Custodial brokerage allows investors to retain control over their investment decisions while the broker safeguards and manages assets securely. Discretionary brokerage grants brokers authority to make investment choices on behalf of clients, often leading to faster execution and tailored portfolio management. Understanding the distinct roles and responsibilities in each type helps investors align their strategies with desired levels of involvement and risk tolerance.

Table of Comparison

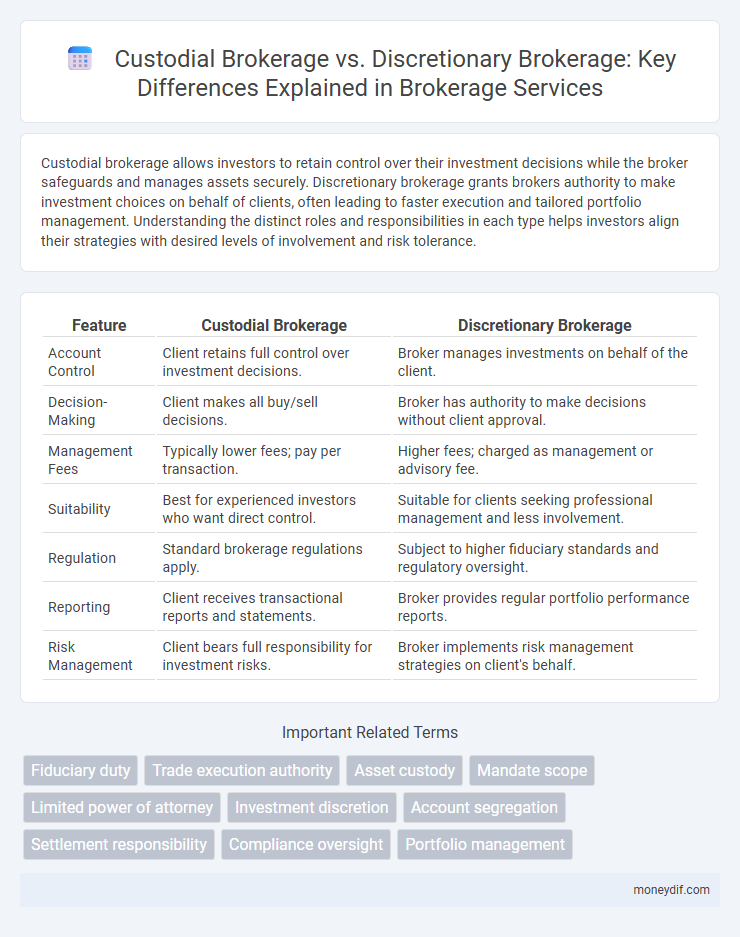

| Feature | Custodial Brokerage | Discretionary Brokerage |

|---|---|---|

| Account Control | Client retains full control over investment decisions. | Broker manages investments on behalf of the client. |

| Decision-Making | Client makes all buy/sell decisions. | Broker has authority to make decisions without client approval. |

| Management Fees | Typically lower fees; pay per transaction. | Higher fees; charged as management or advisory fee. |

| Suitability | Best for experienced investors who want direct control. | Suitable for clients seeking professional management and less involvement. |

| Regulation | Standard brokerage regulations apply. | Subject to higher fiduciary standards and regulatory oversight. |

| Reporting | Client receives transactional reports and statements. | Broker provides regular portfolio performance reports. |

| Risk Management | Client bears full responsibility for investment risks. | Broker implements risk management strategies on client's behalf. |

Understanding Custodial Brokerage

Custodial brokerage involves an account where a trustee or custodian manages investments on behalf of a minor or beneficiary, maintaining legal control while the beneficiary retains ownership. This arrangement ensures that assets are safeguarded and transactions are executed only under the custodian's oversight, providing a layer of protection against unauthorized trades. Unlike discretionary brokerage, where the broker has full authority to make investment decisions, custodial brokerage requires explicit consent for each trade, emphasizing supervision and security in asset management.

What Is Discretionary Brokerage?

Discretionary brokerage allows financial advisors to manage clients' investment portfolios by making buy, sell, and asset allocation decisions without requiring prior client approval for each transaction. This service is ideal for investors seeking professional management and convenience, relying on the broker's expertise to optimize returns and manage risks. Unlike custodial brokerage, discretionary brokerage emphasizes active decision-making authority granted to the broker to execute trades aligned with the client's investment objectives.

Key Differences Between Custodial and Discretionary Brokerage

Custodial brokerage involves a broker holding and safeguarding client assets without actively managing investments, requiring explicit client approval for all transactions, while discretionary brokerage grants brokers authority to make investment decisions and execute trades on behalf of clients without prior consent. Custodial accounts maintain client control over investment choices, ensuring transparency and direct involvement, whereas discretionary accounts prioritize convenience and professional expertise through delegated decision-making. Regulatory frameworks often impose stricter oversight on discretionary brokerage due to the increased responsibility and potential conflicts of interest associated with autonomous portfolio management.

Roles and Responsibilities of Custodial Brokers

Custodial brokers primarily hold and safeguard clients' assets, ensuring security and proper record-keeping without making investment decisions on their behalf. Their responsibilities include facilitating trade settlements, managing client accounts, and providing detailed reporting and compliance monitoring. Unlike discretionary brokers, custodial brokers do not execute trades autonomously but act under explicit client instructions.

