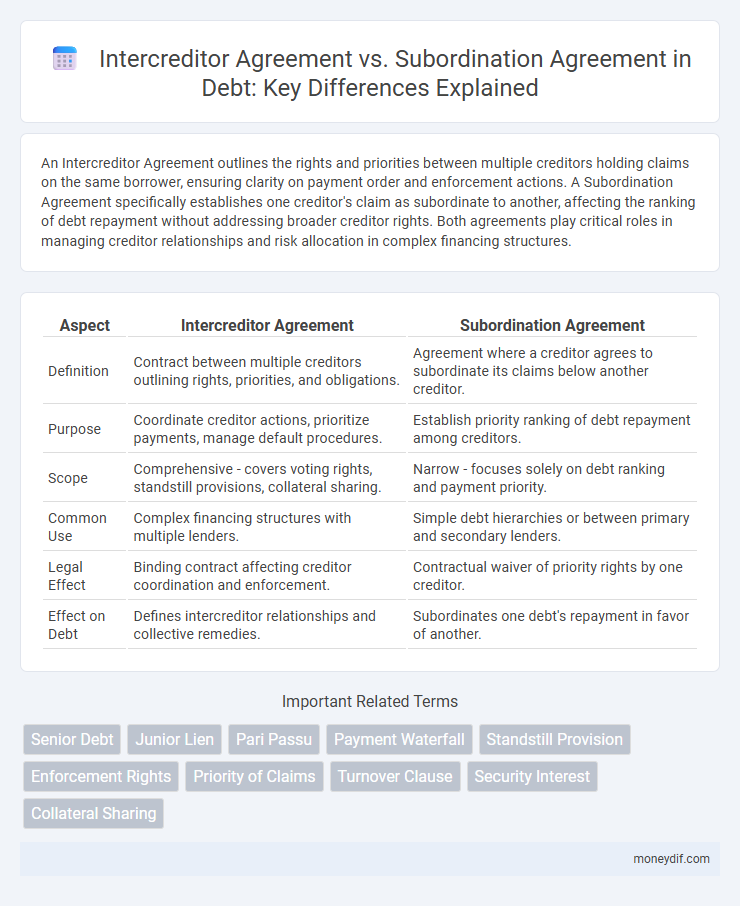

An Intercreditor Agreement outlines the rights and priorities between multiple creditors holding claims on the same borrower, ensuring clarity on payment order and enforcement actions. A Subordination Agreement specifically establishes one creditor's claim as subordinate to another, affecting the ranking of debt repayment without addressing broader creditor rights. Both agreements play critical roles in managing creditor relationships and risk allocation in complex financing structures.

Table of Comparison

| Aspect | Intercreditor Agreement | Subordination Agreement |

|---|---|---|

| Definition | Contract between multiple creditors outlining rights, priorities, and obligations. | Agreement where a creditor agrees to subordinate its claims below another creditor. |

| Purpose | Coordinate creditor actions, prioritize payments, manage default procedures. | Establish priority ranking of debt repayment among creditors. |

| Scope | Comprehensive - covers voting rights, standstill provisions, collateral sharing. | Narrow - focuses solely on debt ranking and payment priority. |

| Common Use | Complex financing structures with multiple lenders. | Simple debt hierarchies or between primary and secondary lenders. |

| Legal Effect | Binding contract affecting creditor coordination and enforcement. | Contractual waiver of priority rights by one creditor. |

| Effect on Debt | Defines intercreditor relationships and collective remedies. | Subordinates one debt's repayment in favor of another. |

Understanding Intercreditor Agreements

Intercreditor Agreements define the rights and priorities between multiple creditors involved in the same borrower's debt structure, ensuring clarity on payment order and collateral claims. These agreements are crucial in complex financing scenarios, such as syndicated loans or mezzanine financing, where senior and junior lenders coexist. Clear terms within Intercreditor Agreements help prevent disputes and protect interests by outlining enforcement mechanisms and restructuring procedures.

What is a Subordination Agreement?

A Subordination Agreement is a legal document that establishes the priority of debt repayment among creditors, ensuring that one creditor's claim is subordinate to another's in the event of borrower default or liquidation. This agreement clarifies the rank of secured or unsecured loans, affecting claim hierarchy and recovery rights. Subordination Agreements are crucial in structured finance and debt refinancing, providing lenders with clear terms on payment priorities.

Key Differences: Intercreditor vs Subordination Agreements

Intercreditor agreements establish the rights and priorities among multiple creditors in complex financing structures, defining voting rights, enforcement procedures, and payment hierarchies. Subordination agreements primarily adjust the priority of one creditor's claim, subordinating it to another without addressing broader inter-creditor governance issues. The key difference lies in intercreditor agreements providing comprehensive coordination between lenders, while subordination agreements solely focus on ranking debt claims.

Common Provisions in Intercreditor Agreements

Intercreditor agreements commonly include provisions addressing payment priorities, enforcement rights, and collateral sharing among multiple creditors to manage the risks of concurrent lending. These agreements establish rules for standstill periods, consent requirements for amendments, and mechanisms for dispute resolution, ensuring coordinated creditor actions. Unlike subordination agreements that primarily alter the priority of claims, intercreditor agreements provide a comprehensive framework governing creditor interactions and debt administration.

