Desk trading involves human brokers executing trades through direct communication and negotiation, offering personalized service and the ability to handle complex orders. Electronic trading uses automated platforms to execute orders rapidly and efficiently, reducing human error and increasing market transparency. Both methods serve distinct purposes, with desk trading favoring customization and electronic trading emphasizing speed and scalability.

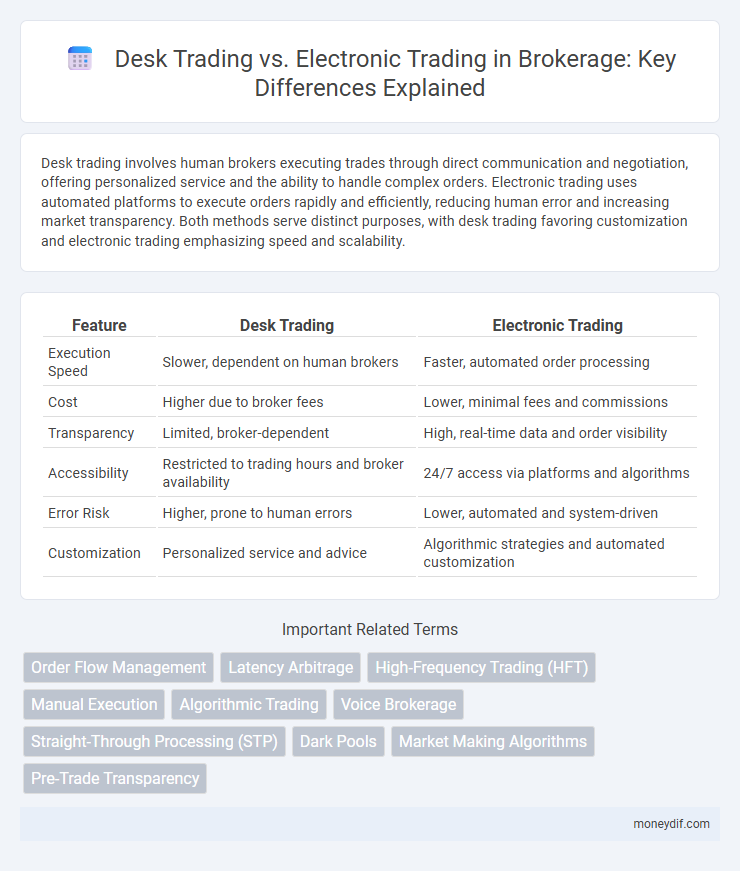

Table of Comparison

| Feature | Desk Trading | Electronic Trading |

|---|---|---|

| Execution Speed | Slower, dependent on human brokers | Faster, automated order processing |

| Cost | Higher due to broker fees | Lower, minimal fees and commissions |

| Transparency | Limited, broker-dependent | High, real-time data and order visibility |

| Accessibility | Restricted to trading hours and broker availability | 24/7 access via platforms and algorithms |

| Error Risk | Higher, prone to human errors | Lower, automated and system-driven |

| Customization | Personalized service and advice | Algorithmic strategies and automated customization |

Introduction to Desk Trading and Electronic Trading

Desk trading involves human brokers executing trades directly on behalf of clients, leveraging personal expertise and real-time market insights to navigate complex transactions. Electronic trading employs automated systems and algorithms to execute orders swiftly across multiple markets, enhancing speed and reducing human error. The integration of these methods optimizes trade execution by combining human judgment with technological efficiency in brokerage operations.

Key Differences Between Desk and Electronic Trading

Desk trading involves human brokers executing trades via phone or proprietary systems, providing personalized market insights and flexible negotiation options. Electronic trading relies on automated platforms executing orders at high speed, offering greater transparency, reduced costs, and access to global liquidity pools. Key differences include the speed of execution, level of human intervention, and the degree of market access and transparency.

Advantages of Desk Trading for Brokerages

Desk trading offers brokerages personalized client interactions that enable tailored investment strategies and enhanced trust-building. It provides access to complex order types and large block trades that electronic platforms may struggle to execute efficiently. The human expertise involved in desk trading helps brokerages navigate volatile markets and deliver superior execution quality for institutional clients.

Benefits of Electronic Trading Platforms

Electronic trading platforms offer enhanced speed and accuracy by automating order execution, reducing human errors common in desk trading. They provide greater transparency through real-time market data and comprehensive trade analytics, enabling better-informed decisions. These platforms also improve accessibility and scalability, allowing brokers to handle high-volume trades efficiently across multiple markets and asset classes.

