Secured debt requires collateral, such as a house or car, which lenders can claim if the borrower defaults, reducing the lender's risk and often resulting in lower interest rates. Unsecured debt, including credit cards and personal loans, lacks collateral, making it riskier for lenders and typically leading to higher interest rates and stricter approval criteria. Understanding the differences between secured and unsecured debt helps borrowers choose the best financing option for their financial situation.

Table of Comparison

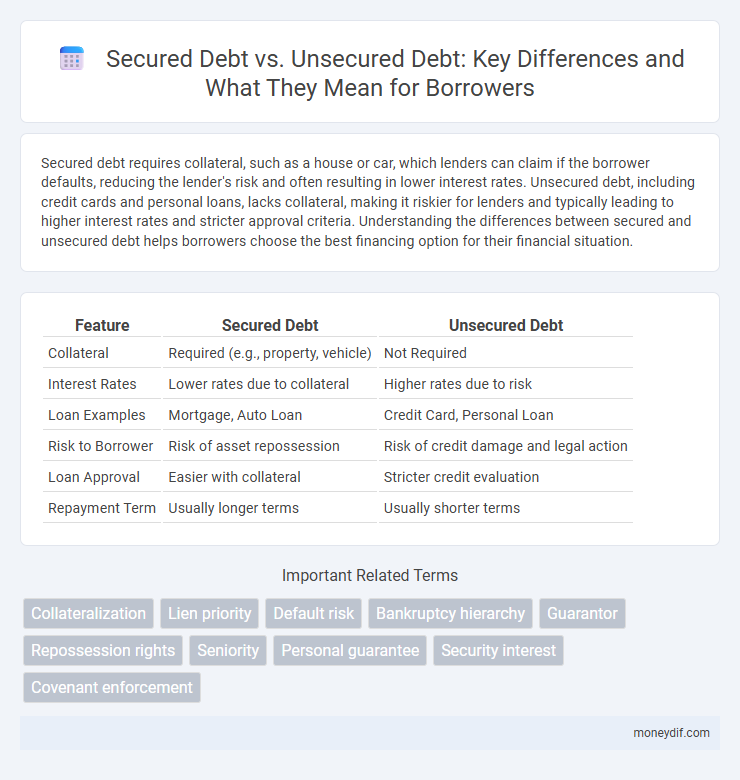

| Feature | Secured Debt | Unsecured Debt |

|---|---|---|

| Collateral | Required (e.g., property, vehicle) | Not Required |

| Interest Rates | Lower rates due to collateral | Higher rates due to risk |

| Loan Examples | Mortgage, Auto Loan | Credit Card, Personal Loan |

| Risk to Borrower | Risk of asset repossession | Risk of credit damage and legal action |

| Loan Approval | Easier with collateral | Stricter credit evaluation |

| Repayment Term | Usually longer terms | Usually shorter terms |

Understanding Secured Debt: Definition and Key Features

Secured debt is a type of loan backed by collateral, such as property or assets, which reduces the lender's risk and typically results in lower interest rates. Key features include the lender's right to seize the collateral if the borrower defaults, providing a legal claim to recover the debt. Common examples of secured debt are mortgages, auto loans, and secured credit cards, distinguishing them clearly from unsecured debt, which lacks asset backing.

What Is Unsecured Debt? Main Characteristics Explained

Unsecured debt is a type of borrowing that does not require collateral, meaning creditors have no specific asset to claim if the borrower defaults. Common examples include credit card debt, medical bills, and student loans, which typically carry higher interest rates due to increased lender risk. The main characteristics of unsecured debt include reliance on the borrower's creditworthiness, potential impact on credit score if unpaid, and generally shorter repayment terms compared to secured debt.

Secured Debt vs Unsecured Debt: Core Differences

Secured debt requires collateral, such as a home or vehicle, which lenders can claim if the borrower defaults, reducing the lender's risk and often leading to lower interest rates. Unsecured debt lacks collateral, relying solely on the borrower's creditworthiness, resulting in higher interest rates and increased risk for lenders. The fundamental difference lies in the presence or absence of asset backing, directly impacting repayment terms, creditor recovery options, and lending criteria.

Risks and Benefits of Secured Debt

Secured debt involves borrowing backed by collateral, which lowers the lender's risk and often results in lower interest rates for the borrower. The primary benefit is access to larger loan amounts and potentially better terms, while the major risk includes the loss of assets if loan payments are missed. Borrowers should carefully evaluate the value of the collateral and their ability to meet repayment obligations before committing to secured debt.

Advantages and Disadvantages of Unsecured Debt

Unsecured debt offers the advantage of not requiring collateral, making it more accessible to borrowers without assets. This type of debt typically has higher interest rates and stricter credit requirements, increasing overall borrowing costs and risk for lenders. Lack of collateral also means that default often leads to legal action or damage to credit scores rather than seizure of assets.

