Block trades involve the buying or selling of large quantities of securities, typically executed by institutional investors to minimize market impact and secure favorable pricing. Odd lots refer to orders for quantities smaller than the standard trading unit, often less than 100 shares, and can result in higher transaction costs due to limited liquidity. Understanding the differences between block trades and odd lots is essential for optimizing trade execution strategies and managing brokerage fees effectively.

Table of Comparison

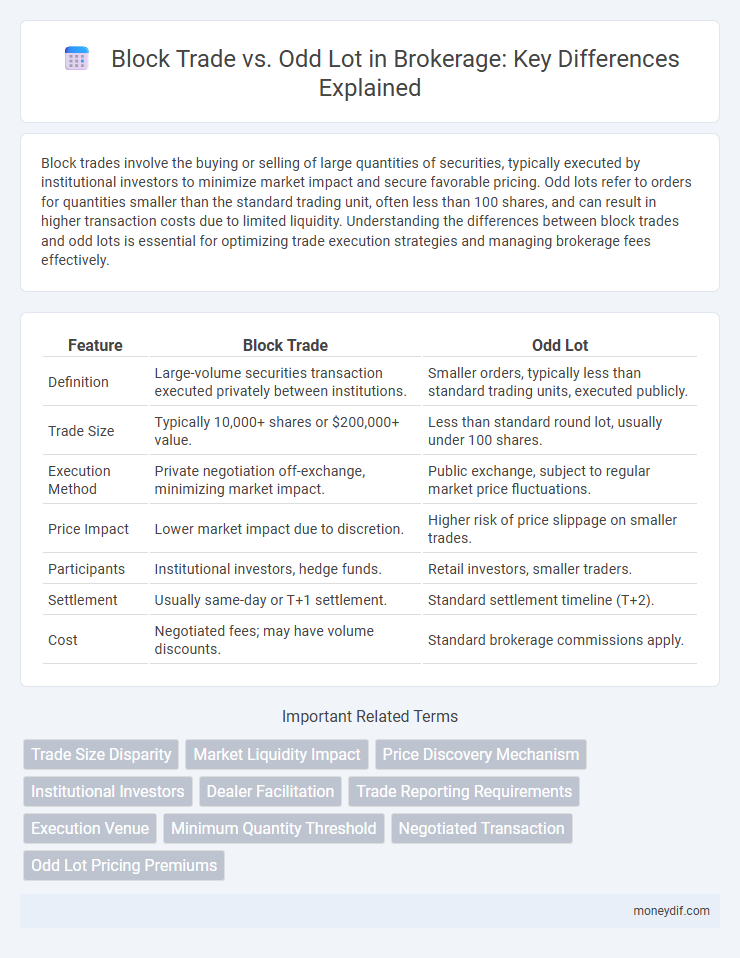

| Feature | Block Trade | Odd Lot |

|---|---|---|

| Definition | Large-volume securities transaction executed privately between institutions. | Smaller orders, typically less than standard trading units, executed publicly. |

| Trade Size | Typically 10,000+ shares or $200,000+ value. | Less than standard round lot, usually under 100 shares. |

| Execution Method | Private negotiation off-exchange, minimizing market impact. | Public exchange, subject to regular market price fluctuations. |

| Price Impact | Lower market impact due to discretion. | Higher risk of price slippage on smaller trades. |

| Participants | Institutional investors, hedge funds. | Retail investors, smaller traders. |

| Settlement | Usually same-day or T+1 settlement. | Standard settlement timeline (T+2). |

| Cost | Negotiated fees; may have volume discounts. | Standard brokerage commissions apply. |

Understanding Block Trades in Brokerage

Block trades in brokerage involve the large-scale purchase or sale of securities, typically exceeding 10,000 shares or $200,000 in value, executed privately to minimize market impact. These trades are often facilitated through institutional investors or specialized brokers to maintain confidentiality and reduce price fluctuations. In contrast, odd lots represent smaller trades with fewer than 100 shares, typically executed on standard exchanges and subject to different pricing dynamics.

Defining Odd Lot Transactions

Odd lot transactions involve the purchase or sale of securities in quantities less than the standard trading unit, typically under 100 shares. These trades often occur in retail brokerage accounts and may incur different pricing or execution terms compared to round lot transactions. Unlike block trades, which consist of large volumes executed as a single transaction, odd lot trades represent smaller, irregular share amounts impacting market liquidity and pricing dynamics.

Key Differences Between Block Trades and Odd Lots

Block trades involve the sale or purchase of large quantities of securities, typically exceeding 10,000 shares or $200,000 in value, enabling institutional investors to execute sizable transactions without significantly impacting market prices. Odd lots refer to smaller trades of fewer than 100 shares, often resulting in higher transaction costs and less favorable pricing due to lower liquidity. The key differences lie in trade size, market impact, and execution methods, with block trades negotiated privately through brokers, while odd lots are executed on standard exchanges.

