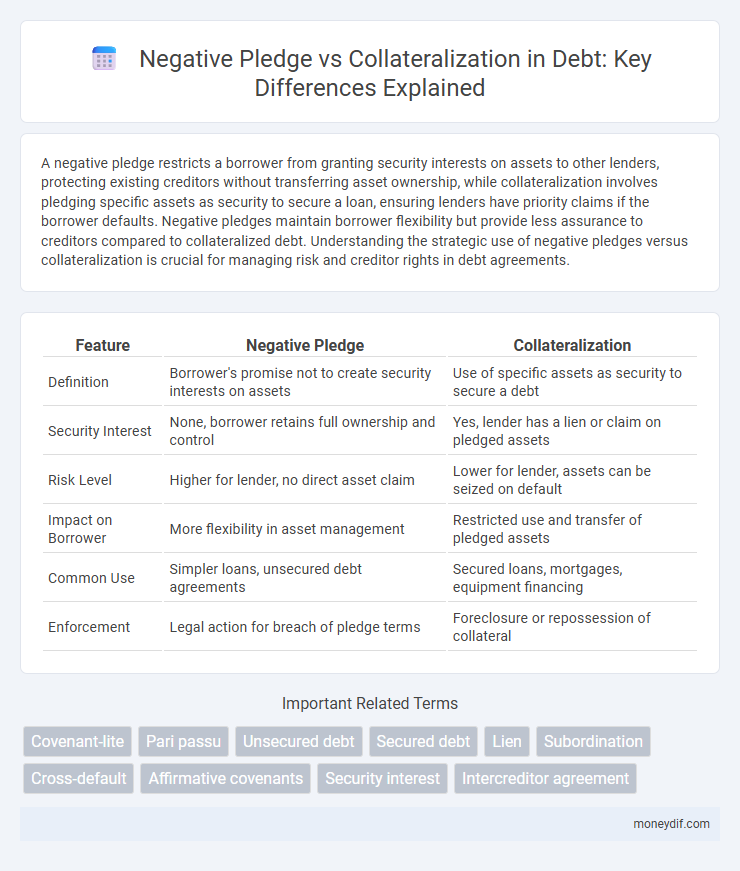

A negative pledge restricts a borrower from granting security interests on assets to other lenders, protecting existing creditors without transferring asset ownership, while collateralization involves pledging specific assets as security to secure a loan, ensuring lenders have priority claims if the borrower defaults. Negative pledges maintain borrower flexibility but provide less assurance to creditors compared to collateralized debt. Understanding the strategic use of negative pledges versus collateralization is crucial for managing risk and creditor rights in debt agreements.

Table of Comparison

| Feature | Negative Pledge | Collateralization |

|---|---|---|

| Definition | Borrower's promise not to create security interests on assets | Use of specific assets as security to secure a debt |

| Security Interest | None, borrower retains full ownership and control | Yes, lender has a lien or claim on pledged assets |

| Risk Level | Higher for lender, no direct asset claim | Lower for lender, assets can be seized on default |

| Impact on Borrower | More flexibility in asset management | Restricted use and transfer of pledged assets |

| Common Use | Simpler loans, unsecured debt agreements | Secured loans, mortgages, equipment financing |

| Enforcement | Legal action for breach of pledge terms | Foreclosure or repossession of collateral |

Introduction to Negative Pledge and Collateralization

Negative pledge clauses restrict borrowers from granting security interests over assets, ensuring creditors maintain an unsecured claim without collateral dilution. Collateralization involves pledging specific assets to secure debt, providing lenders with priority claims in case of default. Understanding the distinction clarifies borrower flexibility and lender risk mitigation in debt agreements.

Key Definitions: Negative Pledge vs. Collateralization

Negative pledge is a covenant restricting a borrower from pledging specific assets to other creditors, securing debt without granting explicit liens, thereby maintaining asset flexibility. Collateralization involves pledging specific assets as security for a loan, giving lenders legal rights to seize these assets if the borrower defaults. Understanding these distinctions clarifies how lenders mitigate risk while balancing borrower asset control.

Legal Framework: Negative Pledge Clauses

Negative pledge clauses restrict borrowers from granting security interests over assets to other creditors, ensuring lenders' ranking remains unsecured and equal. These clauses operate within a legal framework that protects lenders by preventing dilution of their claims, often negotiated in bond indentures or loan agreements. Unlike collateralization, which provides tangible asset security, negative pledges serve as contractual promises limiting future encumbrances without creating direct liens on assets.

Collateralization: Mechanism and Usage

Collateralization involves pledging specific assets as security for a debt, reducing lender risk by providing a tangible claim if the borrower defaults. This mechanism enhances creditworthiness, often resulting in lower interest rates and improved loan terms, especially in secured loans like mortgages and asset-backed securities. Common collateral includes real estate, equipment, inventory, or receivables, which are legally documented to protect creditor interests.

