Directed order flow involves routing client orders to specific market makers or liquidity providers, often based on prearranged agreements, which can result in faster execution but may limit price improvement opportunities. Non-directed order flow allows brokers to route orders to the best available venue dynamically, maximizing price discovery and potentially better fills for clients. Understanding the differences between these order flow types is crucial for traders seeking transparency and optimal trade execution.

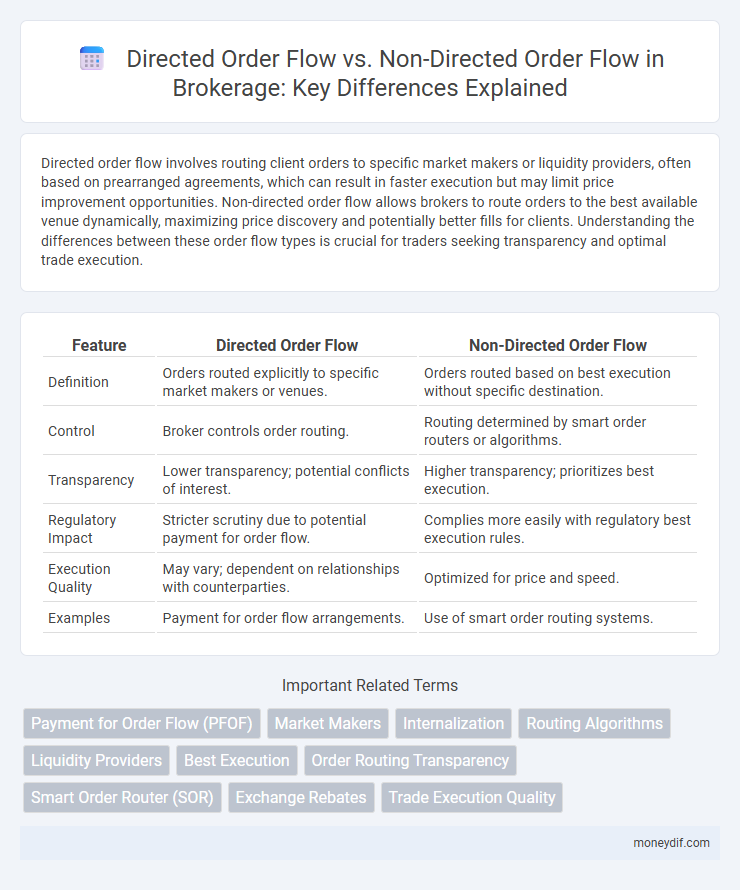

Table of Comparison

| Feature | Directed Order Flow | Non-Directed Order Flow |

|---|---|---|

| Definition | Orders routed explicitly to specific market makers or venues. | Orders routed based on best execution without specific destination. |

| Control | Broker controls order routing. | Routing determined by smart order routers or algorithms. |

| Transparency | Lower transparency; potential conflicts of interest. | Higher transparency; prioritizes best execution. |

| Regulatory Impact | Stricter scrutiny due to potential payment for order flow. | Complies more easily with regulatory best execution rules. |

| Execution Quality | May vary; dependent on relationships with counterparties. | Optimized for price and speed. |

| Examples | Payment for order flow arrangements. | Use of smart order routing systems. |

Understanding Directed Order Flow in Brokerage

Directed order flow in brokerage refers to the practice where brokers route client orders to specific market makers or liquidity providers, often receiving incentives for this designated direction. This flow can enhance execution quality by leveraging predetermined relationships but may also introduce conflicts of interest affecting best execution mandates. Understanding directed order flow is essential for investors to evaluate broker transparency and its impact on trade execution costs and market fairness.

What Is Non-Directed Order Flow?

Non-directed order flow refers to the routing of client orders where brokers do not have explicit instructions on where to send the trades for execution, instead using automated systems or best execution policies to determine the destination. This type of order flow contrasts with directed order flow, where brokers route trades to specific market makers or venues, often for incentives or payment for order flow agreements. Non-directed order flow aims to maximize execution quality by considering factors like price improvement, speed, and reliability without conflicts of interest that may arise from directed routing.

Key Differences Between Directed and Non-Directed Order Flow

Directed order flow channels client trades to specific market makers or liquidity providers, ensuring predictable execution and often enhanced pricing transparency. Non-directed order flow allows brokers to route orders freely across multiple venues, seeking best execution through competitive market pricing and diverse liquidity pools. The key difference lies in execution control and potential conflicts of interest, with directed flow offering more broker influence and non-directed prioritizing market-driven trade execution.

How Brokers Handle Different Order Flow Types

Brokers managing Directed Order Flow typically route client orders to specific market makers or dealers who provide liquidity and may offer price improvement or incentives. In contrast, Non-Directed Order Flow is routed to exchanges or electronic communication networks (ECNs) based on best execution policies, aiming for competitive pricing and transparency. Brokerages use sophisticated algorithms and compliance frameworks to ensure optimal execution while balancing client interests and regulatory requirements for both order flow types.

