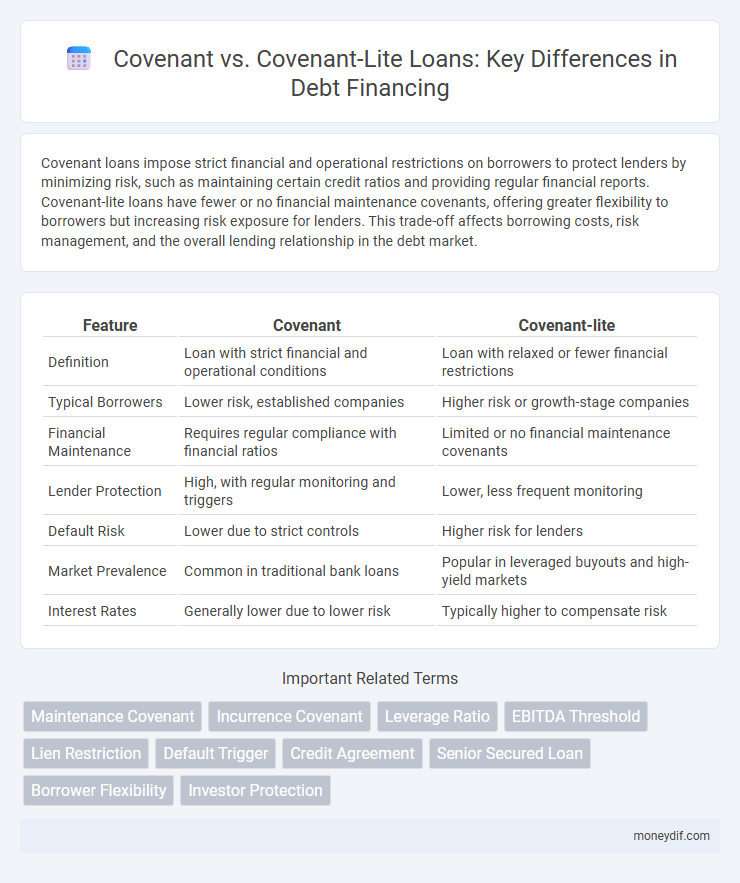

Covenant loans impose strict financial and operational restrictions on borrowers to protect lenders by minimizing risk, such as maintaining certain credit ratios and providing regular financial reports. Covenant-lite loans have fewer or no financial maintenance covenants, offering greater flexibility to borrowers but increasing risk exposure for lenders. This trade-off affects borrowing costs, risk management, and the overall lending relationship in the debt market.

Table of Comparison

| Feature | Covenant | Covenant-lite |

|---|---|---|

| Definition | Loan with strict financial and operational conditions | Loan with relaxed or fewer financial restrictions |

| Typical Borrowers | Lower risk, established companies | Higher risk or growth-stage companies |

| Financial Maintenance | Requires regular compliance with financial ratios | Limited or no financial maintenance covenants |

| Lender Protection | High, with regular monitoring and triggers | Lower, less frequent monitoring |

| Default Risk | Lower due to strict controls | Higher risk for lenders |

| Market Prevalence | Common in traditional bank loans | Popular in leveraged buyouts and high-yield markets |

| Interest Rates | Generally lower due to lower risk | Typically higher to compensate risk |

Understanding Debt Covenants: An Overview

Debt covenants are contractual clauses in loan agreements that impose specific financial and operational requirements on borrowers to protect lenders' interests. Traditional covenants typically include strict financial ratios and restrictions on additional borrowing, asset sales, or dividend payments, ensuring borrower discipline and reducing default risk. Covenant-lite loans, by contrast, feature fewer or less restrictive covenants, offering borrowers greater flexibility but increasing risk for lenders due to reduced oversight on financial performance and behavior.

What Are Covenant-Lite Loans?

Covenant-lite loans are a type of debt financing that offers fewer restrictions and protections for lenders compared to traditional covenant loans. These loans typically lack maintenance covenants, which require borrowers to meet specific financial ratios regularly, making them riskier for investors. Covenant-lite structures are popular in leveraged buyouts and high-yield markets where borrower flexibility is prioritized.

Key Differences Between Traditional Covenants and Covenant-Lite

Traditional covenants in debt agreements impose strict financial maintenance requirements and affirmative or negative covenants aimed at protecting lenders by limiting borrower risk-taking and ensuring timely repayment. Covenant-lite loans significantly relax or eliminate these maintenance covenants, offering borrowers greater flexibility with fewer restrictions but increasing risk exposure for lenders due to reduced monitoring and control. Key differences include the presence of quarterly financial tests in traditional covenants versus the absence or minimal financial covenants in covenant-lite structures, impacting default triggers and lender safeguards.

The Evolution of Debt Covenants in Modern Lending

Debt covenants have evolved from strict financial maintenance tests and performance triggers to more flexible covenant-lite structures that reduce borrower constraints and increase lender risk exposure. Covenant-lite loans typically omit traditional incurrence covenants, allowing borrowers greater operational freedom while posing challenges for early default detection. This shift reflects changing market dynamics and investor preferences, highlighting the tension between risk control and competitive lending practices in modern finance.

Pros and Cons of Strict Debt Covenants

Strict debt covenants impose rigorous financial and operational restrictions on borrowers, enhancing lender protection by minimizing default risk and aligning borrower behavior with creditor interests. These covenants can restrict a company's flexibility to pursue strategic initiatives or restructure debt, potentially hindering growth and agility during economic downturns. While strict debt covenants ensure disciplined financial management, they may increase the risk of technical defaults and limit the borrower's ability to respond to market opportunities effectively.