Typical Clauses in Subordination Agreements

Subordination agreements typically include clauses detailing the priority of repayment, specifying that the subordinated debt will be paid after senior debts are fully satisfied. They often contain provisions restricting the subordinated lender's rights to enforce remedies, such as acceleration or foreclosure, without consent from senior creditors. Additionally, subordination clauses outline the conditions under which payments can be made to subordinated lenders, ensuring senior creditors maintain their preferential position in bankruptcy or liquidation scenarios.

Legal Implications of Debt Prioritization

Intercreditor agreements establish the rights and priorities among multiple creditors, detailing how payments and collateral are allocated during borrower default, which reduces litigation risk and clarifies enforcement procedures. Subordination agreements specifically adjust the priority of one creditor's claim in favor of another, often impacting the recoverability of subordinate debt in bankruptcy or restructuring scenarios. Understanding these agreements is crucial for creditors to manage legal risks associated with debt hierarchies and ensure enforceable protection of their interests.

Impact on Senior and Junior Creditors

Intercreditor agreements establish the rights and priorities between senior and junior creditors, defining control over collateral and enforcement actions to minimize conflicts during default scenarios. Subordination agreements specifically rank the claims of junior creditors below senior creditors, ensuring that senior debt receives payment priority while limiting junior creditors' ability to accelerate repayment. The impact on senior creditors includes enhanced security and control, whereas junior creditors accept increased risk and restricted recovery rights.

Use Cases: When to Choose Each Agreement

Intercreditor agreements are preferred in multi-lender environments where lenders require defined rights and priorities to manage shared collateral and control enforcement actions, commonly used in syndicated loans or complex structured financings. Subordination agreements are ideal when a lender agrees to subordinate its claim to another lender or creditor, frequently applied in situations involving mezzanine debt or when junior debt holders accept a lower repayment priority to facilitate primary financing. Choosing between these agreements depends on the funding structure, the number of creditors, and the necessity for clearly established enforcement and repayment hierarchies.

Risks and Benefits for Borrowers

Intercreditor agreements establish clear priority and control among multiple lenders, reducing conflicts and facilitating smoother debt restructuring, which benefits borrowers by enhancing access to financing and minimizing default risks. Subordination agreements, while simpler, often limit borrower flexibility by subordinating junior debt, potentially increasing borrowing costs and restricting future credit options. Understanding these distinctions helps borrowers negotiate terms that balance risk exposure and capital structure optimization.

Best Practices for Negotiating Debt Agreements

Effective negotiation of debt agreements requires clear delineation of rights and priorities between creditors through Intercreditor Agreements, which establish the hierarchy and administrative mechanisms for multiple lenders. Subordination Agreements specifically address the ranking of debt, ensuring lower-priority creditors acknowledge the claims of senior lenders to mitigate default risks. Best practices include precise definitions of payment priorities, enforcement procedures, and default conditions to minimize disputes and protect creditor interests.

Important Terms

Senior Debt

Senior debt refers to loans or credit facilities that have priority claim over other unsecured or subordinated debts in the event of borrower default or bankruptcy. Intercreditor agreements outline the rights and obligations between multiple creditors, including senior and subordinated lenders, while subordination agreements specifically demote the claim priority of subordinated debt relative to senior debt.

Junior Lien

A Junior Lien in an Intercreditor Agreement establishes priority rights and repayment order between multiple creditors, whereas a Subordination Agreement specifically modifies the ranking of one creditor's claim below another's without addressing broader creditor rights.

Pari Passu

Pari Passu provisions in Intercreditor Agreements establish equal ranking and treatment among multiple creditors, ensuring pro-rata distribution of payments without priority. In contrast, Subordination Agreements explicitly rank one creditor's claims below another's, subordinating repayment rights and impacting the creditor hierarchy in insolvency scenarios.

Payment Waterfall

Payment Waterfall defined by Intercreditor Agreements prioritizes creditor payments, while Subordination Agreements specifically outline the ranking of debt obligations, impacting the order and timing within the waterfall.

Standstill Provision

Standstill provisions in Intercreditor Agreements temporarily halt enforcement actions by junior creditors, unlike Subordination Agreements which primarily establish the priority of claims without pausing enforcement rights.

Enforcement Rights

Enforcement rights in an Intercreditor Agreement define the priority and conditions under which creditors can enforce claims, whereas Subordination Agreements primarily establish the ranking of debt but may not detail enforcement mechanisms comprehensively.

Priority of Claims

Priority of claims in an Intercreditor Agreement establishes the hierarchy and rights between multiple creditors to the debtor's assets, ensuring clear enforcement order during default or insolvency proceedings. In contrast, a Subordination Agreement specifically ranks one creditor's claim below another's, legally relegating lower-priority creditors to receive payment only after senior debts are satisfied.

Turnover Clause

The Turnover Clause in Intercreditor Agreements prioritizes creditor payment rights by mandating debtors to pay senior creditors before subordinated creditors, unlike Subordination Agreements that primarily establish the ranking of creditor claims without enforcing direct payment obligations.

Security Interest

Security Interest establishes collateral rights that prioritize creditor claims within an Intercreditor Agreement, whereas a Subordination Agreement restructures repayment hierarchy without creating new collateral interests.

Collateral Sharing

Collateral sharing in intercreditor agreements establishes priority and rights among multiple creditors to secure shared assets, ensuring clear enforcement rules and reducing conflicts. Subordination agreements, however, reorder repayment priorities without necessarily altering collateral rights, often subordinating junior lenders' claims to senior creditors without redistributing collateral interests.

Intercreditor Agreement vs Subordination Agreement Infographic

moneydif.com

moneydif.com