Commission-based brokerage models generate revenue by charging a percentage of each transaction, incentivizing brokers to increase trading volume. Fee-based advisors impose a flat or hourly fee, offering a transparent and predictable cost structure that prioritizes client interests over transaction frequency. Choosing between commission-based and fee-based services depends on individual investment strategies and preferences for cost clarity or potential transaction-focused advice.

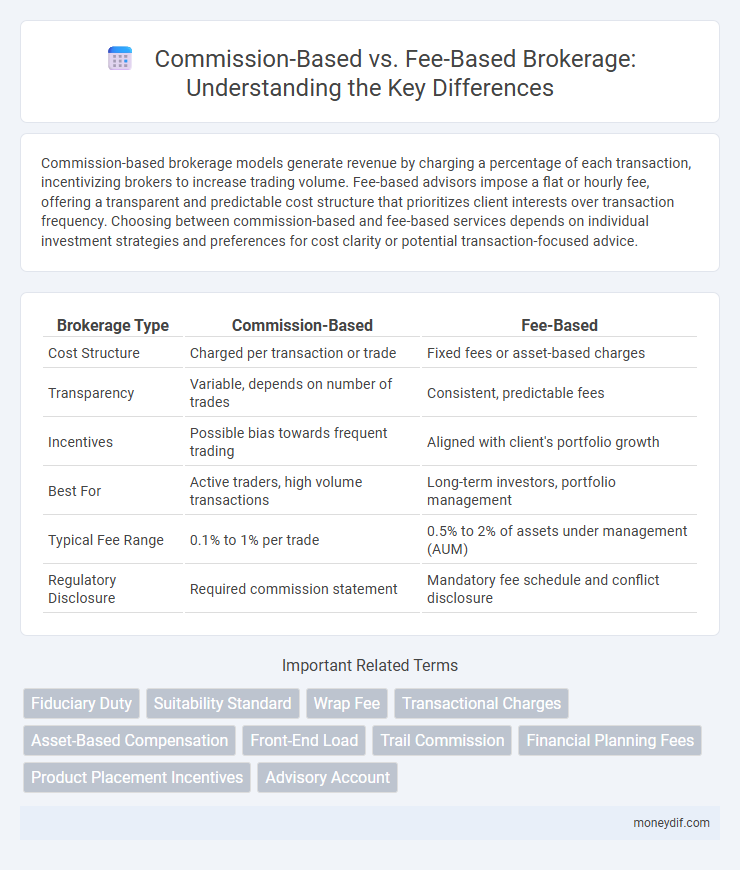

Table of Comparison

| Brokerage Type | Commission-Based | Fee-Based |

|---|---|---|

| Cost Structure | Charged per transaction or trade | Fixed fees or asset-based charges |

| Transparency | Variable, depends on number of trades | Consistent, predictable fees |

| Incentives | Possible bias towards frequent trading | Aligned with client's portfolio growth |

| Best For | Active traders, high volume transactions | Long-term investors, portfolio management |

| Typical Fee Range | 0.1% to 1% per trade | 0.5% to 2% of assets under management (AUM) |

| Regulatory Disclosure | Required commission statement | Mandatory fee schedule and conflict disclosure |

Understanding Commission-Based Brokerage Models

Commission-based brokerage models charge clients a percentage or fixed fee per transaction, incentivizing brokers to facilitate more trades. These models are prevalent in stock trading, real estate, and insurance industries, where commissions typically range from 0.5% to 6% depending on asset class and transaction size. Understanding the impact of commission structures on investment costs and broker behavior is essential for optimizing portfolio performance and client satisfaction.

What Is a Fee-Based Brokerage Structure?

A fee-based brokerage structure charges clients a fixed fee or percentage of assets under management instead of earning commissions from trades, aligning the broker's interests with those of the investor. This model promotes transparency by reducing conflicts of interest commonly associated with commission-based arrangements, where brokers might prioritize frequent trading. Fee-based brokerages typically provide comprehensive financial advice, portfolio management, and holistic planning services, making them suitable for long-term investors seeking unbiased guidance.

Key Differences Between Commission and Fee Models

Commission-based brokerage models generate income through a percentage of each transaction, incentivizing brokers to encourage more trades, while fee-based models charge a fixed or percentage-based fee regardless of trade volume, promoting more objective investment advice. Commission structures can lead to potential conflicts of interest due to variable compensation, whereas fee-based models offer greater transparency and alignment with client goals by focusing on portfolio management fees. Understanding these fundamental differences helps investors choose a brokerage model that best matches their financial planning needs and investment strategies.

