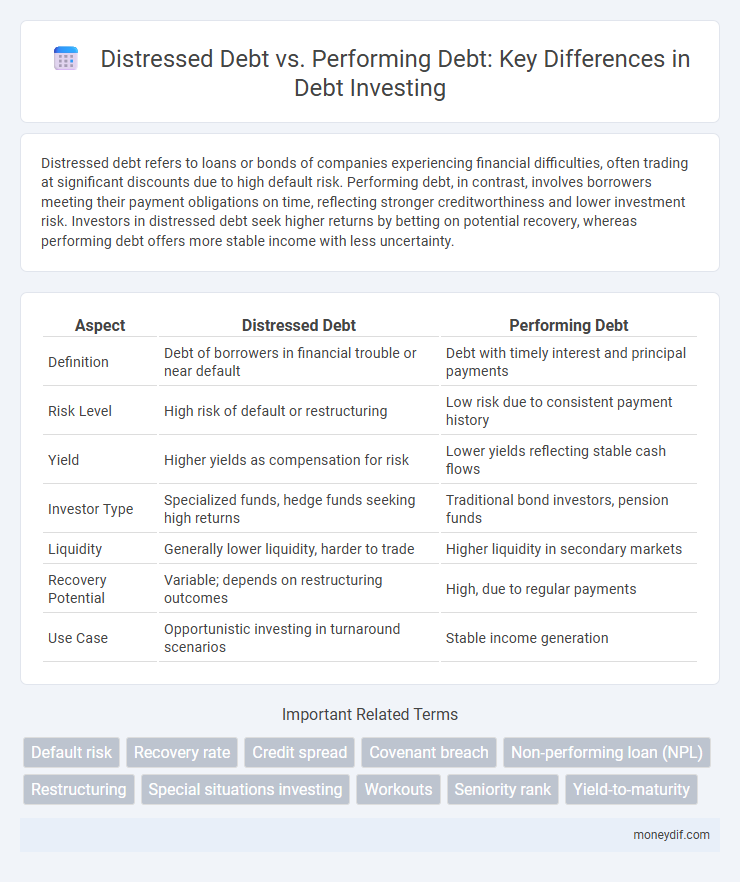

Distressed debt refers to loans or bonds of companies experiencing financial difficulties, often trading at significant discounts due to high default risk. Performing debt, in contrast, involves borrowers meeting their payment obligations on time, reflecting stronger creditworthiness and lower investment risk. Investors in distressed debt seek higher returns by betting on potential recovery, whereas performing debt offers more stable income with less uncertainty.

Table of Comparison

| Aspect | Distressed Debt | Performing Debt |

|---|---|---|

| Definition | Debt of borrowers in financial trouble or near default | Debt with timely interest and principal payments |

| Risk Level | High risk of default or restructuring | Low risk due to consistent payment history |

| Yield | Higher yields as compensation for risk | Lower yields reflecting stable cash flows |

| Investor Type | Specialized funds, hedge funds seeking high returns | Traditional bond investors, pension funds |

| Liquidity | Generally lower liquidity, harder to trade | Higher liquidity in secondary markets |

| Recovery Potential | Variable; depends on restructuring outcomes | High, due to regular payments |

| Use Case | Opportunistic investing in turnaround scenarios | Stable income generation |

Understanding Distressed Debt: Key Characteristics

Distressed debt refers to securities of companies experiencing financial distress, often trading at significant discounts due to high default risk and poor credit ratings. Key characteristics include elevated yield spreads, deteriorating cash flows, and limited recovery prospects compared to performing debt, which is serviced timely with stable credit profiles. Investors analyzing distressed debt prioritize factors like restructuring potential and legal protections to gauge investment viability.

Defining Performing Debt in Corporate Finance

Performing debt in corporate finance refers to loans or bonds where the borrower meets all scheduled payments of principal and interest on time, maintaining favorable credit status and financial stability. This type of debt reflects the company's ability to generate sufficient cash flow to service liabilities without default risks, often resulting in lower yields due to reduced investment risk. Investors prioritize performing debt for predictable income streams and lower credit risk profiles compared to distressed debt, which involves borrowers facing financial difficulties and potential defaults.

Major Differences Between Distressed Debt and Performing Debt

Distressed debt refers to loans or bonds of companies facing financial difficulties, often trading below their face value due to default risk, whereas performing debt represents obligations being met with timely interest and principal payments. Key differences include credit risk levels, recovery prospects, and market liquidity, with distressed debt carrying higher risks but potentially greater returns through restructuring or workouts. Investors in distressed debt often require specialized knowledge and active management, contrasting with the more stable and predictable nature of performing debt investments.

Risk and Return Profiles: Distressed vs Performing Debt

Distressed debt carries significantly higher risk due to the issuer's financial instability and potential default, often resulting in substantial price volatility and credit losses. Performing debt offers lower risk, as issuers maintain timely interest and principal payments, leading to more predictable cash flows and stable returns. Investors in distressed debt seek higher yields as compensation for elevated risk, whereas performing debt typically provides moderate returns aligned with lower credit risk.