Market Impact: Block Trade vs Odd Lot

Block trades involve large volumes of securities typically executed off the open market to minimize price disruption, resulting in reduced market impact compared to standard trades. Odd lots are smaller-than-standard trading units that usually absorb less liquidity and have negligible influence on market prices. Understanding the contrasting market impacts helps brokers optimize trade execution strategies to balance liquidity needs and price stability.

Execution Strategies for Block Trades

Block trades involve the execution of large orders, typically exceeding 10,000 shares or $200,000 in value, requiring specialized strategies to minimize market impact and price slippage. Execution strategies for block trades often utilize dark pools, algorithmic trading, and negotiated transactions to discreetly match buyers and sellers without causing significant price movements. In contrast to odd lots, which are smaller orders under 100 shares executed on public exchanges, block trade strategies emphasize liquidity sourcing and timing to optimize trade efficiency and confidentiality.

Pricing and Liquidity in Odd Lot Trades

Odd lot trades involve purchasing fewer shares than the standard trading unit of 100, often resulting in wider bid-ask spreads and less favorable pricing compared to round lot trades. These trades typically experience lower liquidity due to limited market participants willing to transact in non-standard quantities, impacting execution speed and price efficiency. Pricing inefficiencies in odd lot trades arise from increased transaction costs and reduced market depth, making block trades more advantageous for achieving better price stability and higher liquidity.

Regulatory Considerations for Block and Odd Lot Transactions

Regulatory considerations for block trades typically involve heightened scrutiny due to the large volume of shares exchanged, requiring compliance with reporting requirements such as Form 13H and adherence to SEC Rule 144 for restricted securities. Odd lot transactions, involving less than 100 shares, often face fewer regulatory hurdles but must still comply with best execution obligations under FINRA Rule 5310 and ensure transparency in pricing to protect retail investors. Both types of trades must navigate market surveillance systems designed to detect manipulation, with block trades being closely monitored for potential market impact and odd lots scrutinized for algorithmic trading patterns.

Advantages and Disadvantages of Block Trades

Block trades offer significant advantages such as enabling the execution of large-volume transactions with minimal market impact and reduced price slippage, benefiting institutional investors seeking to move substantial positions discreetly. However, disadvantages include limited transparency compared to public market trades and potential challenges in finding counterparties willing to absorb large orders without affecting price stability. These factors make block trades a strategic choice for managing liquidity and risk but necessitate careful consideration of market conditions and counterparty reliability.

Risks Associated with Odd Lot Trading

Odd lot trading involves purchasing or selling securities in quantities smaller than the standard trading unit, often leading to higher transaction costs and reduced market liquidity. These trades carry increased risks such as wider bid-ask spreads, limited price transparency, and potential difficulties in order execution. Compared to block trades, odd lot transactions may result in unfavorable pricing and greater exposure to market volatility due to their fragmented nature.

Choosing Between Block Trades and Odd Lots in Brokerage

Choosing between block trades and odd lots in brokerage depends on trade size and market impact considerations. Block trades involve large quantities of securities traded privately to minimize market disruption and typically require institutional-level capital, while odd lots are smaller, non-standard trade sizes often executed at retail levels with potentially higher per-share transaction costs. Traders must evaluate execution speed, price impact, and liquidity needs to optimize order placement effectively.

Important Terms

Trade Size Disparity

Trade size disparity significantly impacts block trades by involving large, institutional-sized orders, whereas odd lot trades consist of smaller, non-standard quantities typically executed by retail investors.

Market Liquidity Impact

Block trades significantly impact market liquidity by temporarily absorbing large volumes without drastically affecting price, whereas odd lot trades have minimal liquidity impact due to their small size and execution frequency.

Price Discovery Mechanism

Price discovery in block trades often reflects institutional demand with minimal market impact, while odd lot transactions can signal retail trading activity but typically exert less influence on prevailing market prices.

Institutional Investors

Institutional investors prefer block trades over odd lots due to the efficiency and reduced market impact when executing large-volume transactions.

Dealer Facilitation

Dealer facilitation enhances liquidity in block trades by enabling large-volume transactions without significantly impacting market prices, unlike odd lot trades which involve smaller, less liquid quantities.

Trade Reporting Requirements

Trade reporting requirements mandate distinct protocols for block trades exceeding 10,000 shares or $200,000 in value versus odd lot transactions under 100 shares, ensuring transparency and market integrity.

Execution Venue

Execution venues for block trades typically prioritize liquidity and anonymity to handle large orders efficiently, whereas venues for odd lot trades focus on minimizing transaction costs and ensuring price improvement for small, non-standard order sizes.

Minimum Quantity Threshold

The Minimum Quantity Threshold defines the smallest trade size required to qualify as a Block Trade, differentiating it from smaller Odd Lot transactions typically below this threshold.

Negotiated Transaction

Negotiated transactions in block trades involve large, pre-arranged deal sizes typically exceeding standard round lots, whereas odd lots refer to smaller, non-standard share quantities often excluded from block trade negotiations.

Odd Lot Pricing Premiums

Odd lot pricing premiums typically reflect higher transaction costs and lower liquidity compared to block trades, which involve large volumes executed at negotiated prices with minimal premiums.

Block Trade vs Odd Lot Infographic

moneydif.com

moneydif.com