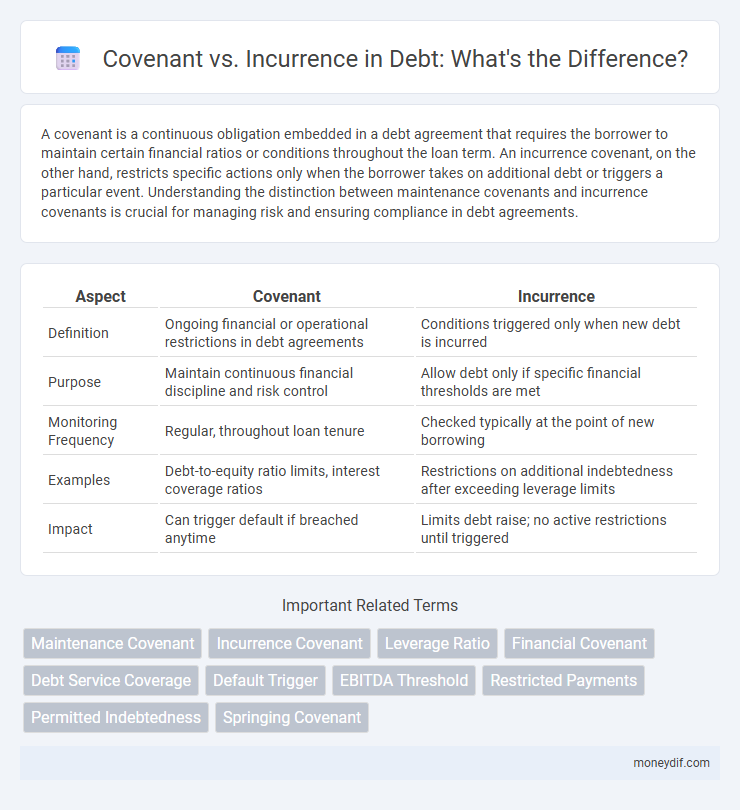

A covenant is a continuous obligation embedded in a debt agreement that requires the borrower to maintain certain financial ratios or conditions throughout the loan term. An incurrence covenant, on the other hand, restricts specific actions only when the borrower takes on additional debt or triggers a particular event. Understanding the distinction between maintenance covenants and incurrence covenants is crucial for managing risk and ensuring compliance in debt agreements.

Table of Comparison

| Aspect | Covenant | Incurrence |

|---|---|---|

| Definition | Ongoing financial or operational restrictions in debt agreements | Conditions triggered only when new debt is incurred |

| Purpose | Maintain continuous financial discipline and risk control | Allow debt only if specific financial thresholds are met |

| Monitoring Frequency | Regular, throughout loan tenure | Checked typically at the point of new borrowing |

| Examples | Debt-to-equity ratio limits, interest coverage ratios | Restrictions on additional indebtedness after exceeding leverage limits |

| Impact | Can trigger default if breached anytime | Limits debt raise; no active restrictions until triggered |

Understanding Debt Covenants vs. Incurrence Covenants

Debt covenants impose ongoing obligations or restrictions on borrowers to maintain certain financial metrics or operational limits. Incurrence covenants, by contrast, trigger specific restrictions only when the borrower takes particular actions, such as incurring additional debt. Understanding the distinction helps creditors monitor risk continuously via maintenance covenants while controlling borrower behavior at key transaction points through incurrence covenants.

Key Differences Between Covenant and Incurrence Debt Structures

Covenant debt structures impose ongoing restrictions or financial ratios that borrowers must maintain throughout the loan term, ensuring continuous lender control and risk mitigation. Incurrence debt structures, in contrast, allow borrowers to take on additional debt only if specific financial tests are met at the time of incurrence, offering more flexibility but less continuous oversight. The key difference lies in the timing and nature of restrictions: covenants monitor borrower behavior continuously, while incurrence clauses trigger limitations only upon new debt issuance.

Advantages of Covenant-Lite Debt

Covenant-lite debt offers borrowers greater flexibility by reducing restrictive financial covenants, minimizing the risk of default technicalities. This structure enhances access to capital for companies with volatile cash flows or transitional phases by lowering the likelihood of covenant breaches. Investors benefit from potentially higher yields due to increased risk tolerance embedded in covenant-lite agreements.

Risks Associated with Incurrence-Based Covenants

Incurrence-based covenants pose higher financial risks because they permit increased debt or financial actions only when specific conditions are met, potentially leading to sudden leverage spikes. Unlike maintenance covenants, which require ongoing compliance, incurrence covenants allow borrowers to take on additional obligations that may strain cash flow or liquidity during adverse economic conditions. This conditional flexibility can delay risk signals, increasing default probability and complicating lenders' ability to manage credit exposure effectively.

When to Choose Covenant vs. Incurrence Debt

Choosing between covenant and incurrence debt depends on the borrower's risk tolerance and financial flexibility needs. Covenant debt imposes ongoing financial and operational restrictions, suitable for companies seeking discipline and creditor confidence during expansion phases. Incurrence debt only triggers restrictions upon taking further debt, ideal for businesses that want maximum operational freedom until a new borrowing event occurs.

