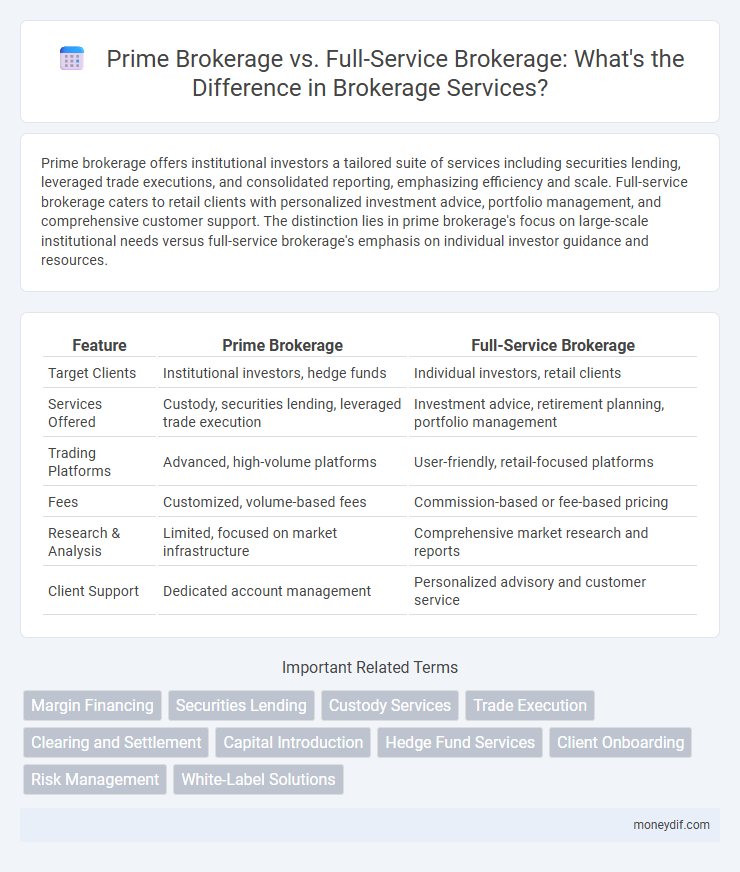

Prime brokerage offers institutional investors a tailored suite of services including securities lending, leveraged trade executions, and consolidated reporting, emphasizing efficiency and scale. Full-service brokerage caters to retail clients with personalized investment advice, portfolio management, and comprehensive customer support. The distinction lies in prime brokerage's focus on large-scale institutional needs versus full-service brokerage's emphasis on individual investor guidance and resources.

Table of Comparison

| Feature | Prime Brokerage | Full-Service Brokerage |

|---|---|---|

| Target Clients | Institutional investors, hedge funds | Individual investors, retail clients |

| Services Offered | Custody, securities lending, leveraged trade execution | Investment advice, retirement planning, portfolio management |

| Trading Platforms | Advanced, high-volume platforms | User-friendly, retail-focused platforms |

| Fees | Customized, volume-based fees | Commission-based or fee-based pricing |

| Research & Analysis | Limited, focused on market infrastructure | Comprehensive market research and reports |

| Client Support | Dedicated account management | Personalized advisory and customer service |

Prime Brokerage vs Full-Service Brokerage: Key Differences

Prime brokerage primarily serves institutional clients, hedge funds, and professional traders by offering services like securities lending, leveraged trade execution, and customized financing solutions. Full-service brokerage caters to retail investors, providing a broad range of services including investment advice, retirement planning, and portfolio management. The key difference lies in their target clients and the complexity of services, with prime brokerage emphasizing high-level, integrated financial operations and full-service brokerage focusing on personalized investment support for individual clients.

Core Services Offered by Prime Brokerages

Prime brokerages specialize in providing institutional investors with tailored core services such as securities lending, leveraged trade execution, and trade clearing and settlement, enabling efficient portfolio management. They offer sophisticated risk management tools, consolidated reporting, and access to multiple markets through a single account, facilitating operational efficiency. Unlike full-service brokerages that cater to individual investors with advisory and research services, prime brokers emphasize customizable solutions and credit facilities designed for hedge funds and large asset managers.

Comprehensive Solutions of Full-Service Brokerages

Full-service brokerages provide comprehensive solutions including personalized investment advice, portfolio management, wealth planning, and access to a wide range of financial products, catering to clients' diverse financial needs. These firms offer tailored strategies combining equity, fixed income, and alternative investments, supported by detailed market research and expert analysis. Enhanced client support with tax planning, retirement advice, and estate planning services distinguishes full-service brokerages from prime brokerage offerings focused more on execution and clearing.

Target Clients: Institutions vs Individuals

Prime brokerage primarily targets institutional clients such as hedge funds, asset managers, and large investment firms, offering tailored services like securities lending, leveraged trade execution, and comprehensive risk management. Full-service brokerage caters mainly to individual investors, providing personalized financial advice, portfolio management, and a broad range of investment products. The distinct client focus drives the service complexity and fee structures in each brokerage model.

Fee Structures in Prime and Full-Service Brokerage

Prime brokerage typically offers a fee structure based on assets under custody and transaction volumes, often including lower commissions and bundled services like securities lending and margin financing. Full-service brokerage tends to charge higher fees or commissions per trade, reflecting personalized advisory services, research, and wealth management. Understanding the contrast in fee models helps investors choose between cost-efficiency in prime brokerage and comprehensive support in full-service brokerage.

