A Give-up Agreement involves one brokerage firm assigning a trade to another firm after execution, allowing the latter to clear and settle the transaction while the former retains the client relationship. In contrast, a Give-in Agreement is where one firm clears and settles a trade executed by another firm, effectively acting as the clearing broker, but without client ownership. Understanding the distinctions between these agreements is crucial for regulatory compliance, risk management, and operational efficiency in brokerage operations.

Table of Comparison

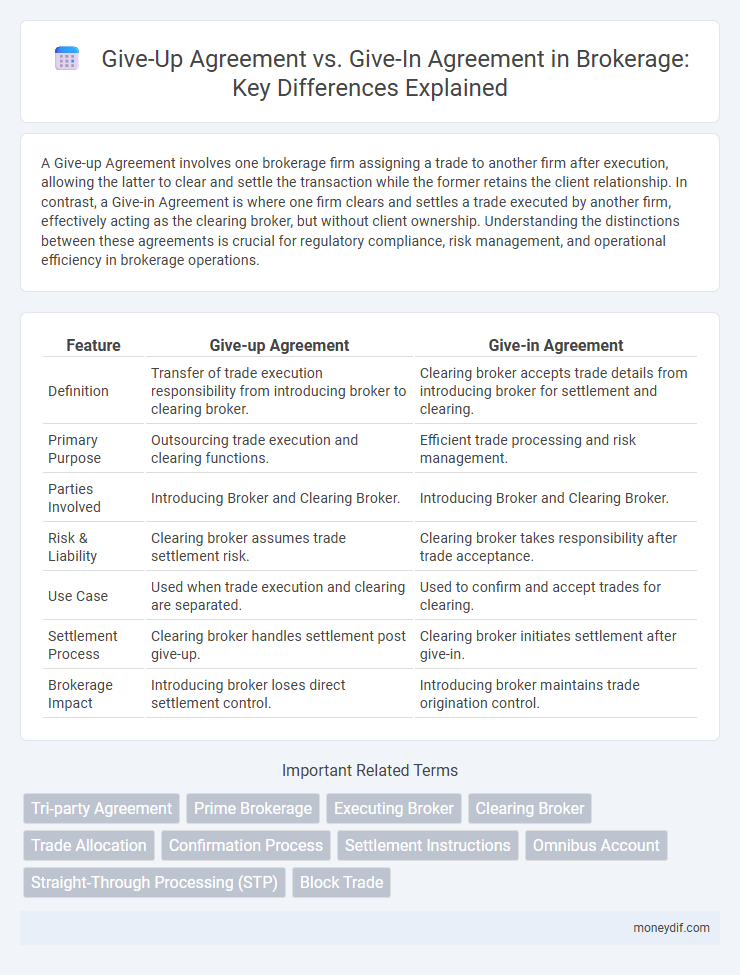

| Feature | Give-up Agreement | Give-in Agreement |

|---|---|---|

| Definition | Transfer of trade execution responsibility from introducing broker to clearing broker. | Clearing broker accepts trade details from introducing broker for settlement and clearing. |

| Primary Purpose | Outsourcing trade execution and clearing functions. | Efficient trade processing and risk management. |

| Parties Involved | Introducing Broker and Clearing Broker. | Introducing Broker and Clearing Broker. |

| Risk & Liability | Clearing broker assumes trade settlement risk. | Clearing broker takes responsibility after trade acceptance. |

| Use Case | Used when trade execution and clearing are separated. | Used to confirm and accept trades for clearing. |

| Settlement Process | Clearing broker handles settlement post give-up. | Clearing broker initiates settlement after give-in. |

| Brokerage Impact | Introducing broker loses direct settlement control. | Introducing broker maintains trade origination control. |

Understanding Give-up Agreements in Brokerage

Give-up agreements in brokerage involve one broker executing trades on behalf of another broker who retains the client relationship and credit with the clearing firm. These agreements enable efficient trade allocation while maintaining regulatory compliance and reducing administrative burdens. Understanding the specific terms and responsibilities in give-up agreements is essential to mitigate counterparty risk and ensure accurate trade settlement.

What is a Give-in Agreement?

A Give-in Agreement is a contractual arrangement in brokerage where one brokerage firm accepts trade executions from another firm and assumes responsibility for clearing and settlement. This agreement enables seamless trade processing by transferring the clearing obligations while maintaining the original executing broker's role. It differs from a Give-up Agreement, where the executing broker gives up the trade to another firm to handle clearing.

Key Differences Between Give-up and Give-in Agreements

Give-up agreements involve one brokerage transferring trade execution responsibilities to another broker while retaining client interaction, whereas give-in agreements feature a broker submitting trades to a clearing broker for settlement without client involvement. The primary difference lies in execution control, with give-up agreements maintaining client relationship and give-in agreements focusing on post-trade processing. Regulatory compliance and commission structures also vary, reflecting each agreement's operational scope within brokerage workflows.

The Role of Give-up Agreements in Multi-Broker Transactions

Give-up agreements play a critical role in multi-broker transactions by enabling one broker to execute trades while transferring the commission and clearing responsibilities to another broker. This arrangement facilitates seamless trade settlement, ensures compliance with regulatory requirements, and optimizes commission allocation among multiple brokers. Give-up agreements enhance operational efficiency and risk management in complex brokerage environments by clearly defining the responsibilities of each party involved in the transaction.

