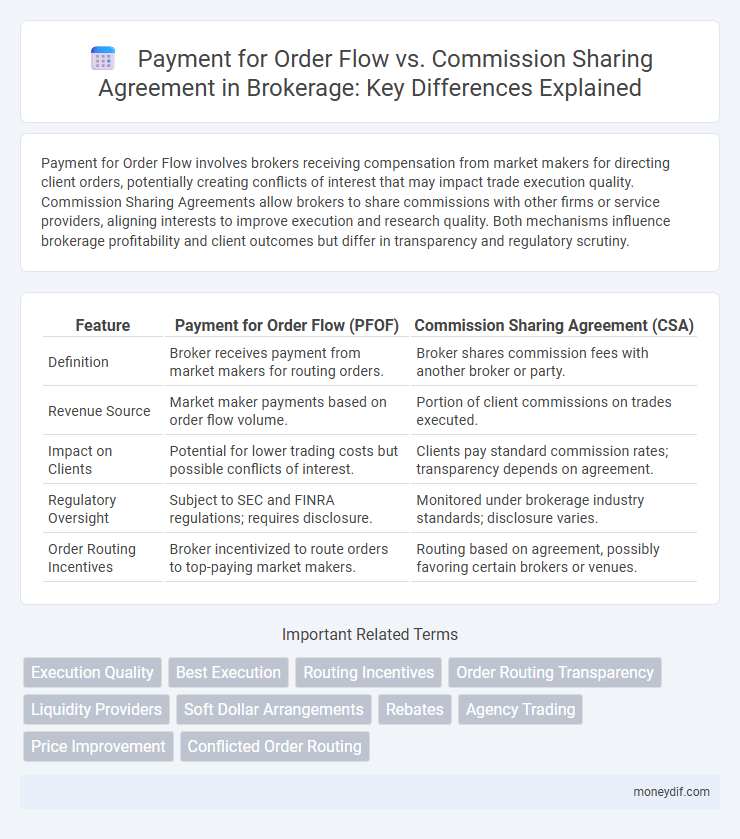

Payment for Order Flow involves brokers receiving compensation from market makers for directing client orders, potentially creating conflicts of interest that may impact trade execution quality. Commission Sharing Agreements allow brokers to share commissions with other firms or service providers, aligning interests to improve execution and research quality. Both mechanisms influence brokerage profitability and client outcomes but differ in transparency and regulatory scrutiny.

Table of Comparison

| Feature | Payment for Order Flow (PFOF) | Commission Sharing Agreement (CSA) |

|---|---|---|

| Definition | Broker receives payment from market makers for routing orders. | Broker shares commission fees with another broker or party. |

| Revenue Source | Market maker payments based on order flow volume. | Portion of client commissions on trades executed. |

| Impact on Clients | Potential for lower trading costs but possible conflicts of interest. | Clients pay standard commission rates; transparency depends on agreement. |

| Regulatory Oversight | Subject to SEC and FINRA regulations; requires disclosure. | Monitored under brokerage industry standards; disclosure varies. |

| Order Routing Incentives | Broker incentivized to route orders to top-paying market makers. | Routing based on agreement, possibly favoring certain brokers or venues. |

Understanding Payment for Order Flow (PFOF)

Payment for Order Flow (PFOF) occurs when brokerages receive compensation from market makers for routing client orders to them, enhancing liquidity and reducing execution costs. Unlike Commission Sharing Agreements (CSA), where order flow payments are shared between brokerages and advisors, PFOF directly benefits brokers by subsidizing zero-commission trades for retail investors. Understanding PFOF is crucial as it impacts trade execution quality, potential conflicts of interest, and transparency in the brokerage industry.

What is a Commission Sharing Agreement (CSA)?

A Commission Sharing Agreement (CSA) allows investment managers to direct client trades to brokers who execute orders and share a portion of the commission with third-party research providers. This arrangement enables asset managers to access valuable research services without paying additional fees directly, integrating execution and research costs. CSAs are an alternative to Payment for Order Flow (PFOF), emphasizing transparency and regulatory compliance by separating execution payments from order routing incentives.

Key Differences: PFOF vs Commission Sharing Agreement

Payment for Order Flow (PFOF) involves brokers receiving compensation from market makers for routing client orders to them, often raising concerns about potential conflicts of interest impacting trade execution quality. Commission Sharing Agreements (CSAs) allow brokers to direct client trades to specific executing brokers or vendors in exchange for a portion of the commissions, promoting transparency and client service customization. The key difference lies in PFOF's direct payment from market makers potentially influencing order routing versus CSAs' structured commission allocation aligning broker incentives with client interests.

Regulatory Landscape: PFOF and CSA

Payment for Order Flow (PFOF) and Commission Sharing Agreements (CSA) operate within distinct regulatory frameworks shaped by entities like the SEC and FINRA, emphasizing transparency and best execution obligations. PFOF involves brokers receiving compensation from market makers for routing orders, raising scrutiny over potential conflicts of interest and disclosure requirements under Reg NMS Rule 606. CSAs, governed by SEC Rule 12b-1 and relevant brokerage compliance rules, require brokers to share commissions with advisors, ensuring alignment with fiduciary duties and client consent standards.

