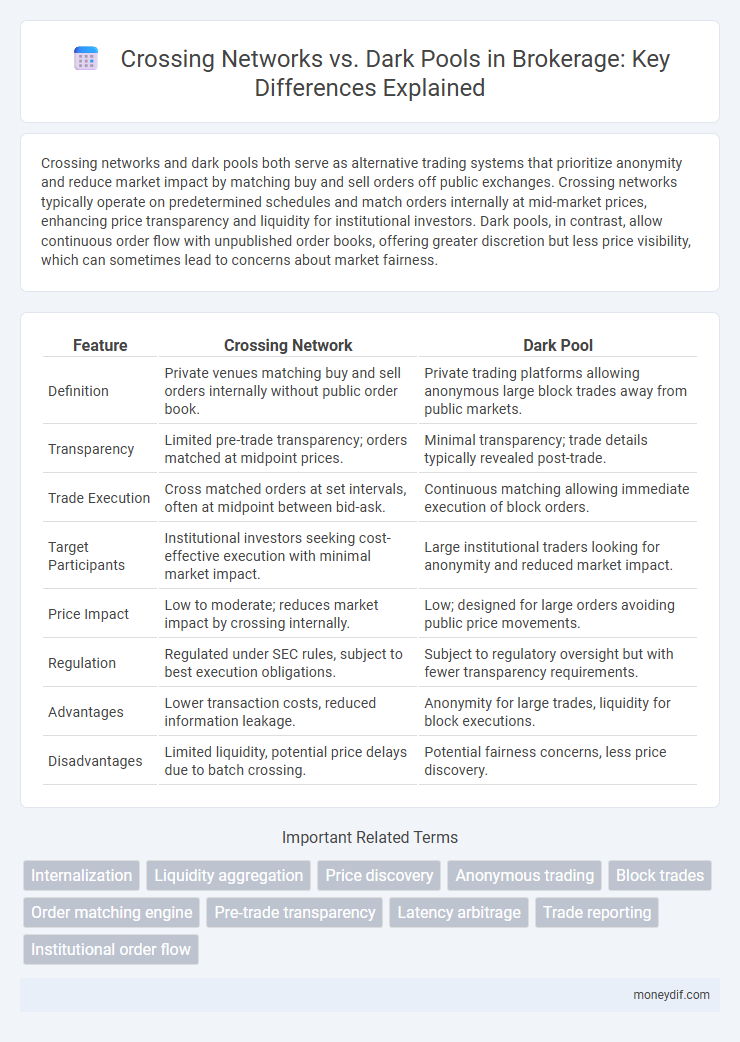

Crossing networks and dark pools both serve as alternative trading systems that prioritize anonymity and reduce market impact by matching buy and sell orders off public exchanges. Crossing networks typically operate on predetermined schedules and match orders internally at mid-market prices, enhancing price transparency and liquidity for institutional investors. Dark pools, in contrast, allow continuous order flow with unpublished order books, offering greater discretion but less price visibility, which can sometimes lead to concerns about market fairness.

Table of Comparison

| Feature | Crossing Network | Dark Pool |

|---|---|---|

| Definition | Private venues matching buy and sell orders internally without public order book. | Private trading platforms allowing anonymous large block trades away from public markets. |

| Transparency | Limited pre-trade transparency; orders matched at midpoint prices. | Minimal transparency; trade details typically revealed post-trade. |

| Trade Execution | Cross matched orders at set intervals, often at midpoint between bid-ask. | Continuous matching allowing immediate execution of block orders. |

| Target Participants | Institutional investors seeking cost-effective execution with minimal market impact. | Large institutional traders looking for anonymity and reduced market impact. |

| Price Impact | Low to moderate; reduces market impact by crossing internally. | Low; designed for large orders avoiding public price movements. |

| Regulation | Regulated under SEC rules, subject to best execution obligations. | Subject to regulatory oversight but with fewer transparency requirements. |

| Advantages | Lower transaction costs, reduced information leakage. | Anonymity for large trades, liquidity for block executions. |

| Disadvantages | Limited liquidity, potential price delays due to batch crossing. | Potential fairness concerns, less price discovery. |

Understanding Crossing Networks in Brokerage

Crossing networks are electronic trading systems that match buy and sell orders internally within a brokerage, reducing market impact and trading costs compared to traditional exchanges. Unlike dark pools, which pool multiple participants' orders anonymously across different firms, crossing networks operate primarily within a single brokerage's client base, offering greater transparency and control. These networks help institutional investors execute large orders efficiently by minimizing price slippage and maintaining confidentiality.

What Are Dark Pools?

Dark pools are private trading venues where institutional investors execute large orders anonymously to minimize market impact and avoid price slippage. They differ from crossing networks by offering more complex order types and greater liquidity through undisclosed order books. Dark pools provide an alternative to public exchanges, enhancing confidentiality and reducing information leakage during high-volume trades.

Key Differences: Crossing Networks vs Dark Pools

Crossing networks provide pre-arranged trades at mid-market prices, reducing market impact by anonymously matching buy and sell orders within a broker's client base. Dark pools, on the other hand, aggregate orders from multiple market participants, allowing large block trades to execute without public order book exposure, thereby minimizing information leakage. Unlike crossing networks, dark pools enable greater liquidity access but may face increased regulatory scrutiny due to less transparency.

How Crossing Networks Operate

Crossing networks operate by matching buy and sell orders internally within a brokerage or between affiliated institutions, minimizing market impact and transaction costs. These platforms execute trades off-exchange at predetermined prices, typically at the midpoint of the national best bid and offer (NBBO), providing improved price transparency and reduced slippage. Leveraging liquidity pools from institutional clients, crossing networks facilitate large block trades while maintaining anonymity and reducing market signaling.

