Syndicated debt involves multiple lenders pooling resources to provide a large loan, spreading risk and enabling borrowers to access significant capital. Bilateral debt is a one-to-one loan agreement between a single lender and borrower, allowing for more tailored and flexible terms. Choosing between syndicated and bilateral debt depends on the borrower's financing needs, risk tolerance, and the complexity of the loan structure.

Table of Comparison

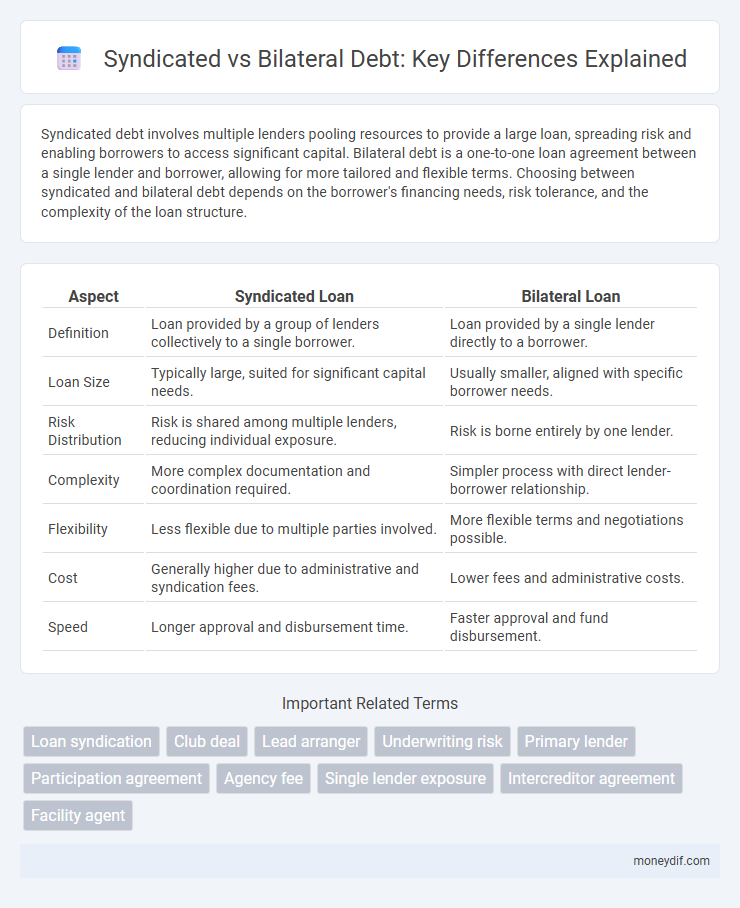

| Aspect | Syndicated Loan | Bilateral Loan |

|---|---|---|

| Definition | Loan provided by a group of lenders collectively to a single borrower. | Loan provided by a single lender directly to a borrower. |

| Loan Size | Typically large, suited for significant capital needs. | Usually smaller, aligned with specific borrower needs. |

| Risk Distribution | Risk is shared among multiple lenders, reducing individual exposure. | Risk is borne entirely by one lender. |

| Complexity | More complex documentation and coordination required. | Simpler process with direct lender-borrower relationship. |

| Flexibility | Less flexible due to multiple parties involved. | More flexible terms and negotiations possible. |

| Cost | Generally higher due to administrative and syndication fees. | Lower fees and administrative costs. |

| Speed | Longer approval and disbursement time. | Faster approval and fund disbursement. |

Overview of Syndicated and Bilateral Debt

Syndicated debt involves multiple lenders jointly providing a single loan, dispersing risk and enabling larger financing amounts, often used by corporations for significant capital needs. Bilateral debt consists of a direct loan agreement between one borrower and one lender, offering simpler negotiation and faster execution suited for smaller financing requirements. Syndicated loans typically feature more complex structures and higher costs due to multiple parties, while bilateral loans maintain straightforward terms and closer lender-borrower relationships.

Key Differences Between Syndicated and Bilateral Loans

Syndicated loans involve multiple lenders pooling funds to provide a large loan to a single borrower, spreading risk and requiring a lead arranger to manage the process. Bilateral loans feature a direct agreement between one borrower and one lender, offering more flexibility and quicker negotiation but concentrating risk on the single lender. Syndicated loans are typically used for high-value financing, while bilateral loans suit smaller, less complex borrowing needs.

Structure and Participants in Syndicated Debt

Syndicated debt involves multiple lenders pooling funds to provide a large loan, structured with a lead arranger who coordinates the agreement and manages communication between participants. Each lender in the syndicate holds a portion of the total loan, diversifying risk and enabling the borrower to access substantial capital. Participants typically include commercial banks, institutional investors, and sometimes alternative lenders, each contributing based on agreed terms and exposure limits.

Structure and Process of Bilateral Loans

Bilateral loans involve a direct lending relationship between a single borrower and one lender, simplifying negotiation and decision-making processes compared to syndicated loans. The structure is straightforward, typically involving one loan agreement, a single set of terms, and individualized covenants tailored to the borrower's credit profile. This streamlined process allows for faster approval and disbursement, with ongoing management handled solely by the lender, reducing complexity and administrative overhead.