Impact on Trade Execution Quality

Directed order flow channels trades to specific market makers or liquidity providers, often resulting in faster execution and potentially better pricing due to established relationships and priority routing. Non-directed order flow allows brokers to route orders to multiple venues, fostering competition that can enhance trade execution quality through improved pricing and reduced market impact. Both methods influence execution quality by balancing speed, price improvement, and market transparency, with directed flow offering stability and non-directed flow promoting competitive price discovery.

Costs and Fees: Directed vs Non-Directed Orders

Directed order flow typically incurs higher costs and fees due to payments to specific market makers or affiliated venues, resulting in potential markups passed to traders. Non-directed order flow often benefits from lower commissions and reduced hidden fees by routing orders to the best available market, promoting price improvement and tighter spreads. Brokerage firms must balance these cost structures to optimize execution quality while managing revenue from order routing arrangements.

Order Flow and Market Transparency

Directed order flow involves routing client orders to specific market makers, often resulting in reduced market transparency due to hidden order routing and potential conflicts of interest. Non-directed order flow sends orders to the most favorable market destinations based on best execution principles, enhancing market transparency and contributing to fair price discovery. Understanding the implications of order flow types is crucial for brokers aiming to optimize execution quality and maintain regulatory compliance in transparent markets.

Regulatory Considerations and Compliance

Directed order flow involves routing client orders to specific market makers or trading venues, which must comply with regulatory requirements such as those imposed by the SEC and FINRA to ensure transparency and fair execution. Non-directed order flow, by contrast, allows brokers to send orders to multiple venues based on best execution principles, demanding strict adherence to order handling and disclosure rules to prevent conflicts of interest and maintain compliance. Compliance frameworks require detailed record-keeping, periodic audits, and clear client disclosures regardless of the order flow type to uphold market integrity and regulatory standards.

Benefits and Drawbacks for Retail Investors

Directed order flow allows retail investors to benefit from potentially better execution prices and quicker trade settlements by routing orders to specific market makers. However, this can lead to conflicts of interest and less transparency, as brokers might prioritize venues that offer higher rebates rather than best prices. Non-directed order flow fosters greater market competition and price discovery, offering retail investors potentially better overall execution but may result in longer execution times and increased exposure to market volatility.

Choosing the Right Order Flow Approach

Choosing the right order flow approach in brokerage depends on market conditions and trading objectives. Directed order flow routes trades to specific market makers or liquidity providers, enhancing price improvement and reducing latency, ideal for high-frequency or institutional traders seeking execution quality. Non-directed order flow, which sends orders to aggregated venues or exchanges, offers broader market access and transparency, better suited for retail investors prioritizing simplicity and competitive pricing.

Important Terms

Payment for Order Flow (PFOF)

Payment for Order Flow (PFOF) involves brokers receiving compensation for routing Directed Order Flow to specific market makers, whereas Non-Directed Order Flow is sent to competing venues based on best execution without predetermined routing agreements.

Market Makers

Market makers optimize liquidity by responding to directed order flow from informed traders while managing risks associated with non-directed order flow driven by uninformed or random market participants.

Internalization

Internalization involves brokers executing client orders internally using Directed Order Flow to match trades within their own system, contrasting with Non-Directed Order Flow that routes orders externally to public exchanges.

Routing Algorithms

Routing algorithms optimize trade execution by efficiently managing directed order flow, which follows predefined paths, versus non-directed order flow, which requires dynamic route determination to minimize latency and maximize liquidity.

Liquidity Providers

Liquidity providers optimize market efficiency by leveraging directed order flow for targeted asset allocation while balancing non-directed order flow to maintain price stability.

Best Execution

Best Execution ensures optimal trade outcomes by prioritizing Directed Order Flow for client-specific routing preferences while balancing Non-Directed Order Flow to achieve competitive pricing and liquidity.

Order Routing Transparency

Order Routing Transparency enhances market fairness by clearly distinguishing Directed Order Flow, where orders are routed to specific market makers, from Non-Directed Order Flow, which is routed without predetermined destination, enabling better trade execution analysis and regulatory oversight.

Smart Order Router (SOR)

Smart Order Router (SOR) optimizes trade execution by efficiently managing directed order flow targeting specific venues and non-directed order flow seeking best available prices across multiple markets.

Exchange Rebates

Exchange rebates incentivize liquidity providers by offering fee reductions or payments for adding directed order flow, which is intentionally routed to specific venues to optimize execution quality. Non-directed order flow, lacking specific routing instructions, often incurs higher fees since it may not contribute as effectively to exchange liquidity models or rebate structures.

Trade Execution Quality

Trade execution quality improves significantly when directed order flow is utilized, as it leverages informed liquidity routing compared to non-directed order flow, which may lead to higher market impact and slippage.

Directed Order Flow vs Non-Directed Order Flow Infographic

moneydif.com

moneydif.com