The Functionality of Dark Pools

Dark pools operate as private trading venues that enable institutional investors to execute large orders anonymously, minimizing market impact and price slippage. Unlike crossing networks, which match buy and sell orders within a limited participant pool at predetermined times, dark pools allow continuous order matching with greater liquidity and price discovery. This functionality enhances confidentiality and reduces information leakage, benefiting large-scale traders seeking optimal execution.

Transparency and Regulation Issues

Crossing networks offer higher transparency by displaying pre-trade information and executing trades within the brokerage's client base, while dark pools operate with limited transparency, often concealing order details until after execution. Regulatory scrutiny is more stringent on dark pools due to concerns about market fairness and potential information asymmetry that can disadvantage retail investors. Brokers must navigate these transparency and regulatory challenges to ensure compliance and maintain investor trust in both trading venues.

Impact on Market Liquidity

Crossing networks improve market liquidity by facilitating large block trades directly between institutions, reducing price impact and minimizing market disruption. Dark pools also enhance liquidity by allowing anonymous trading away from public exchanges, which helps prevent information leakage and reduces volatility. Both platforms contribute to deeper liquidity pools, but crossing networks provide more transparent price discovery compared to the opaque nature of dark pools.

Trading Strategies in Crossing Networks and Dark Pools

Crossing networks execute large block trades by matching buy and sell orders internally, minimizing market impact and price slippage often associated with traditional exchanges. Dark pools offer anonymity and liquidity by aggregating orders off-exchange, enabling institutional investors to trade sizable volumes without revealing intentions to the public market. Both trading strategies optimize execution costs and reduce information leakage, catering to institutional investors aiming for minimal market disruption and enhanced price efficiency.

Risks and Benefits for Institutional Investors

Crossing networks offer institutional investors reduced transaction costs and minimal market impact by matching buy and sell orders internally, but they carry risks of reduced price transparency and potential conflicts of interest. Dark pools provide greater anonymity and access to large liquidity pools, helping to shield large trades from public markets, yet they pose risks related to regulatory scrutiny and limited pre-trade information. Effective use of crossing networks and dark pools requires balancing the benefits of price improvement and confidentiality against risks of execution uncertainty and market opacity.

Future Trends in Off-Exchange Trading

Crossing networks and dark pools are evolving rapidly, driven by increasing regulatory scrutiny and demand for transparency in off-exchange trading. Advanced algorithms and artificial intelligence are enhancing execution quality by reducing market impact and improving price discovery within these venues. Future trends indicate a convergence of technology and compliance measures, fostering more efficient, anonymous, and cost-effective liquidity solutions for institutional investors.

Important Terms

Internalization

Internalization involves broker-dealers matching client orders internally, reducing reliance on crossing networks and dark pools by executing trades within their own systems to enhance liquidity and minimize market impact.

Liquidity aggregation

Liquidity aggregation enhances trading efficiency by combining order flows from crossing networks and dark pools to maximize market depth and minimize price impact.

Price discovery

Price discovery in crossing networks is often less transparent due to pre-negotiated prices and limited market interaction, leading to potential price inefficiencies. Dark pools, by aggregating large orders anonymously, enhance price discovery by reducing market impact and revealing more accurate price signals through consolidated liquidity.

Anonymous trading

Anonymous trading in crossing networks offers pre-arranged, off-exchange transactions that prioritize reduced market impact and price improvement, contrasting with dark pools that provide a venue for large block trades with strict confidentiality and minimal pre-trade transparency. Crossing networks typically match buy and sell orders at a midpoint price, enhancing execution efficiency, while dark pools use complex algorithms to conceal liquidity and minimize signaling risk to market participants.

Block trades

Block trades executed through crossing networks benefit from lower transaction costs by matching large buy and sell orders internally without impacting public market prices, whereas dark pools provide anonymous trading venues that conceal the order size and intent, reducing market impact and signaling risk. Both crossing networks and dark pools facilitate large block trades by improving liquidity and minimizing information leakage, critical for institutional investors aiming to execute substantial positions discreetly.

Order matching engine

Order matching engines in crossing networks prioritize continuous limit order book execution with pre-negotiated prices, while dark pools use non-displayed liquidity pools to match large institutional trades anonymously and reduce market impact.

Pre-trade transparency

Pre-trade transparency in crossing networks typically offers greater visibility of order flow and pricing compared to dark pools, which operate with minimal disclosure to maintain anonymity and reduce market impact. Crossing networks often publish aggregated order information before execution, enhancing market efficiency, while dark pools prioritize confidentiality to attract large institutional trades without signaling intentions.

Latency arbitrage

Latency arbitrage exploits speed advantages to trade ahead in crossing networks and dark pools, impacting market transparency and execution quality.

Trade reporting

Trade reporting in crossing networks mandates real-time transparency to regulatory bodies, ensuring pre-trade interest aggregation without exposing order details, while dark pools emphasize post-trade reporting that maintains trade anonymity until execution. These differences impact market liquidity and price discovery, as crossing networks enable block trades with minimized market impact whereas dark pools offer hidden liquidity to reduce information leakage.

Institutional order flow

Institutional order flow often splits between crossing networks and dark pools, where crossing networks facilitate large blocks of trades at predetermined prices without market impact, while dark pools provide anonymous liquidity allowing institutional investors to execute large orders away from public exchanges. Both venues optimize execution by reducing information leakage and minimizing market impact, but crossing networks typically operate on scheduled crossing sessions, contrasting with the continuous trading environment of dark pools.

crossing network vs dark pool Infographic

moneydif.com

moneydif.com