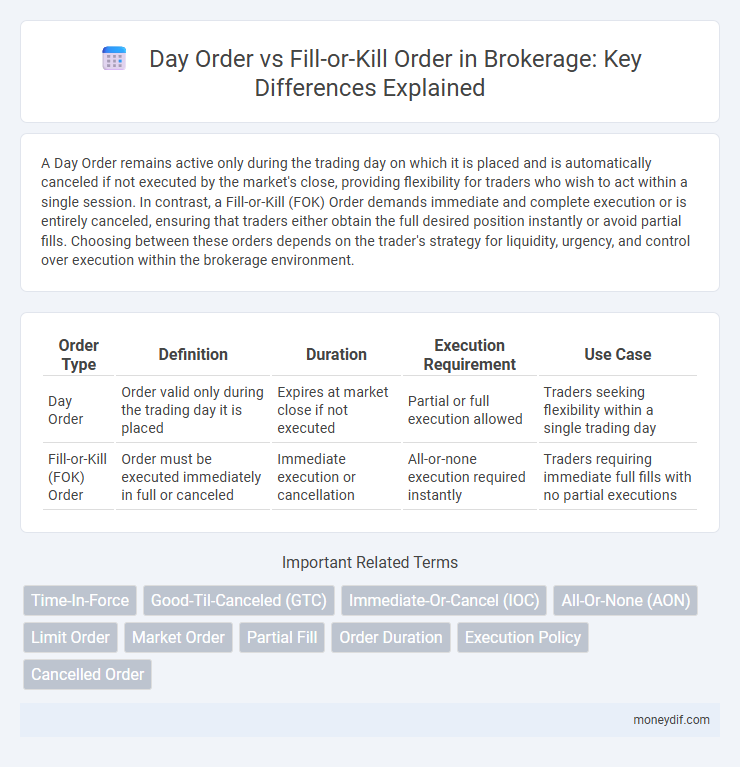

A Day Order remains active only during the trading day on which it is placed and is automatically canceled if not executed by the market's close, providing flexibility for traders who wish to act within a single session. In contrast, a Fill-or-Kill (FOK) Order demands immediate and complete execution or is entirely canceled, ensuring that traders either obtain the full desired position instantly or avoid partial fills. Choosing between these orders depends on the trader's strategy for liquidity, urgency, and control over execution within the brokerage environment.

Table of Comparison

| Order Type | Definition | Duration | Execution Requirement | Use Case |

|---|---|---|---|---|

| Day Order | Order valid only during the trading day it is placed | Expires at market close if not executed | Partial or full execution allowed | Traders seeking flexibility within a single trading day |

| Fill-or-Kill (FOK) Order | Order must be executed immediately in full or canceled | Immediate execution or cancellation | All-or-none execution required instantly | Traders requiring immediate full fills with no partial executions |

Understanding Day Orders in Brokerage

Day orders in brokerage are instructions to buy or sell a security that remain active only during the trading day they are placed, automatically expiring at the market close if not executed. These orders provide traders with flexibility to react to intraday price movements without committing beyond a single session, reducing the risk of unwanted executions in volatile markets. Unlike fill-or-kill orders that require immediate and complete execution or cancellation, day orders prioritize execution within the day without strict fill conditions.

What is a Fill-or-Kill (FOK) Order?

A Fill-or-Kill (FOK) order is a type of brokerage order that must be executed immediately in its entirety or canceled completely, ensuring no partial fills occur. Traders use FOK orders to avoid partial executions and to secure a specific quantity of shares at a designated price without delay. This order type is critical in fast-moving markets where timing and full quantity execution are essential for trading strategies.

Key Differences Between Day Orders and Fill-or-Kill Orders

Day orders remain active only during the trading day and automatically expire if not executed by market close, allowing traders to manage short-term positions flexibly. Fill-or-kill orders require immediate execution of the entire order quantity at the specified price or better, otherwise they are completely canceled, ensuring strict control over order fulfillment. The key difference lies in execution time sensitivity and order completion requirements, with day orders permitting partial fills throughout the day and fill-or-kill orders demanding instant, full execution or no trade.

When to Use a Day Order in Trading

A Day Order is ideal for traders seeking to buy or sell securities within the same trading day, as it automatically expires if not executed by market close, ensuring no overnight market risk. This order type suits situations where price movement or market conditions are expected to change rapidly within a day, offering flexibility without the need for long-term commitment. Investors use Day Orders for stocks, options, or futures when immediate execution during active trading hours aligns with their short-term strategy.

