In brokerage, a disclosed principal is one whose identity is revealed to the third party during the transaction, allowing them to be directly liable for the contract. An undisclosed principal remains hidden, with the broker acting as the contracting party, thereby initially bearing the liability. Understanding this distinction is crucial for managing risks and ensuring clear legal responsibility in agency relationships.

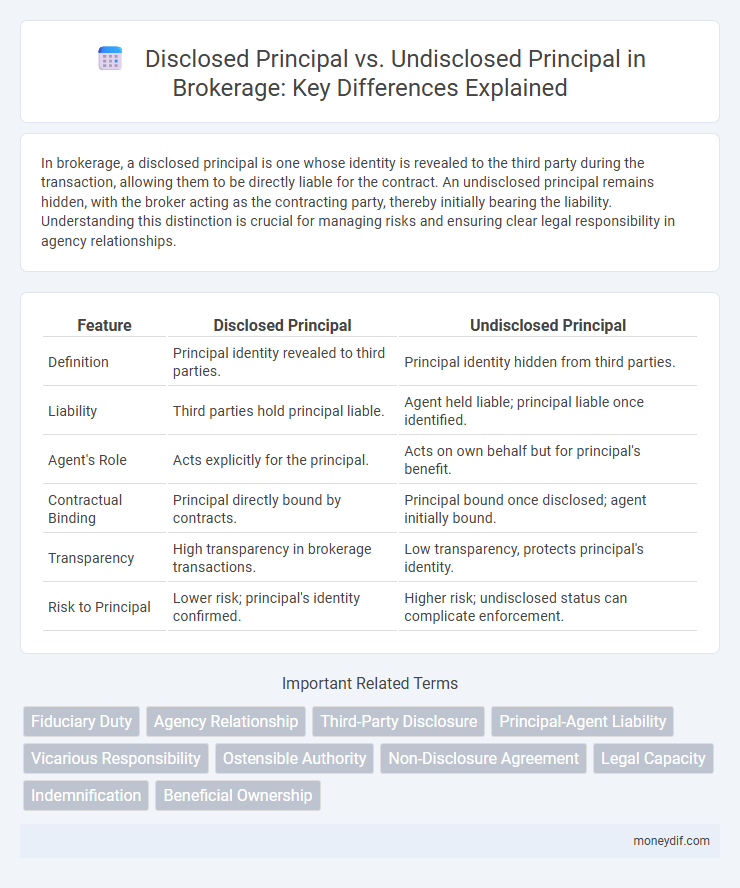

Table of Comparison

| Feature | Disclosed Principal | Undisclosed Principal |

|---|---|---|

| Definition | Principal identity revealed to third parties. | Principal identity hidden from third parties. |

| Liability | Third parties hold principal liable. | Agent held liable; principal liable once identified. |

| Agent's Role | Acts explicitly for the principal. | Acts on own behalf but for principal's benefit. |

| Contractual Binding | Principal directly bound by contracts. | Principal bound once disclosed; agent initially bound. |

| Transparency | High transparency in brokerage transactions. | Low transparency, protects principal's identity. |

| Risk to Principal | Lower risk; principal's identity confirmed. | Higher risk; undisclosed status can complicate enforcement. |

Introduction to Disclosed and Undisclosed Principals

In brokerage, a disclosed principal is one whose identity is revealed to the third party involved in a transaction, allowing clear accountability and direct contractual obligations between the principal and the third party. An undisclosed principal remains anonymous to the third party, with the broker acting as the apparent principal, which can complicate liability and contract enforcement. Understanding the distinction between disclosed and undisclosed principals is crucial for legal clarity and risk management in agency relationships within brokerage.

Key Definitions: Disclosed vs. Undisclosed Principal

A disclosed principal is a party whose identity is revealed to the third party during a brokerage transaction, allowing the broker to act openly on their behalf. An undisclosed principal remains anonymous, with the broker acting without revealing that they represent another party, which can affect liability and contractual obligations. Understanding the distinction between disclosed and undisclosed principals is crucial for determining the legal responsibilities and rights of brokers and involved parties.

Role of the Broker in Principal Disclosure

In brokerage, a disclosed principal is openly identified to the third party, allowing the broker to act transparently on behalf of the principal, ensuring clear contractual obligations and reducing liability risks. Conversely, with an undisclosed principal, the broker acts in their own name without revealing the principal's identity, which may increase the broker's responsibility and potential personal liability if disputes arise. Understanding these roles is crucial for brokers to manage risks and maintain legal compliance in contractual dealings.

Legal Implications of Principal Disclosure

Disclosed principal transactions clearly identify the principal to third parties, reducing liability for the broker and ensuring transparency in contractual obligations. Undisclosed principal arrangements keep the principal's identity hidden, which can lead to increased risk of personal liability for brokers if the contract fails or disputes arise. Legal implications include the potential for brokers to be held personally accountable in undisclosed scenarios, whereas disclosed principal agreements typically shift responsibility directly to the principal.

