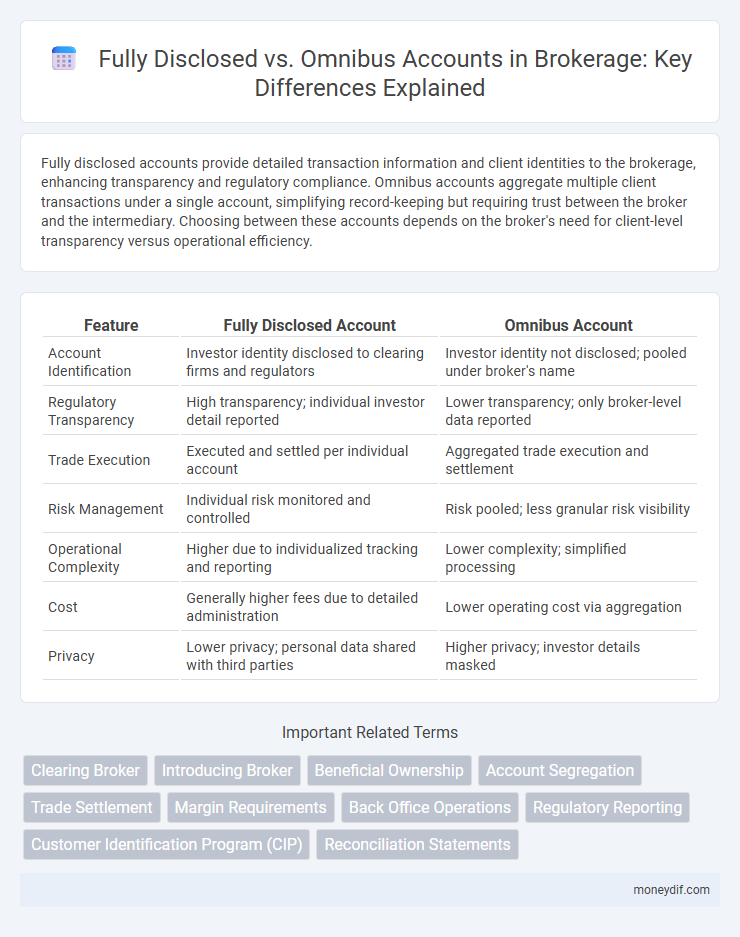

Fully disclosed accounts provide detailed transaction information and client identities to the brokerage, enhancing transparency and regulatory compliance. Omnibus accounts aggregate multiple client transactions under a single account, simplifying record-keeping but requiring trust between the broker and the intermediary. Choosing between these accounts depends on the broker's need for client-level transparency versus operational efficiency.

Table of Comparison

| Feature | Fully Disclosed Account | Omnibus Account |

|---|---|---|

| Account Identification | Investor identity disclosed to clearing firms and regulators | Investor identity not disclosed; pooled under broker's name |

| Regulatory Transparency | High transparency; individual investor detail reported | Lower transparency; only broker-level data reported |

| Trade Execution | Executed and settled per individual account | Aggregated trade execution and settlement |

| Risk Management | Individual risk monitored and controlled | Risk pooled; less granular risk visibility |

| Operational Complexity | Higher due to individualized tracking and reporting | Lower complexity; simplified processing |

| Cost | Generally higher fees due to detailed administration | Lower operating cost via aggregation |

| Privacy | Lower privacy; personal data shared with third parties | Higher privacy; investor details masked |

Introduction to Brokerage Account Structures

Brokerage account structures primarily consist of fully disclosed and omnibus accounts, each offering distinct levels of transparency and control. Fully disclosed accounts provide detailed client information to executing brokers, enabling precise trade allocation and personalized reporting. Omnibus accounts consolidate multiple clients under a single account number, simplifying administration while requiring internal systems to manage individual ownership and compliance.

What is a Fully Disclosed Account?

A fully disclosed account is a brokerage arrangement where the broker has complete information about the individual client underlying the account, including identity and transaction details. This transparency allows the brokerage firm to report trades and regulatory information directly in the client's name, enhancing compliance and personalized service. Unlike omnibus accounts that aggregate multiple clients under one account, fully disclosed accounts provide clear separation of assets and liabilities for each client.

What is an Omnibus Account?

An omnibus account is a brokerage account that groups multiple clients' trades and holdings under a single account to streamline trade execution and reporting. It allows brokers to manage several clients' portfolios collectively while maintaining individual records internally, enhancing operational efficiency and confidentiality. This structure contrasts with fully disclosed accounts, where each client's trades are separately recorded with the clearing firm.

Key Differences Between Fully Disclosed and Omnibus Accounts

Fully disclosed accounts provide brokers with detailed client information, ensuring transparency and regulatory compliance, while omnibus accounts aggregate multiple clients under a single account, masking individual identities and enhancing operational efficiency. In fully disclosed accounts, trade confirmations and statements are sent directly to individual clients, whereas omnibus accounts rely on intermediaries to distribute information. The choice between these account types impacts risk management, with fully disclosed accounts offering greater client-level oversight compared to the pooled nature of omnibus accounts.