Impact on Trade Execution Quality

Payment for Order Flow (PFOF) can lead to conflicts of interest that may compromise trade execution quality by prioritizing payment incentives over best price discovery. In contrast, Commission Sharing Agreements (CSAs) often align brokers' incentives with delivering superior execution quality by allowing direct payments to research providers, fostering transparency and accountability. Empirical studies suggest that CSAs contribute to better execution prices and narrower spreads compared to PFOF arrangements, enhancing overall investor outcomes.

Transparency and Disclosure Requirements

Payment for Order Flow (PFOF) requires brokers to disclose how they receive compensation from market makers for routing client orders, emphasizing transparency to mitigate conflicts of interest. Commission Sharing Agreements (CSA) necessitate detailed disclosures about the allocation of client commissions between brokers and third-party advisors, ensuring clients understand fee distribution. Both frameworks aim to enhance investor protection through clear communication of financial arrangements and potential impacts on trade execution quality.

Cost Implications for Investors

Payment for Order Flow (PFOF) allows brokers to receive compensation from market makers for directing client orders, often resulting in zero-commission trading but potential hidden costs through less favorable execution prices. Commission Sharing Agreements (CSAs) require brokers to pay a portion of their commission to third-party research providers, potentially increasing explicit costs but enhancing trade quality through better market insights. Investors should evaluate PFOF's potential price slippage against CSA's higher fees balanced by improved trade execution and research benefits to determine overall cost efficiency.

Broker Incentives and Potential Conflicts of Interest

Payment for Order Flow (PFOF) incentivizes brokers to route client orders to specific market makers in exchange for fees, potentially compromising execution quality. Commission Sharing Agreements (CSAs) involve brokers directing trades to certain brokerage firms in return for a share of the commissions, which may encourage brokers to prioritize affiliates over best client outcomes. Both models present conflicts of interest where broker incentives might diverge from the fiduciary duty to secure optimal trade execution for investors.

Global Perspectives: PFOF vs CSA Practices

Payment for Order Flow (PFOF) is widely used in the US, allowing brokers to receive payments from market makers for routing client orders, enhancing liquidity but raising regulatory scrutiny due to potential conflicts of interest. In contrast, Commission Sharing Agreements (CSAs) are more prevalent in Europe and Asia, where brokers share commissions with research providers or other intermediaries, promoting transparency and aligning with MiFID II regulations. Global practices highlight a regulatory divide; while PFOF facilitates cost-free trading for clients primarily in the US, CSAs emphasize compliance and research quality in regions with stricter investor protection rules.

The Future of Order Routing Agreements in Brokerage

Payment for Order Flow (PFOF) and Commission Sharing Agreements (CSA) represent evolving models in brokerage order routing, balancing cost-efficiency and transparency. The future of order routing agreements is likely to emphasize enhanced regulatory scrutiny and technological innovation, promoting fair execution and improved investor outcomes. Adoption of blockchain and AI-driven analytics is expected to optimize order routing accuracy, reduce latency, and align incentives between brokers and market makers more effectively.

Important Terms

Execution Quality

Execution quality often varies between Payment for Order Flow and Commission Sharing Agreements, with the former potentially compromising best execution due to conflicts of interest while the latter aligns incentives by distributing commissions to promote better trade outcomes.

Best Execution

Best Execution requires brokers to prioritize optimal trade outcomes over Payment for Order Flow or Commission Sharing Agreements that may introduce conflicts of interest.

Routing Incentives

Routing incentives impact market quality by influencing broker-dealer preferences between Payment for Order Flow, where brokers receive compensation for directing orders, and Commission Sharing Agreements, which allocate commission revenue to improve execution quality.

Order Routing Transparency

Order routing transparency enhances market fairness by revealing how Payment for Order Flow and Commission Sharing Agreements influence broker incentives and trade execution quality.

Liquidity Providers

Liquidity providers enhance market efficiency by supplying assets for trades, while Payment for Order Flow compensates brokers for directing orders to specific venues, and Commission Sharing Agreements allocate a portion of commissions to brokers for order routing, collectively influencing trading costs and execution quality.

Soft Dollar Arrangements

Soft Dollar Arrangements enable brokers to use client commissions for research and services, contrasting with Payment for Order Flow where brokers receive payments from market makers, while Commission Sharing Agreements allow asset managers to direct specific commission amounts to preferred research providers.

Rebates

Payment for Order Flow directs rebates to brokers in exchange for order routing, while Commission Sharing Agreements allocate rebates between brokers and executing firms to enhance trade profitability.

Agency Trading

Agency trading involves brokers executing client orders on behalf of investors, where Payment for Order Flow (PFOF) compensates brokers for directing orders to specific market makers, whereas Commission Sharing Agreements (CSA) allow asset managers to allocate a portion of their commissions to third-party research providers, optimizing order execution and research procurement costs.

Price Improvement

Price improvement occurs when Payment for Order Flow incentivizes brokers to route orders through venues offering better pricing, whereas Commission Sharing Agreements distribute revenue between brokers and venues without directly enhancing execution prices.

Conflicted Order Routing

Conflicted Order Routing occurs when brokers prioritize Payment for Order Flow over Commission Sharing Agreements, potentially compromising trade execution quality to maximize revenue.

Payment for Order Flow vs Commission Sharing Agreement Infographic

moneydif.com

moneydif.com