Margin trading vs cash trading highlights the difference between borrowing funds to invest and using only available capital. Market order vs limit order distinguishes executing trades immediately at current prices versus setting specific price points for transactions. Retail brokerage vs institutional brokerage defines services catered to individual investors compared to large organizations managing significant assets.

Table of Comparison

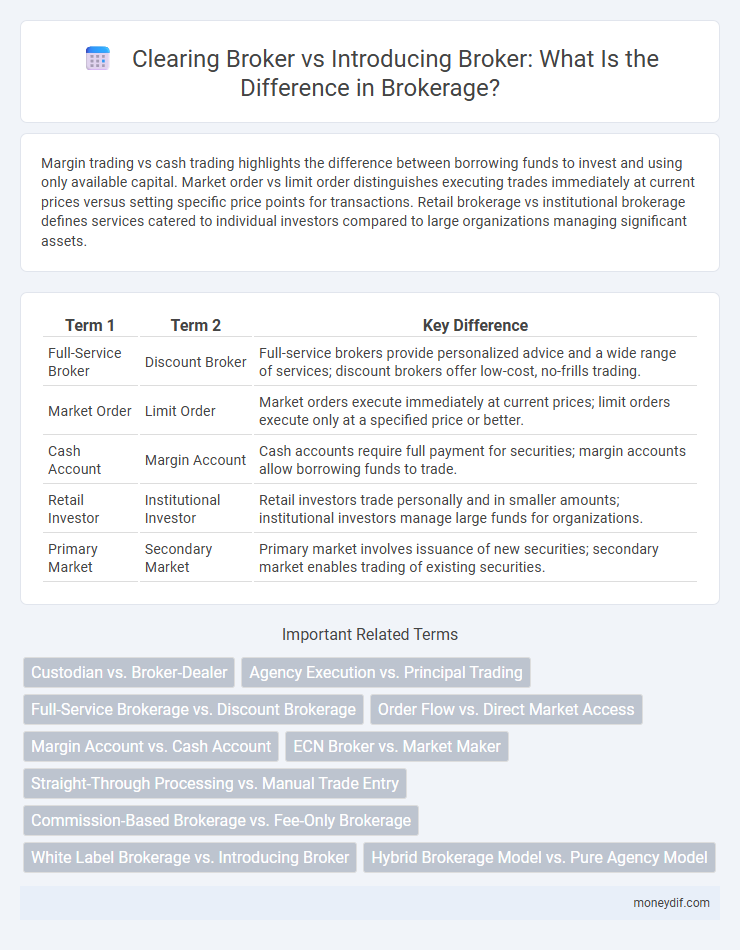

| Term 1 | Term 2 | Key Difference |

|---|---|---|

| Full-Service Broker | Discount Broker | Full-service brokers provide personalized advice and a wide range of services; discount brokers offer low-cost, no-frills trading. |

| Market Order | Limit Order | Market orders execute immediately at current prices; limit orders execute only at a specified price or better. |

| Cash Account | Margin Account | Cash accounts require full payment for securities; margin accounts allow borrowing funds to trade. |

| Retail Investor | Institutional Investor | Retail investors trade personally and in smaller amounts; institutional investors manage large funds for organizations. |

| Primary Market | Secondary Market | Primary market involves issuance of new securities; secondary market enables trading of existing securities. |

Full-Service Broker vs Discount Broker

Full-Service Brokers provide personalized investment advice, portfolio management, and extensive research tools, charging higher commissions for these premium services. Discount Brokers offer low-cost trading options with limited advisory support, appealing to cost-conscious investors focused on self-directed strategies. Choosing between Full-Service and Discount Brokers depends on the investor's need for expert guidance versus cost-efficiency in executing trades.

Online Brokerage vs Traditional Brokerage

Online brokerage platforms provide users with real-time trade execution, lower fees, and advanced digital tools, enabling faster and more cost-effective investment decisions. Traditional brokerage firms offer personalized advisory services, in-depth market research, and human interaction, which appeals to investors seeking tailored guidance and complex financial planning. The choice between online and traditional brokerage depends on an investor's preference for autonomy, service level, and cost sensitivity.

ECN Broker vs Market Maker

ECN brokers provide direct access to interbank liquidity pools, offering transparent pricing and tight spreads without taking the opposite side of client trades. Market makers, in contrast, create their own market by setting bid and ask prices, often profiting from the spread and potentially facing conflicts of interest with traders. Understanding the operational differences between ECN brokers and market makers is crucial for traders seeking optimal execution and reduced transaction costs.

Retail Broker vs Institutional Broker

Retail brokers serve individual investors by providing access to stock markets with lower trade volumes and higher commission rates. Institutional brokers handle large-volume trades for organizations such as mutual funds, pension funds, and hedge funds, often benefiting from reduced fees and enhanced market impact strategies. The distinction centers on client type, trade scale, and service customization tailored to retail versus institutional investment needs.