Impact on Borrowers and Lenders

Covenant breaches can trigger immediate default, increasing risk for borrowers by restricting financial flexibility and potentially leading to accelerated repayment or penalties, while lenders gain enhanced protection through ongoing compliance monitoring. Incurrence covenants, activated only when specific financial actions occur, limit borrowers' ability to take on additional debt without lender approval, providing lenders with control over risk exposure at crucial decision points. Both covenant types shape borrowing capacity and risk management, influencing negotiation leverage and credit terms between borrowers and lenders.

Legal Implications of Covenant and Incurrence Structures

Covenant structures impose ongoing legal obligations on borrowers, requiring continuous compliance with specific financial metrics or operational limits, thereby affecting debt servicing capacity and triggering remediation clauses upon breaches. Incurrence structures, in contrast, restrict specific actions only at the time new debt is incurred, limiting borrower activities like additional borrowing or asset sales based on pre-established financial tests. Legal implications of covenants often lead to stricter lender control and potential acceleration of debt upon non-compliance, while incurrence tests provide flexibility but may increase risk exposure if triggered conditions are not meticulously monitored.

Common Examples in Corporate Finance

Common examples of covenants in corporate finance include debt-to-equity ratio restrictions, interest coverage requirements, and limitations on asset sales. Incurrence covenants typically involve specific triggers such as taking on new debt beyond a certain threshold or making large acquisitions. These mechanisms help lenders monitor credit risk and ensure borrowers maintain financial discipline.

Market Trends: Shift from Maintenance to Incurrence Covenants

Market trends reveal a decisive shift from maintenance covenants, which require ongoing financial performance thresholds, to incurrence covenants, triggered only by specific borrowing actions. This transition reflects lenders' preference for flexibility and borrowers' desire to avoid constant compliance monitoring, enhancing capital raising agility. Data from recent syndicated loans indicate over 70% adoption of incurrence covenants in new issuances, signaling an industry-wide pivot in debt covenant structuring.

Best Practices for Managing Covenant Compliance

Effective management of covenant compliance requires regular monitoring of key financial ratios and maintaining clear communication with lenders to anticipate potential breaches. Implementing automated tracking systems enhances accuracy and timeliness in reporting, ensuring early detection of covenant triggers. Establishing contingency plans for incurrence scenarios minimizes risks and supports proactive negotiation of covenant modifications.

Important Terms

Maintenance Covenant

The Maintenance Covenant requires borrowers to maintain specific financial ratios continuously throughout the loan term, ensuring ongoing creditworthiness; this contrasts with the Incurrence Covenant, which restricts certain actions only when borrowers seek to incur additional debt or undertake specific transactions. Lenders prefer Maintenance Covenants for proactive monitoring of financial health, while Incurrence Covenants offer flexibility by triggering restrictions solely upon new debt issuance or significant corporate events.

Incurrence Covenant

Incurrence covenants restrict specific financial actions or debt incurrences only upon triggering defined events, unlike general covenants which impose continuous obligations throughout the loan term.

Leverage Ratio

The leverage ratio in covenants measures a borrower's debt relative to earnings to restrict additional borrowing, while in incurrence tests it determines whether a specific transaction triggers covenant violations.

Financial Covenant

Financial covenants impose specific performance metrics on borrowers, while incurrence covenants restrict certain actions only if specified financial thresholds are breached.

Debt Service Coverage

Debt Service Coverage Ratio (DSCR) is a critical financial metric used to assess a borrower's ability to meet debt obligations from operating income, with covenant DSCR limits often set as ongoing financial maintenance requirements in loan agreements. Incurrence DSCR thresholds are typically tested only during specific events, such as new debt issuance or large acquisitions, triggering compliance assessments to prevent undue financial risk.

Default Trigger

Default triggers in covenants often distinguish between incurrence-based and maintenance-based covenants, with incurrence triggers activating only when a borrower takes specific actions like acquiring debt or making investments. This targeted approach enables lenders to monitor and respond to risk events linked to borrower decisions rather than ongoing financial ratios.

EBITDA Threshold

EBITDA threshold in covenants typically sets a minimum earnings level to maintain compliance, while in incurrence tests it determines whether specific financial actions or obligations can be undertaken.

Restricted Payments

Restricted Payments clauses limit a borrower's ability to make distributions or payments, typically requiring compliance with incurrence covenants that condition such payments on meeting specified financial ratios or other performance metrics.

Permitted Indebtedness

Permitted Indebtedness defines specific debt types allowed under a covenant without triggering a default, ensuring borrowers maintain compliance while incurring new liabilities. This distinction between covenant-restricted debt and incurrence tests allows flexibility in managing leverage ratios and financial covenants during financing activities.

Springing Covenant

Springing covenants activate only when a borrower incurs additional debt, distinguishing them from incurrence covenants that require compliance immediately upon debt issuance.

covenant vs incurrence Infographic

moneydif.com

moneydif.com