Bullet loans require repayment of the entire principal in one lump sum at maturity, while amortizing loans involve regular payments of both principal and interest over the loan term. Amortizing loans reduce the outstanding balance gradually, leading to lower risk for lenders and predictable monthly expenses for borrowers. Bullet loans offer short-term financing benefits but carry higher refinancing risk due to the large final payment.

Table of Comparison

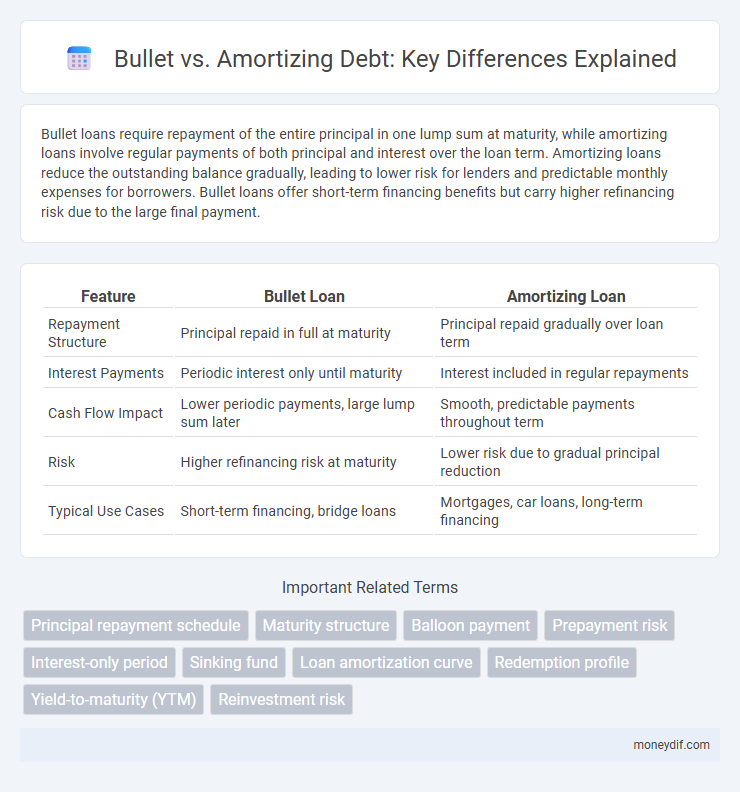

| Feature | Bullet Loan | Amortizing Loan |

|---|---|---|

| Repayment Structure | Principal repaid in full at maturity | Principal repaid gradually over loan term |

| Interest Payments | Periodic interest only until maturity | Interest included in regular repayments |

| Cash Flow Impact | Lower periodic payments, large lump sum later | Smooth, predictable payments throughout term |

| Risk | Higher refinancing risk at maturity | Lower risk due to gradual principal reduction |

| Typical Use Cases | Short-term financing, bridge loans | Mortgages, car loans, long-term financing |

Bullet vs Amortizing Debt: Key Differences Explained

Bullet debt requires the principal to be repaid in a single lump sum at maturity, resulting in lower periodic payments but higher risk at payoff. Amortizing debt involves regular principal and interest payments throughout the loan term, reducing outstanding balance steadily and lowering default risk. Investors and borrowers must weigh the cash flow flexibility of bullet loans against the predictable repayment schedule of amortizing debt.

Understanding Bullet Repayment Structures

Bullet repayment structures involve paying the entire principal amount at the end of the loan term, while interest payments are typically made periodically throughout the loan duration. This structure contrasts with amortizing loans, where principal and interest are paid in regular installments, gradually reducing the loan balance over time. Bullet loans are common in corporate debt and bonds, offering borrowers improved cash flow flexibility but requiring careful planning to manage the large lump-sum repayment at maturity.

Amortizing Loans: How They Work

Amortizing loans require regular payments that cover both principal and interest, reducing the loan balance progressively over time. Each installment includes a portion allocated to interest expense calculated on the outstanding principal, resulting in a declining interest component while the principal repayment portion increases. This structured repayment schedule provides borrowers with predictable payments and ensures the loan is fully paid off by the end of the term.

Pros and Cons of Bullet Repayment Methods

Bullet repayment methods offer the advantage of lower periodic payments since the principal is repaid in a lump sum at maturity, improving short-term cash flow management for borrowers. However, this approach carries higher risk due to the large final payment, which can lead to refinancing challenges or default if funds are unavailable. Lenders may impose higher interest rates to compensate for the increased risk associated with bullet loans, affecting overall borrowing costs.