Speed and Efficiency: Manual vs Automated Execution

Desk trading relies on manual order execution by brokers, resulting in slower transaction speeds and higher potential for human error. Electronic trading utilizes automated algorithms and high-speed data processing, significantly improving execution speed and overall trading efficiency. This automation minimizes latency and enhances precision, making electronic trading ideal for high-frequency and large-volume transactions.

Human Interaction vs Algorithmic Algorithms

Desk trading relies heavily on human interaction, allowing brokers to leverage experience and intuition when executing trades, which can enhance personalized client services and adapt to complex market conditions. Electronic trading utilizes algorithmic algorithms to execute large volumes of transactions at high speeds, minimizing human errors and optimizing execution efficiency through real-time data analysis. Combining both approaches offers diverse strategic advantages, balancing the nuanced judgment of traders with the precision and scalability of automated systems.

Cost Comparison: Desk vs Electronic Trading

Desk trading often involves higher costs due to broker commissions, wider bid-ask spreads, and potential fees for personalized advisory services. Electronic trading reduces expenses by automating order execution, minimizing human intervention, and offering tighter spreads through direct market access platforms. Cost efficiency in electronic trading makes it ideal for high-frequency or algorithmic traders seeking to optimize transaction expenses.

Risk Management and Transparency

Desk trading allows brokers to exercise discretionary control over trades, offering personalized risk management but potentially less transparency due to manual processes and human involvement. Electronic trading platforms enhance transparency with real-time data and automated order execution, reducing the risk of errors and manipulation while supporting systematic risk controls. Integrating electronic trading improves overall risk mitigation and provides clearer audit trails compared to traditional desk trading methods.

Technological Innovations in Trading Desks

Technological innovations in trading desks have revolutionized the brokerage industry by integrating advanced algorithms, real-time data analytics, and automated order execution, enhancing speed and accuracy in Desk Trading. Electronic Trading platforms utilize these innovations to enable seamless transaction processing, liquidity aggregation, and risk management, drastically reducing human errors and operational costs. This shift towards electronic systems fosters greater transparency and accessibility in markets, empowering brokers with sophisticated tools for strategic decision-making.

Future Trends in Desk and Electronic Trading

Future trends in desk trading highlight the integration of advanced AI algorithms and machine learning to enhance decision-making and risk management. Electronic trading is rapidly evolving with increased adoption of blockchain technology and real-time data analytics, improving transparency and execution speed. Hybrid models combining discretionary desk trading with automated electronic systems are expected to dominate, optimizing efficiency and adaptability in brokerage platforms.

Important Terms

Order Flow Management

Order Flow Management enhances trade execution efficiency by optimizing the routing and timing of orders in both Desk Trading environments and Electronic Trading platforms.

Latency Arbitrage

Latency arbitrage exploits millisecond differences between desk trading's human-paced order execution and electronic trading's automated, high-frequency systems to gain profit.

High-Frequency Trading (HFT)

High-frequency trading (HFT) relies on sophisticated algorithms and ultra-fast data processing, making electronic trading platforms vastly more efficient than traditional desk trading for executing rapid, high-volume trades.

Manual Execution

Manual execution in desk trading relies on human decision-making and direct intervention, while electronic trading uses automated algorithms to execute orders rapidly and minimize latency.

Algorithmic Trading

Algorithmic trading leverages advanced algorithms to execute trades with greater speed and precision compared to traditional desk trading, significantly enhancing market efficiency and reducing human error.

Voice Brokerage

Voice Brokerage enhances Desk Trading by providing personalized market insights and negotiation opportunities, while Electronic Trading prioritizes speed and automation for executing trades.

Straight-Through Processing (STP)

Straight-Through Processing (STP) enhances efficiency in electronic trading by automating order execution and settlement, reducing manual intervention common in desk trading environments.

Dark Pools

Dark pools facilitate large institutional trades by allowing Desk Trading to execute block orders with reduced market impact compared to Electronic Trading platforms that prioritize speed and transparency.

Market Making Algorithms

Market making algorithms enhance liquidity and price discovery by continuously quoting bid and ask prices, optimizing inventory risk, and adjusting spreads based on real-time market data, effectively bridging the gap between desk trading's manual strategies and electronic trading's automation. These algorithms integrate seamlessly with electronic trading platforms, enabling faster execution and tighter spreads while maintaining the strategic oversight once dominated by human traders on traditional trading desks.

Pre-Trade Transparency

Pre-trade transparency in electronic trading platforms offers real-time, comprehensive market data that enhances price discovery, whereas desk trading often relies on limited or delayed information, impacting trade execution efficiency.

Desk Trading vs Electronic Trading Infographic

moneydif.com

moneydif.com