Advantages of Syndicated Debt Financing

Syndicated debt financing offers advantages such as access to larger capital amounts by pooling funds from multiple lenders, which reduces the risk exposure for each participant. It enhances borrower creditworthiness through diversified lender participation and provides flexible repayment terms tailored to complex financial needs. This structure also enables streamlined loan management under a single agreement, facilitating more efficient coordination and communication.

Benefits and Limitations of Bilateral Debt

Bilateral debt offers streamlined communication and faster decision-making between a single lender and borrower, enhancing flexibility in loan terms and modifications. However, it carries limited funding capacity compared to syndicated debt, potentially restricting large financing needs and exposing the borrower to higher concentration risk. The simplicity of bilateral loans suits smaller or medium-sized enterprises seeking tailored credit solutions without the complexities of multiple lender coordination.

Risks Associated with Syndicated vs Bilateral Debt

Syndicated debt involves multiple lenders, increasing complexity and coordination risks compared to bilateral debt, which has a single lender relationship. The risk of information asymmetry and miscommunication is higher in syndicated loans, potentially leading to disagreements on terms or restructuring. Bilateral debt offers more flexibility and faster decision-making but lacks risk diversification that syndicated loans provide.

Use Cases: When to Choose Syndicated Over Bilateral Debt

Syndicated debt is ideal for large-scale projects requiring substantial capital infusion, such as infrastructure or corporate acquisitions, where risk is distributed among multiple lenders. Bilateral debt suits smaller enterprises or straightforward financing needs, offering faster negotiation and customized terms with a single lender. Companies pursuing expansion with complex cash flow patterns often prefer syndicated loans due to the flexibility and shared underwriting burden.

Documentation and Legal Considerations

Syndicated loan agreements require complex documentation involving multiple lenders with detailed intercreditor arrangements and consistent legal frameworks to manage shared risk and repayment terms. Bilateral loans feature simpler, customized agreements between borrower and a single lender, allowing for more flexible and streamlined documentation with direct negotiation of covenants and conditions. Legal considerations in syndicated loans emphasize coordination among diverse parties and ensuring enforceability across jurisdictions, whereas bilateral loans focus on tailored terms and quicker legal processes.

Market Trends in Syndicated and Bilateral Lending

Syndicated lending has seen significant growth as large corporations seek sizable financing solutions, leveraging the collective capacity of multiple lenders to spread risk and increase loan amounts. Bilateral lending remains favored for smaller or mid-sized companies due to its simplicity, faster approval processes, and tailored borrower-lender relationships. Current market trends indicate a shift towards syndicated structures in infrastructure and leveraged finance sectors, while bilateral loans maintain strong relevance in middle-market and specialized financing.

Important Terms

Loan syndication

Loan syndication involves multiple lenders sharing a loan to spread risk, whereas bilateral loans are provided by a single lender directly to the borrower.

Club deal

A club deal involves multiple lenders collaborating to provide a single loan, combining features of syndicated financing's shared risk and bilateral loans' direct lender-borrower relationship.

Lead arranger

A lead arranger coordinates the financing structure and syndicates loans among multiple lenders, playing a central role in syndicated loans, which distribute risk across several financial institutions. In contrast, bilateral loans involve a single lender and borrower, where the lead arranger manages the direct lending relationship without the complexity of multiple parties.

Underwriting risk

Underwriting risk in syndicated loans involves multiple lenders sharing exposure, diluting individual risk through diversification, whereas bilateral loans concentrate underwriting risk on a single lender, increasing potential for substantial loss. Syndicated structures mitigate default impact by distributing credit risk across participants, while bilateral loans necessitate rigorous due diligence and capital allocation as the sole risk bearer.

Primary lender

A primary lender in syndicated loans coordinates multiple lenders, while in bilateral loans, the primary lender directly manages the entire loan without sharing.

Participation agreement

A participation agreement in syndicated loans outlines the terms under which multiple lenders share participation interests, whereas bilateral agreements involve direct, exclusive contracts between a single lender and borrower.

Agency fee

Agency fees in syndicated loans are typically shared among multiple lenders based on their participation, whereas bilateral loans involve a single lender who charges a direct agency fee for loan administration.

Single lender exposure

Single lender exposure in syndicated loans is typically lower per lender compared to bilateral loans due to risk-sharing among multiple lenders.

Intercreditor agreement

An intercreditor agreement defines the rights and priorities among lenders in syndicated loans, distinguishing the shared control and risk allocation from the typically singular control in bilateral loan agreements.

Facility agent

A facility agent manages communication and administration for syndicated loans, coordinating among multiple lenders, whereas bilateral loans involve a direct agreement between a single borrower and lender, eliminating the need for a facility agent.

syndicated vs bilateral Infographic

moneydif.com

moneydif.com