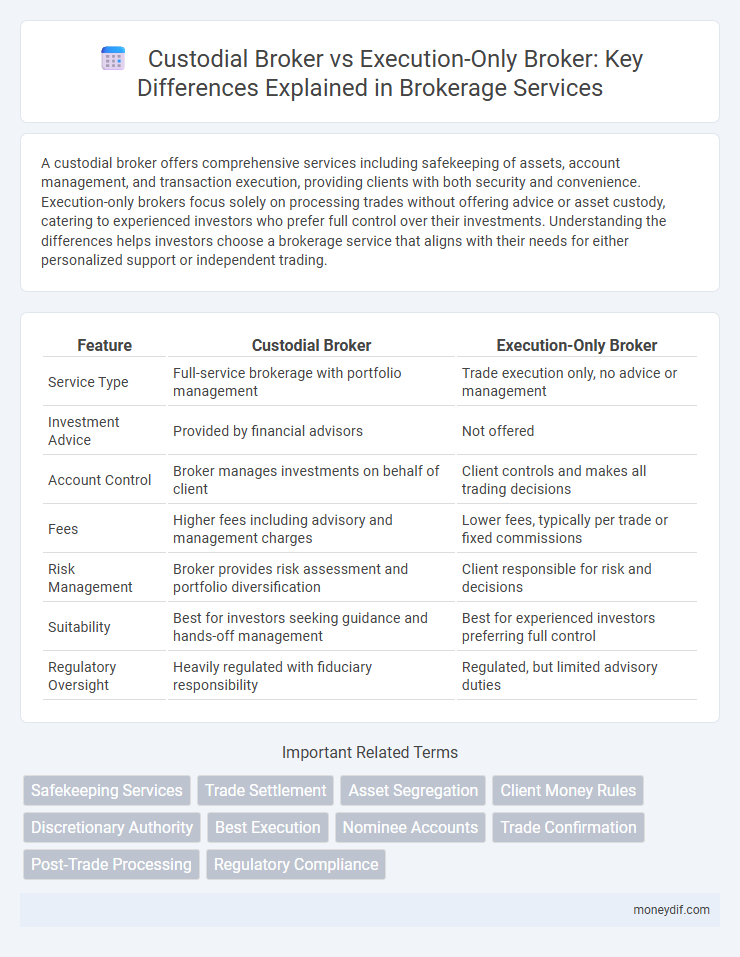

A custodial broker offers comprehensive services including safekeeping of assets, account management, and transaction execution, providing clients with both security and convenience. Execution-only brokers focus solely on processing trades without offering advice or asset custody, catering to experienced investors who prefer full control over their investments. Understanding the differences helps investors choose a brokerage service that aligns with their needs for either personalized support or independent trading.

Table of Comparison

| Feature | Custodial Broker | Execution-Only Broker |

|---|---|---|

| Service Type | Full-service brokerage with portfolio management | Trade execution only, no advice or management |

| Investment Advice | Provided by financial advisors | Not offered |

| Account Control | Broker manages investments on behalf of client | Client controls and makes all trading decisions |

| Fees | Higher fees including advisory and management charges | Lower fees, typically per trade or fixed commissions |

| Risk Management | Broker provides risk assessment and portfolio diversification | Client responsible for risk and decisions |

| Suitability | Best for investors seeking guidance and hands-off management | Best for experienced investors preferring full control |

| Regulatory Oversight | Heavily regulated with fiduciary responsibility | Regulated, but limited advisory duties |

Understanding Custodial Brokers

Custodial brokers hold and safeguard clients' assets, offering comprehensive account management and often providing personalized investment advice, ensuring security and regulatory compliance. They facilitate trade executions while maintaining custody of securities, streamlining portfolio management for investors seeking integrated services. Unlike execution-only brokers, custodial brokers assume responsibility for asset protection and record-keeping, making them ideal for clients prioritizing oversight and asset safety.

Defining Execution-Only Brokers

Execution-only brokers provide clients the ability to execute trades without offering investment advice or portfolio management services. These brokers focus on facilitating order placement and trade execution, often at lower fees compared to custodial brokers. Their model suits experienced investors seeking direct control over transactions without intermediary guidance.

Key Differences Between Custodial and Execution-Only Brokers

Custodial brokers hold client assets and provide safekeeping, account management, and administrative support, ensuring regulatory compliance and protection against loss or fraud. Execution-only brokers strictly execute client orders without offering advisory services or holding assets, resulting in lower fees and full investor control over transactions. The primary distinction lies in asset custody and service scope, with custodial brokers managing assets and compliance, while execution-only brokers focus solely on trade execution.

Services Offered by Custodial Brokers

Custodial brokers provide comprehensive asset management services, including safekeeping of securities, handling corporate actions, and facilitating dividend collection, ensuring clients' investments are securely maintained. They offer additional support such as account administration, transaction settlement, and regulatory compliance monitoring, which enhances portfolio management efficiency. Unlike execution-only brokers, custodial brokers enable seamless integration of investment and administrative functions, providing a more holistic service suite for investors.

