DIP financing provides debtor companies with crucial funding during bankruptcy proceedings, allowing them to maintain operations and restructure effectively under court supervision. Bridge loans offer short-term capital to cover immediate liquidity needs, often facilitating a transition between financing rounds or major transactions. While DIP financing is specifically designed for distressed situations with creditor priorities, bridge loans serve as flexible temporary solutions without the comprehensive legal protections of bankruptcy financing.

Table of Comparison

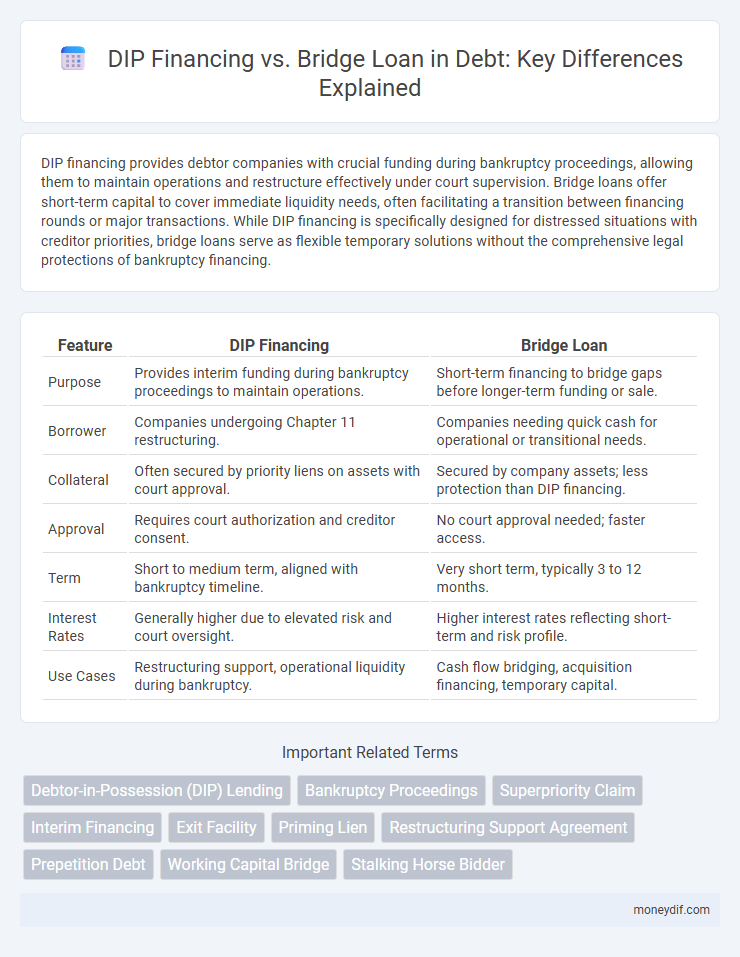

| Feature | DIP Financing | Bridge Loan |

|---|---|---|

| Purpose | Provides interim funding during bankruptcy proceedings to maintain operations. | Short-term financing to bridge gaps before longer-term funding or sale. |

| Borrower | Companies undergoing Chapter 11 restructuring. | Companies needing quick cash for operational or transitional needs. |

| Collateral | Often secured by priority liens on assets with court approval. | Secured by company assets; less protection than DIP financing. |

| Approval | Requires court authorization and creditor consent. | No court approval needed; faster access. |

| Term | Short to medium term, aligned with bankruptcy timeline. | Very short term, typically 3 to 12 months. |

| Interest Rates | Generally higher due to elevated risk and court oversight. | Higher interest rates reflecting short-term and risk profile. |

| Use Cases | Restructuring support, operational liquidity during bankruptcy. | Cash flow bridging, acquisition financing, temporary capital. |

Understanding DIP Financing: Key Features

DIP financing, or debtor-in-possession financing, provides critical funding to companies undergoing bankruptcy to maintain operations and restructure debt efficiently. Unlike bridge loans, DIP financing enjoys priority status over existing debt, ensuring lenders are repaid first, which reduces risk and encourages lender participation. Key features include court approval requirements, specific use for operational expenses, and negotiated terms that support business continuity during financial distress.

