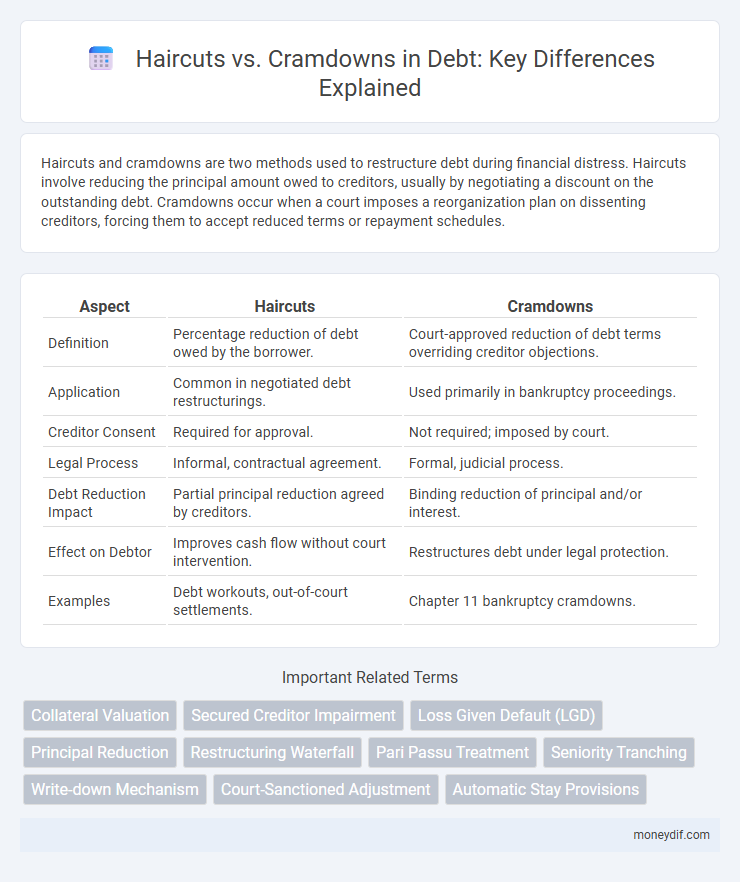

Haircuts and cramdowns are two methods used to restructure debt during financial distress. Haircuts involve reducing the principal amount owed to creditors, usually by negotiating a discount on the outstanding debt. Cramdowns occur when a court imposes a reorganization plan on dissenting creditors, forcing them to accept reduced terms or repayment schedules.

Table of Comparison

| Aspect | Haircuts | Cramdowns |

|---|---|---|

| Definition | Percentage reduction of debt owed by the borrower. | Court-approved reduction of debt terms overriding creditor objections. |

| Application | Common in negotiated debt restructurings. | Used primarily in bankruptcy proceedings. |

| Creditor Consent | Required for approval. | Not required; imposed by court. |

| Legal Process | Informal, contractual agreement. | Formal, judicial process. |

| Debt Reduction Impact | Partial principal reduction agreed by creditors. | Binding reduction of principal and/or interest. |

| Effect on Debtor | Improves cash flow without court intervention. | Restructures debt under legal protection. |

| Examples | Debt workouts, out-of-court settlements. | Chapter 11 bankruptcy cramdowns. |

Understanding Debt Restructuring: Haircuts vs Cramdowns

Debt restructuring often involves haircuts, where creditors agree to accept less than the owed amount to improve the debtor's financial stability, reducing debt burdens and default risk. Cramdowns occur when a court enforces a debt restructuring agreement despite objections from some creditors, overriding dissent to facilitate the debtor's reorganization and maximize asset recovery. Understanding the nuances between haircuts, which are consensual reductions, and cramdowns, which are judicial impositions, is crucial for effective debt management and negotiation strategies.

Defining Haircuts in Debt Negotiations

Haircuts in debt negotiations refer to the partial forgiveness or reduction of the principal amount owed by a debtor to creditors, allowing for easier repayment and avoidance of default. This mechanism differs from cramdowns, where courts impose debt restructuring without creditor consent. Haircuts are often negotiated voluntarily to preserve relationships and improve the debtor's financial stability.

What Are Cramdowns in Bankruptcy Law?

Cramdowns in bankruptcy law refer to a court-approved process that allows a debtor to restructure secured debt by reducing the principal balance or lowering the interest rate without creditor approval. This mechanism forces creditors to accept modified terms if the debtor's repayment plan is deemed feasible and fair under bankruptcy code provisions, particularly in Chapter 11 or Chapter 13 cases. Unlike haircuts, which generally involve voluntary negotiations to reduce debt amounts, cramdowns impose binding adjustments through legal authority.

Key Differences Between Haircuts and Cramdowns

Haircuts in debt restructuring involve creditors agreeing to accept a reduced payment without altering the original terms, while cramdowns impose new terms over creditor objections through court approval. Haircuts rely on creditor consensus for debt reduction, whereas cramdowns legally modify repayment schedules, interest rates, or principal amounts regardless of creditor agreement. These distinctions highlight the voluntary nature of haircuts versus the judicial enforcement characteristic of cramdowns in restructuring processes.

When Are Haircuts Used in Debt Resolution?

