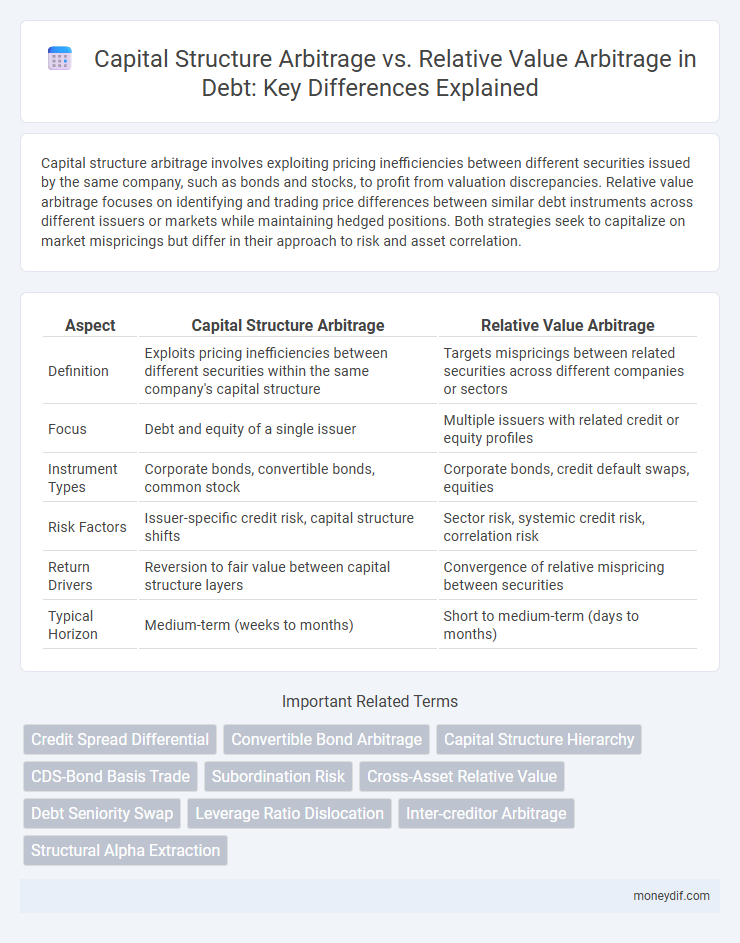

Capital structure arbitrage involves exploiting pricing inefficiencies between different securities issued by the same company, such as bonds and stocks, to profit from valuation discrepancies. Relative value arbitrage focuses on identifying and trading price differences between similar debt instruments across different issuers or markets while maintaining hedged positions. Both strategies seek to capitalize on market mispricings but differ in their approach to risk and asset correlation.

Table of Comparison

| Aspect | Capital Structure Arbitrage | Relative Value Arbitrage |

|---|---|---|

| Definition | Exploits pricing inefficiencies between different securities within the same company's capital structure | Targets mispricings between related securities across different companies or sectors |

| Focus | Debt and equity of a single issuer | Multiple issuers with related credit or equity profiles |

| Instrument Types | Corporate bonds, convertible bonds, common stock | Corporate bonds, credit default swaps, equities |

| Risk Factors | Issuer-specific credit risk, capital structure shifts | Sector risk, systemic credit risk, correlation risk |

| Return Drivers | Reversion to fair value between capital structure layers | Convergence of relative mispricing between securities |

| Typical Horizon | Medium-term (weeks to months) | Short to medium-term (days to months) |

Understanding Capital Structure Arbitrage in Debt Markets

Capital structure arbitrage in debt markets involves exploiting mispricings between a company's equity and its various debt instruments, aiming to profit from the convergence of their relative values. This strategy requires deep analysis of a firm's capital structure, including senior and subordinated debt, bonds, and equity, evaluating credit risk, default probabilities, and recovery rates. Understanding this approach helps investors identify arbitrage opportunities by comparing synthetic equity prices embedded in debt and actual market prices, enabling sophisticated risk-adjusted returns beyond traditional relative value arbitrage.