Technology and Trading Platforms Comparison

Prime brokerage offers advanced technology and trading platforms tailored for institutional clients, featuring high-speed execution, real-time risk analytics, and seamless integration with multiple liquidity providers. Full-service brokerage platforms provide comprehensive tools suited for retail investors, including user-friendly interfaces, educational resources, and basic order management systems. The technological infrastructure in prime brokerage prioritizes scalability and customizability, while full-service brokerages emphasize accessibility and client support across diverse asset classes.

Risk Management and Custody Services

Prime brokerage offers advanced risk management tools tailored for hedge funds and institutional clients, enabling real-time monitoring and mitigation of portfolio exposures. Custody services under prime brokerage provide enhanced asset protection through segregated accounts and comprehensive reporting, reducing counterparty risk. Full-service brokerage typically delivers standard risk management solutions and custody services geared toward retail investors, lacking the specialized infrastructure and customization found in prime brokerage.

Research and Advisory Support: Who Does It Better?

Full-service brokerages excel in research and advisory support by offering comprehensive market analysis, personalized investment strategies, and dedicated client consultations designed to meet diverse investor needs. Prime brokerages primarily cater to institutional clients, providing advanced trade execution and clearing services but typically offer less in-depth advisory resources compared to full-service firms. Investors seeking robust research and tailored guidance often benefit more from full-service brokerage platforms.

Regulatory Landscape for Prime vs Full-Service Brokers

Prime brokers operate under stringent regulatory frameworks designed to monitor risk exposure, capital requirements, and client asset segregation, often subject to oversight by entities such as the SEC and FINRA in the U.S. Full-service brokers face comprehensive regulatory obligations as well but differ in scope, focusing more on suitability and fiduciary responsibilities toward retail clients. The regulatory landscape for prime brokerage is increasingly complex due to the institutional nature of their services, requiring enhanced transparency and compliance measures compared to traditional full-service brokerage firms.

Choosing the Right Brokerage: Factors to Consider

Choosing the right brokerage depends on your trading needs, portfolio size, and desired level of service; prime brokerage offers advanced tools, margin financing, and institutional support ideal for hedge funds and professional traders, while full-service brokerage provides comprehensive investment advice, research, and personalized client support suited for individual investors. Consider factors such as transaction costs, access to global markets, risk management capabilities, and the extent of advisory services when evaluating brokers. Understanding these differences ensures alignment with your investment strategy and maximizes potential returns.

Important Terms

Margin Financing

Margin financing in prime brokerage offers tailored leverage and risk management solutions for institutional clients, while full-service brokerages provide standardized margin loans with broader retail client access.

Securities Lending

Prime brokerage offers comprehensive securities lending services with integrated risk management and customized financing, while full-service brokerage typically provides more limited or transaction-focused securities lending options.

Custody Services

Prime brokerage offers comprehensive custody services including asset safekeeping, settlement, and reporting tailored for institutional clients, whereas full-service brokerages provide custody primarily focused on retail investors with additional advisory and trading support.

Trade Execution

Trade execution in prime brokerage typically offers faster, more efficient handling of large institutional orders compared to full-service brokerage, which provides broader advisory and research support alongside execution.

Clearing and Settlement

Clearing and settlement processes in prime brokerage are tailored to institutional clients, enabling faster trade execution, netting, and collateral management across multiple accounts and asset classes, compared to full-service brokerage which primarily serves retail investors with standardized clearing and settlement services. Prime brokers offer integrated clearing solutions that streamline risk management and liquidity provision, whereas full-service brokers focus on individual transaction processing with less emphasis on multi-asset portfolio consolidation.

Capital Introduction

Capital introduction is a specialized service offered predominantly by prime brokerages to connect hedge funds and asset managers with potential investors, facilitating fundraising and relationship-building without directly managing assets; full-service brokerages, in contrast, focus more broadly on investment services, including trade execution and advisory. Prime brokerage firms integrate capital introduction within a comprehensive suite of offerings such as custody, leverage, and securities lending, optimizing client access to institutional capital and market infrastructure.

Hedge Fund Services

Prime brokerage offers hedge funds consolidated services like securities lending and leverage, while full-service brokerage provides comprehensive investment solutions including trading, research, and advisory.

Client Onboarding

Client onboarding in prime brokerage focuses on streamlined access to multiple services such as securities lending, leveraged trade execution, and custody, offering sophisticated institutional clients tailored risk management and operational efficiency. Full-service brokerage onboarding emphasizes comprehensive customer support, including personalized financial advice, wealth management, and a broad range of investment products catering primarily to retail investors seeking diverse portfolio options.

Risk Management

Risk management in prime brokerage primarily focuses on managing credit and operational risks associated with providing leveraged access and custody services to hedge funds, whereas full-service brokerage emphasizes comprehensive risk assessment across diverse retail client portfolios, including market, credit, and liquidity risks. Prime brokers deploy sophisticated margin and collateral management systems to mitigate counterparty exposure, while full-service brokers often implement broader risk diversification strategies tailored to individual investor profiles.

White-Label Solutions

White-label solutions enable prime brokerage firms to offer customized trading platforms and liquidity services under their brand, enhancing client retention and operational efficiency without heavy infrastructure investments. Full-service brokerages benefit from white-label partnerships by expanding product offerings and technology access while focusing on client relationships and advisory services rather than backend development.

prime brokerage vs full-service brokerage Infographic

moneydif.com

moneydif.com