Direct Market Access (DMA) allows traders to interact directly with the order books of exchanges, providing greater control over order execution and timely access to market liquidity. Sponsored Access enables clients to trade using a broker's market participant ID without routing orders through the broker's risk checks, which can increase speed but also raise regulatory and risk concerns. Choosing between DMA and Sponsored Access depends on the trader's need for control, speed, and risk management preferences within brokerage services.

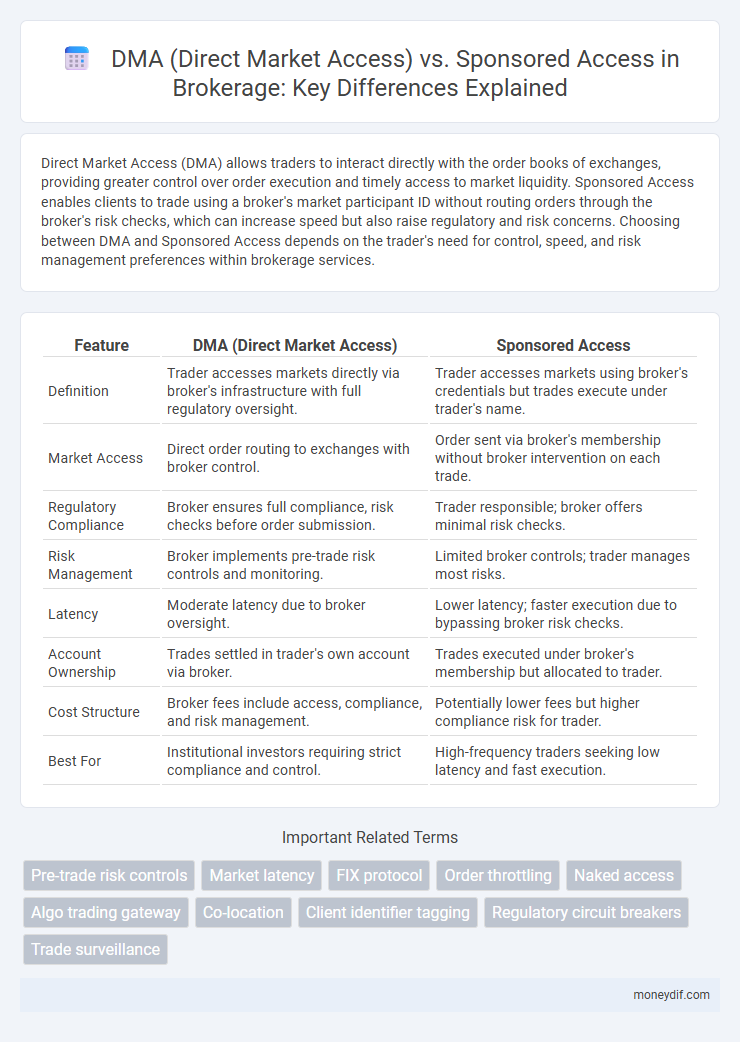

Table of Comparison

| Feature | DMA (Direct Market Access) | Sponsored Access |

|---|---|---|

| Definition | Trader accesses markets directly via broker's infrastructure with full regulatory oversight. | Trader accesses markets using broker's credentials but trades execute under trader's name. |

| Market Access | Direct order routing to exchanges with broker control. | Order sent via broker's membership without broker intervention on each trade. |

| Regulatory Compliance | Broker ensures full compliance, risk checks before order submission. | Trader responsible; broker offers minimal risk checks. |

| Risk Management | Broker implements pre-trade risk controls and monitoring. | Limited broker controls; trader manages most risks. |

| Latency | Moderate latency due to broker oversight. | Lower latency; faster execution due to bypassing broker risk checks. |

| Account Ownership | Trades settled in trader's own account via broker. | Trades executed under broker's membership but allocated to trader. |

| Cost Structure | Broker fees include access, compliance, and risk management. | Potentially lower fees but higher compliance risk for trader. |

| Best For | Institutional investors requiring strict compliance and control. | High-frequency traders seeking low latency and fast execution. |

Overview of DMA and Sponsored Access

Direct Market Access (DMA) allows traders to place orders directly into the market's order book through the broker's infrastructure, providing transparency, control, and access to real-time market data. Sponsored Access enables clients to route orders directly to the exchange using the broker's trading credentials, minimizing latency but increasing the potential risk as trades bypass broker pre-trade risk checks. DMA offers higher control and compliance safeguards, while Sponsored Access prioritizes speed and execution efficiency in brokerage environments.

Key Differences Between DMA and Sponsored Access

Direct Market Access (DMA) allows traders to place orders directly on the exchange's order book, ensuring full control and transparency over trade execution and order routing, while Sponsored Access involves a broker submitting orders on behalf of the client using the broker's infrastructure, potentially raising concerns about risk management and compliance. DMA offers clients ownership of trading decisions and direct interaction with market venues, leading to faster execution and reduced latency, whereas Sponsored Access exposes clients to the broker's credit lines and operational controls. Key differences include DMA's enhanced regulatory oversight and client autonomy compared to the broker-dependent environment of Sponsored Access, making DMA preferable for sophisticated traders prioritizing transparency and control.

Benefits of Direct Market Access (DMA)

Direct Market Access (DMA) offers traders enhanced control and transparency by allowing direct order placement on exchange order books, reducing latency and improving execution speed compared to Sponsored Access. DMA minimizes counterparty risk through direct interaction with exchange infrastructure, providing real-time market data and order management tools that facilitate precise trade execution. This access model supports regulatory compliance by ensuring trades are subject to exchange pre-trade risk checks, enhancing overall trading efficiency and risk mitigation.