Bridge Loans Explained: Essentials and Uses

Bridge loans are short-term financing solutions designed to provide immediate capital while awaiting long-term funding or the sale of an asset. Typically secured by real estate or other collateral, these loans offer quick approval and disbursement, often used in real estate transactions or business acquisitions. Their higher interest rates and fees reflect their risk and temporary nature, making them ideal for bridging financial gaps during transitional periods.

Comparing DIP Financing and Bridge Loans

DIP financing and bridge loans serve distinct purposes in corporate finance; DIP financing supports companies undergoing bankruptcy by providing debtor-in-possession funds to maintain operations, while bridge loans offer short-term liquidity to bridge gaps until longer-term financing is secured. DIP financing typically features higher interest rates and lender protections due to the high-risk restructuring environment, whereas bridge loans may have lower rates but rely heavily on the borrower's collateral and creditworthiness. Comparing DIP financing and bridge loans reveals differences in risk levels, use cases, and creditor priorities essential for strategic debt management during corporate distress or transitional phases.

Eligibility Criteria for DIP Financing vs Bridge Loans

DIP financing eligibility primarily targets companies undergoing Chapter 11 bankruptcy, requiring court approval and demonstrating viable reorganization plans. In contrast, bridge loans are accessible to a broader range of borrowers, including solvent businesses seeking short-term capital for operational continuity or acquisitions, without necessitating bankruptcy proceedings. Lenders for DIP financing prioritize debtor's restructuring viability and creditor protection, whereas bridge loan approvals focus more on borrower creditworthiness and collateral.

Interest Rates: DIP Financing vs Bridge Loans

DIP financing typically offers lower interest rates compared to bridge loans due to its secured position and priority status in bankruptcy proceedings. Bridge loans, often unsecured or junior, carry higher interest rates reflecting their greater risk and shorter terms. Businesses facing financial distress prefer DIP financing to reduce borrowing costs during restructuring.

Typical Lenders in DIP Financing and Bridge Loans

Typical lenders in DIP (Debtor-in-Possession) financing are specialized credit institutions and hedge funds that focus on distressed companies under bankruptcy protection, prioritizing repayment through court-approved financing. Bridge loan lenders commonly include commercial banks, private equity firms, and institutional investors providing short-term capital to bridge gaps between financing rounds or acquisitions, often relying on existing collateral and company stability. DIP lenders accept higher risk with priority liens and bankruptcy court oversight, whereas bridge loan lenders focus on quick turnaround and collateral-backed security.

Collateral and Security Requirements

DIP financing typically requires the debtor's existing assets as collateral, often with a superpriority lien that ranks above existing creditors to ensure repayment during bankruptcy. Bridge loans usually come with stringent security requirements, involving specific collateral such as real estate or accounts receivable, to mitigate lender risk in short-term financing scenarios. Both financing options prioritize asset-based security but differ in lien priority and borrower conditions based on the borrowing context.

Pros and Cons: DIP Financing vs Bridge Loans

DIP financing provides debtor companies with critical liquidity during bankruptcy, offering bankruptcy court approval and protection from lender claims but often comes with higher interest rates and restrictive covenants. Bridge loans enable faster access to capital with flexible terms, ideal for short-term needs but lack the legal protections of DIP financing and may pose refinancing risks. Evaluating the urgency, legal context, and financial stability is essential when choosing between DIP financing and bridge loans for debt management.

Use Cases: When to Choose DIP Financing or a Bridge Loan

DIP financing is ideal for companies undergoing Chapter 11 bankruptcy as it provides debtor-in-possession funding to maintain operations during restructuring. Bridge loans serve businesses needing short-term capital to cover gaps between financing rounds or asset sales, typically outside of bankruptcy contexts. Choosing between DIP financing and a bridge loan depends on the business's financial distress level and immediate liquidity requirements.

