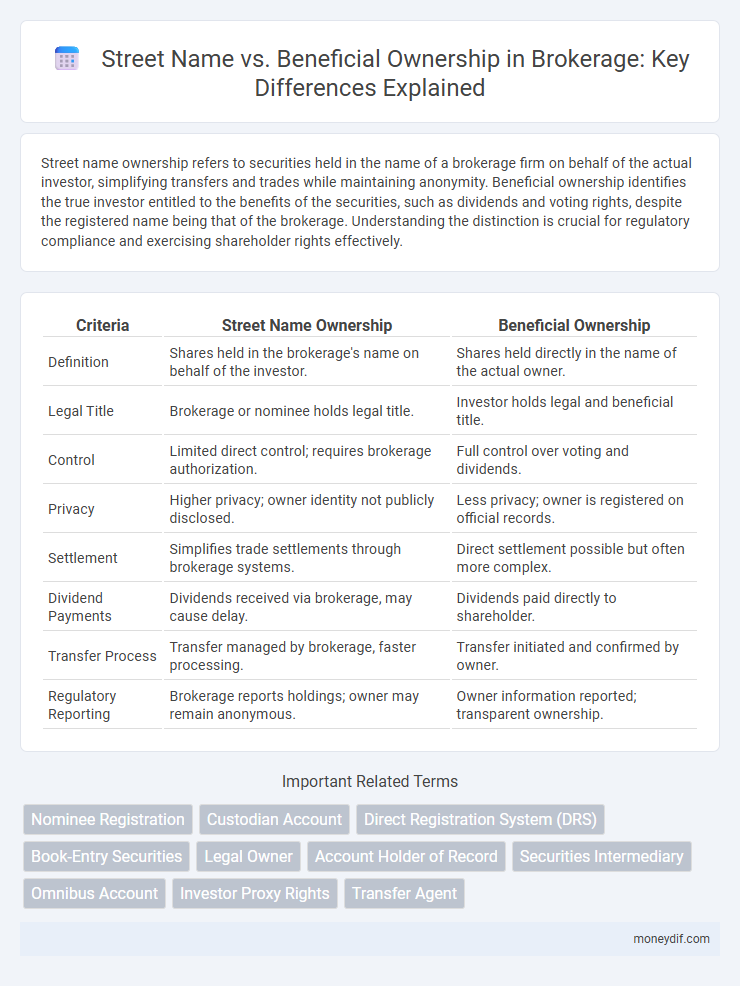

Street name ownership refers to securities held in the name of a brokerage firm on behalf of the actual investor, simplifying transfers and trades while maintaining anonymity. Beneficial ownership identifies the true investor entitled to the benefits of the securities, such as dividends and voting rights, despite the registered name being that of the brokerage. Understanding the distinction is crucial for regulatory compliance and exercising shareholder rights effectively.

Table of Comparison

| Criteria | Street Name Ownership | Beneficial Ownership |

|---|---|---|

| Definition | Shares held in the brokerage's name on behalf of the investor. | Shares held directly in the name of the actual owner. |

| Legal Title | Brokerage or nominee holds legal title. | Investor holds legal and beneficial title. |

| Control | Limited direct control; requires brokerage authorization. | Full control over voting and dividends. |

| Privacy | Higher privacy; owner identity not publicly disclosed. | Less privacy; owner is registered on official records. |

| Settlement | Simplifies trade settlements through brokerage systems. | Direct settlement possible but often more complex. |

| Dividend Payments | Dividends received via brokerage, may cause delay. | Dividends paid directly to shareholder. |

| Transfer Process | Transfer managed by brokerage, faster processing. | Transfer initiated and confirmed by owner. |

| Regulatory Reporting | Brokerage reports holdings; owner may remain anonymous. | Owner information reported; transparent ownership. |

Understanding Street Name vs Beneficial Ownership

Street name registration means securities are held under the name of a brokerage or nominee, allowing easier transfer and faster settlement but leaving the client as the beneficial owner with rights to dividends and voting. Beneficial ownership refers to the actual owner of the securities, who retains full economic benefits and control despite the securities being registered in street name. Understanding this distinction is crucial for investors to ensure clarity on ownership rights, tax implications, and shareholder privileges.

Key Differences Between Street Name and Beneficial Ownership

Street name ownership refers to securities held in the name of a brokerage firm or nominee rather than the investor's personal name, allowing easier transfer and trading of assets. Beneficial ownership denotes the true owner who enjoys the rights and benefits of the securities, including dividends and voting rights, despite the securities being registered under a street name. Key differences include control over shareholder rights, legal recognition of ownership, and the level of transparency regarding the ultimate owner.