Advantages of Sponsored Access in Brokerage

Sponsored Access in brokerage offers faster trade execution by allowing clients to directly access exchange liquidity through the broker's infrastructure, bypassing traditional routing delays. This method reduces operational risks and compliance burdens for clients since the broker maintains regulatory oversight and pre-trade risk checks. Enhanced market transparency and cost efficiency are achieved as traders can benefit from lower latency and improved access without the need for extensive infrastructure investments.

Risks and Challenges: DMA vs Sponsored Access

Direct Market Access (DMA) allows brokers to execute client orders directly on the exchange, minimizing latency and improving transparency but exposing clients to regulatory risks and requiring robust risk controls to prevent erroneous trades. Sponsored Access involves clients trading through the broker's infrastructure without pre-trade risk checks, increasing the risk of market abuse, regulatory non-compliance, and potential liability for the executing broker. Effective risk management and real-time monitoring systems are crucial to mitigate the challenges posed by Sponsored Access compared to the more controlled environment of DMA.

Regulatory Framework and Compliance

Direct Market Access (DMA) provides brokers with full control over client orders and ensures compliance through rigorous pre-trade risk checks under regulatory frameworks like MiFID II and SEC rules. Sponsored Access permits clients to trade directly on exchange platforms using the broker's credentials, but regulatory bodies mandate stringent post-trade monitoring to mitigate risk and enforce compliance. Both models require adherence to market abuse regulations, with DMA generally offering greater transparency and control compared to Sponsored Access, which demands more comprehensive risk management protocols.

Technology Infrastructure Requirements

DMA (Direct Market Access) requires a sophisticated technology infrastructure featuring robust order management systems, real-time risk controls, and comprehensive compliance monitoring to enable clients to interact directly with order books. Sponsored Access demands even higher technological capabilities, including enhanced risk mitigation tools and market connectivity, as the broker assumes responsibility for client orders executed under its credentials. Both models rely heavily on ultra-low latency networks and advanced surveillance systems to meet stringent regulatory standards and ensure seamless trade execution.

Cost Implications for Brokerage Firms

DMA (Direct Market Access) typically involves higher operational costs for brokerage firms due to the need for advanced technology infrastructure, compliance monitoring, and risk management systems. Sponsored Access reduces these costs by allowing clients to trade through the broker's infrastructure without the broker taking principal risk, but it increases regulatory scrutiny and potential liabilities. Brokerage firms must balance the lower operational expenses of Sponsored Access against the increased risk of regulatory fines and capital requirements associated with compliance failures.

Suitability for Institutional and Retail Clients

Direct Market Access (DMA) offers institutional clients enhanced control and transparency by allowing direct order placement on exchanges, making it more suitable for sophisticated traders requiring precise execution and risk management. Sponsored Access provides retail clients faster market entry through broker-delegated infrastructure but involves higher counterparty risk due to indirect market interaction and less control over trade execution. Institutional clients benefit from DMA's regulatory safeguards and compliance alignment, while retail clients may prefer Sponsored Access for its accessibility despite the trade-offs in oversight.

Choosing Between DMA and Sponsored Access

Choosing between DMA and Sponsored Access depends on the trader's need for control and risk management. DMA offers direct order routing to markets, providing transparency and reduced latency, ideal for high-frequency traders seeking full market access. Sponsored Access allows order placement via a broker's infrastructure, reducing setup complexity but increasing counterparty risk and requiring reliance on the sponsor's compliance controls.

Important Terms

Pre-trade risk controls

Pre-trade risk controls for DMA provide broker-mediated safeguards such as order validation and limits, whereas Sponsored Access relies on the sponsor's risk systems to directly filter client orders before reaching the market.

Market latency

Market latency in Direct Market Access (DMA) is generally lower than in Sponsored Access due to DMA's direct control over order flow, reducing transmission delays and improving trade execution speed.

FIX protocol

FIX protocol streamlines trading by enabling Direct Market Access (DMA) with full order transparency and control, while Sponsored Access uses FIX for order routing but relies on a third-party broker's credit and risk management.

Order throttling

Order throttling in DMA limits the number of direct market orders to prevent market impact, while in Sponsored Access, it controls risk by restricting order flow from third-party clients through intermediaries.

Naked access

Naked access allows traders to execute orders directly on exchanges without pre-trade risk checks, unlike sponsored access where a broker intermediates DMA (Direct Market Access) by providing risk controls and regulatory compliance oversight.

Algo trading gateway

Algo trading gateways enhance execution speed by providing Direct Market Access (DMA) for full order control, while Sponsored Access offers faster market entry with broker risk management oversight.

Co-location

Co-location reduces latency by placing trading systems physically close to exchange servers, enhancing DMA speed and reliability compared to Sponsored Access which routes orders through intermediaries and may introduce additional delays.

Client identifier tagging

Client identifier tagging ensures precise trade attribution in DMA (Direct Market Access) by transparently linking orders to the originating client, whereas Sponsored Access may require enhanced tagging protocols to manage risk and compliance effectively.

Regulatory circuit breakers

Regulatory circuit breakers are automated mechanisms designed to temporarily halt trading during excessive volatility, ensuring market stability and protecting investors. In DMA (Direct Market Access) and Sponsored Access, these circuit breakers play a crucial role by enforcing real-time risk controls directly on orders, with DMA typically providing more stringent pre-trade checks compared to the risk exposure inherent in Sponsored Access arrangements.

Trade surveillance

Trade surveillance systems monitor Direct Market Access (DMA) and Sponsored Access transactions to detect market manipulation, ensure regulatory compliance, and mitigate risks associated with unauthorized or high-frequency trading activities.

DMA (Direct Market Access) vs Sponsored Access Infographic

moneydif.com

moneydif.com