Voice brokers provide personalized negotiation and expert advice by directly communicating with clients and counterparties, making them ideal for complex or large transactions that require tailored solutions. Electronic brokers utilize advanced algorithms and automated platforms to execute trades swiftly and efficiently, offering greater transparency, reduced transaction costs, and increased market access. Choosing between voice and electronic brokers depends on factors like trade complexity, speed requirements, and preferred level of human interaction.

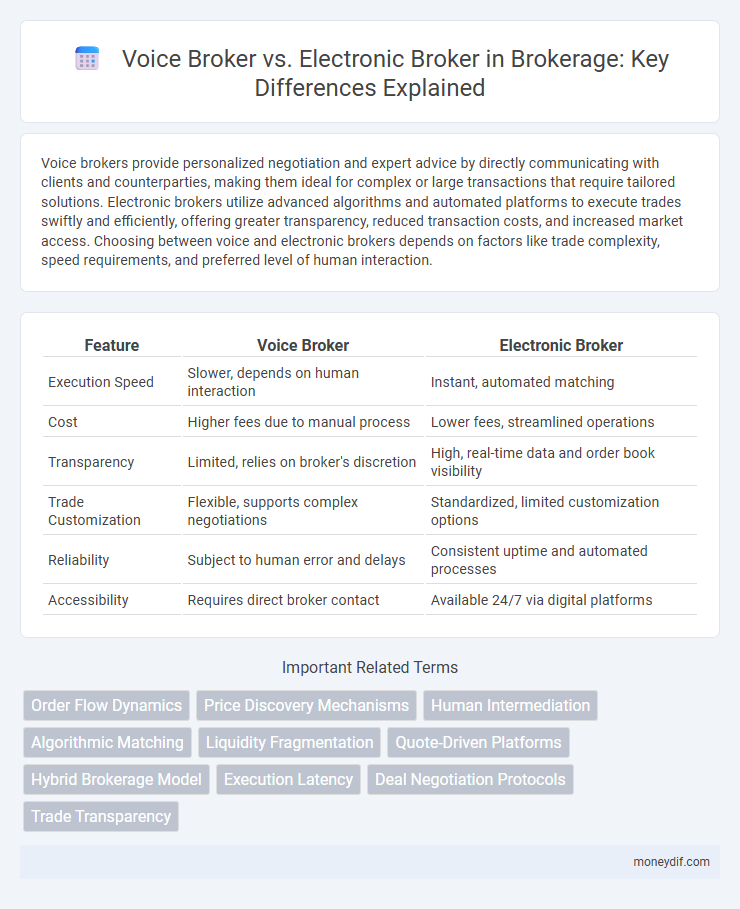

Table of Comparison

| Feature | Voice Broker | Electronic Broker |

|---|---|---|

| Execution Speed | Slower, depends on human interaction | Instant, automated matching |

| Cost | Higher fees due to manual process | Lower fees, streamlined operations |

| Transparency | Limited, relies on broker's discretion | High, real-time data and order book visibility |

| Trade Customization | Flexible, supports complex negotiations | Standardized, limited customization options |

| Reliability | Subject to human error and delays | Consistent uptime and automated processes |

| Accessibility | Requires direct broker contact | Available 24/7 via digital platforms |

Understanding Voice Brokering in Modern Markets

Voice brokering remains a vital method in modern markets, enabling personalized negotiations and complex deal structuring that electronic brokers may not fully replicate. Voice brokers leverage direct human interaction to manage large, bespoke transactions, often in illiquid or opaque markets, where real-time judgment and relationship-building enhance trade execution. This traditional approach complements electronic brokering by handling niche, high-touch trades that rely heavily on expertise, discretion, and dynamic communication.

The Rise of Electronic Brokering Systems

Electronic brokering systems have revolutionized the brokerage industry by automating trade execution and reducing reliance on traditional voice brokers. These platforms utilize advanced algorithms and real-time data to enhance market transparency and efficiency, enabling faster order matching and increased liquidity. The shift toward electronic brokering has significantly lowered transaction costs and expanded access to global markets for institutional and retail investors alike.

Key Differences Between Voice and Electronic Brokers

Voice brokers facilitate trades through direct human interaction, offering personalized negotiation and handling complex or large orders with discretion. Electronic brokers utilize automated platforms to execute trades rapidly, providing greater efficiency, transparency, and lower transaction costs. The key differences lie in speed, human involvement, and the ability to tailor deals versus standardized, algorithm-driven execution.

Advantages of Voice Brokers for Complex Trades

Voice brokers excel in handling complex trades by offering personalized negotiation, which allows for tailored solutions that automated systems often cannot replicate. Their expertise facilitates better price discovery and risk management through direct communication and relationship-building with counterparties. This human element proves invaluable in navigating intricate transactions and market nuances that demand judgment beyond algorithms.

