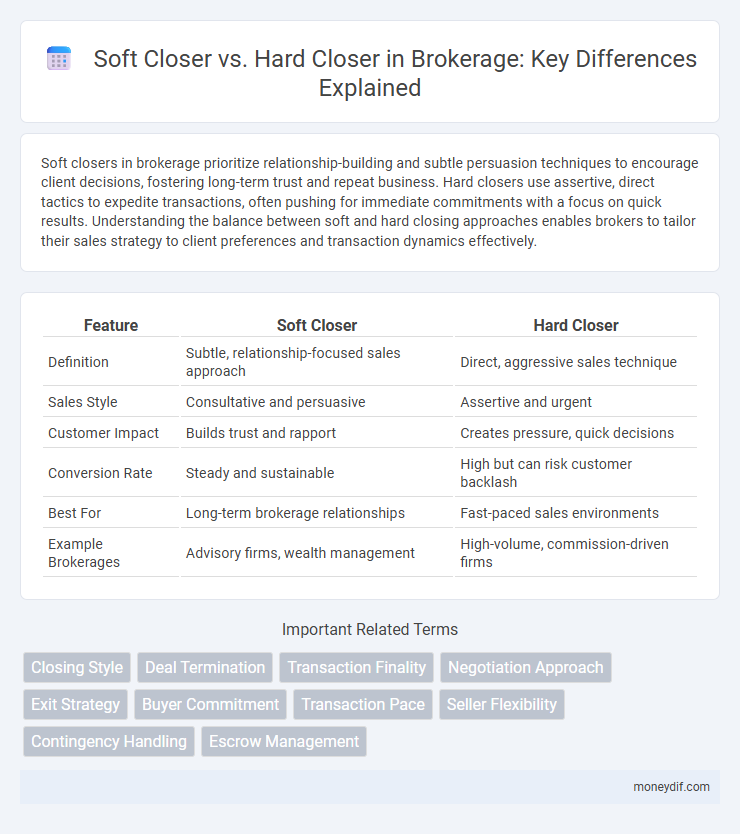

Soft closers in brokerage prioritize relationship-building and subtle persuasion techniques to encourage client decisions, fostering long-term trust and repeat business. Hard closers use assertive, direct tactics to expedite transactions, often pushing for immediate commitments with a focus on quick results. Understanding the balance between soft and hard closing approaches enables brokers to tailor their sales strategy to client preferences and transaction dynamics effectively.

Table of Comparison

| Feature | Soft Closer | Hard Closer |

|---|---|---|

| Definition | Subtle, relationship-focused sales approach | Direct, aggressive sales technique |

| Sales Style | Consultative and persuasive | Assertive and urgent |

| Customer Impact | Builds trust and rapport | Creates pressure, quick decisions |

| Conversion Rate | Steady and sustainable | High but can risk customer backlash |

| Best For | Long-term brokerage relationships | Fast-paced sales environments |

| Example Brokerages | Advisory firms, wealth management | High-volume, commission-driven firms |

Understanding Soft Closer vs Hard Closer in Brokerage

Soft closers in brokerage employ a more consultative approach, prioritizing client relationships and gently guiding prospects toward decisions with less pressure, resulting in higher customer satisfaction and trust. Hard closers use aggressive tactics, emphasizing urgency and firm deadlines to accelerate deals, which can increase short-term sales but may risk long-term client retention. Understanding the differences between soft closers and hard closers helps brokerage firms tailor their sales strategies to maximize both conversion rates and client loyalty.

Key Differences Between Soft Closer and Hard Closer

Soft closers prioritize building rapport and long-term client relationships through empathetic communication and subtle persuasion techniques. Hard closers rely on urgency and direct, assertive tactics to secure immediate agreement, often leveraging pressure and fast decision-making. Key differences include communication style, client engagement approach, and the balance between relationship focus and sales-driven urgency.

Pros and Cons of Soft Closers in Brokerage

Soft closers in brokerage enhance client relationships by allowing agents to gradually build trust and guide prospects through the decision-making process, increasing long-term retention rates. They reduce pressure on potential clients, resulting in higher satisfaction and fewer lost leads due to aggressive tactics. However, soft closers may lengthen sales cycles and require more time investment, potentially delaying immediate revenue generation.

Advantages and Drawbacks of Hard Closers

Hard closers excel at driving swift, decisive transactions by employing assertive sales tactics that can accelerate deal completion within brokerage. Their advantage lies in converting indecisive clients into committed buyers quickly, which enhances sales volume and shortens sales cycles. However, the drawback includes potential client discomfort and higher risk of damaging long-term relationships due to perceived pressure or aggressive negotiation styles.

