for conservative, long-term investing.

Important Terms

Leverage ratio

Leverage ratio in a margin account amplifies purchasing power by allowing traders to borrow funds, unlike a cash account which requires full payment without borrowing capacity.

Day trading

Day trading with a margin account allows traders to leverage borrowed funds, increasing buying power and potential returns while exposing them to higher risks and margin calls; in contrast, a cash account restricts transactions to available cash, limiting leverage but reducing the risk of debt and regulatory restrictions like the pattern day trader rule. Understanding the differences in leverage, risk exposure, and regulatory requirements is crucial for optimizing day trading strategies and capitalizing on short-term market movements.

Pattern day trader rule

The Pattern Day Trader (PDT) rule applies exclusively to margin accounts, requiring traders who execute four or more day trades within five business days to maintain a minimum equity of $25,000; cash accounts are exempt from this rule but restrict the ability to day trade due to settlement delays and lack of margin trading privileges. Margin accounts offer leverage and immediate access to settled funds, enabling more frequent trading, while cash accounts limit transactions to settled cash, reducing day trading flexibility.

Settlement period

The settlement period for a cash account requires full payment for securities by the trade date plus two business days (T+2), whereas margin accounts allow investors to borrow funds, enabling them to settle trades using borrowed money and defer full payment. This difference impacts liquidity and buying power, as margin accounts provide greater flexibility but involve interest charges and potential margin calls if equity falls below required levels.

Initial margin requirement

Initial margin requirement mandates a minimum equity deposit in a margin account to borrow funds for trading, unlike a cash account which requires full upfront payment without leverage.

Maintenance margin

Maintenance margin is the minimum equity level that must be maintained in a margin account to avoid a margin call, whereas a cash account requires full payment for securities without borrowing. Margin accounts allow investors to leverage funds by borrowing from brokers, whereas cash accounts limit trading to available cash, eliminating margin-related risks.

Buying power

Buying power in a margin account significantly exceeds that of a cash account by allowing investors to borrow funds from the broker, typically up to 50% of the purchase price, thereby amplifying potential returns and risks. Conversely, a cash account restricts buying power strictly to the actual cash balance, limiting investment capacity but reducing exposure to debt and margin calls.

Short selling

Short selling requires a margin account because it involves borrowing shares to sell, whereas a cash account only allows purchases with available funds, prohibiting short sales.

Federal Reserve Regulation T

Federal Reserve Regulation T governs the extension of credit by brokers and dealers to customers for purchasing securities in margin accounts, setting an initial margin requirement of 50% for equity securities, while cash accounts require full payment for securities purchases without borrowing. Margin accounts enable investors to leverage their capital by borrowing funds from brokers under Regulation T rules, whereas cash accounts restrict transactions to settled funds, prohibiting the use of borrowed money.

Portfolio margin

Portfolio margin offers lower margin requirements by assessing overall risk across a diversified portfolio, making it more capital-efficient compared to traditional margin accounts. Unlike cash accounts, which do not allow borrowing and require full payment for securities, portfolio margin accounts enable leveraged trading by using calculated risk-based exposure limits.

margin account vs cash account Infographic

moneydif.com

moneydif.com