Core Features of Execution-Only Brokers

Execution-only brokers specialize in providing clients with a platform to trade securities directly without offering personalized financial advice or portfolio management. Their core features include low-cost trading, fast execution of buy and sell orders, and user-friendly digital interfaces designed for self-directed investors. These brokers cater primarily to experienced traders who seek control over their investment decisions while minimizing fees.

Security and Asset Protection

Custodial brokers hold clients' assets directly, providing enhanced security and safeguarding against fraud or insolvency risks. Execution-only brokers facilitate trades without taking custody of assets, requiring clients to maintain their own asset protection measures. Choosing a custodial broker ensures regulatory oversight and stronger protection of securities, while execution-only brokers offer more control but increased responsibility for asset security.

Cost Structures: Custodial vs Execution-Only

Custodial brokers typically charge higher fees due to their comprehensive asset management and safekeeping services, including custody fees, account maintenance charges, and additional administrative costs. Execution-only brokers offer lower transaction fees by providing minimal services focused solely on order execution without ongoing portfolio management or custody responsibilities. Investors seeking cost-efficiency often prefer execution-only brokers for straightforward trading, while those requiring asset safeguarding and integrated management may find custodial brokers more suitable despite higher costs.

Suitability for Different Investor Profiles

Custodial brokers provide tailored portfolio management and are well-suited for investors seeking personalized advice and long-term investment strategies, including retirees and less experienced individuals. Execution-only brokers cater to confident, self-directed investors who prioritize low-cost trading and have sufficient market knowledge to make independent decisions. Selecting between custodial and execution-only brokers depends on an investor's need for professional guidance versus control over trading activities.

Regulatory Considerations and Compliance

Custodial brokers must adhere to stringent regulatory requirements, including client asset protection rules and extensive reporting obligations, ensuring the safekeeping of clients' securities under financial authorities like the SEC or FCA. Execution-only brokers operate under lighter compliance frameworks, focusing primarily on trade execution without offering investment advice, thus facing fewer regulatory burdens but maintaining transparency in order processing. Regulatory differences impact how each broker manages risk, with custodial brokers subject to ongoing audits and compliance checks to safeguard clients' holdings.

Choosing the Right Brokerage Model

Selecting between a custodial broker and an execution-only broker depends on your investment needs and control preferences. Custodial brokers offer full asset safekeeping and administrative services, ideal for investors seeking comprehensive support and security. Execution-only brokers provide transaction-focused services with lower fees, suitable for experienced investors who want direct market access without advisory assistance.

Important Terms

Safekeeping Services

Safekeeping services involve the secure holding and management of clients' financial assets, typically offered by custodial brokers who provide comprehensive asset protection, regulatory compliance, and settlement functions. Execution-only brokers focus solely on executing client orders without providing safekeeping, leaving asset custody responsibilities to the client or a separate custodian.

Trade Settlement

Trade settlement involves the custodial broker managing asset safekeeping and settlement processes, whereas an execution-only broker solely facilitates order placement without handling settlement.

Asset Segregation

Asset segregation ensures client funds and securities are separately maintained by custodial brokers, whereas execution-only brokers typically do not hold client assets, focusing solely on trade execution.

Client Money Rules

Client Money Rules require custodial brokers to segregate client funds separately from their own, while execution-only brokers are typically not permitted to hold client money, enhancing investor protection and regulatory compliance.

Discretionary Authority

Discretionary authority allows a custodial broker to make investment decisions on behalf of clients, whereas an execution-only broker strictly follows client instructions without providing advisory services.

Best Execution

Best Execution requires custodial brokers to manage both trading and safekeeping of assets, whereas execution-only brokers focus solely on executing client orders without holding securities.

Nominee Accounts

Nominee accounts hold securities under the broker's name, offering custodial brokers the ability to manage assets, settle trades, and provide safekeeping services on behalf of clients, whereas execution-only brokers limit their role to processing client orders without asset custody or advisory functions. This distinction affects regulatory responsibilities, client asset protection, and transparency in ownership, with nominee accounts under custodial brokers typically ensuring segregated client assets to comply with investor protection laws.

Trade Confirmation

Trade confirmation for a custodial broker includes detailed record-keeping and asset safekeeping, whereas an execution-only broker primarily provides transaction execution without ongoing custody or advisory services.

Post-Trade Processing

Post-trade processing for custodial brokers involves asset safekeeping and settlement management, whereas execution-only brokers primarily focus on order execution without handling custodial responsibilities.

Regulatory Compliance

Regulatory compliance for custodial brokers involves stringent adherence to safeguarding client assets and maintaining detailed records as mandated by financial authorities, differing from execution-only brokers who must primarily ensure transparent trade execution without providing investment advice. Custodial brokers face more comprehensive regulatory scrutiny regarding fiduciary duties and client fund protection compared to execution-only brokers, who focus on compliance with transaction reporting and best execution standards.

Custodial Broker vs Execution-Only Broker Infographic

moneydif.com

moneydif.com