Pros and Cons of Commission-Based Brokerages

Commission-based brokerages incentivize agents through a percentage of the transaction value, motivating high sales performance and personalized service. However, this structure may lead to potential conflicts of interest, as brokers might prioritize higher commissions over client needs. Clients should weigh the risk of biased advice against the benefit of motivated agents when choosing commission-based brokerage services.

Advantages and Disadvantages of Fee-Based Services

Fee-based brokerage services offer transparent pricing through fixed fees or asset-based charges, allowing clients to better predict costs and avoid conflicts of interest inherent in commission-based models. They provide unbiased investment advice since advisors earn consistent fees regardless of transaction volume, promoting a focus on long-term financial goals. However, fee-based services may result in higher costs for investors with low trading activity and might not suit those who prefer transaction-specific billing.

Typical Client Profiles for Each Brokerage Model

Commission-based brokerages typically attract active traders and investors seeking flexibility and lower upfront costs, as they pay per transaction. Fee-based brokerages appeal to wealthier clients or those with larger portfolios who prefer predictable costs and comprehensive financial advice through a fixed annual or percentage fee. Understanding client risk tolerance and investment frequency helps determine the most suitable brokerage model for individual needs.

Cost Transparency: Which Model is More Clear?

Commission-based brokerage models often lack cost transparency due to variable fees tied to transaction volume, making it difficult for clients to predict expenses. Fee-based models provide clearer cost structures with fixed or percentage-based fees disclosed upfront, enhancing clients' understanding of investment costs. Greater transparency in fee-based models allows for more informed financial decisions and better alignment with client interests.

Regulatory Considerations for Commission vs Fee-Based

Regulatory considerations for commission-based brokerage include strict disclosure requirements under FINRA Rule 2330 to prevent conflicts of interest and ensure transparency in client transactions. Fee-based models are governed by fiduciary standards under the Investment Advisers Act of 1940, mandating brokers to act in clients' best interests and provide clear fee disclosures under Regulation Best Interest (Reg BI). Compliance with Anti-Money Laundering (AML) regulations and SEC oversight is critical for both structures to maintain ethical practices and protect investor assets.

How to Choose the Right Brokerage Model for You

Choosing the right brokerage model depends on your investment style, transaction frequency, and financial goals. Commission-based brokerages charge fees per trade, making them cost-effective for infrequent traders, while fee-based brokerages offer flat fees or percentage-based charges suitable for active traders seeking comprehensive advisory services. Evaluating factors such as trading volume, cost transparency, and service offerings ensures alignment with your personalized investment strategy.

The Future Trends in Brokerage Compensation

The future trends in brokerage compensation indicate a gradual shift from traditional commission-based models to fee-based structures that emphasize transparency and alignment of client interests. Increasing regulatory scrutiny and growing investor demand for unbiased advice are driving firms to adopt fee-based compensation, which offers predictable costs and reduces conflicts of interest. Advanced technology and data analytics further support personalized fee models, enabling brokers to tailor services while enhancing client trust and satisfaction.

Important Terms

Fiduciary Duty

Fiduciary duty requires financial advisors to prioritize clients' best interests, often making fee-based compensation models more aligned with unbiased advice compared to commission-based structures.

Suitability Standard

Suitability standards require financial advisors to recommend products that align with a client's financial needs and risk tolerance, often contrasting with fiduciary duty in fee-based models that emphasize clients' best interests over commission incentives.

Wrap Fee

Wrap fee accounts offer a single, comprehensive fee covering investment advice and transaction costs, contrasting with commission-based accounts where fees are earned per trade.

Transactional Charges

Commission-based transactional charges are calculated as a percentage of the trade value, while fee-based charges are fixed costs regardless of the transaction size.

Asset-Based Compensation

Asset-Based Compensation involves earning fees calculated as a percentage of assets managed, contrasting with Commission-Based models where income derives from transaction fees or sales commissions.

Front-End Load

Front-end load refers to an upfront commission charged on investment purchases, commonly associated with commission-based accounts, whereas fee-based accounts typically avoid front-end loads by charging ongoing advisory fees.

Trail Commission

Trail Commission refers to ongoing payments made to brokers or financial advisors based on a percentage of the assets under management, distinguishing it from commission-based models that pay per transaction and fee-based models that charge a flat or percentage fee regardless of trades.

Financial Planning Fees

Commission-based financial planning fees are charged as a percentage of investment transactions, while fee-based planners typically charge a fixed hourly rate or a flat fee for comprehensive financial advice.

Product Placement Incentives

Commission-based product placement incentives reward partners with a percentage of sales generated, whereas fee-based incentives offer fixed payments regardless of performance.

Advisory Account

Advisory accounts can operate under commission-based models, charging fees through product sales, or fee-based models, charging transparent percentage fees on assets under management for unbiased financial advice.

Commission-Based vs Fee-Based Infographic

moneydif.com

moneydif.com