How Investors Approach Distressed and Performing Debt

Investors approach distressed debt by conducting rigorous credit analysis to identify opportunities for significant returns through restructuring or recovery processes, often accepting higher risks compared to performing debt. In contrast, performing debt attracts investors seeking stable cash flows and lower default risk, favoring predictable interest payments and steady income streams. Portfolio diversification typically involves balancing distressed debt for growth potential and performing debt for consistency and risk mitigation.

Legal Implications in Distressed Debt Investment

Distressed debt investments involve purchasing debt securities of financially troubled companies, which carry significant legal complexities such as default risk, bankruptcy proceedings, and creditor rights enforcement. Investors must navigate restructuring negotiations, potential litigation, and the priority of claims within insolvency frameworks to protect their interests. Understanding jurisdiction-specific insolvency laws and contractual provisions in debt agreements is crucial for mitigating risks and maximizing recovery potential.

Valuation Techniques for Distressed Debt vs Performing Debt

Valuation techniques for distressed debt primarily rely on discounted cash flow analysis adjusted for high default risk, incorporating recovery rates and restructuring probabilities, whereas performing debt valuation focuses on stable cash flow projections discounted by market interest rates reflecting current credit risk. Distressed debt valuation often requires scenario analysis and Monte Carlo simulations to account for uncertain outcomes, contrasting with performing debt's reliance on steady amortization schedules and yield spreads. Market-based methods, such as comparable trades and credit default swap spreads, provide additional calibration for both asset types but carry greater volatility and complexity in distressed situations.

Role of Credit Ratings in Debt Classification

Credit ratings play a critical role in distinguishing distressed debt from performing debt by providing an objective assessment of credit risk and issuer's financial health. Performing debt typically holds higher credit ratings such as investment-grade grades, indicating timely interest and principal payments, while distressed debt carries lower ratings or is rated below investment grade, signaling elevated default risk. Investors and financial institutions rely on these ratings to classify debt accurately, manage portfolios, and make informed lending or investment decisions.

Market Opportunities and Challenges in Distressed vs Performing Debt

Distressed debt offers unique market opportunities with higher yield potential and discounted entry points, appealing to investors willing to navigate elevated credit risk and legal complexities. Performing debt, characterized by regular payments and lower default risk, provides stable returns but typically lower yields, limiting upside potential. Market challenges in distressed debt include valuation uncertainty and liquidity constraints, whereas performing debt faces challenges related to interest rate fluctuations and economic cycles impacting borrower creditworthiness.

Impact on Corporate Restructuring and Recovery

Distressed debt often signals severe financial distress, prompting urgent corporate restructuring to avoid bankruptcy and stabilize cash flow. Performing debt reflects manageable obligations, enabling companies to focus on growth rather than restructuring. Effective management of distressed debt can facilitate recovery by renegotiating terms, reducing liabilities, and restoring operational viability.

Important Terms

Default risk

Default risk significantly increases in distressed debt compared to performing debt due to the borrower's deteriorating financial condition and missed payment schedules. Performing debt typically exhibits lower default risk as regular principal and interest payments indicate ongoing creditworthiness and financial stability.

Recovery rate

Recovery rates on distressed debt average between 30% to 50% of the original loan value, significantly lower than performing debt, which typically sees recovery rates above 90%. Factors influencing these rates include collateral quality, bankruptcy proceedings, and market conditions impacting asset liquidation in distressed situations.

Credit spread

Credit spreads for distressed debt typically widen significantly compared to performing debt, reflecting higher default risk and lower market liquidity.

Covenant breach

Covenant breaches in distressed debt often trigger accelerated repayment and restructuring, whereas performing debt maintains compliance, preserving favorable credit terms and investor confidence.

Non-performing loan (NPL)

Non-performing loans (NPLs) represent distressed debt where borrowers fail to make scheduled payments for 90 days or more, contrasting with performing debt that maintains regular repayment schedules. High NPL ratios indicate financial instability in lending institutions, reflecting increased credit risk and potential losses on distressed assets.

Restructuring

Restructuring distressed debt involves renegotiating terms to avoid default, whereas performing debt restructuring optimizes cash flow and enhances borrower creditworthiness without signs of financial distress.

Special situations investing

Special situations investing focuses on distressed debt opportunities that offer higher risk-adjusted returns compared to performing debt due to financial or operational challenges in the issuer.

Workouts

Workouts in distressed debt involve restructuring or renegotiating terms to recover value, whereas performing debt requires routine management to ensure consistent payments and credit quality.

Seniority rank

Seniority rank determines the repayment priority of creditors, with distressed debt holders often occupying lower ranks than performing debt holders, increasing their risk exposure and potential recovery variability.

Yield-to-maturity

Yield-to-maturity (YTM) for distressed debt is significantly higher than for performing debt, reflecting increased risk and potential default, which investors price as a discount to par value. Performing debt typically has a lower YTM aligned with stable credit conditions, while distressed debt YTM incorporates uncertainty in cash flows and probable restructuring outcomes.

distressed debt vs performing debt Infographic

moneydif.com

moneydif.com