Liability Differences: Disclosed vs. Undisclosed Principal

In brokerage law, a disclosed principal is identified to third parties, making the principal directly liable for contracts and obligations entered into by the agent, while the agent typically bears no personal liability. Conversely, an undisclosed principal remains unknown to third parties, resulting in potential liability for both the agent and the principal, as third parties may hold the agent personally responsible until the principal's existence is revealed. This distinction fundamentally affects the risk exposure and legal recourse available to all parties involved in the transaction.

Rights and Duties of Brokers in Each Scenario

In brokerage involving a disclosed principal, brokers must act transparently, revealing the principal's identity and adhering to fiduciary duties such as loyalty, confidentiality, and full disclosure while ensuring contractual obligations are clear. When dealing with an undisclosed principal, brokers owe duties only to the apparent principal, often themselves, and must exercise care in maintaining confidentiality to protect the hidden principal's identity, which affects liability and enforceability of contracts. Rights of brokers differ as they have claim to commission from the disclosed principal upon consummation of the contract, whereas with an undisclosed principal, brokers may face challenges in enforcing commission rights without betraying confidentiality.

Typical Situations Involving Undisclosed Principals

Undisclosed principals often emerge in real estate transactions where brokers negotiate deals without revealing the true buyer to protect their identity or leverage better terms. This situation commonly arises in competitive markets to avoid price inflation or to maintain confidentiality for high-net-worth individuals. Brokers must carefully navigate disclosure laws to prevent legal disputes and ensure transparent agency relationships.

Risks and Advantages for Parties Involved

Disclosed principals benefit from transparency, gaining direct contractual rights and limiting brokers' personal liability, which reduces risks for both parties. Undisclosed principals carry the advantage of confidentiality, protecting strategic interests, but brokers face higher liability risks as third parties may hold them personally responsible. Brokers must weigh the trade-off between risk exposure in undisclosed arrangements and the clarity and security provided by disclosed principal transactions.

Case Law and Regulatory Guidelines

Disclosed principal arrangements require brokers to clearly identify the principal to third parties, safeguarding transparency as emphasized in *Securities Exchange Act Rule 10b-10* and *Carter v. Aetna Cas. & Sur. Co.* Conversely, undisclosed principal scenarios, regulated under *Restatement (Second) of Agency SS 144* and reinforced by *Madden v. Wells Fargo*, impose fiduciary duties on brokers to avoid conflicts of interest and maintain confidentiality. Regulatory guidelines from FINRA and the SEC mandate clear disclosure and recordkeeping to prevent fraud and protect market integrity in both principal representations.

Best Practices for Transparency in Brokerage Transactions

Disclosed principal transactions promote transparency by clearly identifying the principal to all parties involved, ensuring informed decision-making and reducing conflicts of interest. Best practices include full disclosure of the principal's identity and maintaining accurate documentation to build trust and comply with regulatory requirements. In contrast, undisclosed principal dealings require brokers to uphold strict confidentiality while balancing ethical obligations, emphasizing the importance of clear contractual terms to avoid legal disputes.

Important Terms

Fiduciary Duty

Fiduciary duty requires agents to act loyally and in the best interest of the disclosed principal, whereas duty complexities arise when the principal is undisclosed, potentially exposing the agent to personal liability.

Agency Relationship

An agency relationship involves a disclosed principal when the third party knows the principal's identity, whereas it involves an undisclosed principal when the agent acts without revealing the principal's identity.

Third-Party Disclosure

Third-party disclosure varies significantly depending on whether the principal is disclosed, affecting the agent's liability and the principal's rights in contractual obligations.

Principal-Agent Liability

Principal-agent liability varies significantly as a disclosed principal limits the agent's personal liability while an undisclosed principal may hold the agent personally liable for contracts made on its behalf.

Vicarious Responsibility

Vicarious responsibility arises when an agent acts on behalf of a disclosed principal, making the principal liable for the agent's actions, whereas in the case of an undisclosed principal, the principal's liability is concealed, potentially limiting vicarious responsibility.

Ostensible Authority

Ostensible authority arises when a third party reasonably believes an agent has authority to act on behalf of a disclosed or undisclosed principal, binding the principal to the agent's actions.

Non-Disclosure Agreement

A Non-Disclosure Agreement (NDA) protects confidential information when a disclosed principal's identity is revealed, whereas with an undisclosed principal, the NDA must also safeguard the principal's anonymity while ensuring confidentiality.

Legal Capacity

Legal capacity determines whether a disclosed principal or an undisclosed principal can be held liable for contractual obligations created by an agent acting on their behalf.

Indemnification

Indemnification in agency law distinguishes that an agent acting for a disclosed principal is entitled to reimbursement from the principal for liabilities incurred, whereas for an undisclosed principal, the agent may bear personal liability unless the principal subsequently indemnifies the agent upon disclosure.

Beneficial Ownership

Beneficial ownership determines the true owner behind disclosed or undisclosed principals, revealing who ultimately controls or benefits from a transaction or asset.

Disclosed Principal vs Undisclosed Principal Infographic

moneydif.com

moneydif.com