At-the-Market (ATM) orders enable investors to sell or buy shares continuously throughout the trading day at prevailing market prices, providing greater flexibility and liquidity. At-the-Close (ATC) orders execute exclusively at the market's official closing price, ensuring transactions match the day's final valuation. Choosing between ATM and ATC depends on individual trading strategies, risk tolerance, and objectives for price certainty or market exposure.

Table of Comparison

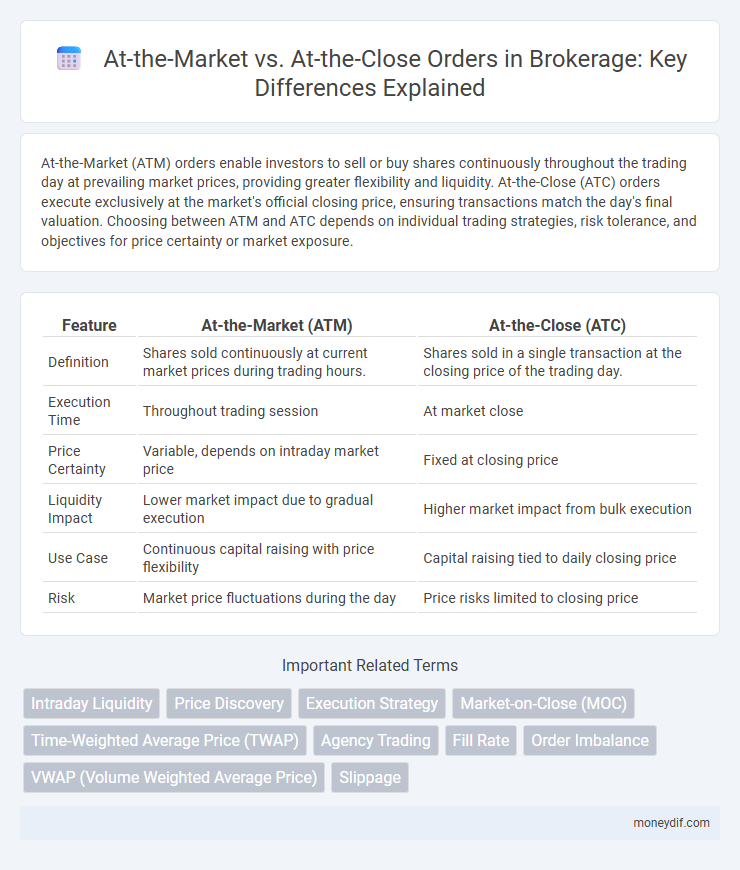

| Feature | At-the-Market (ATM) | At-the-Close (ATC) |

|---|---|---|

| Definition | Shares sold continuously at current market prices during trading hours. | Shares sold in a single transaction at the closing price of the trading day. |

| Execution Time | Throughout trading session | At market close |

| Price Certainty | Variable, depends on intraday market price | Fixed at closing price |

| Liquidity Impact | Lower market impact due to gradual execution | Higher market impact from bulk execution |

| Use Case | Continuous capital raising with price flexibility | Capital raising tied to daily closing price |

| Risk | Market price fluctuations during the day | Price risks limited to closing price |

Understanding At-the-Market and At-the-Close Orders

At-the-Market (ATM) orders execute immediately at the current market price, enabling investors to sell or buy shares continuously throughout the trading day, maximizing liquidity. At-the-Close (ATC) orders are designed to transact exclusively at the market's closing price, providing price certainty for investors looking to match the day's final valuation. Awareness of these distinct order types allows traders to align execution strategy with market dynamics and investment goals.

Key Differences Between At-the-Market and At-the-Close Orders

At-the-Market (ATM) orders execute shares continuously throughout the trading session at the current market price, providing flexibility and immediate liquidity, while At-the-Close (ATC) orders are specifically designed to execute exclusively at the closing price of the trading day, ensuring price certainty. ATM orders are ideal for investors seeking ongoing exposure and gradual position adjustments, whereas ATC orders benefit those aiming for a definitive price benchmark aligned with market close. The key differences lie in execution timing, price certainty, and order visibility, with ATM orders offering real-time execution and ATC orders focusing on price stability at market close.

Impact on Trade Execution Timing

At-the-Market (ATM) orders execute continuously throughout the trading day, allowing for immediate trade execution at prevailing market prices, which can capture intraday price movements but may introduce price variability. At-the-Close (ATC) orders execute only during the market's closing auction, ensuring a single price execution aligned with the closing price, which provides price certainty but delays trade completion until market close. Traders prioritize ATM for timely liquidity and ATC for price stability, impacting execution strategy based on timing and market volatility considerations.

Role in Liquidity and Price Discovery

At-the-Market (ATM) orders enhance liquidity by enabling continuous selling at prevailing market prices, facilitating immediate execution and real-time price discovery. In contrast, At-the-Close (ATC) orders concentrate liquidity at the market close, providing a single, consolidated execution price that reflects end-of-day supply and demand. Brokers leverage ATM for intraday price signals and ATC for reducing price volatility during execution, optimizing client trade outcomes based on market dynamics.

