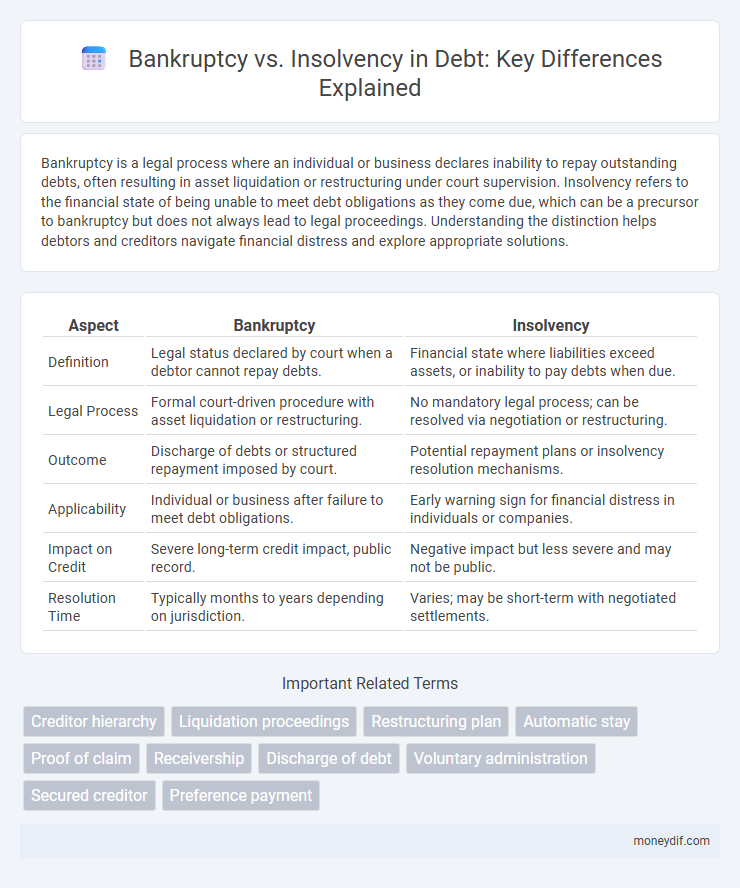

Bankruptcy is a legal process where an individual or business declares inability to repay outstanding debts, often resulting in asset liquidation or restructuring under court supervision. Insolvency refers to the financial state of being unable to meet debt obligations as they come due, which can be a precursor to bankruptcy but does not always lead to legal proceedings. Understanding the distinction helps debtors and creditors navigate financial distress and explore appropriate solutions.

Table of Comparison

| Aspect | Bankruptcy | Insolvency |

|---|---|---|

| Definition | Legal status declared by court when a debtor cannot repay debts. | Financial state where liabilities exceed assets, or inability to pay debts when due. |

| Legal Process | Formal court-driven procedure with asset liquidation or restructuring. | No mandatory legal process; can be resolved via negotiation or restructuring. |

| Outcome | Discharge of debts or structured repayment imposed by court. | Potential repayment plans or insolvency resolution mechanisms. |

| Applicability | Individual or business after failure to meet debt obligations. | Early warning sign for financial distress in individuals or companies. |

| Impact on Credit | Severe long-term credit impact, public record. | Negative impact but less severe and may not be public. |

| Resolution Time | Typically months to years depending on jurisdiction. | Varies; may be short-term with negotiated settlements. |

Understanding Bankruptcy and Insolvency: Key Differences

Bankruptcy is a legal process that formally declares an individual or business unable to repay outstanding debts, often resulting in asset liquidation or debt restructuring under court supervision. Insolvency refers to the financial state where liabilities exceed assets or cash flow is insufficient to meet debt obligations, serving as a precursor to bankruptcy but not always leading to it. Understanding these distinctions is crucial for effective debt management and selecting the appropriate financial remedy.

Defining Insolvency: What Does It Mean?

Insolvency occurs when an individual or company is unable to meet debt obligations as they come due, signaling a financial state where liabilities exceed assets or cash flow is insufficient to cover debts. It serves as a critical indicator of financial distress, often preceding formal bankruptcy proceedings but also existing independently as a solvency assessment. Understanding insolvency helps creditors and debtors evaluate the likelihood of repayment and guides strategic financial decisions for restructuring or liquidation.

What Is Bankruptcy? Legal Classification and Process

Bankruptcy is a legal process that officially declares an individual or business unable to repay outstanding debts, allowing for the protection of assets and an orderly distribution to creditors under court supervision. The legal classification of bankruptcy varies by jurisdiction but commonly includes Chapter 7 (liquidation) and Chapter 13 (reorganization) in the United States, each defining distinct procedures and debtor obligations. Filing for bankruptcy initiates a formal process involving court proceedings, debt verification, creditor meetings, and eventually, discharge or repayment plans to resolve financial distress.

Causes of Insolvency: Why Businesses and Individuals Struggle

Insolvency arises when liabilities exceed assets or cash flow is insufficient to meet financial obligations, commonly caused by poor cash management, declining sales, or unexpected expenses. Businesses may face insolvency due to economic downturns, high operational costs, or excessive debt burdens, while individuals often struggle with job loss, medical bills, or excessive credit card debt. Understanding these causes helps in implementing proactive financial strategies to avoid bankruptcy and stabilize financial health.