Regulatory and Compliance Considerations

Fully disclosed accounts require brokers to maintain detailed client information, ensuring compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, which facilitates transparency and regulatory reporting. Omnibus accounts consolidate multiple clients under a single account number, complicating compliance efforts due to limited individual client data, increasing risks of regulatory scrutiny and potential breaches. Regulatory bodies often favor fully disclosed accounts for their enhanced traceability and accountability in brokerage operations.

Roles and Responsibilities of Broker-Dealers

Broker-dealers managing fully disclosed accounts act as intermediaries, directly revealing client identities to clearing firms, thereby ensuring transparent regulatory compliance and personalized asset management. In omnibus accounts, broker-dealers consolidate multiple client transactions under a single account, assuming heightened responsibilities for accurate record-keeping, client segregation, and regulatory reporting to prevent commingling of assets. The choice between fully disclosed and omnibus structures influences broker-dealer obligations in client confidentiality, trade allocation accuracy, and adherence to FINRA and SEC regulations.

Impact on Investor Transparency and Reporting

A fully disclosed brokerage account provides complete transparency by directly linking client transactions to their individual profiles, enhancing precise reporting and regulatory compliance. Omnibus accounts aggregate multiple clients' trades under a single entity, which can obscure individual investor details and complicate transparency. This aggregation impacts the granularity of reporting, potentially limiting investors' insight into transaction specifics and regulatory oversight.

Pros and Cons of Fully Disclosed Accounts

Fully disclosed accounts provide transparency by revealing the client's identity to the clearing broker, enhancing regulatory compliance and reducing risk of fraud. They allow for personalized service and specific client instructions but involve higher administrative costs and liability for the introducing broker. Confidentiality may be compromised compared to omnibus accounts, where client information remains aggregated and private.

Pros and Cons of Omnibus Accounts

Omnibus accounts consolidate multiple client transactions under a single broker-dealer account, offering streamlined trade execution and reduced administrative overhead. However, this structure may limit transparency and individual client reporting, potentially complicating compliance efforts and increasing risk of misallocation. While cost-efficient and operationally simple, omnibus accounts require robust internal controls to safeguard client assets and ensure regulatory adherence.

Choosing the Right Account Structure for Your Brokerage

Choosing the right account structure, whether a fully disclosed or omnibus account, impacts regulatory compliance and risk management in brokerage operations. Fully disclosed accounts offer transparency by linking individual client trades directly to their identities, enhancing compliance but increasing administrative workload. Omnibus accounts aggregate multiple clients under a single account, simplifying administration but requiring robust controls to manage aggregated risks and maintain privacy.

Important Terms

Clearing Broker

A clearing broker manages trade settlements by either operating fully disclosed accounts, where client identities are transparent to the broker, or omnibus accounts, which aggregate multiple clients under a single account, maintaining client anonymity.

Introducing Broker

An introducing broker operates by either using fully disclosed accounts, where client identities and transactions are transparently shared with clearing firms, or omnibus accounts, which consolidate multiple clients under a single account without disclosing individual details.

Beneficial Ownership

Beneficial ownership in fully disclosed accounts refers to the clear identification of the true owner, while omnibus accounts aggregate multiple clients under one account, obscuring individual beneficial ownership details.

Account Segregation

Account segregation ensures client assets are distinctly separated by using fully disclosed accounts, where individual client identities are transparent to custodians, unlike omnibus accounts that pool multiple clients' assets under a single account with commingled holdings.

Trade Settlement

Trade settlement efficiency varies significantly between fully disclosed accounts, which provide detailed client information for precise transaction processing, and omnibus accounts, which aggregate multiple clients' trades under a single broker ID, streamlining settlement but requiring robust reconciliation systems.

Margin Requirements

Margin requirements for fully disclosed accounts are typically stricter and individually calculated based on each client's positions, whereas omnibus accounts aggregate multiple clients' trades, often leading to different margin treatment and potentially reduced individual margin obligations.

Back Office Operations

Back office operations manage the reconciliation and record-keeping of fully disclosed accounts, ensuring transparency by linking transactions directly to individual clients, while omnibus accounts consolidate multiple client trades under a single account for streamlined processing but require precise allocation systems to maintain compliance and accuracy. Efficient back office workflows optimize trade matching, settlement, and regulatory reporting, differentiating the handling of client data between fully disclosed and omnibus account structures.

Regulatory Reporting

Regulatory reporting for fully disclosed accounts requires detailed client-level data disclosure, whereas omnibus account reporting aggregates transactions under a single account without individual client identification.

Customer Identification Program (CIP)

The Customer Identification Program (CIP) requires financial institutions to verify the identities of all beneficial owners in fully disclosed accounts, while omnibus accounts allow a single entity to manage multiple clients without individual identification.

Reconciliation Statements

Reconciliation statements for Fully Disclosed accounts provide detailed transaction visibility, whereas Omnibus account reconciliations aggregate multiple clients' transactions, requiring enhanced verification to ensure accuracy and compliance.

Fully Disclosed vs Omnibus Account Infographic

moneydif.com

moneydif.com