ECN (Electronic Communication Network) brokers offer direct access to interbank liquidity, enabling traders to interact with multiple market participants for tighter spreads and enhanced transparency. MTFs (Multilateral Trading Facilities) function as regulated trading platforms that aggregate orders from various participants, providing greater market depth and diverse trading opportunities. Understanding the differences influences decision-making in terms of fees, execution speed, and access to liquidity pools.

Table of Comparison

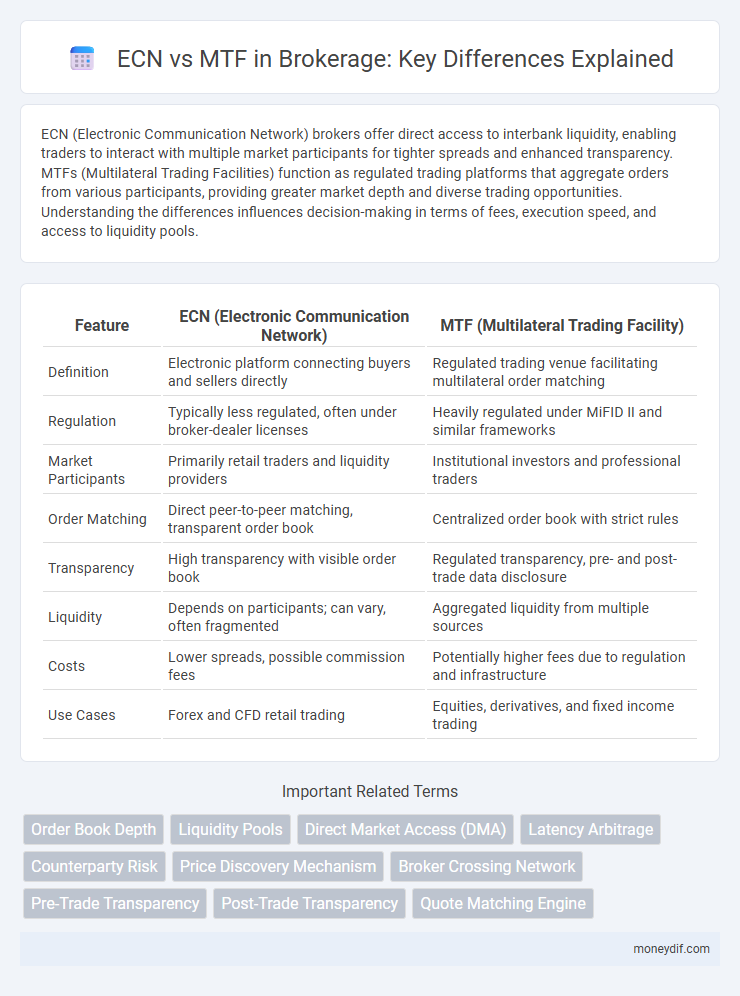

| Feature | ECN (Electronic Communication Network) | MTF (Multilateral Trading Facility) |

|---|---|---|

| Definition | Electronic platform connecting buyers and sellers directly | Regulated trading venue facilitating multilateral order matching |

| Regulation | Typically less regulated, often under broker-dealer licenses | Heavily regulated under MiFID II and similar frameworks |

| Market Participants | Primarily retail traders and liquidity providers | Institutional investors and professional traders |

| Order Matching | Direct peer-to-peer matching, transparent order book | Centralized order book with strict rules |

| Transparency | High transparency with visible order book | Regulated transparency, pre- and post-trade data disclosure |

| Liquidity | Depends on participants; can vary, often fragmented | Aggregated liquidity from multiple sources |

| Costs | Lower spreads, possible commission fees | Potentially higher fees due to regulation and infrastructure |

| Use Cases | Forex and CFD retail trading | Equities, derivatives, and fixed income trading |

Understanding ECN and MTF: Definitions and Core Concepts

Electronic Communication Networks (ECNs) are automated systems that match buy and sell orders for securities in real-time, providing direct market access and increased transparency. Multilateral Trading Facilities (MTFs) are regulated trading platforms that facilitate the exchange of financial instruments between multiple market participants under a transparent and competitive environment. Both ECNs and MTFs aim to enhance market liquidity and price discovery by enabling efficient order matching outside traditional stock exchanges.

Key Differences Between ECN and MTF

ECN (Electronic Communication Network) and MTF (Multilateral Trading Facility) differ primarily in regulatory structure and trading environments; ECNs connect individual traders and liquidity providers directly, enabling anonymous, real-time order matching, whereas MTFs operate as regulated trading venues facilitating standardized market access for multiple participants. ECNs typically offer tighter spreads and higher transparency but may impose fees on order execution, while MTFs provide broader market oversight with distinct membership rules and may aggregate liquidity across various financial instruments. Liquidity sourcing and order matching mechanisms also distinguish ECNs' purely electronic order books from MTFs' multilateral trading protocols under regulatory supervision.

How ECNs Operate in Financial Markets

ECNs (Electronic Communication Networks) operate in financial markets by directly matching buy and sell orders from different participants, providing transparent price discovery and reduced spreads. They facilitate anonymous trading and enable faster execution by connecting liquidity providers and takers without intermediaries. ECNs are essential for high-frequency traders and institutional investors seeking low latency and access to multiple liquidity pools.