Bankruptcy Proceedings: Steps and Requirements

Bankruptcy proceedings involve a formal legal process initiated when an individual or business cannot meet debt obligations, requiring the filing of a bankruptcy petition with the court. The process includes an automatic stay to halt creditor actions, the appointment of a trustee to oversee asset liquidation or reorganization, and creditor meetings to review claims. Key requirements involve submitting detailed financial disclosures, adhering to filing deadlines, and complying with court orders to achieve debt discharge or repayment plans.

Types of Insolvency: Cash Flow vs. Balance Sheet

Types of insolvency include cash flow insolvency, where a debtor cannot meet current payment obligations despite having assets, and balance sheet insolvency, characterized by liabilities exceeding total assets. Cash flow insolvency often signals short-term liquidity issues, while balance sheet insolvency reflects a fundamental financial imbalance. Understanding these distinctions is critical in assessing the risk of bankruptcy and determining appropriate debt restructuring strategies.

Signs You’re Approaching Insolvency or Bankruptcy

Persistent cash flow shortages and the inability to meet debt obligations on time are critical signs you're approaching insolvency. Rapid depletion of assets without corresponding income growth indicates a potential bankruptcy scenario. Increasing creditor demands and mounting unpaid bills further signal financial distress, necessitating early intervention to avoid formal bankruptcy filings.

Consequences of Bankruptcy vs. Insolvency

Bankruptcy results in a formal legal process involving court intervention, potential asset liquidation, and long-term credit damage, while insolvency alone signals an inability to meet financial obligations without immediate legal consequences. Bankruptcy can lead to discharge of debts but also involves significant public records and restrictions on financial activities. Insolvency may prompt renegotiation with creditors or restructuring efforts, often allowing businesses to recover without severe credit impairments.

Solutions and Alternatives to Bankruptcy

Exploring alternatives to bankruptcy, debt consolidation and negotiation with creditors offer viable solutions to manage financial obligations without court intervention. Debt settlement programs and credit counseling services provide structured plans that help reduce total debt and improve repayment terms, preserving creditworthiness. For businesses, out-of-court restructurings and formal debt agreements facilitate operational continuity while addressing insolvency issues effectively.

Choosing the Right Path: Bankruptcy or Insolvency?

Choosing between bankruptcy and insolvency depends on the severity of debt and long-term financial goals. Bankruptcy is a legal process providing debt discharge or reorganization under court supervision, often impacting credit scores for years. Insolvency, a financial state where liabilities exceed assets, may lead to restructuring options like debt negotiation or repayment plans without full court intervention.

Important Terms

Creditor hierarchy

Creditor hierarchy prioritizes secured creditors first, followed by unsecured creditors and equity holders during bankruptcy, while insolvency determines the company's inability to meet obligations but does not dictate creditor payment order.

Liquidation proceedings

Liquidation proceedings involve the court-ordered sale of a debtor's assets to repay creditors, typically initiated during bankruptcy when a business is legally insolvent and unable to meet its debt obligations.

Restructuring plan

A restructuring plan during bankruptcy focuses on reorganizing debt and operational changes to enable a company's survival and creditor repayment, while insolvency specifically denotes the financial state where liabilities exceed assets or cash flow is insufficient to meet obligations. Effective restructuring in insolvency situations aims to restore solvency by negotiating debt terms, asset sales, or operational adjustments to avoid liquidation and preserve business value.

Automatic stay

Automatic stay halts creditor actions immediately upon bankruptcy filing, protecting debtors from collection and foreclosure efforts. Insolvency indicates a financial state where liabilities exceed assets, but does not automatically trigger the legal protections provided by an automatic stay in bankruptcy proceedings.

Proof of claim

A proof of claim is a formal document filed by a creditor in a bankruptcy case to assert the amount owed and seek repayment from the debtor's estate. While bankruptcy is a legal status where a court oversees asset distribution to creditors, insolvency refers to the financial state of being unable to pay debts as they come due, which may or may not lead to bankruptcy proceedings.

Receivership

Receivership is a legal process initiated by creditors to manage and dispose of a debtor's assets during insolvency, distinct from bankruptcy which is a court-supervised liquidation or reorganization of the debtor's estate.

Discharge of debt

Discharge of debt in bankruptcy legally eliminates debtor's obligation, whereas insolvency refers to the financial state of being unable to pay debts without necessarily resulting in discharge.

Voluntary administration

Voluntary administration is a legal process used in insolvency to restructure a financially distressed company and avoid bankruptcy by appointing an independent administrator to assess options for creditors.

Secured creditor

A secured creditor holds a legal claim backed by collateral, giving priority in repayment during bankruptcy proceedings, whereas in insolvency, their rights may influence restructuring or liquidation outcomes but are governed by different statutory frameworks. Bankruptcy prioritizes secured creditors over unsecured ones, often enabling them to recover more of the owed amount through asset liquidation.

Preference payment

Preference payment refers to a transaction made by a debtor to a creditor shortly before bankruptcy, which can be reversed to ensure equitable distribution among all creditors. In insolvency cases, courts scrutinize such payments to prevent unfair advantage and preserve the debtor's remaining assets for fair creditor treatment.

bankruptcy vs insolvency Infographic

moneydif.com

moneydif.com