Best Execution requires brokers to seek the most advantageous terms for client orders by considering price, speed, and likelihood of execution across multiple venues. Best Efforts, however, obligate brokers only to try their hardest to execute an order without guaranteeing specific outcomes or prices. Understanding these distinctions ensures investors know how their trades are handled and the potential risks involved in each approach.

Table of Comparison

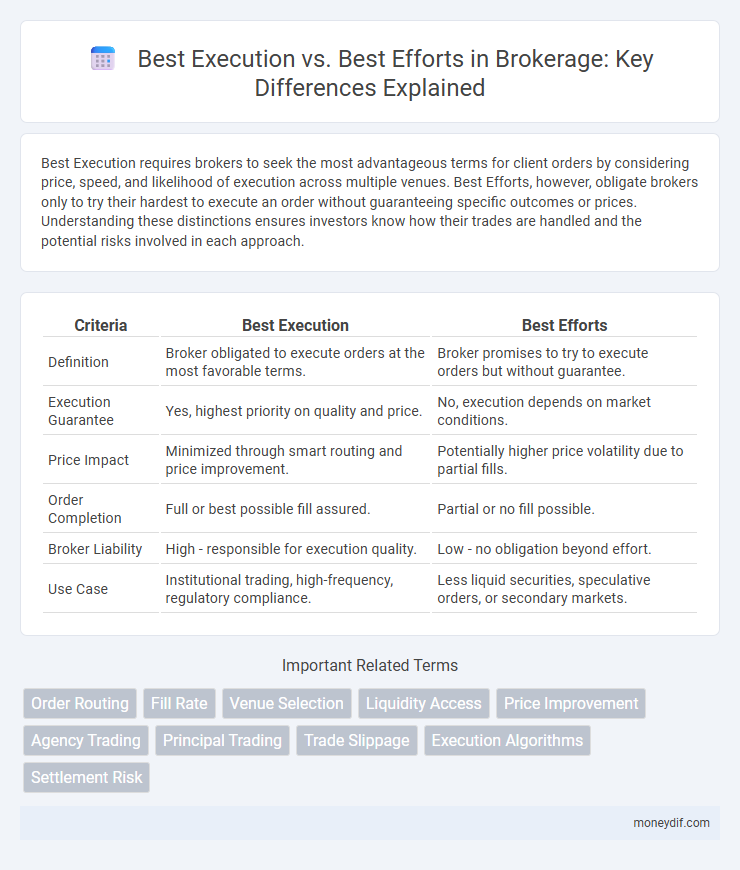

| Criteria | Best Execution | Best Efforts |

|---|---|---|

| Definition | Broker obligated to execute orders at the most favorable terms. | Broker promises to try to execute orders but without guarantee. |

| Execution Guarantee | Yes, highest priority on quality and price. | No, execution depends on market conditions. |

| Price Impact | Minimized through smart routing and price improvement. | Potentially higher price volatility due to partial fills. |

| Order Completion | Full or best possible fill assured. | Partial or no fill possible. |

| Broker Liability | High - responsible for execution quality. | Low - no obligation beyond effort. |

| Use Case | Institutional trading, high-frequency, regulatory compliance. | Less liquid securities, speculative orders, or secondary markets. |

Understanding Best Execution in Brokerage

Best Execution in brokerage mandates that brokers strive to execute client orders at the most advantageous terms, considering price, speed, and likelihood of execution. This duty involves continuously monitoring market conditions and order-routing options to ensure optimal trade outcomes aligned with regulatory standards. Unlike Best Efforts, where brokers make reasonable attempts without guarantees, Best Execution requires a demonstrable commitment to achieving the best possible result for clients.

Defining Best Efforts in Trading

Best Efforts in trading refers to a brokerage firm's commitment to execute client orders with due diligence but without guaranteeing a specific price or execution outcome. This approach contrasts with Best Execution, which mandates brokers to seek the most favorable terms across available markets. Best Efforts prioritize flexibility and timely order handling, often applied in less liquid or volatile markets where precise execution is challenging.

Key Differences Between Best Execution and Best Efforts

Best Execution mandates brokers to secure the most favorable terms for clients across price, speed, and likelihood of execution, emphasizing fiduciary responsibility and regulatory compliance. Best Efforts, by contrast, requires brokers to attempt to execute orders but does not guarantee optimal pricing or complete fulfillment, highlighting a lower level of obligation. The key difference lies in the guaranteed quality of execution under Best Execution versus the reasonable attempt standard characterizing Best Efforts.

Regulatory Requirements for Best Execution

Regulatory requirements for best execution mandate brokers to take all sufficient steps to achieve the most favorable terms for their clients when executing orders, considering price, costs, speed, and likelihood of execution. Unlike best efforts, which involve making a reasonable attempt without a guarantee, best execution imposes a legal obligation to prioritize client interests and continuously monitor execution quality. Compliance with regulations such as MiFID II in the EU ensures transparency, accountability, and the use of systematic order routing and execution policies to meet these standards.