Direct Market Access vs Broker-Assisted Trading

Direct Market Access (DMA) allows traders to place orders directly into the market order book, offering faster execution and lower latency compared to Broker-Assisted Trading, where brokers manually execute trades on behalf of clients. DMA provides increased transparency and control over trading strategies, while Broker-Assisted Trading is often preferred for complex orders or when professional guidance is required. The choice between DMA and Broker-Assisted Trading impacts trade execution speed, cost, and the level of trader involvement.

Fixed Commission vs Variable Commission Brokers

Fixed commission brokers charge a set fee per trade regardless of the transaction size, providing cost certainty for investors with frequent small trades. Variable commission brokers adjust fees based on trade volume or asset value, often offering lower rates for high-value trades that benefit active or institutional investors. Understanding these fee structures helps clients optimize their brokerage costs according to their trading frequency and portfolio size.

Stock Brokerage vs Forex Brokerage

Stock brokerage involves the buying and selling of equity shares on regulated exchanges, primarily focusing on companies listed in stock markets like NYSE or NASDAQ. Forex brokerage specializes in the trading of currency pairs within the global foreign exchange market, operating 24 hours and emphasizing leverage and liquidity. Key differences include asset type, market hours, regulatory frameworks, and trading strategies tailored to equities versus currencies.

Execution-Only Broker vs Advisory Broker

Execution-Only Brokers provide clients with direct access to trading platforms without offering personalized investment advice, enabling cost-effective self-directed trading. Advisory Brokers analyze client portfolios and financial goals to deliver tailored investment recommendations and ongoing portfolio management. The choice between Execution-Only and Advisory Brokers depends on the investor's need for professional guidance versus control over trading decisions.

Introducing Broker vs Clearing Broker

Introducing Brokers (IBs) act as intermediaries who bring clients to clearing brokers without holding client funds or executing trades directly, while Clearing Brokers handle trade execution, custody of funds, and regulatory compliance. IBs earn commissions or fees by referring clients, relying on clearing brokers for operational infrastructure and risk management. Clearing Brokers assume operational responsibilities, ensuring trade settlement, margin requirements, and regulatory reporting within the brokerage ecosystem.

Domestic Broker vs International Broker

Domestic brokers specialize in transactions within a single country's financial markets, providing localized expertise and compliance with specific national regulations. International brokers facilitate cross-border trading, offering access to global markets and understanding diverse regulatory environments. Choosing between domestic and international brokers depends on an investor's target market and regulatory preferences.

Important Terms

Custodian vs. Broker-Dealer

Custodians safeguard client assets by holding securities securely, while broker-dealers execute trades and provide investment services in brokerage accounts.

Agency Execution vs. Principal Trading

Agency execution involves a broker acting on behalf of clients to execute orders without taking market risk, whereas principal trading occurs when a broker trades securities for its own account, potentially creating a conflict of interest.

Full-Service Brokerage vs. Discount Brokerage

Full-service brokerages offer personalized investment advice and comprehensive financial planning, while discount brokerages provide lower-cost, self-directed trading platforms with limited advisory services.

Order Flow vs. Direct Market Access

Order Flow involves routing client orders to third parties for execution and payment, while Direct Market Access enables traders to place orders directly onto the exchange order book, facilitating faster execution and greater market transparency.

Margin Account vs. Cash Account

Margin accounts allow investors to borrow funds to trade securities, increasing buying power and risk, whereas cash accounts require full payment for all transactions, limiting leverage but reducing potential losses.

ECN Broker vs. Market Maker

ECN brokers route client orders directly to the interbank market ensuring transparent pricing and reduced spreads, while market makers create internal liquidity by taking the opposite side of client trades, often resulting in wider spreads and potential conflicts of interest.

Straight-Through Processing vs. Manual Trade Entry

Straight-Through Processing in brokerage automates trade execution for faster, error-free settlements, whereas Manual Trade Entry relies on human input, increasing risks of delays and inaccuracies.

Commission-Based Brokerage vs. Fee-Only Brokerage

Commission-based brokerages earn revenue through transaction commissions, potentially creating conflicts of interest, while fee-only brokerages charge a fixed fee or percentage, offering more transparent and unbiased financial advice.

White Label Brokerage vs. Introducing Broker

White label brokerage allows firms to offer trading platforms under their own brand while relying on an established broker's infrastructure, enabling full control over client relationships and branding. Introducing brokers act as intermediaries who refer clients to a brokerage, earning commissions without handling regulatory compliance or platform management.

Hybrid Brokerage Model vs. Pure Agency Model

The Hybrid Brokerage Model blends commission-based and flat-fee services offering flexibility and personalized support, whereas the Pure Agency Model strictly charges flat fees with standardized services focusing on cost-efficiency and transparency.

Sure! Here is a list of niche "term1 vs term2" distinctions in the context of Brokerage: Infographic

moneydif.com

moneydif.com