Borrower Advantages with Covenant-Lite Loans

Covenant-lite loans offer borrowers greater flexibility by reducing restrictive financial maintenance covenants, allowing more freedom to manage operations and capital allocation without frequent lender intervention. These loans minimize the risk of technical defaults by loosening covenants related to leverage ratios, interest coverage, and asset sales, thereby enhancing borrowers' ability to pursue growth opportunities and restructuring options. Borrowers benefit from streamlined negotiation processes and lower compliance costs, improving cash flow management and strategic decision-making.

Risks to Lenders: Covenant vs Covenant-Lite Structures

Covenant agreements impose strict financial and operational requirements on borrowers, providing lenders with early warning signals and enforcement rights that mitigate credit risk. Covenant-lite loans lack these protective covenants, increasing lender exposure to default risk due to less restrictive terms and reduced ability to monitor borrower performance. This structural difference elevates the probability of loss severity in covenant-lite deals, particularly under economic stress or deteriorating borrower credit quality.

Market Trends: Increasing Popularity of Covenant-Lite Loans

The market trend shows a significant rise in covenant-lite loans, reflecting lenders' growing tolerance for fewer borrower restrictions in debt agreements. Covenant-lite loans, which impose minimal financial covenants, have gained popularity in leveraged loan markets, particularly in private equity-sponsored transactions. This shift is driven by strong investor demand and competitive financing environments, resulting in looser protections for creditors compared to traditional covenant loans.

Impact of Covenant Types on Loan Pricing and Terms

Covenant loans impose strict financial and operational requirements, resulting in lower interest rates and tighter control for lenders due to reduced risk. Covenant-lite loans offer fewer restrictions, leading to higher borrowing costs and increased risk exposure for lenders, who compensate by charging premiums or demanding other concessions. The divergence in covenant structures directly influences loan pricing, with covenant-lite structures typically associated with elevated yields and more flexible terms for borrowers.

Choosing the Right Covenant Structure for Your Debt Financing

Choosing the right covenant structure for your debt financing depends on balancing lender protection with borrower flexibility. Traditional covenants impose stricter financial and operational restrictions, enhancing creditor security but potentially limiting business agility. Covenant-lite loans offer fewer restrictions, appealing to borrowers seeking growth adaptability but may carry higher risk for lenders requiring careful risk assessment and negotiation.

Important Terms

Maintenance Covenant

A Maintenance Covenant requires borrowers to meet specific financial performance metrics regularly, such as minimum EBITDA or debt service coverage ratios, ensuring ongoing credit quality throughout the loan term. Covenant-lite loans lack these stringent maintenance tests and typically impose fewer restrictions, often only requiring financial checks at origination, increasing risk for lenders.

Incurrence Covenant

Incurrence covenants are strict financial restrictions that require borrowers to meet predefined conditions before incurring additional debt, ensuring lender protection through stringent control measures. Covenant-lite loans, contrastingly, lack these incurrence covenants and impose fewer limitations during the loan term, increasing borrower flexibility but elevating lender risk.

Leverage Ratio

Leverage ratio quantifies a borrower's debt relative to their earnings and serves as a critical metric in credit agreements, distinguishing traditional covenant loans, which impose strict financial maintenance tests, from covenant-lite loans that feature fewer or no maintenance covenants, thereby granting borrowers more operational flexibility but increasing lender risk exposure. Covenant-lite loans typically allow higher leverage ratios before triggering defaults, reflecting looser credit protections compared to standard covenants that enforce tighter leverage limits to mitigate credit risk.

EBITDA Threshold

EBITDA threshold in financial covenants sets a minimum earnings benchmark that borrowers must maintain to avoid default, distinguishing traditional covenants from covenant-lite loans which often lack such strict financial maintenance requirements. Covenant-lite loans provide greater flexibility by typically excluding EBITDA thresholds, reducing lender protection but increasing borrower leverage in the credit agreement.

Lien Restriction

Lien restrictions in covenant-lite loans are significantly looser compared to traditional covenants, allowing borrowers greater flexibility but increasing lender risk due to fewer protections on collateral claims.

Default Trigger

Default triggers in Covenant loans impose stricter financial thresholds and covenants compared to Covenant-lite loans, increasing the likelihood of borrower default and lender intervention.

Credit Agreement

A credit agreement with traditional covenants imposes strict financial and operational restrictions on borrowers, enhancing lender protection through maintenance and incurrence covenants that require regular financial benchmarks and limit additional debt. Covenant-lite credit agreements reduce or eliminate many of these restrictions, offering borrowers greater flexibility by relaxing or removing maintenance covenants, which can increase risk exposure for lenders in default situations.

Senior Secured Loan

Senior secured loans with traditional covenants impose stricter financial maintenance requirements, whereas covenant-lite loans offer borrowers greater flexibility by limiting such restrictions.

Borrower Flexibility

Borrower flexibility is significantly higher in covenant-lite loans as they impose fewer financial maintenance covenants compared to traditional covenant loans, allowing borrowers more operational leeway and reduced risk of technical default.

Investor Protection

Investor protection is significantly stronger in covenant loans as they include strict financial maintenance tests and affirmative covenants, whereas covenant-lite loans lack these protective provisions, increasing risk exposure for investors.

Covenant vs Covenant-lite Infographic

moneydif.com

moneydif.com