Risk Implications for Lenders and Borrowers

Negative pledge agreements limit borrowers from encumbering assets, reducing lender risk by preserving asset availability without direct collateral claims, yet they offer less security than collateralization. Collateralization provides lenders with a legal claim to specific assets, significantly lowering credit risk but increasing borrower burden through asset encumbrance and potential foreclosure. Lenders face higher recovery certainty with collateralized debt, while borrowers encounter restricted asset use and reduced financial flexibility under negative pledge clauses.

Impact on Borrowing Costs and Loan Terms

Negative pledges typically result in lower borrowing costs by avoiding the need to pledge specific assets, allowing more flexibility in maintaining unencumbered collateral. Collateralization usually leads to reduced interest rates due to increased lender security but often imposes stricter loan terms and covenants. Borrowers must weigh the trade-off between flexibility with negative pledges and potentially better loan pricing against tighter conditions associated with collateralized debt.

Enforceability Challenges in Cross-border Debt

Negative pledge clauses often face enforceability challenges in cross-border debt due to varying jurisdictional interpretations and conflicting local laws, which can undermine creditor protections. Collateralization provides a more tangible security interest but may require complex registration procedures and compliance with differing property rights regulations in multiple jurisdictions. The effectiveness of enforcing either mechanism depends heavily on the debtor's location, asset type, and the coordination between involved legal systems.

Negative Pledge vs. Collateralization: Pros and Cons

Negative pledge clauses prevent borrowers from granting security interests to other creditors, maintaining asset flexibility but often resulting in higher borrowing costs due to increased lender risk. Collateralization offers lenders secured claims on specific assets, reducing risk and potentially lowering interest rates but limiting the borrower's ability to leverage those assets for additional financing. The choice between negative pledge and collateralization depends on factors like borrower creditworthiness, asset liquidity, and the need for financing flexibility.

Case Studies: Real-world Applications

Negative pledge clauses are frequently used in corporate bond agreements to prevent issuers from granting security interests to new creditors, preserving asset availability for existing unsecured lenders. Case studies from infrastructure projects in emerging markets reveal how negative pledges helped maintain creditworthiness without tying up key assets, contrasting with collateralization in real estate financing where tangible assets back loans, reducing lender risk. In the oil and gas sector, negative pledge frameworks have enabled companies to secure multiple financing rounds without encumbering core assets, demonstrating flexibility in capital structure management.

Choosing Between Negative Pledge and Collateralization

Choosing between negative pledge and collateralization depends on the borrower's need to maintain asset flexibility versus the lender's desire for security. Negative pledge clauses prevent the borrower from pledging assets to other creditors, offering limited protection without tying specific assets, which suits companies aiming to preserve operational freedom. Collateralization provides lenders with rights to designated assets upon default, increasing borrowing costs but enhancing lender confidence through secured claims.

Important Terms

Covenant-lite

Covenant-lite loans typically lack traditional negative pledge clauses, allowing borrowers greater flexibility by limiting restrictions on additional debt but increasing risk for lenders due to reduced collateralization requirements. This absence of collateralization-backed protections often results in higher default risk and lower recovery rates for investors in covenant-lite structures.

Pari passu

Pari passu ensures equal ranking of creditors' claims, whereas negative pledge prohibits securing new debt with collateral, affecting creditor priority and collateralization strategies.

Unsecured debt

Unsecured debt lacks collateral backing, increasing lender risk compared to secured debt, which is supported by collateral assets. Negative pledge clauses restrict the borrower from granting security interests to other creditors, preserving the priority of unsecured lenders without actual collateralization.

Secured debt

Secured debt involves collateralization where specific assets back the loan, unlike negative pledge agreements that prohibit pledging assets to other creditors without granting a security interest.

Lien

A lien grants a creditor the legal right to retain possession of a debtor's property until a debt is satisfied, contrasting with a negative pledge which prohibits the debtor from creating security interests over specific assets without consent. Unlike collateralization that involves pledging assets as security, a negative pledge ensures priority by preventing subsequent encumbrances rather than providing direct asset control.

Subordination

Subordination typically ranks creditor claims below those secured by collateralization, whereas a negative pledge prohibits the borrower from offering future collateral, ensuring unsecured creditors retain priority.

Cross-default

Cross-default clauses trigger debt acceleration when a borrower breaches either a negative pledge covenant restricting asset liens or collateralization requirements securing outstanding loans.

Affirmative covenants

Affirmative covenants require borrowers to maintain certain conditions, while negative pledges restrict additional liens without creating collateralization that secures the lender's interests.

Security interest

Security interest grants a creditor legal rights over a debtor's asset to secure a loan, typically involving collateralization where specific assets are pledged as collateral. Negative pledge clauses restrict a debtor from creating other security interests on their assets, effectively preventing collateralization to protect existing creditors' priority.

Intercreditor agreement

An intercreditor agreement delineates the priority and rights between multiple creditors, addressing conflicts between negative pledge clauses that restrict asset encumbrance and collateralization that provides secured interests. Effective negotiation balances protecting unsecured lenders through negative pledges while allowing secured creditors priority claims over collateralized assets, optimizing risk allocation and credit terms.

negative pledge vs collateralization Infographic

moneydif.com

moneydif.com