Legal and Regulatory Considerations

DIP financing involves court approval under bankruptcy laws, ensuring debtor-in-possession protections and priority repayment status, while bridge loans typically function in out-of-court contexts with fewer statutory constraints but higher lender risk. DIP loans are subject to stringent disclosure and creditor negotiation requirements mandated by the Bankruptcy Code, contrasting with bridge loans governed by standard commercial lending regulations and contractual agreements. Lenders in DIP financing benefit from enhanced legal safeguards, whereas bridge loan agreements must carefully negotiate default and collateral provisions to mitigate regulatory and enforcement challenges.

Important Terms

Debtor-in-Possession (DIP) Lending

Debtor-in-Possession (DIP) financing provides companies undergoing Chapter 11 bankruptcy with critical capital to maintain operations, offering priority claims over existing debt unlike bridge loans, which are short-term funding options facilitating temporary liquidity needs without bankruptcy protections. DIP loans typically feature higher interest rates and stringent covenants, reflecting the elevated risk and legal safeguards unique to restructuring scenarios compared to conventional bridge financing arrangements.

Bankruptcy Proceedings

Bankruptcy proceedings often involve debtor-in-possession (DIP) financing, which provides the debtor with critical liquidity under court approval, offering priority repayment over existing debt to facilitate reorganization. In contrast, bridge loans serve as short-term funding solutions outside formal bankruptcy protections, typically lacking the same priority status and often used to cover immediate cash flow needs before permanent financing is secured.

Superpriority Claim

A Superpriority Claim grants DIP financing lenders the highest repayment priority over bridge loan creditors during bankruptcy proceedings.

Interim Financing

Interim financing provides temporary capital during organizational transitions, with DIP financing specifically tailored for companies undergoing bankruptcy to maintain operations and satisfy creditor requirements, while bridge loans serve as short-term solutions bridging the gap until longer-term financing is secured or major capital events occur. DIP financing often involves court approval and creditor oversight, whereas bridge loans typically offer quicker access without bankruptcy constraints.

Exit Facility

An Exit Facility is a type of loan designed to refinance or repay DIP (Debtor-in-Possession) financing, providing companies with more favorable terms as they transition out of bankruptcy. Unlike bridge loans, which are short-term and primarily used to provide immediate liquidity, Exit Facilities offer longer maturities and structured repayment plans to support ongoing operations post-reorganization.

Priming Lien

Priming lien in DIP financing grants senior claim over existing liens to new creditors, enhancing lender protection compared to bridge loans which typically do not involve priming liens.

Restructuring Support Agreement

A Restructuring Support Agreement (RSA) outlines creditor commitments and terms to facilitate debtor-in-possession (DIP) financing, which provides priority funding during bankruptcy, contrasted with bridge loans that are short-term financing used to bridge gaps before long-term restructuring.

Prepetition Debt

Prepetition debt refers to the financial obligations incurred by a company prior to filing for bankruptcy, which remain outstanding when seeking debtor-in-possession (DIP) financing or bridge loans. DIP financing is specifically designed to provide debtor companies with liquidity during bankruptcy proceedings, often taking priority over prepetition debt, whereas bridge loans are short-term funding solutions that may serve as interim financing but do not inherently offer the same protections or priority status in restructuring contexts.

Working Capital Bridge

A Working Capital Bridge in DIP financing provides debtor-in-possession liquidity during bankruptcy, offering priority over traditional Bridge Loans typically used for short-term operational funding but subject to higher risk and costs.

Stalking Horse Bidder

A Stalking Horse Bidder in bankruptcy proceedings often leverages DIP financing for debtor-in-possession liquidity, whereas a bridge loan provides short-term funding to bridge gaps before finalizing the sale or restructuring.

DIP Financing vs Bridge Loan Infographic

moneydif.com

moneydif.com