Pros and Cons of At-the-Market Orders

At-the-Market (ATM) orders provide investors with immediate execution at the current market price, offering liquidity and flexibility without the need to wait for a specific closing price. However, ATM orders expose traders to price volatility and potential slippage, increasing the risk of execution at unfavorable prices. Unlike At-the-Close orders, which execute strictly at the closing price, ATM orders lack guaranteed pricing but enable faster transaction completion.

Pros and Cons of At-the-Close Orders

At-the-Close orders execute trades at the final market price, ensuring that transactions occur at the definitive closing price, which can be beneficial for investors aiming to match the market close valuation. However, they carry the risk of price volatility during the closing auction, potentially leading to less favorable execution compared to intraday prices. This trade-off between price certainty at close versus potential intraday liquidity and price improvement makes At-the-Close orders preferable for investors prioritizing closing price exposure over immediate execution.

Strategic Use Cases for Each Order Type

At-the-Market (ATM) orders provide continuous liquidity by allowing investors to sell shares at prevailing market prices, ideal for those seeking flexibility and immediate execution throughout the trading day. At-the-Close (ATC) orders execute at the market close price, benefiting traders looking to minimize market impact and secure a price reflective of the day's final valuations. Utilizing ATM orders supports dynamic portfolio rebalancing and timely capital raising, while ATC orders are strategic for index fund adjustments and end-of-day pricing accuracy.

Common Mistakes When Using Market vs. Close Orders

Common mistakes when using At-the-Market (ATM) versus At-the-Close (ATC) orders include misunderstanding timing and price execution differences, leading to unexpected trade outcomes. Traders often overlook that ATM orders execute continuously at current market prices, which can cause slippage in volatile markets, while ATC orders execute only at the close price, potentially missing intraday liquidity. Failure to align order type with strategic goals and market conditions frequently results in higher transaction costs and suboptimal execution.

Regulatory Considerations and Market Rules

At-the-Market (ATM) offerings are subject to continuous disclosure requirements under SEC Rule 415, ensuring issuers comply with filing obligations during open trading periods, while At-the-Close transactions must adhere to specific exchange market rules governing closing price executions to prevent price manipulation. Regulatory considerations for ATM programs include monitoring volume limitations and timely reporting of sales to maintain market transparency and investor protection. Market rules for At-the-Close orders focus on maintaining price integrity at market close, with exchanges enforcing specific parameters around order acceptance and execution timing to align with fair trading practices.

Choosing the Right Order Type for Your Trading Strategy

Selecting the appropriate order type between At-the-Market (ATM) and At-the-Close (ATC) hinges on your trading strategy and market conditions. At-the-Market orders execute immediately at prevailing market prices, providing liquidity and flexibility for active traders seeking prompt execution. At-the-Close orders, executed at the market's closing price, suit investors targeting price certainty and reduced intraday volatility, ideal for end-of-day portfolio adjustments.

Important Terms

Intraday Liquidity

Intraday liquidity management enhances At-the-Market trading by enabling real-time fund availability unlike At-the-Close strategies, which depend on end-of-day price settlement and may limit timely transaction execution.

Price Discovery

Price discovery in At-the-Market (ATM) offerings allows continuous real-time trading prices while At-the-Close (ATC) transactions determine prices based on the closing market price, impacting liquidity and valuation accuracy.

Execution Strategy

Execution strategy for At-the-Market orders focuses on continuous liquidity access throughout the trading day, while At-the-Close strategies aim to execute trades at the market's closing price to minimize market impact and capture closing price benchmarks.

Market-on-Close (MOC)

Market-on-Close (MOC) orders are executed precisely at the closing price of the trading session, ensuring that investors transact at the final market price rather than intraday fluctuations. Unlike At-the-Market orders, which execute immediately at the prevailing price, MOC orders specifically target the closing auction, allowing for predictable pricing and reduced market impact during volatile periods.

Time-Weighted Average Price (TWAP)

Time-Weighted Average Price (TWAP) optimizes trade execution by evenly distributing orders over a set period, contrasting with At-the-Market strategies that execute immediately and At-the-Close orders that focus on the market's final price.

Agency Trading

Agency trading involves executing large orders on behalf of clients without taking proprietary positions, often utilizing At-the-Market (ATM) or At-the-Close (ATC) strategies to optimize trade execution and minimize market impact. ATM orders provide continuous liquidity throughout the trading session by allowing sales at prevailing market prices, while ATC orders target execution precisely at the market close to capture end-of-day pricing and reduce price volatility.

Fill Rate

Fill rate for At-the-Market orders typically exceeds 90%, whereas At-the-Close orders often experience lower fill rates due to execution constraints limited to the market close.

Order Imbalance

Order imbalance during At-the-Market (ATM) trades often leads to price volatility, while At-the-Close (ATC) transactions minimize imbalance impact by aligning executions with closing prices.

VWAP (Volume Weighted Average Price)

VWAP (Volume Weighted Average Price) is a critical benchmark used to compare the execution quality of At-the-Market orders, which transact continuously throughout the trading day, against At-the-Close orders, executed specifically at the market's closing price.

Slippage

Slippage in At-the-Market orders often results in more immediate but less predictable execution prices compared to At-the-Close orders, which aim to minimize slippage by executing strictly at the closing price.

At-the-Market vs At-the-Close Infographic

moneydif.com

moneydif.com