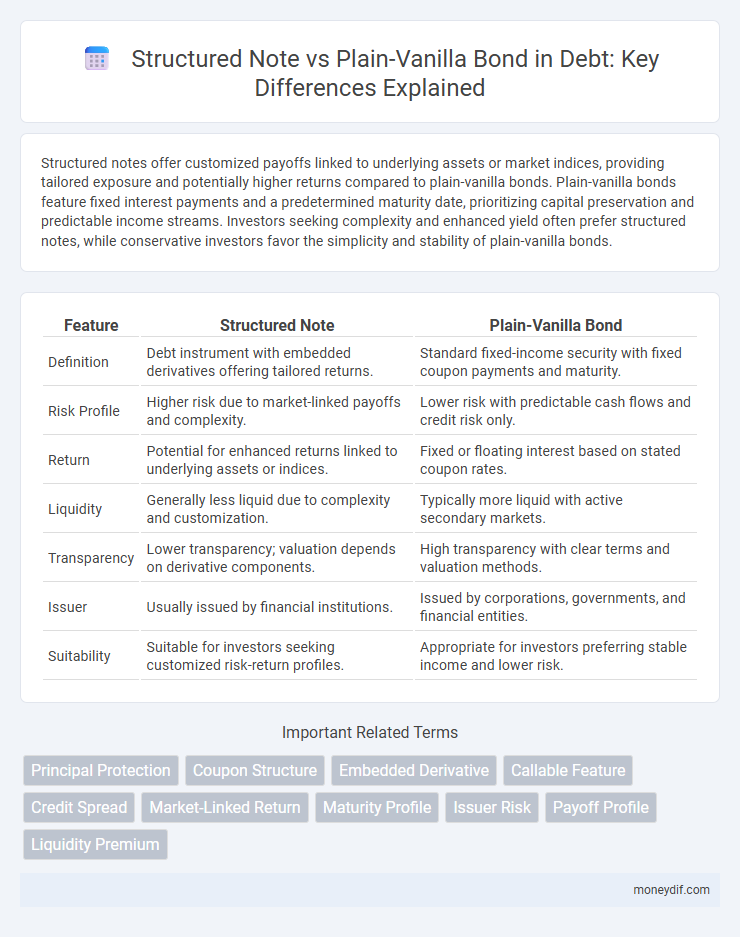

Structured notes offer customized payoffs linked to underlying assets or market indices, providing tailored exposure and potentially higher returns compared to plain-vanilla bonds. Plain-vanilla bonds feature fixed interest payments and a predetermined maturity date, prioritizing capital preservation and predictable income streams. Investors seeking complexity and enhanced yield often prefer structured notes, while conservative investors favor the simplicity and stability of plain-vanilla bonds.

Table of Comparison

| Feature | Structured Note | Plain-Vanilla Bond |

|---|---|---|

| Definition | Debt instrument with embedded derivatives offering tailored returns. | Standard fixed-income security with fixed coupon payments and maturity. |

| Risk Profile | Higher risk due to market-linked payoffs and complexity. | Lower risk with predictable cash flows and credit risk only. |

| Return | Potential for enhanced returns linked to underlying assets or indices. | Fixed or floating interest based on stated coupon rates. |

| Liquidity | Generally less liquid due to complexity and customization. | Typically more liquid with active secondary markets. |

| Transparency | Lower transparency; valuation depends on derivative components. | High transparency with clear terms and valuation methods. |

| Issuer | Usually issued by financial institutions. | Issued by corporations, governments, and financial entities. |

| Suitability | Suitable for investors seeking customized risk-return profiles. | Appropriate for investors preferring stable income and lower risk. |

Introduction to Structured Notes and Plain-Vanilla Bonds

Structured notes are hybrid debt securities combining traditional bonds with derivatives, designed to offer customized risk-return profiles based on underlying assets like equities, interest rates, or commodities. Plain-vanilla bonds are straightforward fixed-income instruments with predetermined interest payments and principal repayment at maturity, providing predictable cash flows to investors. Investors often choose structured notes for tailored exposure and enhanced yield potential, while plain-vanilla bonds prioritize simplicity and lower risk.

Key Features of Structured Notes

Structured notes combine debt instruments with derivatives to offer customized risk-return profiles, unlike plain-vanilla bonds that provide fixed interest payments and principal repayment. Key features include embedded options, potential for enhanced yields, and exposure to underlying assets such as equities, commodities, or interest rates. Investors benefit from tailored payoff structures but must consider higher complexity and credit risk associated with the issuer.

Core Characteristics of Plain-Vanilla Bonds

Plain-vanilla bonds feature fixed interest rates, predetermined maturity dates, and principal repayment at maturity, offering predictable cash flows and lower complexity compared to structured notes. These bonds are typically issued by governments or corporations to raise capital with straightforward terms and minimal embedded options. Their transparency and standardization make them highly liquid and suitable for risk-averse investors seeking stable income streams.

Risk and Return Profiles

Structured notes offer tailored risk-return profiles by embedding derivatives to enhance yield or provide downside protection, making them more complex and potentially riskier than plain-vanilla bonds. Plain-vanilla bonds provide fixed or predictable interest payments with lower credit and market risk, attracting conservative investors seeking steady income. Investors must weigh the higher return potential and embedded risks of structured notes against the simplicity and credit stability of traditional bonds.