How Street Name Registration Works

Street name registration allows brokers to hold securities in their name on behalf of the actual investors, simplifying the process of buying, selling, and transferring stocks. This system enables faster transaction settlements and easier management of corporate actions like dividends and proxy voting. Despite the broker's name appearing on the records, the beneficial owner retains all rights and economic benefits associated with the securities.

The Role of Beneficial Owners in Brokerage Accounts

Beneficial owners hold the true rights to securities within brokerage accounts, despite the securities often being registered in street name under the brokerage's name for operational convenience. This distinction ensures that beneficial owners retain the ability to receive dividends, vote on corporate matters, and enforce ownership rights, even though the brokerage appears as the registered owner on official records. Understanding the role of beneficial ownership is crucial for accurately managing asset control, compliance, and transparency in brokerage account operations.

Advantages of Holding Securities in Street Name

Holding securities in street name allows for faster trade settlement and streamlined administrative procedures, enhancing overall brokerage efficiency. It provides investors with immediate access to electronic statements and trade confirmations through their brokerage accounts. Furthermore, street name registration reduces the complexity of transferring ownership and facilitates easier dividend reinvestment and proxy voting processes.

Drawbacks of Street Name Registration for Investors

Street name registration can expose investors to risks such as loss of direct control over their shares and increased vulnerability to broker insolvency or fraud. This registration method complicates the exercise of shareholder rights, including voting and receiving dividends, due to intermediary involvement. Furthermore, it may hinder prompt access to critical corporate communications and reduce transparency in ownership records.

Legal Implications of Street Name vs Beneficial Ownership

Street name registration allows brokers to hold securities on behalf of clients, streamlining transactions but potentially complicating legal claims in disputes. Beneficial ownership grants the actual owner rights to dividends and voting, ensuring direct legal control and clearer title to assets. Understanding these distinctions affects liability, regulatory compliance, and the enforcement of shareholder rights in brokerage agreements.

Impact on Voting Rights and Corporate Actions

Street name registration allows shares to be held in the broker's name, enabling faster trade settlements but often limiting the shareholder's direct voting rights and participation in corporate actions. Beneficial ownership grants investors direct control over their shares, ensuring full voting power and the ability to receive timely proxy materials and dividends. This distinction significantly impacts investors' influence on corporate governance and access to shareholder benefits.

Street Name vs Beneficial Ownership: Security and Privacy Considerations

Street name registration involves holding securities in the name of a brokerage or its nominee, offering streamlined transaction processing but potentially limiting direct privacy and security control for investors. Beneficial ownership, where securities are registered directly in the investor's name, enhances transparency and control, reducing risks related to unauthorized transfers or misuse. Understanding the differences in data protection, access rights, and regulatory safeguards is crucial for investors prioritizing security and privacy in managing their portfolios.

Choosing the Best Ownership Structure for Your Securities

Choosing between street name and beneficial ownership significantly impacts control and privacy of your securities. Street name ownership allows brokers to hold securities on behalf of investors, facilitating easier trading and faster transaction processing, while beneficial ownership ensures direct control and clearer legal rights over the assets. Understanding regulatory frameworks and tax implications helps investors determine the optimal ownership structure aligned with their financial goals.

Important Terms

Nominee Registration

Nominee registration obscures beneficial ownership by listing a street name or proxy instead of the individual who ultimately controls or benefits from the asset.

Custodian Account

A custodian account holds securities in street name to facilitate trading and record-keeping while the beneficial ownership rights remain with the actual investor.

Direct Registration System (DRS)

The Direct Registration System (DRS) allows investors to hold securities in their own name on the issuer's books, enhancing beneficial ownership transparency compared to street name registrations held by brokers.

Book-Entry Securities

Book-entry securities held in street name register the brokerage firm as the legal owner while the investor retains beneficial ownership rights, enabling easier transfers and reduced paperwork.

Legal Owner

Legal owner holds the title registered under the street name while beneficial ownership refers to the true individual who enjoys the benefits of the asset without necessarily appearing on official records.

Account Holder of Record

The Account Holder of Record legally holds securities under a street name custodian, while beneficial ownership remains with the investor who retains rights and benefits despite the securities being registered in the nominee's name.

Securities Intermediary

A securities intermediary holds securities in street name, legally owning them on behalf of the beneficial owners who retain the economic rights and control.

Omnibus Account

An Omnibus Account consolidates multiple clients' securities under a single street name for record-keeping while maintaining clear beneficial ownership for each individual investor.

Investor Proxy Rights

Investor proxy rights depend on the distinction between street name registration, where securities are held by intermediaries, and beneficial ownership, which confers direct voting and proxy privileges to the actual investor.

Transfer Agent

A transfer agent manages securities ownership records, distinguishing between street name registration--where shares are held in a brokerage's name--and beneficial ownership, where the investor retains legal rights to the shares.

Street Name vs Beneficial Ownership Infographic

moneydif.com

moneydif.com