How Discretionary Brokers Operate

Discretionary brokers operate by managing clients' investment portfolios without requiring prior approval for each trade, leveraging their expertise to make real-time decisions aligned with the client's financial goals. They employ advanced market analysis tools and risk assessment strategies to optimize portfolio performance while adhering to pre-agreed investment mandates. This hands-on approach contrasts with custodial brokerage, where brokers execute trades only upon client instruction, limiting responsiveness and proactive asset management.

Decision-Making Authority: Client vs. Broker

In custodial brokerage, the client retains full decision-making authority over investment choices, ensuring direct control of asset management. Discretionary brokerage grants the broker the power to make trading decisions on behalf of the client based on pre-agreed investment objectives. This shift in decision-making authority significantly impacts portfolio management style, risk tolerance, and responsiveness to market changes.

Risk Management in Custodial vs. Discretionary Brokerage

Risk management in custodial brokerage centers on safeguarding client assets by strictly following client instructions, minimizing the risk of unauthorized trades and ensuring compliance with regulatory standards. Discretionary brokerage involves higher risk exposure as portfolio managers exercise autonomous decision-making, requiring robust internal controls, thorough performance monitoring, and risk assessment frameworks to mitigate potential losses. Effective risk management in both models depends on transparent reporting, stringent compliance protocols, and tailored oversight to protect client interests and maintain market integrity.

Fees and Costs: A Comparative Overview

Custodial brokerage accounts typically charge lower fees since clients retain control over investment decisions, minimizing advisory costs, while discretionary brokerage services incur higher fees due to professional portfolio management and active monitoring. Custodial accounts may involve transaction fees or flat maintenance charges, whereas discretionary accounts often include management fees calculated as a percentage of assets under management (AUM), impacting overall investment returns. Understanding the fee structures is crucial for investors evaluating cost efficiency against the level of service and expertise provided.

Choosing the Right Brokerage for Your Needs

Selecting the right brokerage hinges on understanding custodial brokerage, where clients maintain control over investment decisions, versus discretionary brokerage, where portfolio managers make decisions on behalf of clients. Clients seeking hands-on management may prefer custodial accounts, offering direct oversight and flexible trading, while those desiring professional expertise and time savings might opt for discretionary services. Evaluating factors such as control preferences, investment goals, risk tolerance, and management fees ensures alignment with personal financial strategies.

Regulatory Considerations for Custodial and Discretionary Brokerage

Regulatory considerations for custodial brokerage primarily emphasize safeguarding client assets through strict segregation of funds and ensuring transparent reporting, aligning with regulations such as the SEC's Customer Protection Rule (Rule 15c3-3). Discretionary brokerage faces enhanced oversight requiring brokerage firms to act in the best interest of clients under fiduciary standards, with regulatory bodies like FINRA enforcing compliance through routine audits and suitability assessments. Both brokerage types must adhere to rigorous anti-money laundering (AML) protocols and maintain comprehensive records to prevent fraud and protect investor rights.

Important Terms

Fiduciary duty

Fiduciary duty in custodial brokerage requires the broker to safeguard client assets without making investment decisions, whereas discretionary brokerage entails a higher fiduciary responsibility, allowing the broker to make investment decisions on behalf of the client under a mandate. This distinction emphasizes the broker's active role in managing portfolios in discretionary accounts versus the passive asset-holding role in custodial accounts.

Trade execution authority

Trade execution authority in custodial brokerage limits clients to authorizing trades, whereas discretionary brokerage grants brokers full authority to execute trades on behalf of clients.

Asset custody

Asset custody involves the secure holding and administration of financial assets by a custodian, ensuring protection against theft or loss. Custodial brokerage provides clients with access to asset safekeeping and transaction execution under their instruction, while discretionary brokerage grants the broker authority to manage and trade assets on behalf of the client without prior consent.

Mandate scope

Mandate scope in custodial brokerage typically involves safekeeping and executing trades based on client instructions without providing investment advice, whereas discretionary brokerage grants the broker authority to make investment decisions and manage the portfolio on behalf of the client. Discretionary mandates require clearly defined guidelines and limits to align with the client's risk tolerance and investment objectives, ensuring compliance and accountability.

Limited power of attorney

Limited power of attorney in custodial brokerage authorizes specific transactions with client consent, whereas discretionary brokerage grants the broker full authority to make investment decisions without prior approval.

Investment discretion

Investment discretion allows discretionary brokerage firms to make investment decisions on behalf of clients, unlike custodial brokerage services where clients maintain full control over trades and asset management.

Account segregation

Account segregation in custodial brokerage ensures client assets are held separately from the broker's own funds, enhancing protection and reducing risk in insolvency scenarios. In contrast, discretionary brokerage may allow pooled accounts where investment decisions are managed collectively, potentially affecting individual asset segregation and requiring robust regulatory safeguards.

Settlement responsibility

Settlement responsibility in custodial brokerage typically lies with the brokerage holding client assets, whereas in discretionary brokerage, the broker managing the portfolio directly assumes settlement obligations.

Compliance oversight

Compliance oversight in custodial brokerage focuses on safeguarding client assets and ensuring transaction transparency, while discretionary brokerage oversight prioritizes fiduciary duty adherence and investment decision accountability.

Portfolio management

Discretionary brokerage allows portfolio managers to make investment decisions on behalf of clients, while custodial brokerage focuses on securely holding and safeguarding clients' assets without making active trading decisions.

custodial brokerage vs discretionary brokerage Infographic

moneydif.com

moneydif.com