Interest Payment Mechanisms

Structured notes offer customizable interest payment mechanisms often tied to the performance of underlying assets, allowing for variable or conditional coupons that can enhance yield or provide downside protection. In contrast, plain-vanilla bonds feature fixed or floating interest payments with predetermined schedules, providing straightforward and predictable cash flows for investors. The complexity of interest calculations in structured notes requires detailed analysis of embedded options and market factors, whereas plain-vanilla bonds prioritize simplicity and transparency in debt servicing.

Liquidity and Secondary Market Considerations

Structured notes typically exhibit lower liquidity compared to plain-vanilla bonds due to their complexity and bespoke features, which limit the pool of potential buyers in the secondary market. Plain-vanilla bonds benefit from standardized terms and widespread investor familiarity, resulting in higher trading volumes and tighter bid-ask spreads. Secondary market considerations are pivotal as structured notes may face price inefficiencies and wider spreads, impacting investors' ability to liquidate positions quickly.

Credit and Issuer Risk Comparison

Structured notes present higher issuer risk compared to plain-vanilla bonds due to their dependence on the creditworthiness of both the issuer and underlying reference assets. Plain-vanilla bonds typically offer greater transparency and lower credit risk since they represent straightforward debt obligations with fixed coupon payments. Investors in structured notes must assess complex credit exposures, including derivatives embedded in the notes, which can amplify default risk relative to traditional bonds.

Suitability for Different Investor Types

Structured notes offer customized payoff profiles suited for sophisticated investors seeking tailored risk-return strategies, incorporating derivatives to enhance income or hedge market exposure. Plain-vanilla bonds provide predictable fixed income and principal repayment, ideal for conservative investors prioritizing capital preservation and stable cash flows. Retail investors often prefer plain-vanilla bonds for simplicity, while institutional investors leverage structured notes for portfolio diversification and specific market views.

Regulatory and Tax Implications

Structured notes often carry complex regulatory classifications due to embedded derivatives, triggering stricter oversight from agencies like the SEC and requiring detailed disclosures under Dodd-Frank regulations. Plain-vanilla bonds typically benefit from clearer tax treatment, with interest income taxed as ordinary income and fewer compliance burdens. Investors should evaluate the potential for varied tax consequences and reporting requirements when considering structured notes versus traditional bonds.

Choosing Between Structured Notes and Plain-Vanilla Bonds

Investors selecting between structured notes and plain-vanilla bonds should consider risk tolerance, return expectations, and market conditions. Structured notes often offer customized payoffs linked to underlying assets but carry higher credit and liquidity risks compared to plain-vanilla bonds, which provide fixed interest payments and greater transparency. Evaluating credit ratings, maturity profiles, and payoff complexity helps optimize portfolio allocation in fixed-income investments.

Important Terms

Principal Protection

Principal protection in structured notes combines a fixed income element with derivative components to ensure the return of the initial investment at maturity, unlike plain-vanilla bonds that primarily rely on issuer creditworthiness for principal safety. Structured notes offer customizable exposure to market-linked returns while maintaining principal security, whereas plain-vanilla bonds provide predictable coupon payments without market-linked upside potential.

Coupon Structure

A structured note features a coupon linked to the performance of underlying assets or indices, offering customized payoffs, whereas a plain-vanilla bond provides fixed or floating coupon payments based solely on a predetermined interest rate.

Embedded Derivative

An embedded derivative in a structured note alters its risk profile by incorporating features like options or swaps, differentiating it significantly from a plain-vanilla bond that lacks such contingent components.

Callable Feature

The callable feature in structured notes allows issuers to redeem the security before maturity, providing flexibility to manage interest rate risk compared to plain-vanilla bonds, which typically have fixed terms without early redemption options. This embedded option affects the pricing, often resulting in higher yields for investors due to the reinvestment risk borne when the issuer exercises the call feature.

Credit Spread

Credit spread in structured notes typically exceeds that of plain-vanilla bonds due to embedded derivatives and additional credit risk components. Investors demand higher compensation for structured notes' complexity and potential cash flow variability compared to the straightforward coupon payments of plain-vanilla bonds.

Market-Linked Return

Market-linked returns in structured notes offer investors the potential for higher gains tied to the performance of underlying assets such as equity indices or commodities, unlike plain-vanilla bonds which provide fixed or variable interest payments with principal protection. Structured notes combine features of debt instruments and derivatives, enabling customized risk-return profiles, while plain-vanilla bonds prioritize capital preservation and predictable income streams without exposure to market fluctuations.

Maturity Profile

A structured note's maturity profile often includes variable or extended maturities tied to underlying assets, contrasting with the fixed, predetermined maturity of a plain-vanilla bond.

Issuer Risk

Issuer risk in structured notes is typically higher than in plain-vanilla bonds due to the embedded derivatives and complex payout structures that increase sensitivity to the issuer's creditworthiness.

Payoff Profile

Structured notes offer tailored payoff profiles combining principal protection and market-linked returns, whereas plain-vanilla bonds provide fixed interest payments with principal repayment at maturity.

Liquidity Premium

Structured notes often exhibit higher liquidity premiums than plain-vanilla bonds due to their complex features and lower market transparency, leading investors to demand greater compensation for reduced tradability.

structured note vs plain-vanilla bond Infographic

moneydif.com

moneydif.com