A wrap account offers a comprehensive investment solution with a single, all-inclusive fee covering advisory, transaction, and management services, simplifying fee structures and potentially reducing overall costs. Transaction-based accounts charge fees for each trade or service separately, which can lead to higher expenses during active trading but may be more cost-effective for less frequent transactions. Choosing between the two depends on your trading frequency, investment style, and preference for transparent, predictable fees versus pay-as-you-go flexibility.

Table of Comparison

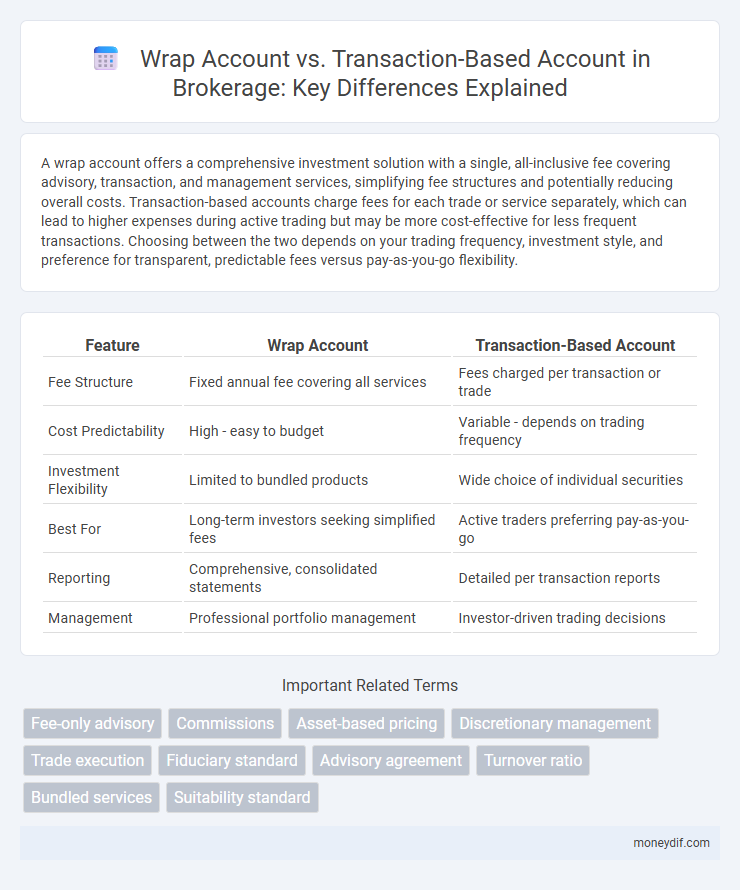

| Feature | Wrap Account | Transaction-Based Account |

|---|---|---|

| Fee Structure | Fixed annual fee covering all services | Fees charged per transaction or trade |

| Cost Predictability | High - easy to budget | Variable - depends on trading frequency |

| Investment Flexibility | Limited to bundled products | Wide choice of individual securities |

| Best For | Long-term investors seeking simplified fees | Active traders preferring pay-as-you-go |

| Reporting | Comprehensive, consolidated statements | Detailed per transaction reports |

| Management | Professional portfolio management | Investor-driven trading decisions |

Understanding Wrap Accounts: An Overview

Wrap accounts consolidate investment management, brokerage fees, and administrative expenses into a single annual fee, simplifying cost structures for investors. These accounts often provide seamless portfolio management through professional asset allocation and ongoing monitoring, making them suitable for clients seeking comprehensive financial services. Compared to transaction-based accounts, wrap accounts reduce per-trade costs and promote holistic investment strategies, enhancing long-term portfolio growth potential.

Transaction-Based Accounts Explained

Transaction-based accounts charge fees per trade, making them ideal for investors who prefer flexibility and control over individual trades. These accounts typically feature commissions, spreads, and fees directly linked to each transaction, enabling precise cost management. Investors with active trading strategies benefit from transparent billing and the ability to execute multiple trades without a fixed annual fee.

Key Differences Between Wrap and Transaction-Based Accounts

Wrap accounts charge a single, comprehensive fee covering investment management, advisory services, and transaction costs, typically calculated as a percentage of assets under management. In contrast, transaction-based accounts incur fees per trade or transaction, which can lead to variable costs depending on the trading activity. Wrap accounts offer simplified billing and potentially lower costs for active traders, while transaction-based accounts provide cost efficiency for investors with infrequent trading needs.

Cost Structures: Wrap Account vs. Transaction-Based Account

Wrap accounts typically charge a single, comprehensive fee based on assets under management, simplifying cost structures and providing predictable expenses for investors. Transaction-based accounts incur fees for each trade or service, which can accumulate and lead to higher costs during active trading periods. Investors seeking transparency and budget control often prefer wrap accounts, while those with infrequent trades may benefit from lower transaction-based fees.