Common Examples of Secured Debt

Common examples of secured debt include mortgage loans, auto loans, and home equity lines of credit (HELOCs), where the borrower pledges collateral such as real estate or a vehicle to secure the debt. Secured debts typically offer lenders less risk, resulting in lower interest rates compared to unsecured debts like credit cards or personal loans. In the event of default, lenders can repossess or foreclose on the collateral to recover the outstanding loan balance.

Common Examples of Unsecured Debt

Common examples of unsecured debt include credit card balances, medical bills, personal loans, and utility bills. These debts lack collateral, meaning lenders cannot claim specific assets if borrowers default. Interest rates on unsecured debt tend to be higher due to increased risk for lenders.

Impact on Credit Score: Secured vs Unsecured Debt

Secured debt, backed by collateral such as a house or car, often has a more positive impact on credit scores when payments are made on time, as it lowers the lender's risk and enhances creditworthiness. Unsecured debt, including credit cards and personal loans, typically carries higher interest rates and missed payments can lead to deeper credit score declines due to the lack of collateral protection. Maintaining timely payments on both secured and unsecured debts is crucial, but the presence of secured debt generally contributes to a stronger credit profile and improved credit utilization ratios.

Which is Better for Borrowers: Secured or Unsecured Debt?

Secured debt offers lower interest rates and higher borrowing limits due to collateral, making it more affordable and accessible for borrowers with assets. Unsecured debt lacks collateral but provides more flexibility and less risk of asset loss, suited for borrowers without valuable property or who prefer not to tie assets to loans. For borrowers prioritizing cost and larger loans, secured debt is better, while those seeking flexibility and minimal risk prefer unsecured debt.

How to Choose: Factors to Consider Between Secured and Unsecured Debt

Choosing between secured and unsecured debt depends on factors such as interest rates, collateral availability, and risk tolerance. Secured debt often offers lower interest rates due to asset backing but poses a risk of losing collateral upon default. Unsecured debt carries higher interest rates without collateral requirements, making it suitable for borrowers with strong credit who prefer less risk to personal assets.

Important Terms

Collateralization

Collateralization involves pledging specific assets to secure a loan, reducing lender risk and typically resulting in lower interest rates for secured debt compared to unsecured debt, which relies solely on the borrower's creditworthiness without asset backing. Secured debt often includes mortgages and auto loans where collateral can be repossessed upon default, whereas unsecured debt, such as credit cards and personal loans, generally carries higher interest rates due to increased lender risk.

Lien priority

Secured debt takes priority over unsecured debt in lien claims because it is backed by collateral ensuring repayment.

Default risk

Default risk tends to be lower for secured debt because it is backed by collateral, reducing potential losses for lenders in case of borrower default. Unsecured debt carries higher default risk since it lacks asset backing, making recovery more difficult and often leading to higher interest rates.

Bankruptcy hierarchy

In bankruptcy hierarchy, secured debt holds a superior claim over unsecured debt, as secured creditors have collateral backing their claims, allowing them priority in repayment from the liquidation proceeds. Unsecured creditors rank lower and are typically repaid only after secured debts and administrative expenses have been satisfied, often receiving partial or no recovery depending on asset availability.

Guarantor

A guarantor provides a legal commitment to repay secured debt with collateral or unsecured debt without collateral, increasing lender confidence and reducing default risk.

Repossession rights

Repossession rights apply primarily to secured debt, allowing lenders to reclaim collateral upon borrower default, while unsecured debt lacks such rights, leaving creditors to pursue other collection methods like lawsuits or wage garnishment. Secured creditors hold a legal claim to specific assets, enhancing their recovery prospects compared to unsecured creditors who depend on debtor repayment without asset backing.

Seniority

Seniority in debt prioritizes secured debt holders over unsecured debt holders, ensuring secured creditors have first claim on assets during liquidation.

Personal guarantee

A personal guarantee is a legal commitment by an individual to repay a debt if the primary borrower defaults, often used in unsecured debt agreements where no collateral exists. In contrast, secured debt is backed by assets, reducing the lender's risk and typically not requiring a personal guarantee since the collateral can be seized to satisfy the debt.

Security interest

A security interest grants a creditor a legal claim on collateral in secured debt, reducing lender risk compared to unsecured debt, which lacks such collateral and relies solely on the debtor's creditworthiness.

Covenant enforcement

Covenant enforcement plays a critical role in secured debt by providing lenders legal rights to specific collateral if financial terms are violated, ensuring priority repayment over unsecured debt holders who typically have limited recourse in default situations. Secured debt covenants often impose stricter financial ratios and operational restrictions, enhancing lender protection compared to unsecured debt, which relies primarily on borrower creditworthiness and carries higher risk exposure.

secured debt vs unsecured debt Infographic

moneydif.com

moneydif.com