An introducing broker acts as an intermediary between clients and clearing brokers, handling customer relationships and trade orders without holding client funds or securities. Clearing brokers are responsible for executing, settling, and maintaining custody of trades, ensuring compliance with regulatory requirements. This division of roles allows introducing brokers to focus on client service while clearing brokers manage back-office functions and risk.

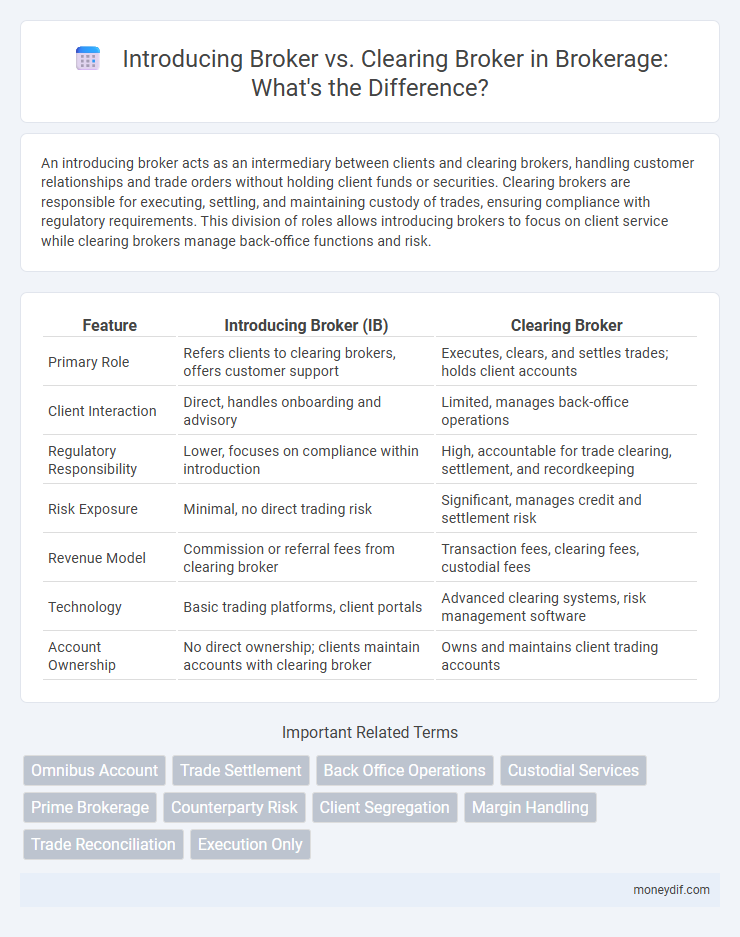

Table of Comparison

| Feature | Introducing Broker (IB) | Clearing Broker |

|---|---|---|

| Primary Role | Refers clients to clearing brokers, offers customer support | Executes, clears, and settles trades; holds client accounts |

| Client Interaction | Direct, handles onboarding and advisory | Limited, manages back-office operations |

| Regulatory Responsibility | Lower, focuses on compliance within introduction | High, accountable for trade clearing, settlement, and recordkeeping |

| Risk Exposure | Minimal, no direct trading risk | Significant, manages credit and settlement risk |

| Revenue Model | Commission or referral fees from clearing broker | Transaction fees, clearing fees, custodial fees |

| Technology | Basic trading platforms, client portals | Advanced clearing systems, risk management software |

| Account Ownership | No direct ownership; clients maintain accounts with clearing broker | Owns and maintains client trading accounts |

Understanding the Roles: Introducing Broker vs Clearing Broker

An introducing broker serves as the client-facing intermediary responsible for acquiring and managing customer accounts without handling trade executions or custody of funds. In contrast, a clearing broker handles the processing, clearing, and settlement of trades, as well as the safekeeping of client assets and regulatory compliance. Understanding the distinction between these roles is essential for brokers seeking to optimize operational efficiency and manage regulatory responsibilities effectively.

Key Responsibilities of Introducing Brokers

Introducing brokers focus on client acquisition, providing personalized service, and offering market insights to enhance trading experiences. They act as intermediaries, facilitating account setup and order routing to clearing brokers, who handle trade execution and settlement. Emphasizing client relationship management and initial transaction facilitation distinguishes introducing brokers within the brokerage framework.

Core Functions of Clearing Brokers

Clearing brokers are essential in the brokerage industry, responsible for the settlement, clearing, and custody of trades executed by introducing brokers. They ensure accurate trade confirmation, margin collection, and regulatory compliance while managing risk and safeguarding client assets. Unlike introducing brokers who focus on client acquisition and order execution, clearing brokers facilitate the post-trade processing that ensures market stability and operational efficiency.

Regulatory Differences Between Introducing and Clearing Brokers

Introducing brokers act as intermediaries that solicit and accept orders from clients but do not hold customer funds or handle trade settlements, which places them under less stringent regulatory requirements such as reduced capital and reporting obligations. Clearing brokers assume responsibility for trade execution, settlement, and clearing, subjecting them to stricter regulatory oversight including higher capital requirements, enhanced compliance obligations, and increased operational risk management under securities and futures regulations. The regulatory divergence reflects the differing risk profiles and operational roles, with clearing brokers facing intensified scrutiny from regulatory bodies like the SEC and FINRA compared to introducing brokers.