Haircuts are used in debt resolution primarily during negotiations between creditors and debtors to reduce the principal amount owed without altering the original loan terms. They typically occur in out-of-court restructurings where creditors agree to accept less than the full repayment to avoid lengthy bankruptcy proceedings. Haircuts help improve the debtor's liquidity and financial stability while offering creditors partial recovery faster than through cramdowns or other legal processes.

Legal Frameworks Governing Cramdowns

Legal frameworks governing cramdowns vary significantly by jurisdiction, with U.S. bankruptcy law under Chapter 11 providing courts the authority to impose restructured terms over dissenting creditors when a feasible reorganization plan is presented. In contrast, many European insolvency regimes limit cramdown powers to safeguard creditor protections, often requiring creditor consent or majority approval within classes. These legal distinctions influence debtor-creditor negotiations, affecting the likelihood of agreed restructurings versus enforced haircuts.

Impact on Creditors: Haircuts versus Cramdowns

Haircuts reduce creditors' claims by voluntarily accepting less than the owed amount, which can preserve relationships and facilitate faster debt restructuring. Cramdowns impose debt repayment terms through court approval, often overriding dissenting creditors' objections and potentially leading to longer legal processes. Creditors facing cramdowns typically experience greater uncertainty and risk, as the imposed terms may significantly affect recovery rates and rights.

Debtor Outcomes: Which Is More Favorable?

Haircuts allow debtors to negotiate reduced repayments with creditors, often preserving more control over assets and potentially leading to less aggressive recovery efforts. Cramdowns impose court-approved debt reductions and repayment terms, which can protect debtors from creditor interference but may extend the duration of financial strain. Studies indicate that haircuts typically result in quicker financial recovery and higher debtor satisfaction compared to cramdowns, which offer more structured yet rigid relief options.

Global Case Studies: Haircuts and Cramdown Examples

Global case studies reveal that haircuts often involve negotiated reductions in debt principal, as seen in Greece's 2012 debt restructuring where private creditors accepted a 53.5% nominal haircut to restore fiscal sustainability. In contrast, cramdowns impose restructuring terms despite creditor dissent, exemplified by Argentina's 2005 debt exchange where courts enforced terms affecting holdout bondholders. These mechanisms highlight varied approaches in sovereign debt crises, balancing creditor losses and debtor repayment capacity.

Choosing the Right Strategy: Haircuts or Cramdowns?

Choosing between haircuts and cramdowns depends largely on the debtor's financial situation and creditor willingness. Haircuts involve negotiated reductions in debt principal, preserving creditor consent and minimizing litigation risks, while cramdowns impose court-ordered debt restructuring, often overriding creditor objections but risking prolonged legal battles. Evaluating factors like debt volume, negotiation leverage, and timeline urgency helps determine the optimal strategy for efficient debt resolution.

Important Terms

Collateral Valuation

Collateral valuation plays a critical role in determining appropriate haircuts, which are percentage reductions applied to asset value to mitigate risk during lending or restructuring. Haircuts protect lenders by reflecting potential losses in collateral value, whereas cramdowns involve court-approved reductions in debt obligations, often based on reassessed collateral values that may differ from initial haircuts.

Secured Creditor Impairment

Secured creditor impairment occurs when haircuts reduce claim values below loan amounts, whereas cramdowns restructure debt terms without necessarily lowering principal, affecting secured creditor recovery differently.

Loss Given Default (LGD)

Loss Given Default (LGD) quantifies the potential loss severity lenders face after borrower default, with haircuts representing pre-default asset devaluations and cramdowns involving judicially imposed reductions in borrower debt. Understanding how haircuts reduce collateral value before default while cramdowns adjust debt recoveries post-default is critical for accurate LGD modeling in credit risk management.

Principal Reduction

Principal reduction lowers the outstanding loan balance, distinguishing itself from cramdowns by specifically reducing the debt principal rather than restructuring loan terms or interest rates.

Restructuring Waterfall

Restructuring waterfall outlines the priority order in which creditors receive payments during bankruptcy or financial restructuring, where haircuts represent negotiated reductions in debt claims agreed upon by creditors, while cramdowns refer to court-imposed reductions overriding dissenting creditor objections. Understanding the distinction between haircuts and cramdowns is crucial for predicting recovery rates and negotiating debt settlements within the waterfall framework.

Pari Passu Treatment

Pari passu treatment ensures all creditors receive equal haircuts during restructurings, contrasting with cramdowns where courts impose imbalanced debt reductions on dissenting creditors.

Seniority Tranching

Seniority tranching prioritizes debt repayment order by allocating haircuts to subordinated tranches while protecting senior tranches from cramdowns during restructuring.

Write-down Mechanism

Write-down mechanisms reduce debt value through haircuts by negotiating partial lender losses, whereas cramdowns impose court-approved debt restructuring regardless of creditor consent.

Court-Sanctioned Adjustment

Court-sanctioned adjustments allow bankruptcy judges to implement cramdowns, reducing secured creditors' claims below the original value, unlike negotiated haircuts agreed upon outside court.

Automatic Stay Provisions

Automatic stay provisions temporarily halt creditor actions, influencing haircuts and cramdowns by preserving debtor assets during bankruptcy negotiations.

haircuts vs cramdowns Infographic

moneydif.com

moneydif.com