Relative Value Arbitrage: A Debt Market Perspective

Relative Value Arbitrage in the debt market exploits pricing inefficiencies between related fixed income securities, such as bonds with similar credit ratings or maturities, aiming to profit from the convergence of their yield spreads. This strategy leverages detailed credit analysis and market signals to identify mispriced debt instruments without relying on significant capital structure mismatches. By focusing on relative price movements within homogeneous debt segments, investors minimize exposure to idiosyncratic risks and capture alpha through spread normalization.

Key Differences Between Capital Structure and Relative Value Arbitrage

Capital structure arbitrage targets mispricings between different securities issued by the same company, such as debt versus equity, by exploiting price inefficiencies within a firm's capital structure. Relative value arbitrage involves identifying valuation discrepancies between related assets across different issuers or sectors, aiming to profit from mean reversion without exposure to broad market trends. The primary difference lies in capital structure arbitrage's focus on intra-company securities relationships, while relative value arbitrage emphasizes cross-company or cross-sector comparative valuations.

Fundamental Principles of Capital Structure Arbitrage

Capital structure arbitrage exploits mispricings between different securities issued by the same company, such as bonds and equity, by leveraging their relative risk and return profiles. This strategy relies on analyzing the company's fundamentals, including cash flow stability, debt covenants, and default risk, to identify discrepancies in valuation that can be hedged effectively. The core principle is that the market inefficiencies between equity and debt pricing within a single firm will converge over time, allowing arbitrageurs to profit from the correction.

Mechanics of Relative Value Arbitrage in Debt Instruments

Relative value arbitrage in debt instruments exploits pricing inefficiencies between related fixed-income securities by simultaneously taking long and short positions to capitalize on convergence. The strategy often involves analyzing credit spreads, interest rate differentials, and bond covenants to identify mispricings within capital structures, targeting discrepancies in seniority, maturity, or issuer credit risk. Execution relies on comprehensive credit research, sophisticated risk models, and dynamic portfolio adjustments to balance exposure while capturing arbitrage profits.

Risk Factors in Capital Structure Arbitrage vs Relative Value Arbitrage

Risk factors in capital structure arbitrage primarily include credit risk, liquidity risk, and the potential for asymmetric information between different securities of the same issuer, affecting debt and equity valuations. Relative value arbitrage faces risks from market volatility, model risk, and execution risk due to mispricing across related securities, often influenced by macroeconomic events. Capital structure arbitrage investors must carefully assess the interplay between senior and subordinated debt claims, while relative value arbitrage requires close monitoring of correlation breakdowns and temporary price dislocations.

Profit Drivers: Comparing Arbitrage Opportunities in Debt

Capital structure arbitrage generates profits by exploiting price discrepancies between a company's debt and equity securities, capitalizing on shifts in credit risk and capital structure inefficiencies. Relative value arbitrage focuses on identifying mispricings within similar debt instruments or sectors, benefiting from yield spreads and credit rating changes across comparable bonds. Both strategies rely heavily on credit analysis, but capital structure arbitrage often involves cross-asset insights, while relative value arbitrage emphasizes debt instrument correlation and sector-specific factors.

Instruments Used in Capital Structure vs Relative Value Arbitrage

Capital structure arbitrage primarily utilizes instruments such as corporate bonds, convertible bonds, credit default swaps (CDS), and equity linked to the same issuer to exploit price inefficiencies within a company's capital structure. Relative value arbitrage employs a broader range of instruments including equities, bonds, options, futures, and swaps to capitalize on pricing discrepancies between related securities across different companies or sectors. The focus in capital structure arbitrage is on mispricings between debt and equity of a single issuer, whereas relative value arbitrage targets valuation gaps between securities with similar risk profiles in the broader market.

Case Studies: Successful Debt Arbitrage Strategies

Capital structure arbitrage exploits mispricings between different securities of the same company, such as bonds and equity, to profit from convergence in their values. Relative value arbitrage identifies pricing inefficiencies between correlated debt instruments across companies or sectors. Case studies reveal that firms like Millennium Management and Citadel have successfully implemented these strategies by leveraging deep credit analysis and advanced quantitative models to capture risk-adjusted returns.