Benefits of Give-in Agreements for Institutional Clients

Give-in Agreements offer institutional clients enhanced control over trade execution by allowing them to direct order flow while benefiting from consolidated reporting and compliance support. These agreements facilitate improved transparency and accountability, enabling clients to monitor broker performance and trade allocations more effectively. Institutional investors also gain streamlined operational efficiency through centralized trade allocations and simplified post-trade processes.

Risks and Considerations: Give-up vs Give-in

Give-up agreements transfer trade execution responsibilities between brokers, creating risks of inaccurate trade allocation, delayed settlement, and counterparty exposure. Give-in agreements involve the receiving broker absorbing the trade, presenting considerations around compliance with regulatory requirements and potential financial liability. Both agreements require stringent due diligence to mitigate operational risks, ensure clear communication, and maintain regulatory compliance in brokerage transactions.

Legal Framework and Documentation Requirements

Give-up agreements require clear contractual terms specifying the transfer of trade execution and settlement responsibilities between broker-dealers, ensuring compliance with regulatory standards such as FINRA Rule 11870. Give-in agreements involve acceptance of trade allocations by executing brokers and typically demand detailed documentation to verify execution authority and risk management controls. Both agreements necessitate meticulous record-keeping and adherence to jurisdiction-specific legal frameworks to mitigate counterparty risk and fulfill audit requirements.

Workflow Process: Step-by-Step in Each Agreement

In a Give-up Agreement, the initiating broker sends trade details to the executing broker who confirms and records the trade, then the executing broker clears and settles the transaction through the clearinghouse. The workflow in a Give-in Agreement starts with the executing broker executing the trade and reporting it to the clearing member, who then gives the trade up to the introducing broker for confirmation and settlement. Both agreements require precise communication and timely data exchange between brokers and clearing entities to ensure accurate trade capture and regulatory compliance.

Common Use Cases in Modern Brokerage

Give-up Agreements are commonly used when introducing brokers (IBs) refer clients to clearing brokers who execute trades on their behalf, facilitating commission sharing and regulatory compliance. Give-in Agreements typically occur when an executing broker submits trades to another broker for clearing and settlement, enabling efficient trade processing and risk management. Modern brokerage firms rely on these agreements to streamline operations, manage counterparty risk, and ensure accurate trade allocation across multiple market participants.

Choosing the Right Agreement: Factors to Consider

Choosing between a Give-up Agreement and a Give-in Agreement depends on factors such as regulatory compliance, risk management, and operational efficiency within brokerage operations. A Give-up Agreement is preferred when maintaining broker-dealer relationships and facilitating trade clearing is critical, while a Give-in Agreement suits scenarios requiring direct execution through the receiving broker's platform. Evaluating counterparty trust, transaction volume, and settlement procedures ensures alignment with business objectives and legal requirements.

Important Terms

Tri-party Agreement

Tri-party agreements establish obligations among three parties and differ from give-up agreements, which transfer trade settlement responsibilities, and give-in agreements, which involve party consent to assume liabilities or rights.

Prime Brokerage

Prime Brokerage services often involve complex trade facilitation mechanisms, where a Give-up Agreement allows an executing broker to transfer trade details to a clearing broker for settlement, enhancing operational efficiency and risk management. Conversely, a Give-in Agreement requires the clearing broker to accept trades from multiple executing brokers, centralizing clearing responsibilities and streamlining post-trade processing within capital markets.

Executing Broker

An executing broker facilitates trade execution under a Give-up Agreement by passing confirmed trades to a clearing broker, whereas a Give-in Agreement involves the executing broker receiving trades from another broker for clearing and settlement.

Clearing Broker

A Clearing Broker facilitates trade settlement by assuming responsibility for clearing and margin requirements, often under a Give-up Agreement where the executing broker 'gives up' the trade to the clearing broker for processing. In contrast, a Give-in Agreement involves the clearing broker 'giving in' the trade details to another broker for execution or clearing, highlighting different roles in the trade life cycle and risk management.

Trade Allocation

Trade allocation involves distributing executed trades among multiple accounts, with Give-up Agreements assigning trade responsibilities to a clearing broker while Give-in Agreements transfer trade processing and settlement duties to the receiving broker.

Confirmation Process

The confirmation process in Give-up Agreements ensures that both executing and clearing brokers validate trade details to facilitate proper settlement, minimizing discrepancies and settlement failures. In contrast, Give-in Agreements typically involve the receiving broker confirming trade allocations before clearing, emphasizing accurate trade acceptance and reducing operational risks.

Settlement Instructions

Settlement instructions in a Give-up Agreement involve one broker transferring trade details to another for clearing, while in a Give-in Agreement, the receiving broker submits trade details directly to the clearinghouse for settlement.

Omnibus Account

An omnibus account consolidates multiple client transactions under a single broker, where a Give-up Agreement transfers trade execution responsibility to another broker, while a Give-in Agreement records the receipt of such trades for clearing purposes.

Straight-Through Processing (STP)

Straight-Through Processing (STP) enhances trade efficiency by automating transactions, where Give-up Agreements transfer execution responsibilities to clearing brokers, while Give-in Agreements involve accepting trade details from executing brokers for settlement processing.

Block Trade

A block trade involving a give-up agreement transfers trade details from the executing broker to the clearing broker for settlement, whereas a give-in agreement requires the originating broker to submit the trade information directly to the clearinghouse.

Give-up Agreement vs Give-in Agreement Infographic

moneydif.com

moneydif.com