How Introducing Brokers Interact with Clients

Introducing brokers (IBs) serve as the primary point of contact for clients, offering personalized advice, market insights, and trade recommendations while building strong client relationships. They facilitate account openings and gather client information but do not execute or clear trades themselves, relying on clearing brokers for these functions. By focusing on client acquisition and service, introducing brokers enable seamless access to financial markets through partnerships with clearing brokers who handle the back-end processing and trade settlement.

The Process of Trade Execution and Clearing

Introducing brokers facilitate client acquisition and order routing, acting as intermediaries without holding client funds or executing trades directly. Clearing brokers handle the confirmation, settlement, and custody of trades by managing the clearing process, ensuring accurate transfer of securities and funds. This division of roles optimizes trade execution efficiency and risk management in brokerage operations.

Advantages of Using an Introducing Broker

Using an introducing broker offers personalized client support and tailored trading advice, enhancing customer experience and trust. Introducing brokers facilitate market access without handling trade settlements, reducing operational burden and regulatory compliance costs for clients. This model allows investors to benefit from localized expertise while relying on clearing brokers for efficient trade clearing and risk management.

Benefits of Partnering with a Clearing Broker

Partnering with a clearing broker provides access to trade settlement and custody services, reducing operational risks and ensuring regulatory compliance. Clearing brokers offer advanced technology and risk management tools that enhance trading efficiency and security for introducing brokers. This collaboration enables introducing brokers to focus on client acquisition and support while leveraging the clearing broker's infrastructure for back-office functions.

Risk Management: Introducing Broker vs Clearing Broker

Introducing brokers primarily focus on client acquisition and relationship management, leaving trade execution and settlement responsibilities to clearing brokers. Clearing brokers handle risk management by maintaining margin accounts, ensuring regulatory compliance, and absorbing counterparty risks associated with trade clearing and settlement. Effective risk management depends on the clearing broker's capacity to monitor credit exposure and enforce margin requirements, while introducing brokers rely on clearing brokers to safeguard clients' transactions.

Choosing the Right Broker Type for Your Trading Needs

Choosing the right broker type for your trading needs depends on your level of experience and the services required. Introducing brokers act as intermediaries, providing client acquisition and support without holding client funds, while clearing brokers handle trade execution, clearing, and custody of assets. Traders seeking direct market access and full trade settlement typically prefer clearing brokers, whereas those who prioritize personalized guidance may opt for introducing brokers.

Important Terms

Omnibus Account

An omnibus account consolidates multiple clients' trades through an introducing broker, enabling the clearing broker to process trades efficiently without directly identifying individual investors.

Trade Settlement

Trade settlement involves the clearing broker finalizing transactions and managing custody while the introducing broker handles client acquisition and order placement without assuming settlement risk.

Back Office Operations

Back office operations differentiate introducing brokers, who handle client acquisition and record-keeping, from clearing brokers, responsible for trade execution, settlement, and regulatory compliance.

Custodial Services

Custodial services in brokerage involve safekeeping client assets, where introducing brokers focus on client acquisition and order placement without holding assets, while clearing brokers handle trade settlement, custody, and regulatory compliance. Clearing brokers provide essential back-office functions ensuring trade execution, margin management, and asset protection, enabling introducing brokers to maintain client relationships without managing operational risks.

Prime Brokerage

An introducing broker acts as an intermediary that refers clients to a clearing broker, which handles trade execution, clearing, and custody services in prime brokerage.

Counterparty Risk

Counterparty risk in the relationship between an introducing broker and a clearing broker arises from the potential default or failure of the clearing broker to fulfill trade settlements, exposing the introducing broker's clients to financial loss. The clearing broker assumes responsibility for trade execution and custody, while the introducing broker relies on the clearing broker's operational integrity, making the risk management frameworks and capital adequacy of the clearing broker critical factors in mitigating exposure.

Client Segregation

Client segregation in the context of introducing brokers versus clearing brokers ensures that client funds and assets are distinctly separated from the brokers' proprietary accounts, enhancing transparency and reducing counterparty risk. Introducing brokers primarily handle client relationships and order execution, while clearing brokers manage trade settlement, custody, and regulatory compliance, necessitating robust segregation practices to protect client assets throughout the trade lifecycle.

Margin Handling

Margin handling between introducing brokers and clearing brokers involves the introducing broker soliciting and managing client relationships while the clearing broker assumes responsibility for maintaining margin requirements, ensuring regulatory compliance, and managing risk exposure. Clearing brokers hold client funds in segregated accounts and perform trade clearing and settlement, whereas introducing brokers focus primarily on customer service and order execution without direct margin control.

Trade Reconciliation

Trade reconciliation between introducing brokers and clearing brokers ensures accuracy by matching trade data, settlement instructions, and commission calculations to prevent discrepancies and mitigate settlement risks.

Execution Only

Execution Only services involve executing client orders without providing investment advice, commonly utilized by introducing brokers to offer clients access to markets while outsourcing trade settlement and clearing functions to clearing brokers; this separation allows introducing brokers to focus on client acquisition and order flow, whereas clearing brokers manage post-trade processes, risk, and regulatory compliance efficiently.

introducing broker vs clearing broker Infographic

moneydif.com

moneydif.com