Suitable Scenarios for Fill-or-Kill Orders

Fill-or-Kill (FOK) orders are highly suitable for traders seeking immediate execution of large trades without partial fills, especially in fast-moving markets where delays may increase risk. These orders are ideal for institutional investors who require full order completion at a specified price or better, ensuring no residual exposure if the order cannot be entirely filled at once. Market conditions characterized by high volatility and thin liquidity also favor the use of FOK orders to avoid the uncertainty of partial executions inherent in Day Orders.

Advantages and Disadvantages of Day Orders

Day orders offer flexibility by remaining active only during normal trading hours, preventing unwanted trades outside market sessions and allowing traders to reassess positions daily. The main advantage is reducing risk exposure overnight, but the downside is potential missed opportunities if the order is not executed before market close. Day orders also provide greater control over order management compared to fill-or-kill orders, which demand immediate execution or complete cancellation, limiting strategic options.

Pros and Cons of Fill-or-Kill Orders

Fill-or-Kill (FOK) orders provide immediate execution or complete cancellation, ensuring traders avoid partial fills and unwanted market exposure. This type of order is especially useful for large volume trades where full execution is critical, but its downside includes the risk of no execution if liquidity is insufficient. Traders must weigh the advantage of certainty in execution against potentially missing the market opportunity altogether.

Impact of Order Types on Execution Speed

Day Orders remain active until the market closes, potentially delaying execution if prices fluctuate or liquidity is low. Fill-or-Kill Orders demand immediate execution of the entire order volume at the specified price or better, ensuring faster execution or immediate cancellation. This speed difference impacts trading strategies where timing and certainty of execution are critical factors for brokerage clients.

Risk Management with Day vs Fill-or-Kill Orders

Day Orders expire at the end of the trading day, allowing investors to manage risk by cancelling unexecuted orders and avoiding overnight market exposure. Fill-or-Kill (FOK) Orders require immediate and complete execution or cancellation, reducing the risk of partial fills and ensuring precise trade execution. Selecting between Day and Fill-or-Kill Orders impacts exposure to market volatility and order execution certainty in effective brokerage risk management.

Choosing the Right Order Type for Your Trading Strategy

A Day Order expires if not executed by the close of the trading day, making it ideal for traders seeking flexibility and short-term opportunities. Fill-or-Kill Orders require immediate execution in full or cancellation, suitable for traders aiming to avoid partial fills and require precise entry or exit points. Selecting the right order type depends on trading goals, market conditions, and risk tolerance to optimize execution efficiency and strategy alignment.

Important Terms

Time-In-Force

Time-In-Force determines the duration an order remains active, with Day Orders expiring at market close if unfilled, while Fill-or-Kill Orders require immediate and complete execution or cancellation.

Good-Til-Canceled (GTC)

Good-Til-Canceled (GTC) orders remain active until executed or canceled, contrasting with Day Orders that expire at market close and Fill-or-Kill Orders requiring immediate full execution or automatic cancellation.

Immediate-Or-Cancel (IOC)

Immediate-Or-Cancel (IOC) orders require all or part of the order to be executed immediately, canceling any unfilled portion, unlike Day Orders which remain active throughout the trading day, and Fill-or-Kill (FOK) orders which demand complete execution immediately or full cancellation without partial fills.

All-Or-None (AON)

All-Or-None (AON) orders require complete execution or none at all, while Day Orders remain active only during trading hours and Fill-or-Kill Orders demand immediate full execution or cancellation.

Limit Order

A Limit Order specifies a maximum purchase or minimum sale price and can be set as a Day Order, which expires if not executed by the end of the trading day, or as a Fill-or-Kill Order, which requires immediate execution in its entirety or else is canceled.

Market Order

A Market Order executes immediately at the best available price, while a Day Order remains active until the end of the trading day and a Fill-or-Kill Order requires immediate full execution or automatic cancellation.

Partial Fill

Partial fill occurs when a Day Order remains open until fully executed or expires, whereas a Fill-or-Kill Order requires immediate complete execution or cancellation without partial fills.

Order Duration

Day Orders remain active until the end of the trading day, while Fill-or-Kill Orders require immediate execution in full or are canceled instantly.

Execution Policy

Execution Policy differentiates between Day Order, which remains active until the end of the trading day, and Fill-or-Kill Order, which requires immediate and complete execution or cancellation.

Cancelled Order

A cancelled order occurs when a Day Order, which remains active only until the market closes, is manually withdrawn before execution, contrasting with a Fill-or-Kill (FOK) Order that mandates immediate full execution or automatic cancellation to prevent partial fills. Traders use Day Orders for flexibility within a single trading session, while FOK Orders prioritize precise transaction timing and volume without lingering pending status.

Day Order vs Fill-or-Kill Order Infographic

moneydif.com

moneydif.com