Future Trends in Debt Arbitrage: Capital Structure vs Relative Value

Future trends in debt arbitrage emphasize increasing integration of artificial intelligence and machine learning to enhance predictive accuracy in capital structure arbitrage strategies, leveraging complex debt and equity instrument interactions. Relative value arbitrage is evolving with advanced data analytics that enable more precise identification of mispricings in credit spreads and bond valuations across various sectors and geographies. The growth of ESG-linked debt and regulatory changes will further shape capital structure and relative value arbitrage, driving market participants to develop innovative risk management models and dynamic portfolio optimization techniques.

Important Terms

Credit Spread Differential

Credit spread differentials in capital structure arbitrage exploit pricing inefficiencies between a company's debt and equity securities, whereas relative value arbitrage focuses on broader market mispricings across correlated assets.

Convertible Bond Arbitrage

Convertible bond arbitrage exploits pricing inefficiencies between a company's convertible bonds and its underlying equity, positioning it as a hybrid strategy intersecting capital structure arbitrage, which focuses on mispricings across different securities within the same company's capital structure, and relative value arbitrage, which seeks to profit from valuation disparities between related financial instruments.

Capital Structure Hierarchy

Capital structure hierarchy prioritizes debt over equity claims, enabling capital structure arbitrage to exploit pricing inefficiencies between different securities within the same issuer, unlike relative value arbitrage which focuses on price discrepancies across different issuers or sectors.

CDS-Bond Basis Trade

CDS-bond basis trade exploits pricing discrepancies between credit default swaps and corporate bonds, serving as a form of capital structure arbitrage by targeting mispricings within a company's capital structure rather than pure relative value arbitrage across different issuers.

Subordination Risk

Subordination risk in capital structure arbitrage arises from the hierarchical priority of debt claims, where junior debt holders face higher default exposure compared to senior creditors, impacting the arbitrage spread between different tranches. Relative value arbitrage focuses on mispricings across similar securities without extensive credit hierarchy analysis, making subordination risk less critical in its strategy.

Cross-Asset Relative Value

Cross-Asset Relative Value leverages discrepancies across different asset classes by exploiting capital structure arbitrage strategies that target mispricings within a company's debt and equity versus broader relative value arbitrage focusing on price inefficiencies between related securities.

Debt Seniority Swap

Debt seniority swaps enable investors to exploit capital structure arbitrage by exchanging debt tranches of varying seniority to capture mispricings between secured and unsecured claims, complementing relative value arbitrage strategies focused on pricing inefficiencies across related securities.

Leverage Ratio Dislocation

Leverage ratio dislocation occurs when discrepancies in leverage metrics create inefficiencies between capital structure arbitrage and relative value arbitrage strategies. Capital structure arbitrage focuses on exploiting mispricings between debt and equity within the same company, while relative value arbitrage seeks opportunities across similar securities or sectors, both affected by distortions in leverage ratios that impact risk assessment and pricing models.

Inter-creditor Arbitrage

Inter-creditor arbitrage exploits pricing inefficiencies between different debt tranches within a company's capital structure, focusing on capital structure arbitrage to capitalize on credit risk discrepancies among senior and subordinated debt. Relative value arbitrage encompasses broader strategies comparing credit instruments across different issuers or markets, whereas inter-creditor arbitrage specifically targets mispricings arising from contractual rights and priority differences within a single issuer's credit hierarchy.

Structural Alpha Extraction

Structural alpha extraction focuses on exploiting inefficiencies in a firm's capital structure by identifying mispricings between debt and equity securities, distinguishing it from traditional relative value arbitrage which targets price discrepancies across similar asset classes. Capital structure arbitrage strategies specifically analyze credit spreads, bond covenants, and equity volatilities to capture alpha derived from the interplay between a company's liabilities and equity instruments.

capital structure arbitrage vs relative value arbitrage Infographic

moneydif.com

moneydif.com