Efficiency and Speed: The Electronic Broker’s Edge

Electronic brokers leverage advanced algorithms and real-time data processing to execute trades with unmatched speed and precision, significantly enhancing market efficiency. Voice brokers, relying on human interaction, often introduce latency and potential errors that can slow down transaction times. The automation and direct market access of electronic brokers reduce execution costs and improve trade accuracy, offering a clear advantage in fast-paced financial environments.

Technology’s Impact on Brokerage Operations

Voice brokers leverage traditional communication methods such as phone calls to execute trades, often requiring more time and human intervention, while electronic brokers utilize advanced algorithms and digital platforms to facilitate faster, more efficient transactions. The integration of machine learning, AI-driven analytics, and real-time data feeds in electronic brokerage systems significantly enhances trade accuracy, reduces operational costs, and improves market access. Technological advancements have shifted brokerage operations towards automation, increasing scalability and enabling firms to handle high-frequency trading with minimal latency.

Liquidity Access: Voice vs Electronic Platforms

Voice brokers offer personalized liquidity access through direct human interaction, enabling tailored negotiation and flexibility in complex or illiquid markets. Electronic brokers provide instant access to extensive liquidity pools via algorithm-driven platforms, facilitating rapid execution and transparency. The choice between voice and electronic brokerage depends on the need for customization versus speed and scale in trading strategies.

Risk Management in Voice and Electronic Brokering

Voice brokers excel in managing complex negotiation risks through real-time human judgment and personalized client interactions, allowing for flexibility in volatile markets. Electronic brokers minimize operational risks by automating trade execution with algorithmic precision, reducing errors and increasing transaction speed. Risk management in voice brokering relies heavily on broker expertise, while electronic platforms emphasize robust technological safeguards and data analytics.

Choosing the Right Brokerage Model for Your Needs

Voice brokers offer personalized trading experiences with expert advice, ideal for complex or large transactions requiring discretion and negotiation skills. Electronic brokers provide faster execution, lower fees, and transparency through automated platforms, suited for high-frequency trading and cost-sensitive investors. Selecting the right brokerage model depends on transaction complexity, speed requirements, cost considerations, and the need for personalized service.

The Future of Brokerage: Voice, Electronic, or Hybrid Solutions?

Voice brokers leverage human expertise and negotiation skills for complex, high-value trades, while electronic brokers provide speed, efficiency, and 24/7 accessibility through algorithm-driven platforms. Hybrid brokerage solutions combine these strengths, integrating real-time data analytics with personalized advisory services to optimize trade execution. The future of brokerage hinges on balancing technological innovation with human judgment to meet diverse client needs in dynamic financial markets.

Important Terms

Order Flow Dynamics

Order Flow Dynamics show that Voice Brokers excel in handling complex, large block trades through personalized negotiation, while Electronic Brokers prioritize speed, transparency, and automation in high-frequency, smaller transactions.

Price Discovery Mechanisms

Voice brokers facilitate price discovery through personalized negotiation and market intuition, while electronic brokers optimize price transparency and speed using algorithmic matching and real-time data.

Human Intermediation

Human intermediation in brokerage leverages personalized negotiation and relationship-building, whereas electronic brokers prioritize automated, algorithm-driven transactions for faster execution and reduced costs.

Algorithmic Matching

Algorithmic matching in electronic brokers leverages advanced algorithms and AI to optimize trade execution speed and accuracy, while voice brokers rely on human negotiation and market intuition for personalized transaction matching.

Liquidity Fragmentation

Liquidity fragmentation occurs when Voice Brokers and Electronic Brokers operate on separate platforms, dispersing order flow and reducing market depth across trading venues.

Quote-Driven Platforms

Quote-driven platforms rely on market makers to provide continuous bid and ask prices, whereas electronic broker platforms facilitate direct order matching between buyers and sellers without intermediary pricing.

Hybrid Brokerage Model

The Hybrid Brokerage Model combines the personalized negotiation advantages of Voice Brokers with the speed and efficiency of Electronic Brokers to optimize trading execution.

Execution Latency

Execution latency for voice brokers typically ranges from several seconds to minutes due to manual processes, whereas electronic brokers achieve execution latency in milliseconds by leveraging automated trading algorithms and direct market access.

Deal Negotiation Protocols

Deal negotiation protocols vary significantly between voice brokers and electronic brokers, where voice brokers rely on real-time human interaction to negotiate terms, prices, and execution strategies, often accommodating complex requests and adjustments. Electronic brokers utilize algorithm-driven platforms and predefined protocols that facilitate faster, more transparent, and automated trade executions, optimizing efficiency and reducing the risk of human error in financial markets.

Trade Transparency

Trade transparency improves significantly with electronic brokers by providing real-time, accessible price and order information compared to the limited and less transparent data flow in voice broker transactions.

Voice Broker vs Electronic Broker Infographic

moneydif.com

moneydif.com