Service Offerings: What’s Included in Each Account Type

Wrap accounts provide a comprehensive service offering that includes portfolio management, advisory services, and consolidated reporting for a single, all-inclusive fee. Transaction-based accounts charge fees per trade or transaction, offering more flexibility but potentially higher costs depending on trading frequency. Investors seeking bundled services and simplicity often prefer wrap accounts, while those wanting control over individual trades may opt for transaction-based accounts.

Pros and Cons of Wrap Accounts

Wrap accounts offer investors a simplified fee structure by consolidating multiple services under a single, flat annual fee, which can enhance cost predictability and streamline portfolio management. However, wrap accounts may lead to higher overall costs for investors with infrequent trading activity due to the bundled fee nature, reducing cost efficiency compared to transaction-based accounts. The comprehensive service and professional management provided in wrap accounts benefit clients seeking hands-off investment strategies but can limit customization and flexibility in trading choices.

Pros and Cons of Transaction-Based Accounts

Transaction-based accounts offer greater flexibility by allowing investors to pay only for the specific trades they execute, which can result in lower costs for those with infrequent trading activity. These accounts provide transparent pricing and enable more control over individual transactions, but frequent trading can incur higher cumulative fees compared to wrap accounts. They lack the bundled management services found in wrap accounts, making them less suitable for investors seeking comprehensive portfolio management or advisory support.

Who Should Choose a Wrap Account?

Investors seeking simplified portfolio management and predictable, all-inclusive fees should consider a wrap account, ideal for those with larger portfolios or who desire consolidated reporting and professional investment advice. High-net-worth individuals benefit from the comprehensive service that combines investment management, custody, and administrative costs under one fee. Conversely, investors with smaller portfolios or those preferring pay-per-trade pricing may find transaction-based accounts more cost-effective.

Ideal Clients for Transaction-Based Accounts

Transaction-based accounts suit active investors who prefer paying per trade rather than a fixed fee, enabling cost control aligned with trading frequency. Ideal clients include frequent traders, those executing large, opportunistic trades, and individuals seeking transparent fee structures tied directly to transactions. These accounts offer flexibility for managing portfolios with varied and dynamic trading strategies.

Making the Right Choice: Factors to Consider

Choosing between a wrap account and a transaction-based account hinges on factors such as investment frequency, fee structures, and service preferences. Wrap accounts offer a bundled fee covering advisory, trading, and administrative costs, making them suitable for investors with frequent trades and a need for comprehensive management. Transaction-based accounts charge fees per trade, benefiting those with infrequent transactions who prefer paying only for specific services.

Important Terms

Fee-only advisory

Fee-only advisory typically offers transparent pricing with a fixed percentage of assets under management in wrap accounts, whereas transaction-based accounts charge fees per trade, potentially increasing costs for frequent investors.

Commissions

Wrap accounts charge a single comprehensive commission covering all services and trades, while transaction-based accounts apply individual fees per trade or transaction executed.

Asset-based pricing

Asset-based pricing charges fees as a percentage of total assets in wrap accounts, while transaction-based accounts incur fees per individual trade or transaction.

Discretionary management

Discretionary management in wrap accounts offers bundled investment services with a single fee, contrasting with transaction-based accounts that charge per trade and require client approval for each transaction.

Trade execution

Trade execution speed and cost efficiency differ significantly between wrap accounts, which charge a fixed fee for bundled services, and transaction-based accounts, where fees are incurred per trade.

Fiduciary standard

The fiduciary standard mandates that financial advisors prioritize clients' best interests, making wrap accounts, which offer bundled advisory services for a flat fee, more aligned with this standard than transaction-based accounts that may create conflicts of interest due to commission-based trading.

Advisory agreement

An advisory agreement in a wrap account consolidates investment management fees into a single comprehensive fee covering various services, whereas a transaction-based account charges fees per individual trade or transaction. Wrap accounts offer cost predictability and streamlined billing, contrasting with the potentially higher and variable costs associated with transaction-based fee structures.

Turnover ratio

The turnover ratio in wrap accounts typically reflects a more stable, long-term investment strategy with lower transaction frequency, whereas transaction-based accounts often exhibit higher turnover ratios due to active buying and selling. This difference impacts cost efficiency and tax implications, making turnover ratio a critical metric for evaluating portfolio management styles within each account type.

Bundled services

Bundled services in wrap accounts typically include a comprehensive fee covering investment management, advisory services, and transaction costs, providing clients with an all-inclusive pricing model. In contrast, transaction-based accounts charge fees per trade or service, potentially leading to higher costs depending on trading frequency and account activity.

Suitability standard

The Suitability standard requires financial advisors to recommend wrap accounts over transaction-based accounts only when the investment portfolio, fee structure, and trading frequency align with the client's financial goals and risk tolerance.

wrap account vs transaction-based account Infographic

moneydif.com

moneydif.com