Advantages of Amortizing Debt for Borrowers

Amortizing debt offers borrowers the advantage of predictable, fixed monthly payments that simplify budgeting and financial planning, reducing the risk of payment shock. Regular principal reduction decreases the outstanding balance over time, leading to lower interest costs compared to bullet loans, where the principal is repaid in a lump sum. This structure enhances creditworthiness by demonstrating consistent repayment, improving access to future financing options.

Bullet Loans: Risks and Considerations

Bullet loans require repayment of the entire principal in one lump sum at maturity, increasing the borrower's risk of default if cash flow is insufficient. These loans often carry higher interest rates to compensate lenders for concentrated repayment risk and can lead to refinancing challenges in volatile markets. Borrowers must carefully assess their liquidity and repayment strategies to avoid financial distress associated with bullet loan structures.

Amortizing Debt: Building Equity Over Time

Amortizing debt requires regular payments that cover both principal and interest, gradually reducing the total loan balance and building equity over time. Unlike bullet loans with lump-sum repayments, amortizing loans provide a predictable repayment schedule that helps borrowers steadily own more of their asset. This method is common in mortgages and auto loans, where consistent equity accumulation benefits long-term financial stability.

Suitability of Bullet vs Amortizing Debt for Businesses

Bullet debt suits businesses with strong short-term cash flow expecting large future inflows, as it requires interest-only payments until maturity. Amortizing debt benefits companies seeking steady cash outflows, reducing principal alongside interest to minimize long-term financial risk. Businesses with volatile revenues often prefer amortizing loans to avoid large single repayments, while stable firms anticipating asset sales or refinancing may opt for bullet structures.

Impact on Cash Flow: Bullet vs Amortizing Payments

Bullet loans require a single lump-sum payment at maturity, resulting in lower periodic cash outflows but a substantial cash burden at the end of the term. Amortizing loans spread principal and interest payments evenly over the loan term, creating consistent cash flow requirements and reducing risk of large terminal payments. Understanding these payment structures is crucial for managing operational cash flow and liquidity planning.

Choosing Between Bullet and Amortizing Structures

Choosing between bullet and amortizing debt structures depends on cash flow priorities and repayment capacity. Bullet loans require a lump-sum principal payment at maturity, benefiting borrowers seeking lower periodic payments and flexibility during the loan term. Amortizing loans involve regular principal and interest payments, reducing risk and providing predictable debt servicing schedules for enhanced financial planning.

Important Terms

Principal repayment schedule

A bullet principal repayment schedule requires a full repayment of the loan principal at maturity, whereas an amortizing schedule spreads principal repayments evenly over the loan term.

Maturity structure

The maturity structure of debt differs significantly between bullet loans, which require full principal repayment at maturity, and amortizing loans, which involve periodic principal payments reducing outstanding balance over time.

Balloon payment

A balloon payment is a large lump sum due at the end of a loan term, contrasting with amortizing loans where principal and interest are paid gradually through scheduled installments.

Prepayment risk

Prepayment risk is higher in bullet loans because borrowers can repay the entire principal early, unlike amortizing loans where scheduled principal repayments reduce exposure gradually.

Interest-only period

The interest-only period allows borrowers to pay only interest on the principal balance without reducing the loan amount, contrasting with amortizing loans where each payment covers both principal and interest, gradually decreasing the loan balance. Bullet loans require a lump-sum principal repayment at maturity, while amortizing loans fully pay off the principal by scheduled installments over the loan term.

Sinking fund

A sinking fund reduces default risk by regularly setting aside funds for amortizing bonds, whereas bullet bonds rely on a lump-sum repayment at maturity without periodic principal payments.

Loan amortization curve

A loan amortization curve visually represents the gradual repayment of principal over time, distinguishing amortizing loans that reduce both principal and interest through periodic payments from bullet loans where the principal is repaid in a lump sum at maturity. Understanding this curve helps borrowers and lenders analyze cash flow impact, interest savings, and risk profiles for amortizing versus bullet loan structures.

Redemption profile

A redemption profile detailed in bond agreements specifies whether the debt is repaid via bullet payment at maturity or through scheduled amortizing installments, impacting cash flow and refinancing risk management.

Yield-to-maturity (YTM)

Yield-to-maturity (YTM) measures the annual return on bonds, with bullet bonds paying principal in full at maturity and amortizing bonds gradually repaying principal over time, affecting their cash flow patterns and interest calculations.

Reinvestment risk

Reinvestment risk is higher in bullet bonds because investors receive a lump sum principal at maturity requiring reinvestment, unlike amortizing bonds, which return principal gradually and reduce exposure to reinvestment risk.

bullet vs amortizing Infographic

moneydif.com

moneydif.com