Impact on Client Relationships: Soft vs Hard Closing Techniques

Soft closers foster trust and long-term client loyalty by using gentle persuasion and prioritizing the client's needs, enhancing relationship quality and repeat business. Hard closers employ aggressive tactics aimed at quick sales, which can strain client trust and potentially damage future interactions. Choosing soft closing techniques in brokerage leads to stronger client rapport and sustainable growth.

Which Approach Drives More Closings?

Soft closers in brokerage rely on building rapport and subtle persuasion, often leading to higher client satisfaction and repeat business, which drives more long-term closings. Hard closers use aggressive tactics to force decisions quickly, resulting in faster deal completion but potentially reducing client trust and future transactions. Market analysis shows that brokers employing soft closing techniques tend to achieve higher closing rates over time due to stronger client relationships and trust.

Situational Best Uses: Soft Closer vs Hard Closer

Soft closers excel in consultative sales environments where building long-term relationships and trust is crucial, such as financial advisory or complex brokerage deals. Hard closers are best suited for high-pressure, time-sensitive transactions requiring quick decision-making, common in high-stakes stock trading or real estate brokerage. Selecting between soft and hard closers depends on client temperament, deal complexity, and the urgency of closing the sale.

Transitioning Between Soft and Hard Closing Strategies

Transitioning between soft closer and hard closer strategies in brokerage requires careful client analysis and market condition assessment to maximize deal success. Soft closers leverage relationship-building and subtle persuasion, ideal for long-term client retention, while hard closers use assertive tactics to accelerate decision-making in competitive environments. Effective brokers blend both approaches by recognizing cues and adjusting their negotiation style to align with client temperament and transaction urgency.

Training Your Team: Emphasizing the Right Closing Style

Training your brokerage team to master the right closing style--soft closer or hard closer--enhances client trust and transaction success rates. Soft closers prioritize building rapport and addressing clients' concerns gently, ideal for high-value or long-term relationships, while hard closers drive urgency and decisive action, fitting for competitive markets with fast-paced deals. Tailoring training to align closing techniques with your brokerage's niche improves conversion metrics and overall sales performance.

Maximizing Brokerage Success with Effective Closing Techniques

Soft closers build rapport and trust, encouraging clients to make decisions without pressure, which increases long-term brokerage success through relationship-driven sales. Hard closers use direct and assertive tactics to expedite decisions, maximizing immediate deal closures but risking client discomfort and future reluctance. Balancing soft and hard closing techniques fosters sustainable brokerage growth by adapting approaches to client preferences and transaction dynamics.

Important Terms

Closing Style

Soft closers foster trust and long-term relationships by gently guiding prospects, while hard closers use firm, assertive tactics to secure quick sales.

Deal Termination

Deal termination strategies differentiate soft closers who prioritize relationship preservation and gradual exit from hard closers who enforce immediate, definitive contract cessation.

Transaction Finality

Transaction finality in blockchain is achieved faster with a hard closer, which immediately confirms and settles transactions, whereas a soft closer provides probabilistic finality subject to potential reversals during its confirmation period.

Negotiation Approach

Soft Closers prioritize relationship-building and empathy during negotiations, while Hard Closers focus on assertiveness and decisive tactics to secure agreements quickly.

Exit Strategy

Choosing between a soft closer and a hard closer in an exit strategy impacts client retention rates, revenue optimization, and long-term brand reputation.

Buyer Commitment

Buyer commitment increases significantly when a soft closer approach emphasizes relationship building and trust rather than the pressure tactics characteristic of a hard closer.

Transaction Pace

Soft Closers increase transaction pace by allowing flexible deal finalization, while Hard Closers enforce strict deadlines that can accelerate decisions but risk transaction delays.

Seller Flexibility

Seller flexibility increases when adopting a soft closer approach compared to a hard closer, enhancing customer satisfaction and long-term sales relationships.

Contingency Handling

Contingency handling in negotiation differentiates soft closers--who prioritize relationship-building and flexibility--from hard closers who focus on assertive, decisive agreement enforcement.

Escrow Management

Escrow management involves controlling funds and documents during transactions, where a soft closer allows flexible, conditional release of escrow while a hard closer enforces strict, unconditional finalization.

Soft Closer vs Hard Closer Infographic

moneydif.com

moneydif.com