The Structure and Functionality of MTFs

Multilateral Trading Facilities (MTFs) operate as regulated trading platforms that match buyers and sellers of financial instruments, providing increased transparency and liquidity compared to traditional exchanges. Unlike Electronic Communication Networks (ECNs), MTFs can host multiple asset classes and offer a broader scope of order types and execution strategies. MTFs typically function under strict regulatory oversight, ensuring fair access and compliance while enabling competitive pricing through their multi-lateral order books.

Liquidity Comparison: ECN vs MTF

ECN brokers provide liquidity by connecting multiple market participants directly, resulting in tighter spreads and faster execution through aggregated order books. MTF platforms offer liquidity by aggregating orders from various trading venues, which can increase depth but may introduce slight latency compared to ECNs. The choice between ECN and MTF liquidity depends on the trader's preference for direct market access versus broader order aggregation.

Pricing and Costs: Which is More Competitive?

ECN (Electronic Communication Network) platforms offer direct market access with pricing based on real-time liquidity providers, resulting in tighter spreads and lower latency. MTFs (Multilateral Trading Facilities) aggregate multiple liquidity sources, but their pricing may include additional fees or wider spreads due to intermediary costs. Traders seeking the most competitive pricing and minimal transaction costs often prefer ECNs for transparent, cost-efficient execution.

Execution Speed and Order Matching Mechanisms

ECN (Electronic Communication Network) brokers provide rapid trade execution by directly matching buy and sell orders from multiple liquidity providers, reducing latency and slippage. MTFs (Multilateral Trading Facilities) utilize centralized order books that aggregate client orders, which can lead to slightly slower execution compared to ECNs but offer greater transparency in order matching. Execution speed in ECNs benefits from continuous electronic matching engines, while MTFs prioritize organized price-time priority systems to balance execution fairness with market depth.

Regulatory Frameworks: ECN vs MTF

Electronic Communication Networks (ECNs) operate under stringent regulatory frameworks emphasizing transparency and direct market access, often regulated as broker-dealers or trading venues depending on jurisdiction. Multilateral Trading Facilities (MTFs) adhere to comprehensive regulations outlined in the Markets in Financial Instruments Directive II (MiFID II) within the European Union, focusing on fair access and investor protection. Both ECNs and MTFs require robust compliance with anti-money laundering (AML) and market abuse regulations to maintain market integrity and safeguard participants.

Advantages and Disadvantages of ECNs and MTFs

ECNs (Electronic Communication Networks) offer direct market access with increased transparency and faster execution, but may have higher costs and limited liquidity compared to traditional exchanges. MTFs (Multilateral Trading Facilities) provide competitive pricing through multiple liquidity providers and often lower transaction fees, though they may face regulatory constraints and less robust market depth. Both platforms enhance trading efficiency but differ in liquidity, cost structure, and regulatory impact, influencing broker choices based on client needs.

Choosing Between ECN and MTF: Factors for Brokerages

Brokerages must evaluate liquidity access, trade execution speed, and regulatory requirements when choosing between ECN (Electronic Communication Network) and MTF (Multilateral Trading Facility) platforms. ECNs provide direct market access with greater transparency and typically lower costs, benefiting high-frequency and institutional traders, while MTFs offer centralized order matching with enhanced regulatory oversight, appealing to a broader client base. The decision hinges on client trading behavior, desired market access, and compliance frameworks to align with specific brokerage business models.

Important Terms

Order Book Depth

ECN platforms offer deeper Order Book Depth by aggregating multiple liquidity providers, whereas MTFs typically provide narrower depth focused on specific market segments.

Liquidity Pools

Liquidity pools aggregate multiple ECN and MTF market participants' orders, enhancing price transparency and execution efficiency in decentralized trading environments.

Direct Market Access (DMA)

Direct Market Access (DMA) enables traders to interact directly with Electronic Communication Networks (ECNs) and Multilateral Trading Facilities (MTFs), providing faster execution and greater transparency in financial markets.

Latency Arbitrage

Latency arbitrage exploits milliseconds of execution speed difference between ECN and MTF trading venues to gain unfair market advantages.

Counterparty Risk

Counterparty risk is generally lower in regulated MTFs due to standardized clearing processes compared to ECNs where direct counterparty exposure is higher.

Price Discovery Mechanism

Price discovery mechanisms in ECNs rely on real-time, transparent order books enabling direct matching of buy and sell orders, while MTFs aggregate liquidity from multiple sources, enhancing price formation efficiency across fragmented markets.

Broker Crossing Network

Broker Crossing Networks operate as intermediaries matching buy and sell orders internally, differing from ECNs and MTFs by facilitating anonymous order crossing within a single broker's client base rather than pooling orders from multiple market participants.

Pre-Trade Transparency

Pre-Trade Transparency requirements differ between ECNs and MTFs, with MTFs often mandated to display real-time order book data publicly, while ECNs may offer varying levels of disclosure depending on regulatory jurisdiction.

Post-Trade Transparency

Post-trade transparency in ECNs and MTFs enhances market efficiency by providing real-time trade data that improves price discovery and investor confidence.

Quote Matching Engine

Quote Matching Engines in ECNs (Electronic Communication Networks) prioritize direct, faster matching of buy and sell orders from multiple market participants, enhancing price transparency and liquidity. In contrast, MTFs (Multilateral Trading Facilities) aggregate orders from various sources, offering a more regulated environment with centralized order books while still promoting competitive pricing.

ECN vs MTF Infographic

moneydif.com

moneydif.com