Investor Implications: Best Execution vs Best Efforts

Investors benefit from Best Execution as it mandates brokers to seek the most favorable terms across price, speed, and likelihood of execution, ensuring optimal order fulfillment. In contrast, Best Efforts obligate brokers to try to complete the order without guaranteeing optimal pricing or execution speed, potentially resulting in less favorable outcomes for investors. Understanding these differences allows investors to make informed decisions about trade reliability and potential risks associated with their orders.

How Brokers Achieve Best Execution

Brokers achieve best execution by rigorously analyzing market conditions, including price, speed, and likelihood of order completion, to secure the most favorable trade outcomes for clients. They utilize advanced algorithms, access multiple trading venues, and continuously monitor orders to ensure optimal pricing and minimize market impact. Execution quality reports and compliance with regulatory standards further support brokers in fulfilling their fiduciary duty to deliver best execution.

Scenarios Favoring Best Efforts

Best Efforts are favored in scenarios involving illiquid or volatile markets where obtaining a guaranteed price is impractical, allowing brokers to use their judgment to execute trades at the best possible terms. This approach suits large block trades, emerging market securities, or complex instruments where market impact and price fluctuations pose significant execution risks. Brokers employing Best Efforts prioritize maximizing execution likelihood over assured price certainty, aligning with client objectives in uncertain trading environments.

Measuring Performance: Metrics and Benchmarks

Measuring performance in brokerage involves comparing Best Execution and Best Efforts through metrics such as fill rates, execution speed, and price improvement against established benchmarks like the National Best Bid and Offer (NBBO) or volume-weighted average price (VWAP). Key performance indicators include slippage analysis, transaction cost analysis (TCA), and spread capture, which help assess how closely executions align with the optimal market conditions. Consistent monitoring and reporting of these benchmarks enable brokers to optimize trade outcomes and comply with regulatory requirements.

Risks Associated With Each Approach

Best Execution prioritizes achieving the most favorable terms for clients, but it carries risks related to market volatility and potential conflicts of interest when brokers pursue optimal trades aggressively. Best Efforts involve brokers attempting to execute orders without guaranteeing outcomes, exposing clients to execution risk and possible delays or partial fills during volatile market conditions. Both approaches require careful risk management to balance trade efficiency, transparency, and client protection in dynamic trading environments.

Choosing the Right Brokerage: What Investors Should Consider

Investors should assess execution quality, including price improvement, speed, and likelihood of order completion when choosing between Best Execution and Best Efforts brokerage models. Best Execution mandates brokers to seek the most favorable terms for clients, emphasizing transparency and accountability. Evaluating brokerage reputation, fee structures, and trading platform technological capabilities helps ensure alignment with investment goals and risk tolerance.

Important Terms

Order Routing

Order routing optimizes trade execution by prioritizing best execution strategies that seek the highest quality fills, while best efforts routing focuses on attempting execution without guaranteed outcomes.

Fill Rate

Fill rate measures the percentage of orders completely executed, with Best Execution strategies focusing on optimizing trade quality while Best Efforts prioritize maximizing order completion despite market conditions.

Venue Selection

Venue selection in trading prioritizes best execution by actively seeking optimal prices and liquidity rather than relying on best efforts, which involves executing trades without guaranteeing the most favorable outcomes.

Liquidity Access

Liquidity access enhances best execution by enabling more efficient trade fulfillment compared to best efforts, which may limit order completion due to less aggressive sourcing.

Price Improvement

Price improvement enhances best execution by ensuring trades are executed at better prices than the prevailing best efforts quotes, optimizing trade outcomes for investors.

Agency Trading

Agency trading prioritizes best execution by seeking the optimal price and terms for clients, whereas best efforts focus on the trader's attempt to fulfill the order without guaranteeing execution quality.

Principal Trading

Principal trading involves firms executing trades on their own account, impacting the choice between best execution--which mandates optimizing trade quality--and best efforts, where firms merely strive to fulfill client orders without guaranteeing optimal pricing.

Trade Slippage

Trade slippage occurs when actual execution prices deviate from expected prices, highlighting the difference between best execution--aiming for optimal price fulfillment--and best efforts, which prioritize order completion without guaranteeing price quality.

Execution Algorithms

Execution algorithms optimize trade execution by balancing Best Execution mandates, which require achieving the most favorable terms for clients, against Best Efforts approaches that prioritize order fulfillment without guaranteeing optimal pricing.

Settlement Risk

Settlement risk increases when relying on best efforts execution compared to best execution, as the latter prioritizes optimal trade completion and reduces chances of failed or delayed settlements.

Best Execution vs Best Efforts Infographic

moneydif.com

moneydif.com